Blank Adp Pay Stub PDF Form

File Breakdown

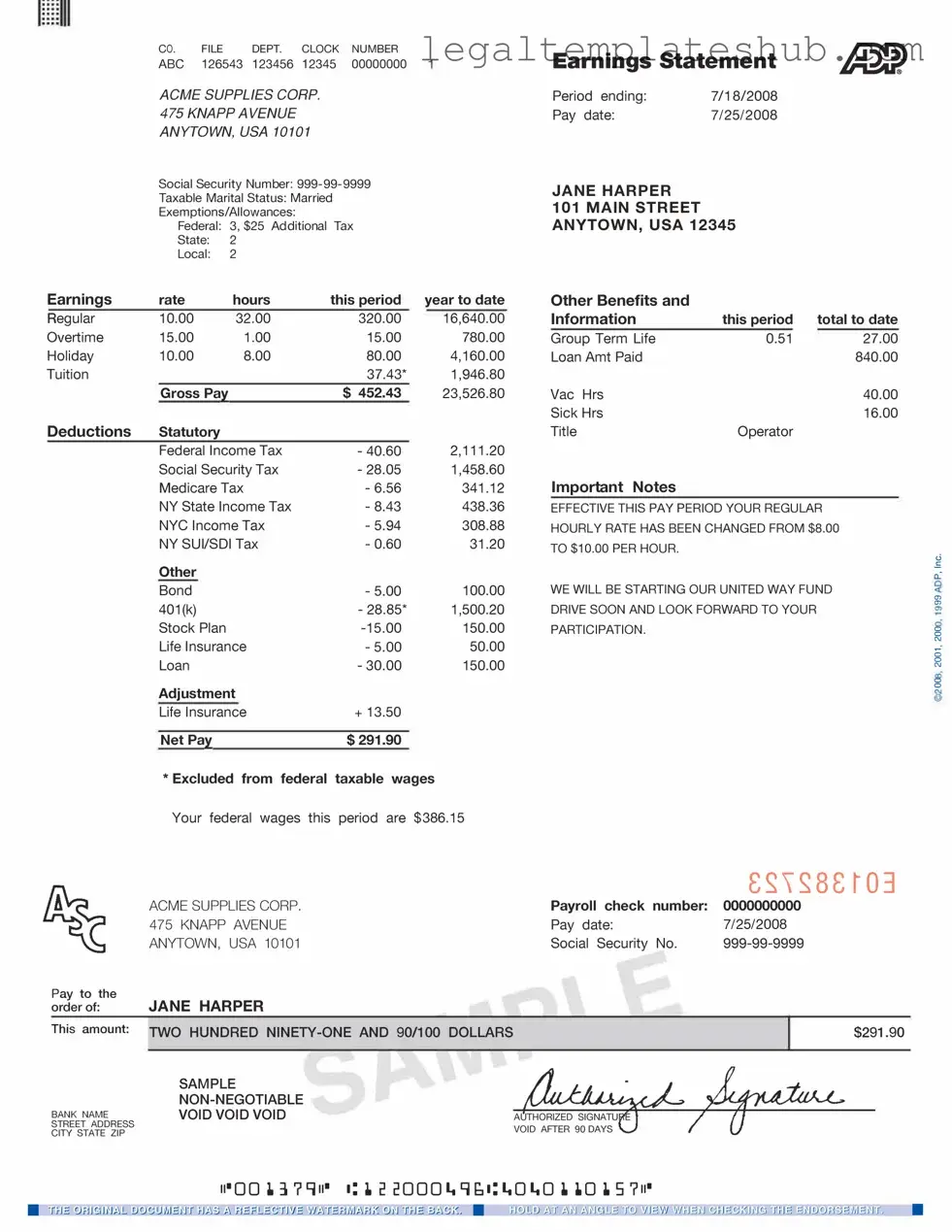

| Fact Name | Description |

|---|---|

| Purpose | The ADP Pay Stub form provides employees with a detailed breakdown of their earnings and deductions for each pay period. |

| Components | The pay stub typically includes gross pay, net pay, taxes withheld, and other deductions such as health insurance and retirement contributions. |

| Frequency | Pay stubs are generated for each pay period, which can be weekly, bi-weekly, or monthly, depending on the employer's payroll schedule. |

| State-Specific Requirements | Some states have specific laws regarding the information that must be included on pay stubs. For example, California requires itemized deductions. |

| Access | Employees can often access their pay stubs online through the ADP portal, allowing for easy tracking of earnings and deductions. |

| Record Keeping | It is advisable for employees to keep their pay stubs for at least a year for tax purposes and to verify income. |

| Tax Information | The pay stub provides essential tax information, including federal and state tax withholdings, which is crucial for accurate tax filing. |

| Direct Deposit | If an employee opts for direct deposit, the pay stub will show the amount deposited into their bank account for each pay period. |

| Contact Information | ADP pay stubs typically include contact information for the payroll department, allowing employees to address any discrepancies. |

| Compliance | Employers must comply with federal and state laws regarding the issuance of pay stubs, ensuring employees receive accurate and timely information. |

Key takeaways

When filling out and using the ADP Pay Stub form, understanding the key components can enhance your experience and ensure accuracy. Here are some essential takeaways:

- Personal Information: Always include accurate personal details such as your name, address, and employee ID to ensure proper record-keeping.

- Pay Period: Clearly indicate the pay period covered by the stub. This helps in tracking earnings over time.

- Earnings Breakdown: Review the earnings section carefully. It should detail your gross pay, overtime, bonuses, and any other compensation.

- Deductions: Examine the deductions section. This will include taxes, insurance, retirement contributions, and other withholdings.

- Net Pay: Understand your net pay, which is the amount you take home after all deductions. This figure is crucial for budgeting.

- Employer Information: The form should contain your employer's name and contact information. This is useful for any inquiries.

- Accessing Online: Many employers provide access to pay stubs online. Familiarize yourself with the digital platform for convenience.

- Record Keeping: Keep a copy of your pay stubs for personal records. They are important for tax filing and financial planning.

By following these guidelines, you can effectively manage your pay stub information and ensure that your financial records are accurate and up to date.

Dos and Don'ts

When filling out the ADP Pay Stub form, it’s essential to approach the task with care. Here are some important dos and don’ts to keep in mind:

- Do double-check your personal information for accuracy.

- Do ensure that all hours worked are correctly recorded.

- Do review your deductions to confirm they align with your expectations.

- Do keep a copy of your completed pay stub for your records.

- Don't leave any sections blank unless instructed.

- Don't submit the form without verifying all entries.

By following these guidelines, you can help ensure that your pay stub is filled out accurately and efficiently.

Common PDF Templates

Renewing a Passport - You may submit feedback about the passport service through the official channels.

For anyone looking to draft an important legal document, a comprehensive template for a bill of sale can be invaluable. This resource provides clarity on the necessary sections and details, ensuring that your transaction is protected and documented efficiently. You can find a reliable format at comprehensive Alabama bill of sale form, designed to meet your specific selling needs.

Whats a W9 Form - The W-9 helps ensure compliance with tax reporting regulations.

Instructions on Filling in Adp Pay Stub

Filling out the ADP Pay Stub form is a straightforward process that helps you keep track of your earnings and deductions. By following these steps, you can ensure that all necessary information is accurately recorded, making it easier to understand your pay details.

- Start by locating the form. Ensure you have the correct version of the ADP Pay Stub form.

- Fill in your employee information. This includes your name, employee ID, and department.

- Enter the pay period. Specify the start and end dates for the pay period you are documenting.

- Record your earnings. List all applicable wages, including regular hours worked, overtime, and any bonuses or commissions.

- Detail your deductions. Include taxes withheld, retirement contributions, and any other deductions that apply.

- Calculate your net pay. Subtract total deductions from total earnings to determine your take-home pay.

- Review the form for accuracy. Ensure all information is correct and complete.

- Sign and date the form if required. This may be necessary for official records.

After completing the form, keep a copy for your records. This will help you track your income over time and assist in any future financial planning or inquiries.

Misconceptions

- Misconception 1: The ADP pay stub only shows gross pay.

- Misconception 2: ADP pay stubs are only for salaried employees.

- Misconception 3: The pay stub is not important for tax purposes.

- Misconception 4: Deductions on the pay stub are always the same.

- Misconception 5: You cannot access your pay stub if you lose it.

- Misconception 6: The pay stub is only relevant during tax season.

This is incorrect. The ADP pay stub includes gross pay, deductions, and net pay, providing a complete overview of earnings and withholdings.

ADP pay stubs are used by both hourly and salaried employees. They reflect the earnings for all types of employees.

This is a misunderstanding. Pay stubs are essential for tracking earnings and deductions, which are necessary for accurate tax filing.

Deductions can vary based on several factors, including changes in benefits, tax withholding adjustments, or overtime pay.

ADP provides online access to pay stubs, allowing employees to retrieve lost documents easily through their accounts.

Pay stubs are useful year-round for budgeting, verifying income, and understanding deductions, not just during tax season.