Printable Business Bill of Sale Template

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Business Bill of Sale is a legal document that transfers ownership of a business or its assets from one party to another. |

| Purpose | This document serves to protect both the buyer and seller by providing a clear record of the transaction. |

| Components | Typically includes the names of the parties, a description of the business or assets, purchase price, and date of transfer. |

| State-Specific Forms | Some states may have specific requirements for the Bill of Sale, which can vary significantly. |

| Governing Law | In most states, the sale of a business is governed by the Uniform Commercial Code (UCC). |

| Signatures | Both parties should sign the document to validate the transaction and confirm their agreement to the terms. |

| Notarization | While not always required, notarization can add an extra layer of authenticity to the document. |

| Record Keeping | It is advisable for both parties to keep a copy of the Bill of Sale for their records. |

| Legal Advice | Consulting with a legal professional is recommended to ensure compliance with local laws and regulations. |

Key takeaways

Always include accurate details about the business being sold. This includes the name, address, and any relevant identification numbers.

Clearly outline the terms of the sale. Specify what is included in the sale, such as inventory, equipment, or intellectual property.

Both the buyer and seller should sign the document. This ensures that both parties agree to the terms laid out in the bill of sale.

Consider having the document notarized. This adds an extra layer of authenticity and can help prevent disputes later on.

Keep a copy of the signed bill of sale for your records. This serves as proof of the transaction and can be useful for tax purposes.

Review the form carefully before signing. Ensure that all information is correct and that you understand the terms of the sale.

Dos and Don'ts

When filling out a Business Bill of Sale form, it's important to approach the task with care. Here are some essential do's and don'ts to keep in mind:

- Do: Ensure all information is accurate and complete. Double-check names, addresses, and business details.

- Do: Include the date of the transaction. This helps establish a clear timeline for the sale.

- Do: Clearly describe the items or assets being sold. This prevents any confusion about what is included in the sale.

- Do: Keep a copy of the signed Bill of Sale for your records. This can be important for future reference.

- Don't: Leave any sections blank. Incomplete forms can lead to disputes or issues later on.

- Don't: Use vague language. Be specific to avoid misunderstandings about the terms of the sale.

- Don't: Forget to have both parties sign the document. Without signatures, the sale may not be legally binding.

- Don't: Rush the process. Take your time to review everything carefully before finalizing the sale.

Common Types of Business Bill of Sale Forms:

Sample Bill of Sale for Dog - By documenting the sale, both parties can maintain clear communication about responsibilities.

A General Bill of Sale is a vital legal document that facilitates the transfer of ownership of personal property between individuals. It ensures that all essential details such as the item description, purchase price, and the identities of both buyer and seller are documented clearly for a hassle-free transaction. To ensure everything is in order, you can easily access and fill out the General Bill of Sale form.

Faa Form 8050-2 - The AC 8050-2 includes important details about both the aircraft and the parties involved.

Tractor Bill of Sale Word Template - The form can streamline the registration and titling process with state agencies.

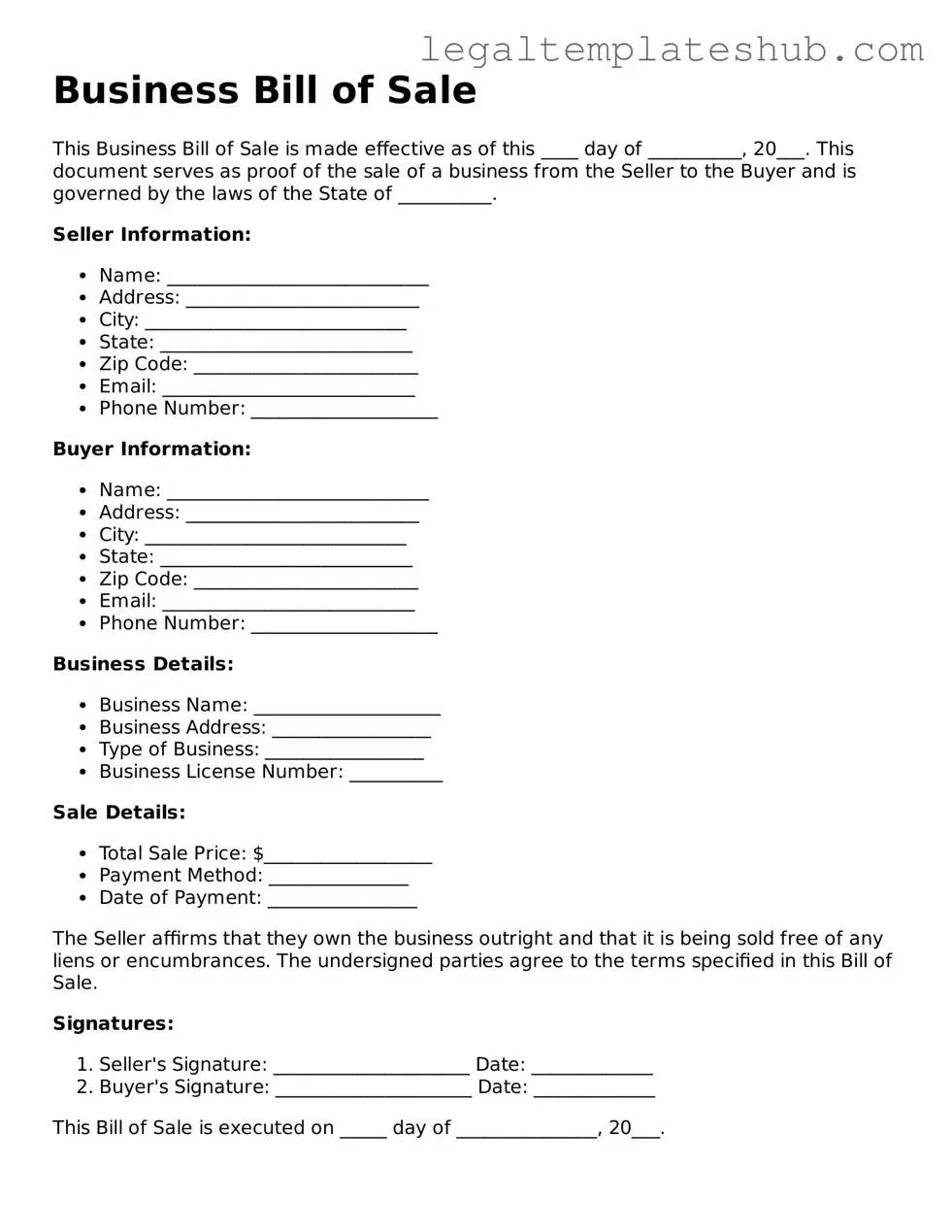

Instructions on Filling in Business Bill of Sale

After obtaining the Business Bill of Sale form, it's important to complete it accurately to ensure a smooth transaction. This document is essential for transferring ownership of a business and provides legal protection for both the buyer and the seller. Follow the steps outlined below to fill out the form correctly.

- Begin by entering the date of the sale at the top of the form.

- Provide the full legal name of the seller. This should match the name on official documents.

- Next, enter the seller's address, including city, state, and zip code.

- Fill in the buyer's full legal name, ensuring it is accurate and complete.

- Include the buyer's address in the same format as the seller's address.

- Clearly describe the business being sold. Include details such as the business name, location, and any relevant identification numbers.

- Specify the purchase price for the business. Be clear and precise in this section.

- If applicable, list any items included in the sale, such as equipment, inventory, or intellectual property.

- Both parties should sign and date the form at the bottom. Ensure that the signatures are legible.

- Finally, make copies of the completed form for both the buyer and seller for their records.

Misconceptions

When dealing with the Business Bill of Sale form, several misconceptions can lead to confusion. Here are nine common misunderstandings:

- A Business Bill of Sale is only for large transactions. Many believe this form is only necessary for significant sales, but it is useful for any business transfer, regardless of size.

- It is only needed for selling physical assets. While it is often used for tangible items, a Business Bill of Sale can also apply to intangible assets, such as intellectual property or business goodwill.

- The form is optional. Some think that a Business Bill of Sale is not required. However, having a written record is crucial for legal protection and clarity in the transaction.

- Only the buyer needs a copy. Both the buyer and seller should retain a copy of the Business Bill of Sale. This ensures that both parties have documentation of the agreement.

- It is the same as a contract. While both documents serve important purposes, a Business Bill of Sale is specifically focused on the transfer of ownership, whereas a contract may outline broader terms and conditions.

- Verbal agreements are sufficient. Relying on verbal agreements can lead to misunderstandings. A written Business Bill of Sale provides clear evidence of the transaction.

- All states have the same requirements. Requirements for a Business Bill of Sale can vary by state. It’s important to check local regulations to ensure compliance.

- It does not need to be notarized. While notarization is not always required, having the document notarized can add an extra layer of authenticity and protection.

- Once signed, it cannot be changed. If both parties agree, modifications can be made to the Business Bill of Sale. However, any changes should be documented in writing.

Understanding these misconceptions can help ensure a smoother transaction process and protect both parties involved.