Blank Broker Price Opinion PDF Form

File Breakdown

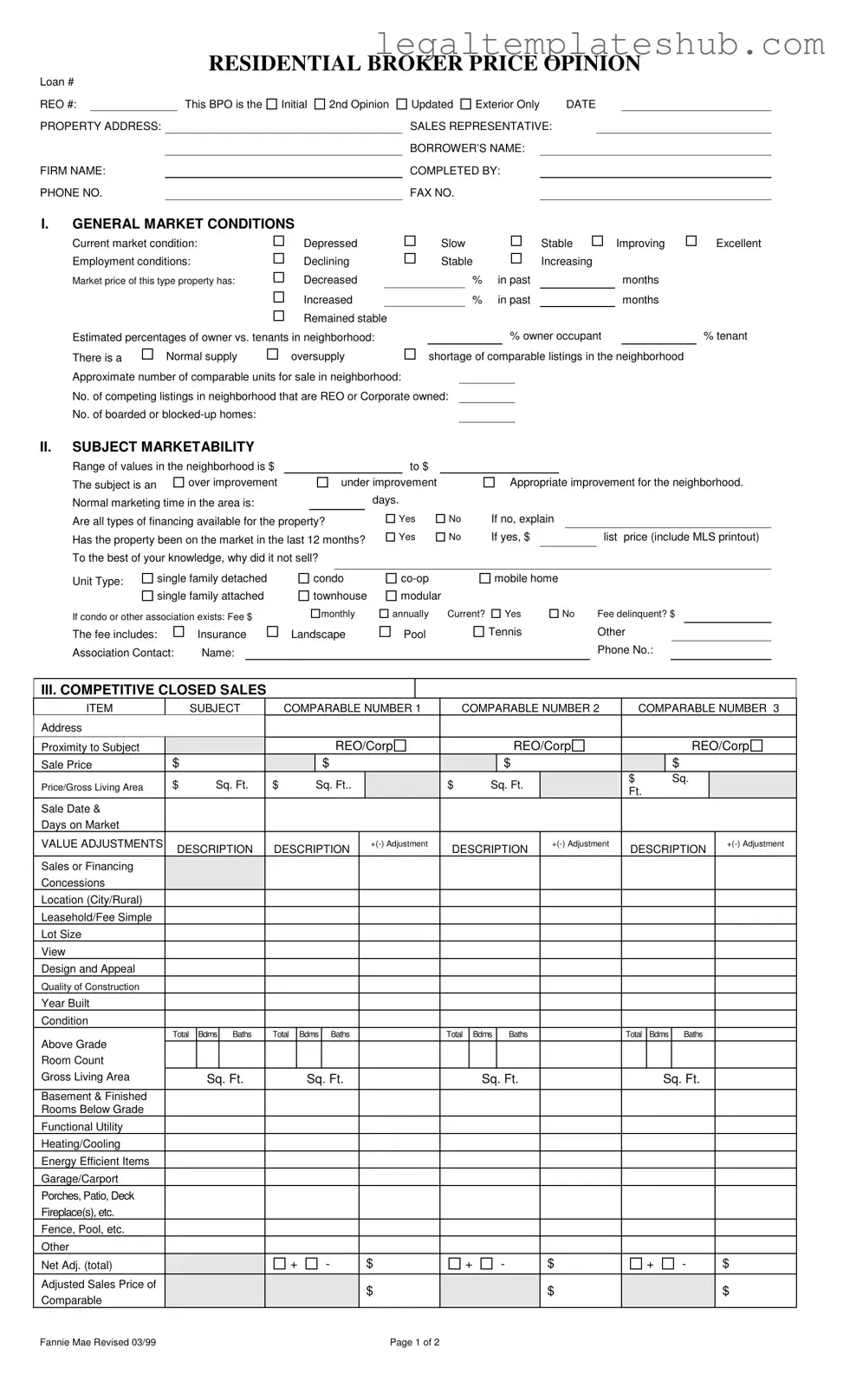

| Fact Name | Details |

|---|---|

| Purpose | The Broker Price Opinion (BPO) form is used to estimate the value of a property, typically for lenders or real estate professionals. |

| Components | The form includes sections for general market conditions, subject marketability, competitive closed sales, and marketing strategy. |

| Market Conditions | It assesses current market conditions, including employment trends and supply versus demand for comparable listings. |

| Financing Availability | The BPO form requires information on the types of financing available for the property, which can influence its marketability. |

| Comparable Sales | It includes a section for competitive closed sales, allowing for a comparison between the subject property and similar properties that have recently sold. |

| Legal Framework | In many states, BPOs are governed by real estate licensing laws, which dictate who can complete these forms and under what circumstances. |

| Repairs and Marketing | The form outlines necessary repairs and marketing strategies to enhance the property's appeal to potential buyers. |

Key takeaways

When filling out and using the Broker Price Opinion (BPO) form, consider these key takeaways:

- Accurate Information is Crucial: Ensure that all sections of the form are filled out with precise and current information. This includes market conditions, comparable sales, and property details.

- Understand Market Conditions: Assess the general market conditions and employment trends. This will help in determining the property's value and marketing strategy.

- Comparable Properties Matter: Include detailed information about comparable properties. This includes their sale prices, conditions, and any adjustments made to their values.

- Document Repairs Needed: Clearly itemize any repairs required to bring the property to marketable condition. This will aid in setting a realistic price and attract potential buyers.

Dos and Don'ts

When filling out the Broker Price Opinion (BPO) form, it is essential to follow certain guidelines to ensure accuracy and clarity. Here are ten things to do and not do:

- Do fill in all required fields completely.

- Do use clear and concise language.

- Do provide current market conditions based on reliable data.

- Do accurately describe the property’s condition and any necessary repairs.

- Do include comparable sales that are relevant and recent.

- Don't leave any sections blank unless they are not applicable.

- Don't exaggerate the property's value or condition.

- Don't use outdated or irrelevant comparables.

- Don't forget to check for any financing options available for the property.

- Don't overlook the importance of providing thorough comments on the property.

Following these guidelines will help ensure that the BPO form is completed accurately and effectively.

Common PDF Templates

Signing Over Parental Rights in Sc - It prompts the affiant to specify if they have a court obligation for child support.

The New York Operating Agreement is an essential tool for Limited Liability Companies (LLCs) in New York, clearly detailing the management structure and operational protocols necessary for smooth functioning. This document not only safeguards the interests of all members but also clarifies the responsibilities and procedures involved in running the business. To make the process easier, you can access necessary forms, including the PDF Templates, to ensure your LLC is established properly.

Profits or Loss From Business - Schedule C requires information about the business, including the name and type of business conducted.

Printable Job Application - Your attention to detail could enhance your chances.

Instructions on Filling in Broker Price Opinion

Completing the Broker Price Opinion (BPO) form requires careful attention to detail and accuracy. This process will involve gathering relevant information about the property, market conditions, and comparable sales. Each section of the form must be filled out systematically to ensure a comprehensive evaluation.

- Begin with the top section of the form. Fill in the Loan # and REO #, if applicable.

- Enter the Property Address and the Firm Name. Include your Phone No. and Fax No..

- Indicate whether this is an Initial, 2nd Opinion, or Updated BPO.

- Provide the Date and the name of the Sales Representative.

- Fill in the Borrower’s Name and the name of the person Completed By.

Next, move to the General Market Conditions section. Assess the current market condition and employment conditions, selecting the appropriate options. Provide the estimated percentages of owner-occupants versus tenants in the neighborhood.

- Indicate the current market condition: Depressed, Slow, Stable, or Improving.

- Choose the employment condition: Declining, Stable, or Increasing.

- State the market price trend for the property type.

- Provide the approximate number of comparable units for sale and details about any REO or corporate-owned listings.

Proceed to the Subject Marketability section. Here, you will evaluate the property's marketability and financing options.

- Enter the range of values in the neighborhood.

- Assess whether the subject property is an over improvement, under improvement, or appropriate improvement.

- Estimate the normal marketing time in days.

- Determine if all types of financing are available for the property.

- If the property was on the market in the last 12 months, provide the list price and reasons for not selling.

Next, complete the Competitive Closed Sales section by comparing the subject property to similar properties.

- Fill in the details for Comparable Number 1, 2, and 3, including address, sale price, and other relevant metrics.

- Make necessary value adjustments for each comparable property.

- Calculate the adjusted sales price for each comparable.

In the Marketing Strategy section, indicate the recommended strategy for selling the property, whether As-is or with Minimal Lender Required Repairs.

- State the occupancy status of the property.

- Identify the most likely buyer type.

- List all repairs needed to bring the property to an average marketable condition.

Finally, fill in the Competitive Listings section with details of comparable listings currently on the market.

- Provide the address and list price for each comparable.

- Make necessary value adjustments and calculate adjusted sales prices.

Complete the Market Value section by suggesting a market value and list price. Include any pertinent comments about the property.

- Indicate the market value and suggested list price.

- Provide comments on any special concerns related to the property.

- Sign and date the form.

Upon completion, review the entire form for accuracy and clarity before submission.

Misconceptions

- Misconception 1: A Broker Price Opinion (BPO) is the same as an appraisal.

- Misconception 2: The BPO is only for foreclosures.

- Misconception 3: Only real estate agents can complete a BPO.

- Misconception 4: A BPO guarantees a sale price.

- Misconception 5: The BPO is a one-time evaluation.

- Misconception 6: The BPO is too simplistic to be useful.

- Misconception 7: All BPOs follow the same format.

A BPO is not a formal appraisal. It provides a market value estimate based on comparable sales, but it lacks the detailed analysis and legal standing of an appraisal.

While BPOs are often used for foreclosures, they can also apply to regular home sales, helping sellers and buyers understand current market conditions.

While real estate agents frequently conduct BPOs, other qualified professionals may also perform them, provided they understand the local market.

A BPO provides an estimated value but does not guarantee what a property will sell for. Market conditions and buyer interest can affect the final sale price.

BPOs can be updated as market conditions change. An initial BPO may need adjustments based on new comparable sales or shifts in the local market.

While a BPO may seem straightforward, it incorporates various factors, including market trends and property conditions, making it a valuable tool for pricing.

BPOs can vary in format and content depending on the lender or company requesting them. Each may have specific requirements and focus areas.