Printable Business Purchase and Sale Agreement Template

PDF Form Data

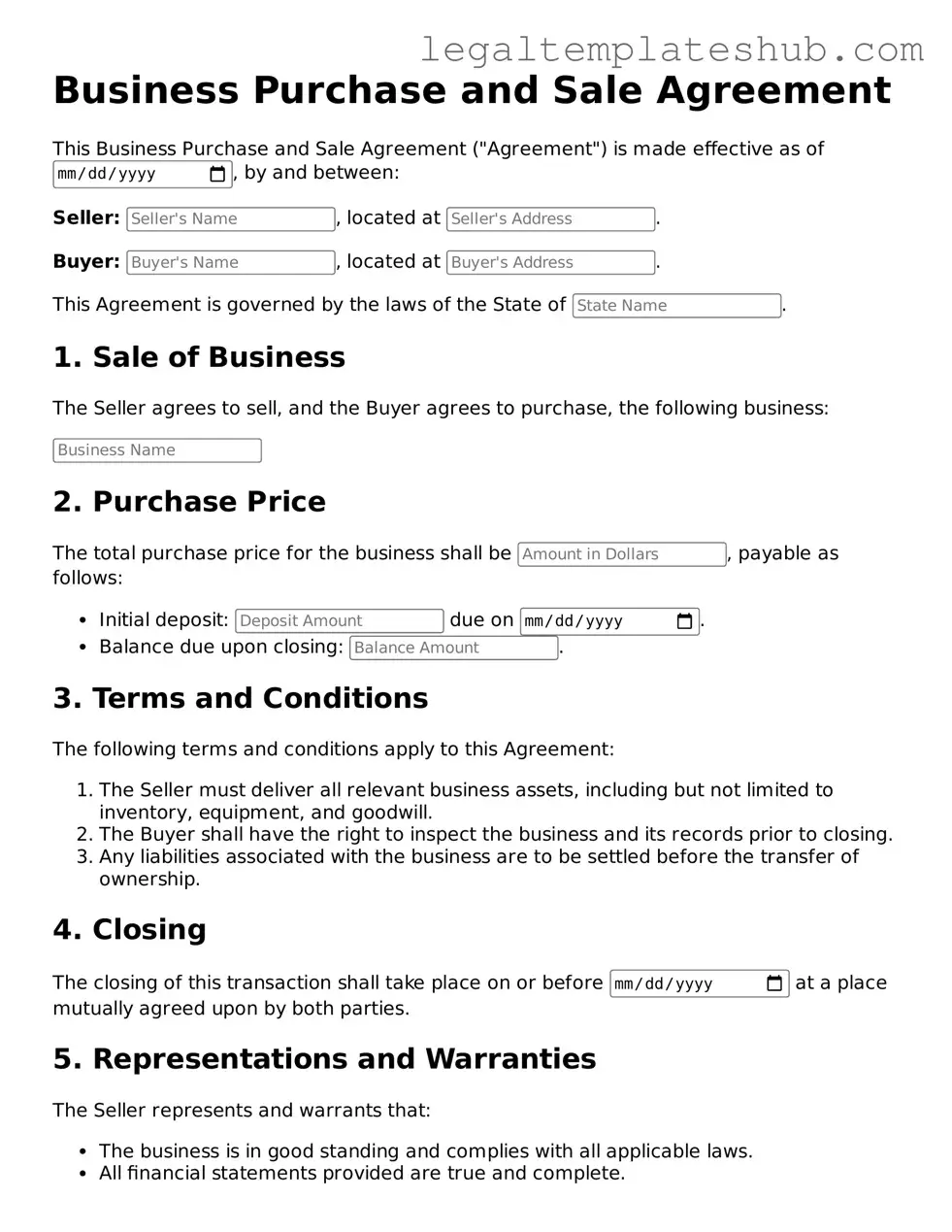

| Fact Name | Description |

|---|---|

| Purpose | A Business Purchase and Sale Agreement outlines the terms for buying or selling a business. |

| Key Components | This agreement typically includes details about the purchase price, payment terms, and assets involved. |

| Governing Law | The agreement is subject to state-specific laws, which vary by location. For example, in California, it follows the California Commercial Code. |

| Parties Involved | The agreement involves the buyer and the seller, each of whom must be clearly identified. |

| Due Diligence | Buyers typically conduct due diligence to assess the business's financial health before finalizing the agreement. |

| Legal Review | It is advisable for both parties to have the agreement reviewed by legal professionals to ensure compliance and protection. |

Key takeaways

When filling out and using the Business Purchase and Sale Agreement form, it is important to consider several key points to ensure clarity and legal compliance.

- Clearly identify the parties involved in the transaction, including full legal names and contact information.

- Provide a detailed description of the business being sold, including assets, liabilities, and any included inventory.

- Specify the purchase price and the terms of payment, including any deposits or financing arrangements.

- Outline any contingencies that must be met before the sale is finalized, such as financing or inspections.

- Include representations and warranties from both the seller and buyer regarding the condition of the business and its assets.

- Define the closing date and the process for transferring ownership and assets.

- Address any post-sale obligations, such as non-compete clauses or training for the new owner.

- Ensure that both parties sign and date the agreement to validate it legally.

- Consider consulting with legal counsel to review the agreement for any potential issues or concerns.

- Keep copies of the signed agreement for both parties for future reference.

By following these guidelines, individuals can help facilitate a smoother transaction and protect their interests throughout the process.

Dos and Don'ts

When filling out a Business Purchase and Sale Agreement form, it is essential to approach the task with care. Here are some important dos and don'ts to consider:

- Do read the entire agreement carefully before filling it out.

- Do provide accurate and complete information about the business being sold.

- Do consult with a legal professional if you have any questions.

- Do ensure all parties involved sign and date the agreement.

- Don't leave any sections blank; fill in all required fields.

- Don't rush through the process; take your time to ensure accuracy.

- Don't ignore any terms or conditions that may affect the sale.

- Don't forget to keep a copy of the signed agreement for your records.

Common Templates:

Letter of Intent to Purchase Real Estate - It may include timelines for further actions or events related to the transaction.

To ensure a smooth investment process, it is advisable to utilize the thorough Investment Letter of Intent preparation guide which outlines the key elements necessary for drafting this important document. This resource will aid in establishing clear terms and fostering effective negotiations.

Injury Report Template - This report is a vital part of the company's safety records.

Instructions on Filling in Business Purchase and Sale Agreement

Filling out the Business Purchase and Sale Agreement form is an important step in the process of buying or selling a business. This form outlines the terms and conditions of the transaction, ensuring that both parties are clear on their rights and responsibilities. Follow these steps to complete the form accurately.

- Gather necessary information: Collect all relevant details about the business, including its name, address, and any identifying numbers.

- Identify the parties involved: Clearly state the names and addresses of both the buyer and the seller.

- Describe the business: Provide a brief description of the business being sold, including its operations, assets, and liabilities.

- Specify the purchase price: Clearly outline the total purchase price and any payment terms, such as deposits or installment payments.

- Outline contingencies: Include any conditions that must be met for the sale to proceed, such as financing or inspections.

- Detail the closing process: Specify the date and location of the closing, as well as any required documentation.

- Include representations and warranties: State any guarantees made by the seller regarding the business’s condition or operations.

- Sign and date the agreement: Ensure that both parties sign and date the document to make it legally binding.

Once the form is completed, both parties should review it carefully to ensure all information is accurate and complete. After that, it’s advisable to keep a copy for your records and proceed with the next steps in the transaction.

Misconceptions

Misconceptions about the Business Purchase and Sale Agreement can lead to confusion and potential issues during a transaction. Here are eight common misconceptions explained:

-

All agreements are the same.

Many people believe that all business purchase agreements are identical. In reality, each agreement should be tailored to the specific transaction and the unique needs of both parties involved.

-

Verbal agreements are sufficient.

Some assume that a verbal agreement is enough to finalize a business sale. However, a written agreement is essential for clarity and legal protection.

-

Only the purchase price matters.

While the purchase price is important, other terms like payment structure, warranties, and liabilities are equally critical to the agreement.

-

Due diligence is optional.

Many believe that due diligence can be skipped if both parties trust each other. This is a risky assumption; thorough checks are necessary to uncover any potential issues.

-

Once signed, the agreement cannot be changed.

Some think that a signed agreement is set in stone. In truth, amendments can be made if both parties agree, allowing for flexibility as needed.

-

Legal advice is unnecessary.

Many individuals feel they can handle the agreement without professional help. Seeking legal advice can prevent costly mistakes and ensure compliance with applicable laws.

-

Only buyers need to be concerned with the agreement.

It’s a common belief that only buyers should focus on the terms. Both buyers and sellers must understand their rights and obligations outlined in the agreement.

-

Signing the agreement means the deal is done.

Some think that signing the document finalizes the sale. However, additional steps, such as closing procedures, may still be necessary to complete the transaction.