Blank Cash Drawer Count Sheet PDF Form

File Breakdown

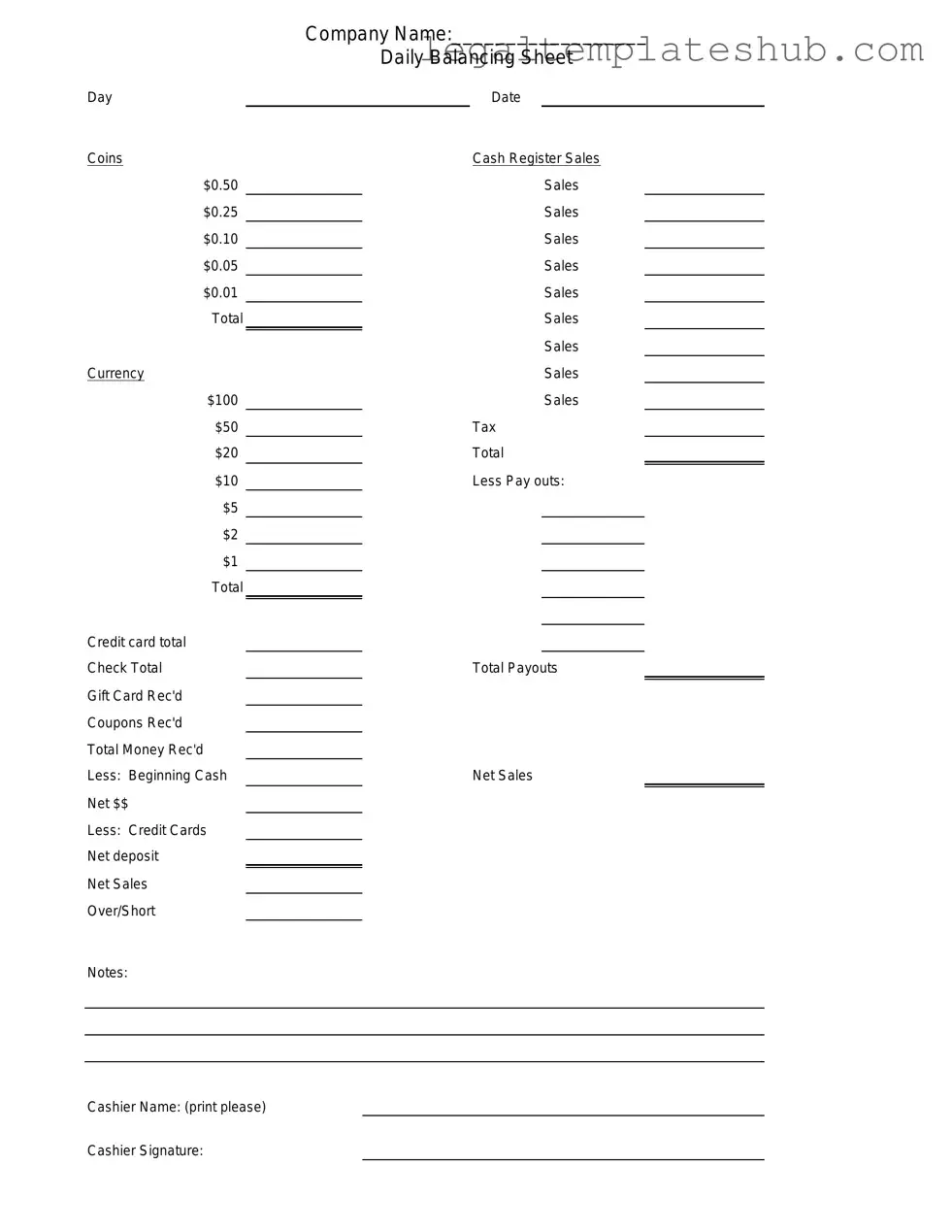

| Fact Name | Description |

|---|---|

| Purpose | The Cash Drawer Count Sheet is used to document the cash on hand in a business's cash drawer at the end of a shift or business day. |

| Importance | This form helps ensure accurate financial reporting and can assist in identifying discrepancies in cash handling. |

| Components | The sheet typically includes fields for recording the starting cash amount, cash sales, cash received, and cash remaining. |

| Frequency of Use | Businesses should complete the Cash Drawer Count Sheet at the end of each shift or day to maintain accurate records. |

| Legal Considerations | While there are no specific federal laws governing this form, businesses must comply with general accounting principles and state regulations regarding cash handling. |

Key takeaways

When managing cash transactions, the Cash Drawer Count Sheet form is an essential tool. Here are some key takeaways to ensure accurate and effective use of this form:

- Accuracy is Crucial: Always double-check the amounts entered on the sheet. Mistakes can lead to discrepancies that complicate cash management.

- Document Every Transaction: Record all cash inflows and outflows. This includes sales, returns, and any other cash movements. Comprehensive documentation helps maintain transparency.

- Use Clear Labels: Clearly label each section of the form. This clarity will help anyone reviewing the sheet understand the cash flow without confusion.

- Regular Reconciliation: Reconcile the cash drawer count regularly. Compare the recorded amounts against actual cash on hand to identify any differences promptly.

- Train Staff Properly: Ensure that all staff members who handle cash are trained in how to fill out the form correctly. Consistency in how the form is used will lead to better cash management.

By following these guidelines, using the Cash Drawer Count Sheet can significantly enhance cash handling processes and improve overall accuracy in financial reporting.

Dos and Don'ts

When filling out the Cash Drawer Count Sheet form, following best practices ensures accuracy and efficiency. Here are seven things you should and shouldn't do:

- Do double-check the total amount of cash before recording it.

- Don't rush through the process; take your time to avoid mistakes.

- Do use clear and legible handwriting when filling out the form.

- Don't leave any fields blank; fill in all required information.

- Do keep the form in a secure location until it is submitted.

- Don't use correction fluid on the form; it can lead to confusion.

- Do review the completed form for accuracy before finalizing it.

Common PDF Templates

Broker Price Opinion Letter Pdf - Utilizing recent sales data, the BPO helps determine a competitive price for a property in its local market.

Signed Real Doctors Note for Work - This document is part of vital patient-provider communication.

For those looking to facilitate a smooth transaction, the importance of an accurate Horse Bill of Sale cannot be overstated. This comprehensive Horse Bill of Sale documentation is crucial for ensuring that all parties are protected and informed throughout the sale process. For further details, you can find the necessary form at Colorado Horse Bill of Sale.

How to Pause Melaleuca Membership - You can write in any other reasons that apply to your situation.

Instructions on Filling in Cash Drawer Count Sheet

Completing the Cash Drawer Count Sheet form is essential for maintaining accurate financial records. This process ensures that all cash transactions are accounted for and helps identify any discrepancies. Below are the steps to properly fill out the form.

- Begin by entering the date at the top of the form. This should reflect the day the cash count is conducted.

- In the designated section, write your name or the name of the person conducting the count. This identifies who is responsible for the cash drawer at that time.

- Count the cash in the drawer. Separate bills by denomination for clarity.

- Record the total amount of cash counted for each denomination in the appropriate columns on the form.

- Add the totals of all denominations to find the overall cash total. Write this amount in the designated box.

- If applicable, note any discrepancies between the expected cash amount and the counted cash. Provide a brief explanation if necessary.

- Finally, sign and date the form at the bottom to certify that the count is accurate.

Misconceptions

The Cash Drawer Count Sheet is an essential tool for businesses that handle cash transactions. However, several misconceptions often cloud its importance and usage. Here are six common misunderstandings about this form:

- It’s only for large businesses. Many people believe that only large retail chains need a Cash Drawer Count Sheet. In reality, any business that deals with cash—whether it’s a small coffee shop or a large department store—can benefit from this form. It helps ensure accurate cash handling and accountability, regardless of size.

- It’s unnecessary if you use a POS system. Some assume that modern Point of Sale (POS) systems eliminate the need for a Cash Drawer Count Sheet. While POS systems can streamline transactions, they do not replace the need for manual cash counts. The sheet serves as a physical record that can help identify discrepancies and ensure cash is accounted for.

- It’s only used at the end of the day. Many think the Cash Drawer Count Sheet is only relevant for end-of-day cash reconciliation. However, it can be used throughout the day to monitor cash flow and identify any issues before they escalate. Regular counts can help maintain accuracy and prevent theft or errors.

- It’s a complicated form. Some may feel intimidated by the thought of filling out a Cash Drawer Count Sheet, assuming it’s overly complex. In truth, the form is designed to be straightforward and user-friendly. It typically includes sections for recording cash amounts, checks, and other relevant details, making it easy to complete.

- Only managers need to fill it out. A common belief is that only managers or owners should complete the Cash Drawer Count Sheet. In fact, any employee responsible for handling cash can fill it out. This promotes accountability across the team and ensures that everyone is aware of cash management practices.

- It’s just a formality. Some people view the Cash Drawer Count Sheet as a mere formality, believing it has little real value. However, this form plays a crucial role in financial management. It helps track cash flow, identify discrepancies, and provides a clear record for audits, making it an invaluable part of business operations.

Understanding these misconceptions can help businesses utilize the Cash Drawer Count Sheet effectively. By recognizing its importance, any business can enhance its cash management practices and maintain financial integrity.