Printable Deed in Lieu of Foreclosure Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure is a legal agreement where a borrower voluntarily transfers ownership of their property to the lender to avoid foreclosure. |

| Purpose | This process helps borrowers avoid the lengthy and damaging foreclosure process while allowing lenders to recover their losses more quickly. |

| Eligibility | Typically, borrowers must demonstrate financial hardship and show that they cannot continue making mortgage payments. |

| State-Specific Forms | Many states have specific forms for this process. For example, California requires adherence to Civil Code Section 2924. |

| Impact on Credit | A deed in lieu of foreclosure may still negatively impact a borrower's credit score, but it is often less severe than a foreclosure. |

| Tax Implications | Borrowers may face tax consequences if the lender forgives any remaining debt after the deed transfer. |

| Process Steps | The process generally includes negotiating with the lender, signing the deed, and completing necessary paperwork. |

| Alternatives | Other options include loan modification or short sale, which may be more beneficial in certain situations. |

Deed in Lieu of Foreclosure - Adapted for State

Key takeaways

Filling out and using a Deed in Lieu of Foreclosure form can be a crucial step for homeowners facing financial difficulties. Here are some key takeaways to keep in mind:

- Understanding the Process: A Deed in Lieu of Foreclosure allows you to transfer ownership of your property to the lender, which can help you avoid the lengthy foreclosure process.

- Eligibility Requirements: Not everyone qualifies for a Deed in Lieu. Typically, you must demonstrate financial hardship and have a valid reason for your inability to continue making mortgage payments.

- Negotiating Terms: Before filling out the form, consider negotiating with your lender. They may agree to forgive some debt or offer other options that could be more beneficial for you.

- Document Preparation: Ensure all required documents are completed accurately. This includes your mortgage agreement and any additional paperwork your lender may require.

- Seek Legal Guidance: Consulting with a legal professional can provide clarity and ensure that your rights are protected throughout the process.

Taking these steps can help streamline the process and make a difficult situation a bit more manageable.

Dos and Don'ts

When filling out the Deed in Lieu of Foreclosure form, it is crucial to follow certain guidelines to ensure the process goes smoothly. Here’s a list of what to do and what to avoid.

- Do read the entire form carefully before starting.

- Do provide accurate information about the property.

- Do sign the document in the presence of a notary.

- Do keep a copy of the completed form for your records.

- Do consult with a legal advisor if you have questions.

- Don't rush through the form; take your time.

- Don't leave any required fields blank.

- Don't sign the document without understanding its implications.

- Don't submit the form without double-checking for errors.

By following these guidelines, you can help ensure that your Deed in Lieu of Foreclosure process is handled efficiently and correctly.

Common Types of Deed in Lieu of Foreclosure Forms:

Ladybird Deed Michigan Form - The advantages of a Lady Bird Deed can extend to maintaining eligibility for certain financial benefits.

To better understand the significance of a Hold Harmless Agreement, consider the implications of having a well-drafted document in your business engagements. Such agreements not only protect parties from unforeseen liabilities but also ensure a smoother operation in project implementation, emphasizing the need for this important Hold Harmless Agreement form in Colorado.

Correction Deed Form California - Homeowners can utilize a Corrective Deed to amend misspellings or incorrect names on a property deed.

Instructions on Filling in Deed in Lieu of Foreclosure

After completing the Deed in Lieu of Foreclosure form, you will need to submit it to your lender. They will review the document and may require additional information or documentation. This process can help you avoid foreclosure and may allow for a smoother transition to a new living situation.

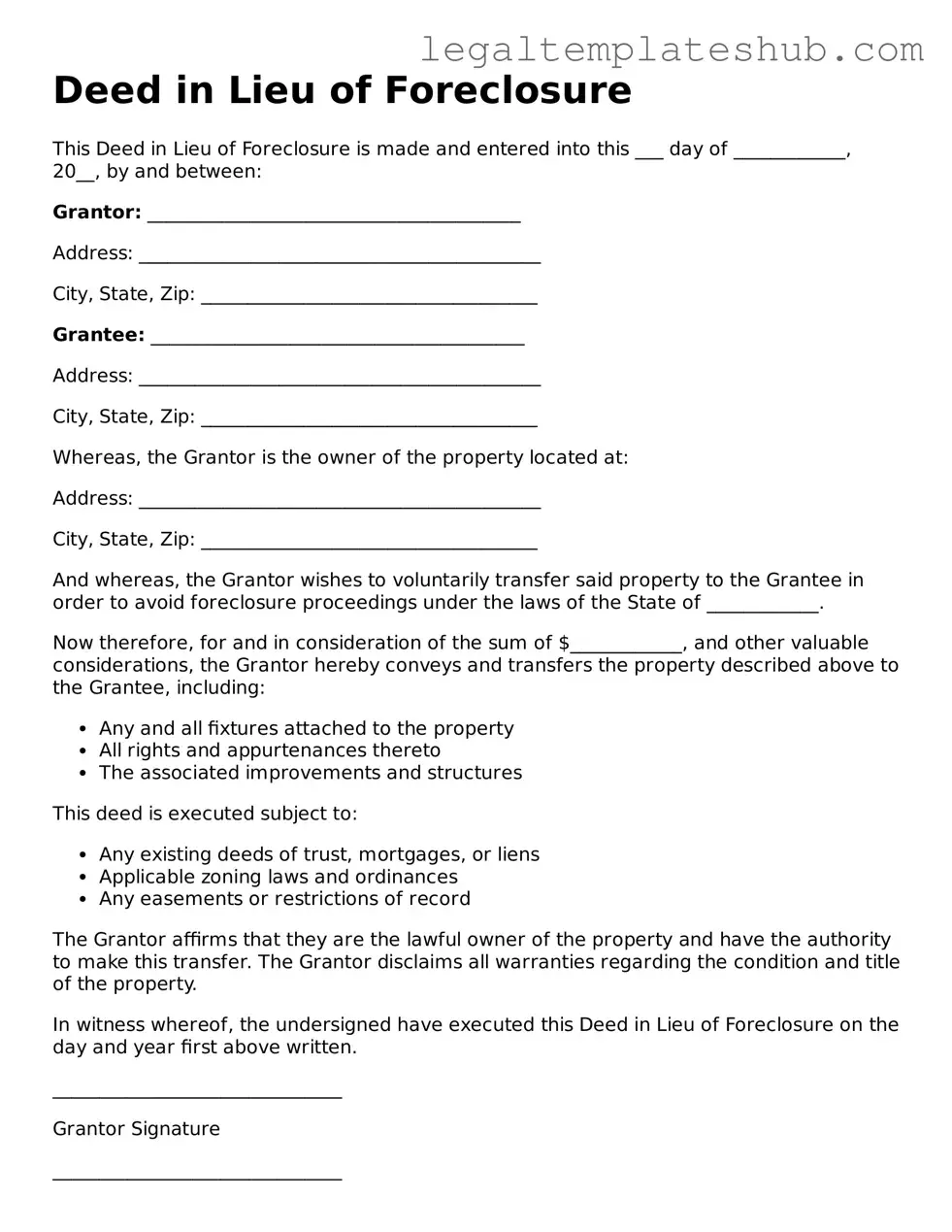

- Obtain the Deed in Lieu of Foreclosure form from your lender or a trusted legal resource.

- Fill in your name and contact information at the top of the form.

- Provide the property address that is subject to the deed.

- Include the loan number associated with the mortgage.

- List any co-owners of the property, if applicable.

- State the reason for the deed in lieu, if required.

- Sign and date the form where indicated.

- Have the form notarized to ensure its validity.

- Make copies of the completed form for your records.

- Submit the original form to your lender along with any additional required documents.

Misconceptions

Many people have misunderstandings about the Deed in Lieu of Foreclosure process. Here are seven common misconceptions, along with clarifications to help you better understand this option.

-

It eliminates all debts.

Some believe that a Deed in Lieu of Foreclosure wipes out all mortgage-related debts. However, it typically only addresses the mortgage. Other debts, like second mortgages or liens, may still remain.

-

It guarantees a quick resolution.

While a Deed in Lieu can speed up the process compared to foreclosure, it does not guarantee immediate results. Lenders must review the request and may take time to approve it.

-

It affects only the homeowner.

This option impacts the homeowner, but it can also affect their credit score. It may not be as damaging as a foreclosure, but it still leaves a mark.

-

It is a simple process.

Many think that the Deed in Lieu process is straightforward. In reality, it involves paperwork and negotiations with the lender, which can be complex.

-

It is available to everyone.

Not everyone qualifies for a Deed in Lieu of Foreclosure. Lenders often have specific criteria, and homeowners must demonstrate financial hardship.

-

It releases the homeowner from all liability.

Some assume that signing a Deed in Lieu means they are free from all obligations. This is not always true, especially if there are other debts tied to the property.

-

It is the same as foreclosure.

While both processes involve the loss of a home, they are not the same. A Deed in Lieu is a voluntary agreement, whereas foreclosure is a legal action taken by the lender.

Understanding these misconceptions can help homeowners make informed decisions. If considering a Deed in Lieu of Foreclosure, it’s wise to seek guidance from a qualified professional.