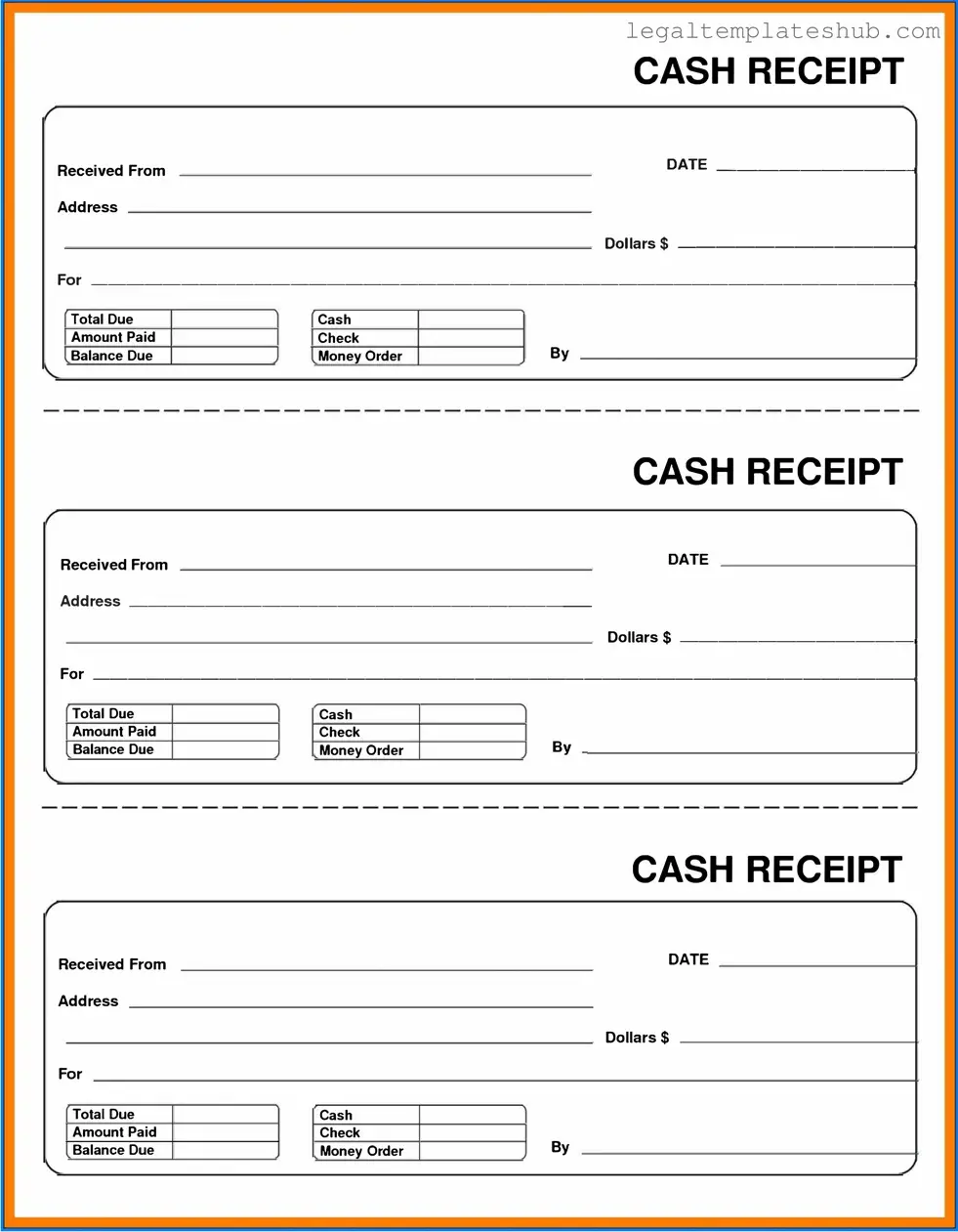

Blank Cash Receipt PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Cash Receipt form is used to document the receipt of cash payments from clients or customers. |

| Components | This form typically includes fields for the date, amount received, payer's information, and purpose of payment. |

| Record Keeping | It serves as an important record for both the payer and the recipient, ensuring transparency in financial transactions. |

| State-Specific Requirements | Some states may have specific laws governing the use of cash receipts, such as the Uniform Commercial Code (UCC) in commercial transactions. |

| Legal Importance | Cash Receipt forms can serve as evidence in legal disputes regarding payment, making accurate completion crucial. |

Key takeaways

When filling out and using the Cash Receipt form, it is important to keep the following key takeaways in mind:

- Accuracy is Crucial: Ensure all information is entered correctly. This includes the date, amount received, and the name of the individual or entity making the payment.

- Documentation: Always attach any relevant documents, such as invoices or contracts, to support the transaction. This helps maintain clear records.

- Signatures: The form must be signed by the person receiving the cash. This provides accountability and verifies that the transaction occurred.

- Retention of Records: Keep a copy of the completed Cash Receipt form for your records. This is essential for financial tracking and future reference.

- Timeliness: Complete and submit the Cash Receipt form promptly after receiving payment. Delays can lead to discrepancies in financial records.

By adhering to these guidelines, you can ensure that the process of handling cash transactions is efficient and reliable.

Dos and Don'ts

When filling out the Cash Receipt form, it is essential to follow certain guidelines to ensure accuracy and compliance. Below is a list of things you should and shouldn't do.

- Do double-check all amounts entered to avoid any discrepancies.

- Do ensure that the date of the transaction is accurately recorded.

- Do provide clear descriptions for each item or service paid for.

- Do keep a copy of the completed form for your records.

- Don't leave any fields blank; fill out all required information.

- Don't use abbreviations that may cause confusion for anyone reviewing the form.

Following these guidelines will help maintain clear records and promote effective communication. Taking the time to fill out the Cash Receipt form correctly benefits everyone involved.

Common PDF Templates

Stock Transfer Forms - This form is essential for documenting stockholder transactions clearly.

For those looking to facilitate the sale of a vehicle in Pennsylvania, utilizing the appropriate documentation is crucial. The PDF Templates can provide you with the necessary forms to ensure that all required information is captured correctly, thus simplifying the transfer of ownership process.

U.S. Corporation Income Tax Return - The form distinguishes between various types of income, including ordinary and capital gains.

Electrical Panel Schedule Template - Provides a reference for energy audits and assessments.

Instructions on Filling in Cash Receipt

Once you have the Cash Receipt form in front of you, the next steps involve carefully filling it out to ensure accuracy. This process is straightforward, and following these steps will help you complete the form without any confusion.

- Begin by entering the date of the transaction at the top of the form.

- In the "Received From" section, write the name of the individual or organization providing the payment.

- Next, specify the amount received in the designated field. Make sure to double-check the figures.

- Indicate the method of payment, such as cash, check, or credit card, in the appropriate area.

- If applicable, include any reference number related to the payment, like a check number or invoice number.

- In the "Description" section, briefly describe the purpose of the payment.

- Finally, sign and date the form at the bottom to validate the receipt.

After completing the form, keep a copy for your records. This will be essential for tracking payments and maintaining accurate financial documentation.

Misconceptions

Understanding the Cash Receipt form is essential for accurate financial record-keeping. However, several misconceptions can lead to confusion. Here are eight common misconceptions:

- All cash receipts are the same. Many believe that all cash receipts serve the same purpose. In reality, they can vary based on the type of transaction, the parties involved, and the specific accounting practices of a business.

- Cash receipts are only for cash transactions. Some think that cash receipts only apply to cash transactions. However, they can also be used for credit card payments, checks, and other forms of payment.

- You don't need to keep cash receipts. A common misconception is that cash receipts can be discarded after recording transactions. In fact, keeping them is crucial for auditing and tax purposes.

- Cash receipts are only for large transactions. Many assume that cash receipts are only necessary for significant amounts. However, they should be issued for all transactions, regardless of size, to maintain accurate records.

- Cash receipts are only relevant for businesses. Some believe that cash receipts are only important for businesses. Individuals receiving payments, such as freelancers or contractors, should also use them to document income.

- Cash receipts do not require detailed information. There is a misconception that cash receipts can be vague. In truth, they should include specific details, such as the date, amount, payer information, and purpose of the transaction.

- Only the seller needs a cash receipt. Many think that only the seller requires a copy of the cash receipt. Both the payer and the payee should retain a copy for their records.

- Cash receipts are not legally binding. Some people believe that cash receipts hold no legal weight. However, they can serve as proof of payment and may be used in legal disputes or audits.

Being aware of these misconceptions can help ensure proper use of the Cash Receipt form and promote better financial practices.