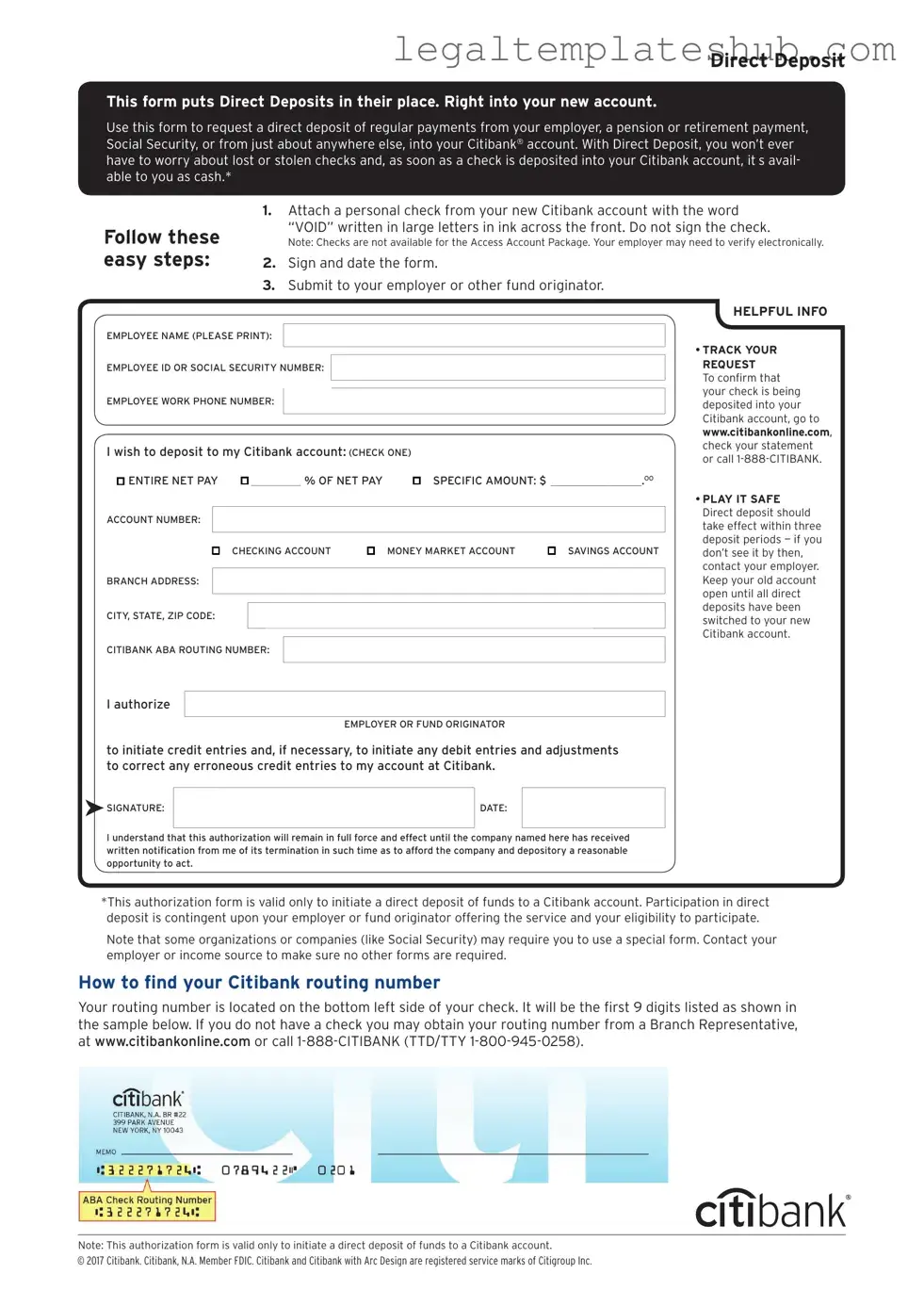

Blank Citibank Direct Deposit PDF Form

File Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Citibank Direct Deposit form is used to authorize automatic deposits into a Citibank account. |

| Eligibility | Individuals with a Citibank account can use this form to set up direct deposit for payroll, government benefits, or other recurring payments. |

| Information Required | To complete the form, you'll need your bank account number, routing number, and personal identification details. |

| Submission Process | After filling out the form, you must submit it to your employer or the organization making the payments. |

| State-Specific Forms | Some states may have specific requirements. For example, California law governs employment-related direct deposits. |

| Processing Time | Once submitted, it may take one to two pay cycles for the direct deposit to become effective. |

Key takeaways

Filling out the Citibank Direct Deposit form is straightforward. Here are some key takeaways to keep in mind:

- Personal Information: Ensure you enter your name, address, and Social Security number accurately. This information is crucial for processing your deposit.

- Account Details: Provide the correct bank account number and routing number. Double-check these numbers to avoid any errors.

- Deposit Amount: You can choose to deposit your entire paycheck or a specific amount. Make your selection clear on the form.

- Signature: Don’t forget to sign the form. Your signature authorizes the direct deposit and confirms that the information is correct.

- Submission: Submit the completed form to your employer or payroll department. They will process it to set up your direct deposit.

- Timing: Allow time for the setup. It may take one or two pay cycles for your direct deposit to begin.

- Monitoring Deposits: Keep an eye on your bank statements. This will help you confirm that your direct deposits are being made correctly.

By following these tips, you can ensure a smooth experience with your Citibank Direct Deposit form.

Dos and Don'ts

When filling out the Citibank Direct Deposit form, it's important to follow specific guidelines to ensure your information is processed correctly. Here’s a list of things you should and shouldn't do:

- Do double-check your account number for accuracy.

- Don't use a temporary account number.

- Do provide the correct routing number for your bank.

- Don't leave any fields blank unless specified.

- Do sign and date the form where required.

- Don't forget to keep a copy of the completed form for your records.

- Do notify your employer of any changes to your bank account.

- Don't submit the form without confirming your personal information is up to date.

- Do follow up with your employer to ensure the direct deposit has been set up.

By adhering to these guidelines, you can help facilitate a smooth direct deposit process with Citibank.

Common PDF Templates

Trafer Joes - Enthusiastic about teamwork and contributing to a positive workplace culture.

For those considering their healthcare choices, the importance of a reliable Medical Power of Attorney cannot be overstated. This document empowers designated individuals to make vital health decisions on your behalf when you may not be in a position to do so. You can learn more about the specifics by visiting a comprehensive guide on Medical Power of Attorney forms.

Navpers 1336 3 - The form will indicate whether your request is approved or disapproved.

Dd 214 - It provides important details about military service.

Instructions on Filling in Citibank Direct Deposit

Filling out the Citibank Direct Deposit form is a straightforward process. Once completed, you can submit it to ensure your payments are deposited directly into your Citibank account. Follow these steps carefully to avoid any delays.

- Begin by downloading the Citibank Direct Deposit form from the Citibank website or obtain a physical copy from your employer.

- Enter your personal information at the top of the form. This typically includes your full name, address, and Social Security number.

- Provide your Citibank account details. You will need your account number and the routing number for your bank. These numbers can usually be found on your checks or through your online banking account.

- Indicate the type of account you are using for the direct deposit. This is usually a checking or savings account.

- Review the form to ensure all information is accurate and complete. Double-check your account numbers and personal details.

- Sign and date the form at the bottom. Your signature is required to authorize the direct deposit.

- Submit the completed form to your employer or the designated payroll department. Make sure to keep a copy for your records.

Misconceptions

Understanding the Citibank Direct Deposit form is crucial for ensuring timely and accurate payments. However, several misconceptions can lead to confusion. Below is a list of common misunderstandings regarding this form.

- Direct deposit is only for payroll payments. Many believe that direct deposit is limited to salary payments. In reality, it can also be used for government benefits, tax refunds, and other types of payments.

- You must have a Citibank account to use the form. While the form is designed for Citibank customers, it can also be used by those who have accounts at other banks, as long as they provide the necessary account details.

- Filling out the form is complicated. Some individuals feel intimidated by the form. In fact, it is straightforward, requiring only basic information such as account number and routing number.

- Direct deposits are processed instantly. There is a common belief that once the form is submitted, funds will appear immediately. However, processing times can vary, and it may take one to two business days for deposits to reflect in the account.

- You cannot change your direct deposit information. Some think that once they set up direct deposit, they cannot make changes. This is incorrect; individuals can update their information at any time by submitting a new form.

- Direct deposit is not secure. There is a misconception that direct deposits are less secure than paper checks. In fact, direct deposits are often more secure, as they reduce the risk of lost or stolen checks.

- Once set up, direct deposit requires no further action. Many assume that once direct deposit is established, it will continue indefinitely. However, it is important to monitor deposits regularly, as changes in employment or banking information can affect payments.

- Direct deposit eliminates all paperwork. Some believe that using direct deposit means no paperwork is needed. In reality, individuals should retain copies of their forms and any correspondence related to their direct deposit setup for their records.

Being aware of these misconceptions can help individuals navigate the Citibank Direct Deposit process more effectively, ensuring that they receive their funds without unnecessary delays or complications.