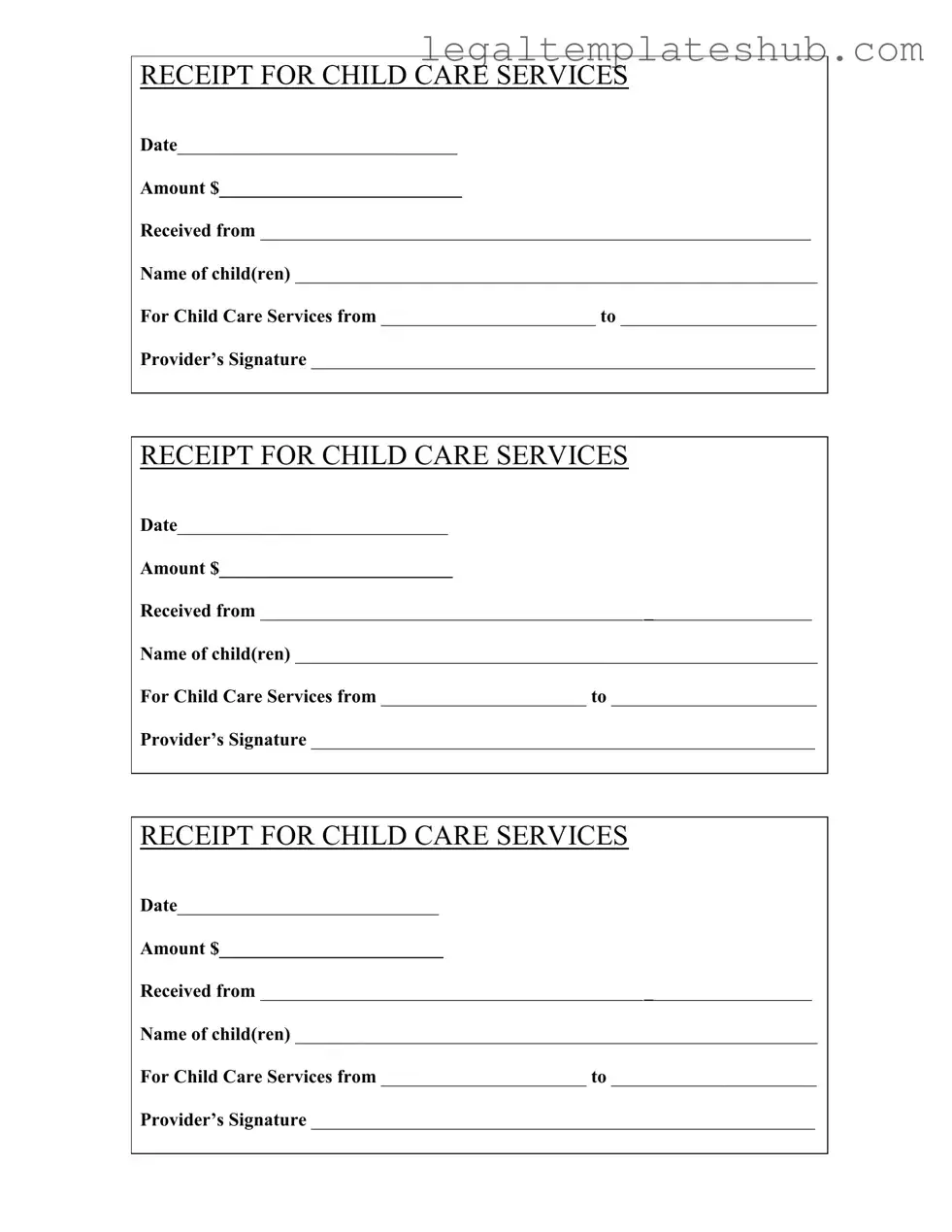

Blank Childcare Receipt PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Date of Service | This form includes a section to specify the date when the childcare services were provided. Accurate dates are crucial for record-keeping. |

| Amount Paid | Providers must indicate the total amount paid for the childcare services. This helps in financial tracking for both parents and providers. |

| Recipient Information | The form requires the name of the person who paid for the childcare services. This ensures that payments are properly attributed. |

| Child's Name | Parents must provide the names of the child or children receiving care. This is essential for identifying the services rendered. |

| Service Period | There is a section to indicate the start and end dates of the childcare services. This helps clarify the duration of care provided. |

| Provider's Signature | The form requires the signature of the childcare provider. This serves as a confirmation of the services rendered and the payment received. |

| Legal Compliance | In many states, this receipt may be necessary for tax purposes or to comply with state laws governing childcare services. |

| Duplicate Copies | It is advisable to keep a copy of the receipt for both the provider and the parent. This ensures that both parties have a record of the transaction. |

Key takeaways

When filling out and using the Childcare Receipt form, consider the following key takeaways:

- Ensure that the date is clearly filled in to indicate when the payment was made.

- Write the amount received in both numbers and words for clarity.

- Include the name of the person who made the payment to avoid confusion.

- List the names of the children receiving care to specify the services provided.

- Clearly state the service period by filling in the start and end dates of childcare services.

- The provider must sign the receipt to validate the transaction.

- Keep a copy of the receipt for your records, as it may be needed for tax purposes.

- Use the form for each separate payment to maintain clear records.

- Double-check all information for accuracy before providing the receipt.

- Consider using a consistent format for all receipts to ensure uniformity.

Dos and Don'ts

When filling out the Childcare Receipt form, it’s important to ensure accuracy and clarity. Here are some essential dos and don’ts to keep in mind:

- Do fill in the date clearly to indicate when the services were provided.

- Do specify the total amount paid for the childcare services.

- Do provide the full name of the person who is making the payment.

- Do include the names of all children receiving care.

- Do indicate the period during which the childcare services were rendered.

- Don’t leave any fields blank; every section should be completed.

- Don’t use abbreviations or nicknames for names; full legal names are required.

- Don’t forget to sign the form as the provider to validate the receipt.

- Don’t alter the form after it has been signed; keep it as is for record-keeping.

Common PDF Templates

Create Gift Card Online Free - Being honest and forthright in a Gift Letter is crucial for compliance.

The Last Will and Testament is a crucial document for ensuring your final wishes are honored. For more insights on its importance and how it functions, you can check this comprehensive overview of the Last Will and Testament process.

Create Gift Certificate - Make someone's day with a gift certificate that speaks to their passions.

Geico Supplement Request Form Pdf - Accurate details can lead to faster approvals from GEICO.

Instructions on Filling in Childcare Receipt

Completing the Childcare Receipt form is straightforward. Follow these steps to ensure that all necessary information is accurately recorded. This form will serve as a record of payment for childcare services rendered.

- Begin by entering the Date at the top of the form. Write the date in the format MM/DD/YYYY.

- Next, fill in the Amount received for the childcare services. Specify the dollar amount.

- In the Received from section, write the name of the individual who made the payment.

- List the Name of child(ren) for whom the childcare services were provided. Include all relevant names.

- Indicate the period of childcare services by filling in the For Child Care Services from and to sections. Specify the start and end dates.

- Finally, the provider must sign in the Provider’s Signature section to validate the receipt.

Misconceptions

Misconceptions about the Childcare Receipt form can lead to confusion for parents and providers alike. Here are four common misunderstandings:

- The form is only for tax purposes. While many parents use the receipt for tax deductions, it serves a broader purpose. It acts as proof of payment for childcare services, which can be important for personal record-keeping and disputes.

- Only licensed providers can issue this receipt. This is not true. Any childcare provider, whether licensed or unlicensed, can issue a receipt as long as they provide the necessary information. This includes the amount paid and the dates of service.

- All childcare receipts look the same. In reality, receipts can vary significantly in format. However, they should include essential details such as the provider's signature, the name of the child, and the dates of service. The key is that the information is accurate, regardless of the design.

- Parents need to keep receipts forever. While it’s a good idea to hold onto receipts for a few years, especially during tax season, there is no requirement to keep them indefinitely. Generally, keeping them for three to seven years is sufficient, depending on your situation.

Understanding these misconceptions can help you navigate the childcare process more effectively. Clear communication with your provider and proper record-keeping can make a significant difference.