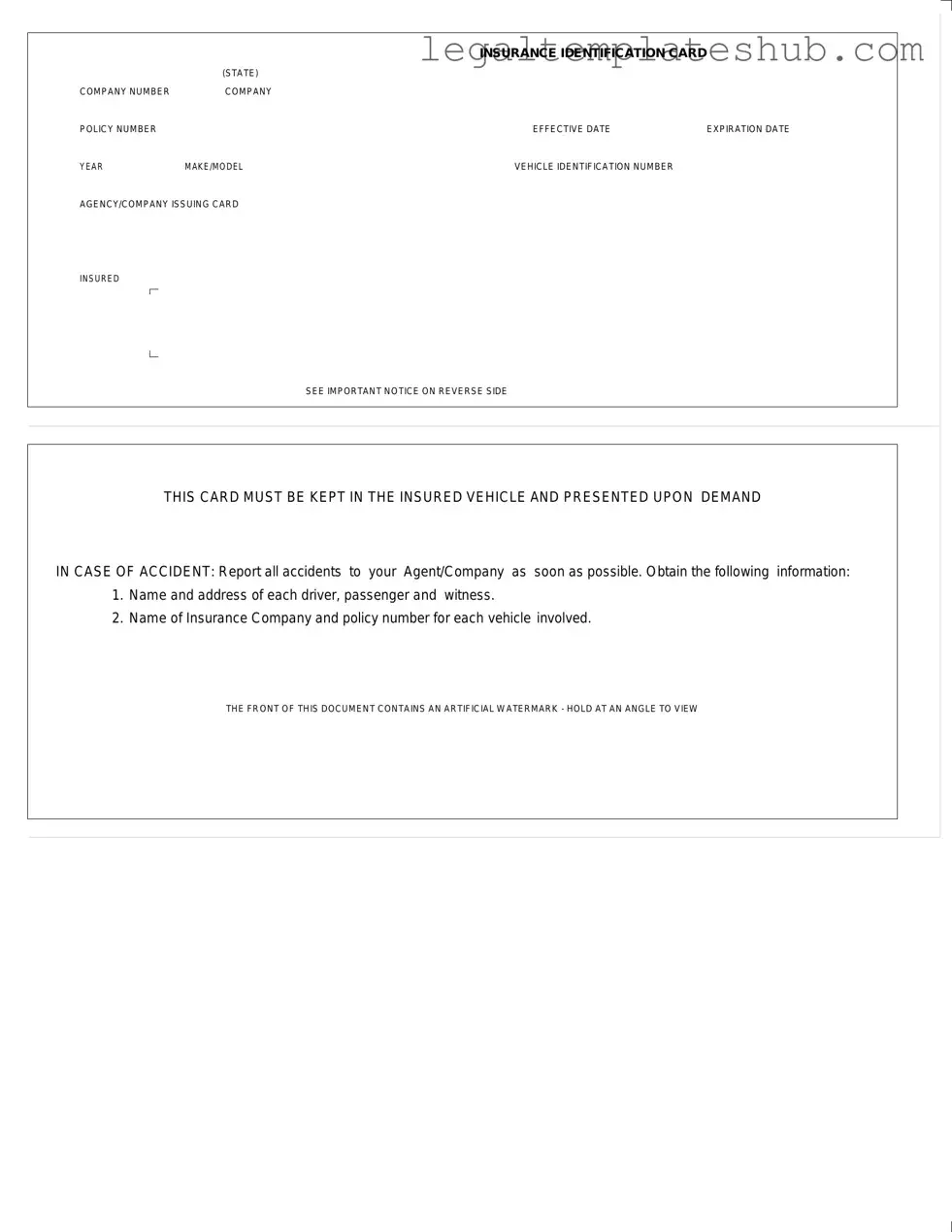

Blank Auto Insurance Card PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Insurance Identification Card | This card serves as proof of auto insurance coverage in the state. |

| Company Number | The unique identifier assigned to the insurance company providing coverage. |

| Policy Number | This number is specific to the insurance policy and is crucial for claims. |

| Effective Date | The date when the insurance coverage begins. |

| Expiration Date | The date when the insurance coverage ends and renewal may be necessary. |

| Vehicle Information | Details about the vehicle, including year, make, model, and VIN. |

| Issuing Agency/Company | The name of the agency or company that issued the insurance card. |

| Important Notice | Instructions on what to do in case of an accident, including reporting requirements. |

| Watermark Feature | The front of the card includes an artificial watermark for security purposes. |

Key takeaways

When filling out and using the Auto Insurance Card form, keep these key points in mind:

- Insurance Identification Card: This card serves as proof of your auto insurance coverage.

- Essential Information: Ensure that the company number, policy number, effective date, and expiration date are filled out correctly.

- Vehicle Details: Include the year, make/model, and vehicle identification number (VIN) for accurate identification.

- Agency Information: The card must clearly state the agency or company issuing it.

- Keep It Handy: Always keep this card in your insured vehicle. It must be presented upon demand in case of an accident.

- Accident Protocol: Report all accidents to your insurance agent or company as soon as possible.

- Collect Information: In the event of an accident, gather names and addresses of drivers, passengers, and witnesses, along with insurance details for all vehicles involved.

Remember, the front of the document features an artificial watermark. To view it, hold the card at an angle.

Dos and Don'ts

When filling out the Auto Insurance Card form, it is essential to approach the task with care and attention. Here’s a list of things you should and shouldn’t do to ensure accuracy and compliance.

- Do double-check all personal information for accuracy.

- Do ensure that the vehicle identification number (VIN) is correct.

- Do keep a copy of the completed form for your records.

- Do fill out the effective and expiration dates clearly.

- Do include the correct insurance company name and policy number.

- Don't leave any sections of the form blank.

- Don't use abbreviations that might confuse the information.

- Don't forget to sign and date the form if required.

- Don't ignore the important notice on the reverse side.

By following these guidelines, you can ensure that your Auto Insurance Card form is completed correctly, helping to avoid any potential issues in the future.

Common PDF Templates

Blank Fillable Invoice - This tool is available for free, with no hidden fees.

The process of selling a mobile home becomes much easier with the proper documentation, such as the Mobile Home Bill of Sale form, which serves as an essential tool for both sellers and buyers in ensuring a smooth transfer of ownership and compliance with state regulations.

Security Report Writing - Summarizing daily activities fosters a culture of vigilance among officers.

Stillborn Birth Certificate - The form is essential for confirming that the miscarriage was not the result of intentional termination.

Instructions on Filling in Auto Insurance Card

After obtaining the Auto Insurance Card form, ensure that you have all necessary information at hand. This includes details about your insurance policy, vehicle, and the issuing agency. Follow these steps to accurately complete the form.

- Locate the section labeled INSURANCE IDENTIFICATION CARD (STATE) at the top of the form.

- Fill in the COMPANY NUMBER provided by your insurance provider.

- Enter your COMPANY POLICY NUMBER in the designated field.

- Record the EFFECTIVE DATE of your insurance policy.

- Indicate the EXPIRATION DATE of your insurance policy.

- Write down the YEAR of your vehicle.

- Provide the MAKE/MODEL of your vehicle.

- Input the VEHICLE IDENTIFICATION NUMBER (VIN) for your vehicle.

- Identify the AGENCY/COMPANY ISSUING CARD and fill in the name.

- Review the form for accuracy before submission.

Once completed, keep the card in your vehicle as it must be presented upon demand in case of an accident. It is also important to report any accidents to your insurance agent or company as soon as possible.

Misconceptions

Understanding the auto insurance card is crucial for every driver. However, several misconceptions can lead to confusion. Here are five common misunderstandings about the auto insurance card:

- The card is only necessary for accidents. Many believe that the insurance card is only needed when an accident occurs. In reality, it should be kept in the vehicle at all times and presented upon demand, whether in an accident or during a routine traffic stop.

- All information on the card is optional. Some people think that they can ignore certain details on the card. However, vital information such as the policy number, effective dates, and vehicle identification number is essential for verifying coverage.

- It’s okay to rely on a digital version. While many insurance companies offer digital cards, some states require a physical card to be present in the vehicle. Always check your local laws to ensure compliance.

- Only the policyholder needs to carry the card. A common belief is that only the person whose name is on the policy must have the card. In fact, any authorized driver should have access to it while operating the vehicle.

- The card never expires. Some individuals think that once they receive their insurance card, it remains valid indefinitely. This is misleading; the card has an expiration date and must be updated when the policy is renewed.

By clarifying these misconceptions, drivers can better understand the importance of their auto insurance card and ensure they are prepared for any situation on the road.