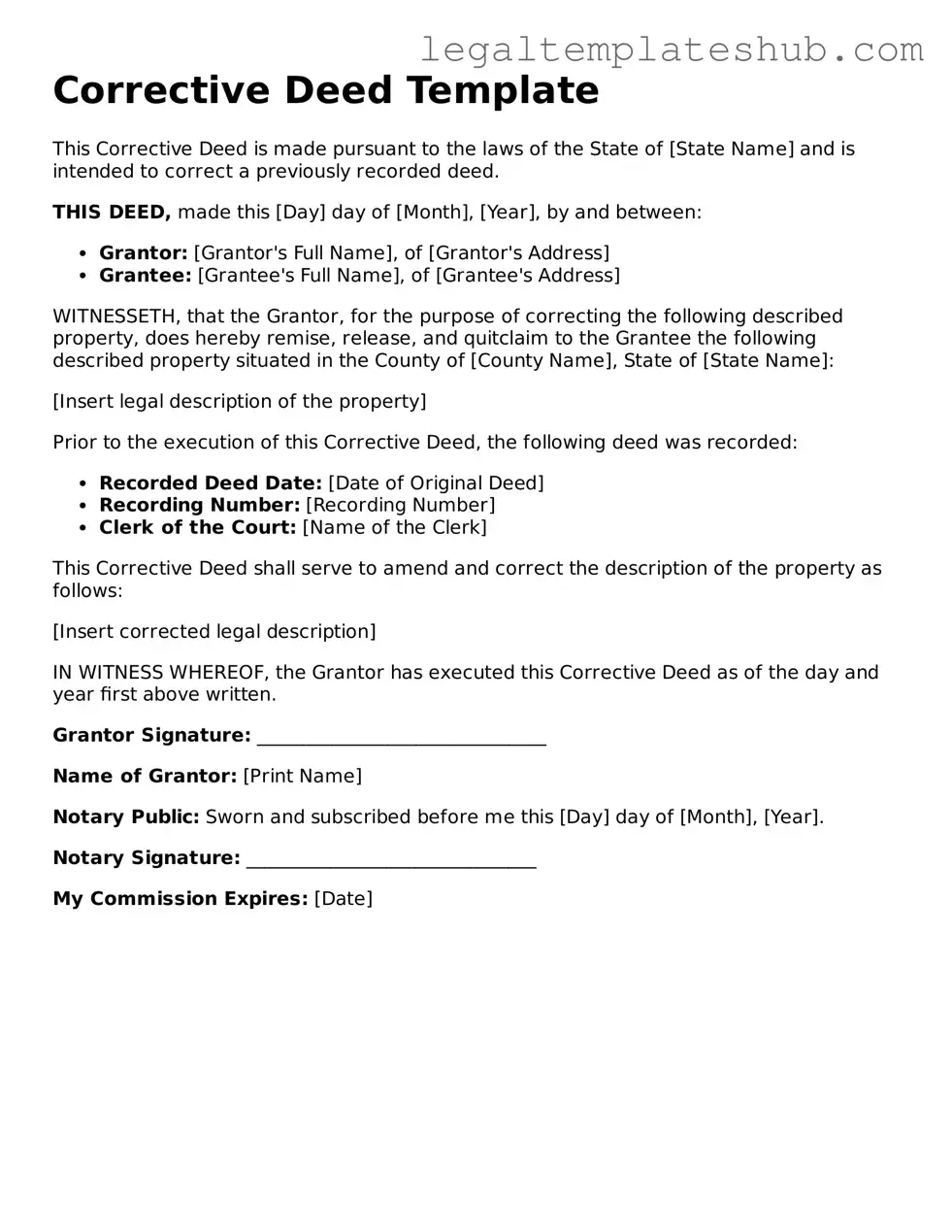

Printable Corrective Deed Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Corrective Deed is a legal document used to correct errors in a previously executed deed. |

| Purpose | The primary purpose is to clarify or amend details such as names, property descriptions, or other inaccuracies. |

| Governing Law | Each state has its own laws governing the use of Corrective Deeds; for example, in California, it falls under the California Civil Code. |

| Execution | Typically, a Corrective Deed must be signed by the parties involved in the original deed. |

| Recording | After execution, the Corrective Deed must be recorded in the county where the property is located. |

| Effectiveness | The Corrective Deed retroactively corrects the original deed, making the changes effective as of the date of the original deed. |

| Notarization | Most states require notarization of the Corrective Deed to ensure its validity. |

| Common Errors | Common mistakes corrected include misspellings of names, incorrect legal descriptions, and errors in property boundaries. |

| Legal Advice | Consulting with a legal professional is advisable to ensure the Corrective Deed meets all legal requirements. |

| Limitations | A Corrective Deed cannot be used to change the substance of the original agreement; it can only correct clerical errors. |

Key takeaways

Here are key takeaways about filling out and using the Corrective Deed form:

- Ensure you have the correct property description. This includes the address and legal description.

- Verify the names of all parties involved. All owners must be accurately listed to avoid future disputes.

- Use clear and concise language. Ambiguities can lead to misunderstandings or legal issues.

- Include the original deed’s recording information. This helps establish the context of the correction.

- Signatures must be notarized. A notary public will validate the identities of the signers.

- Check local laws and requirements. Different jurisdictions may have specific rules regarding corrective deeds.

- File the Corrective Deed with the appropriate county office. This typically is the county recorder or clerk's office.

- Keep copies of the completed form. Retaining records is important for future reference.

- Consider consulting a legal professional. They can provide guidance and ensure compliance with all regulations.

- Be aware of any fees associated with filing. There may be costs involved in recording the deed.

Dos and Don'ts

When filling out the Corrective Deed form, it is important to approach the task with care. Here are five essential dos and don'ts to keep in mind:

- Do: Read the instructions carefully before starting.

- Do: Use clear and legible handwriting or type the information.

- Do: Double-check all names and addresses for accuracy.

- Do: Sign and date the form where required.

- Do: Keep a copy of the completed form for your records.

- Don't: Rush through the process; take your time to ensure accuracy.

- Don't: Leave any required fields blank.

- Don't: Use correction fluid or tape on the form.

- Don't: Submit the form without reviewing it thoroughly.

- Don't: Forget to check the local requirements for filing.

Common Types of Corrective Deed Forms:

What Is a Gift Deed in Real Estate - A Gift Deed is a legal document used to transfer property ownership without receiving payment in return.

A Georgia Deed form is a legal document used to transfer property ownership in the state of Georgia. This document outlines the details of the transaction, including information about the buyer, seller, and the property itself. It plays a vital role in the process of buying or selling property, ensuring that all parties have a clear understanding of the terms and conditions. For additional information, you can refer to All Georgia Forms.

Instructions on Filling in Corrective Deed

After obtaining the Corrective Deed form, it's important to carefully complete it to ensure all necessary information is accurately provided. Once filled out, you will need to submit the form to the appropriate office for recording. This helps to correct any errors in the original deed and update public records accordingly.

- Begin by entering the date at the top of the form. This should reflect the date you are filling out the document.

- Next, provide the names of the parties involved in the deed. This includes the current owner(s) and the intended recipient(s) of the property.

- In the designated area, describe the property being corrected. Include the address and any relevant details, such as parcel number or legal description.

- Clearly state the nature of the correction. Specify what information is incorrect and what the correct information should be.

- Sign the form. Ensure that all parties involved in the deed provide their signatures where required.

- Have the document notarized. A notary public will need to witness the signatures to validate the form.

- Make copies of the completed form for your records before submitting it.

- Finally, submit the Corrective Deed to the appropriate local government office for recording. Check the office's requirements for submission to ensure compliance.

Misconceptions

Many people have misunderstandings about the Corrective Deed form. Here are nine common misconceptions, along with clarifications to help you understand its purpose and use.

- Corrective Deeds are only for mistakes made by title companies. This is not true. While title companies may make errors, Corrective Deeds can also address mistakes made by property owners or other parties involved in the transaction.

- Once a Corrective Deed is filed, it automatically resolves all issues. A Corrective Deed can fix specific errors, but it does not resolve all potential disputes or claims related to the property.

- Corrective Deeds are the same as quitclaim deeds. These are different. A quitclaim deed transfers ownership without guaranteeing that the title is clear, while a Corrective Deed specifically addresses and corrects errors in an existing deed.

- You do not need legal assistance to file a Corrective Deed. While it is possible to file one on your own, seeking legal advice can help ensure the deed is completed correctly and that all necessary corrections are made.

- All errors can be corrected with a Corrective Deed. This is misleading. A Corrective Deed can only fix specific types of mistakes, such as misspellings or incorrect legal descriptions, not issues related to ownership disputes.

- Filing a Corrective Deed is a lengthy process. In many cases, the process can be completed relatively quickly, depending on local regulations and how promptly the necessary documents are submitted.

- Corrective Deeds can be used to change ownership interests. This is incorrect. A Corrective Deed is meant to correct errors, not to change who owns the property or their respective shares.

- Once a Corrective Deed is filed, it cannot be changed. While it is true that changes after filing can be complicated, it is possible to file additional documents to address new issues if they arise.

- Only real estate professionals can file a Corrective Deed. Any property owner can file a Corrective Deed, but they should understand the implications and requirements involved.

Understanding these misconceptions can help you navigate the process of filing a Corrective Deed more effectively. If you have questions or need assistance, consider reaching out to a legal professional for guidance.