Blank Business Credit Application PDF Form

File Breakdown

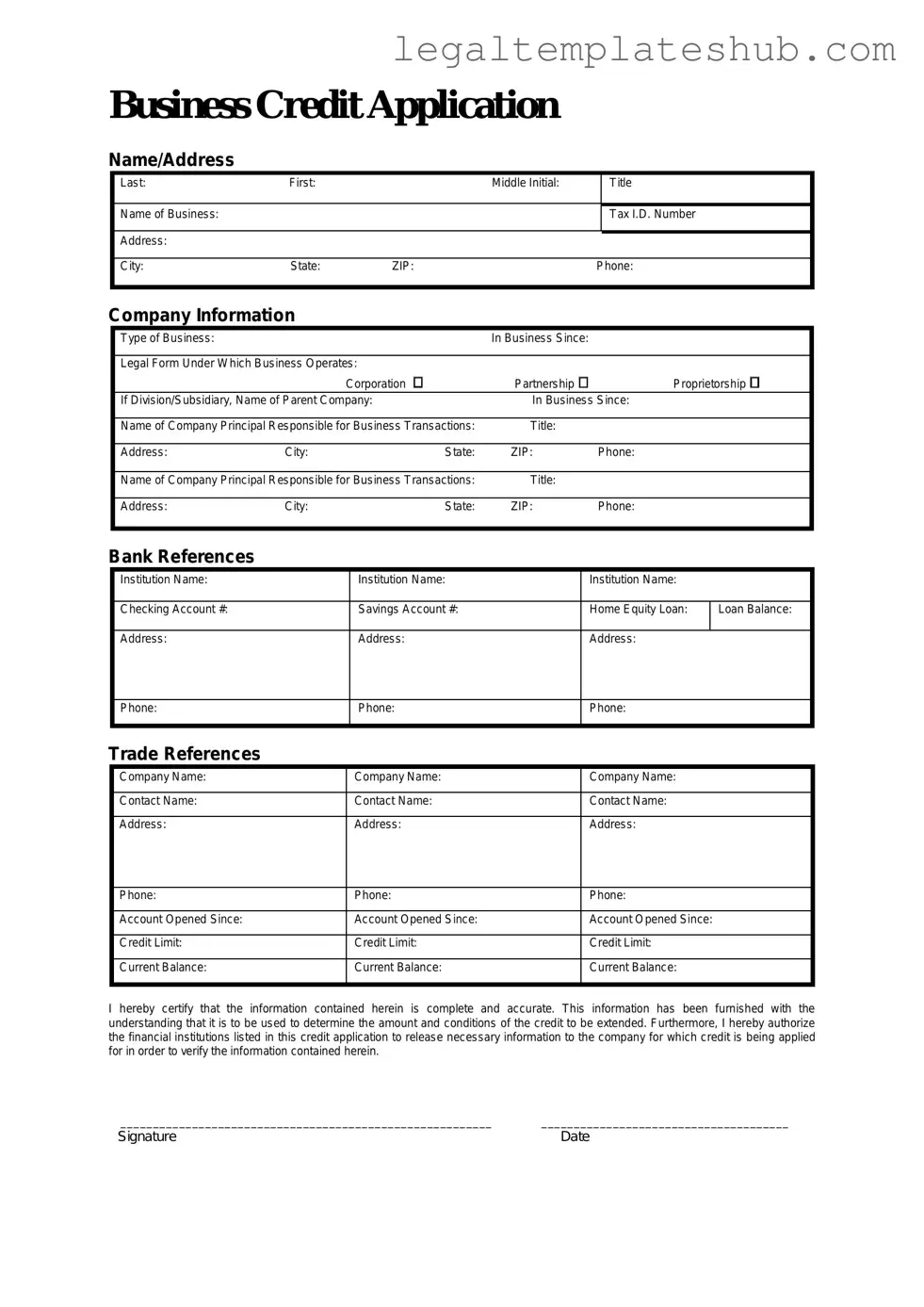

| Fact Name | Description |

|---|---|

| Purpose | The Business Credit Application form is used to assess a business's creditworthiness. |

| Information Required | The form typically requires details such as business name, address, and financial information. |

| Governing Laws | State-specific forms may be governed by state commercial code and consumer protection laws. |

| Authorization | Signing the form grants permission for the lender to check credit history. |

| Confidentiality | Information provided is generally kept confidential and used solely for credit assessment. |

| Submission Process | The completed form must be submitted to the lender for review and processing. |

| Approval Timeline | Approval can take anywhere from a few hours to several days, depending on the lender. |

| Impact on Credit Score | Submitting the application may result in a hard inquiry, which can affect the business's credit score. |

Key takeaways

Filling out a Business Credit Application form is a crucial step for any business seeking credit. Here are some key takeaways to keep in mind:

- Accuracy is Essential: Ensure that all information provided is accurate and up-to-date. Incorrect details can lead to delays or denials in credit approval.

- Provide Comprehensive Information: Include all necessary details about your business, such as ownership structure, financial history, and credit references. This helps lenders assess your creditworthiness.

- Understand the Terms: Familiarize yourself with the terms and conditions associated with the credit being applied for. Knowing the interest rates and repayment terms can prevent future financial issues.

- Follow Up: After submitting your application, don’t hesitate to follow up with the lender. This shows your commitment and can help expedite the review process.

Dos and Don'ts

When filling out a Business Credit Application form, it's important to approach the process with care. Here are some essential dos and don'ts to keep in mind:

- Do provide accurate and complete information.

- Do review the application for errors before submission.

- Don't leave any sections blank unless instructed.

- Don't exaggerate your business's financial status.

Following these guidelines can help ensure a smooth application process and improve your chances of securing the credit you need.

Common PDF Templates

B+l - Integral to the transportation business’s paperwork requirements.

Pharmacy Medication Labels - Use this document to keep track of multiple medications.

In addition to completing the Arizona ATV Bill of Sale form, which is essential for the official transfer of ownership, you may also consider reviewing the Bill of Sale for ATVs to ensure you have all the necessary information and documentation for a successful transaction.

Printable:5s6uydlipco= Living Will Template - The act of completing Five Wishes can foster a sense of empowerment regarding one’s health care journey.

Instructions on Filling in Business Credit Application

Completing the Business Credit Application form is an important step in establishing a business relationship. Once the form is filled out, it will be reviewed to determine eligibility for credit. Below are the steps to ensure that the application is completed accurately.

- Begin by entering the business name at the top of the form.

- Provide the business address, including street, city, state, and zip code.

- Fill in the contact information for the primary contact person, including their name, phone number, and email address.

- Indicate the type of business (e.g., corporation, partnership, sole proprietorship).

- List the federal tax ID number or Social Security number if applicable.

- Provide information regarding the business ownership, including names and addresses of owners or partners.

- Fill out the banking information, including the name of the bank, account number, and type of account.

- Disclose any trade references, including names, addresses, and contact information of suppliers or other creditors.

- Review all information for accuracy and completeness.

- Sign and date the form to certify that the information provided is true and correct.

Once the form is completed, it should be submitted as instructed. The review process will follow, during which the application will be evaluated based on the provided information.

Misconceptions

Understanding the Business Credit Application form is crucial for any business seeking credit. However, many misconceptions exist about this form. Here are ten common misunderstandings:

- Only large businesses need to fill it out. Many small and medium-sized businesses also require credit and should complete this form.

- It’s only for loans. The form is used for various types of credit, including lines of credit and vendor accounts.

- All credit applications are the same. Each lender may have different requirements, so the forms can vary significantly.

- Submitting the form guarantees credit approval. Approval depends on various factors, including credit history and financial stability.

- Personal credit scores are irrelevant. Some lenders may consider personal credit scores, especially for small businesses.

- Once submitted, you can’t make changes. You can often update or amend your application if necessary.

- It’s a quick process. The review process can take time, and it’s essential to be patient.

- Only the owner needs to sign. Depending on the lender, other authorized individuals may also need to sign the application.

- Financial statements are optional. Most lenders will require financial statements to assess your business’s health.

- It doesn’t matter how you fill it out. Providing accurate and complete information is crucial for a successful application.

By addressing these misconceptions, businesses can approach the credit application process with greater confidence and clarity.