Printable Durable Power of Attorney Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney allows someone to make financial or legal decisions on behalf of another person, even if that person becomes incapacitated. |

| State-Specific Forms | Each state has its own Durable Power of Attorney form. It's crucial to use the correct form for your state to ensure it meets legal requirements. |

| Governing Laws | In the U.S., the laws governing Durable Power of Attorney vary by state. For example, California’s laws can be found in the California Probate Code. |

| Durability | The "durable" aspect means the power remains effective even if the principal becomes mentally incapacitated, unlike a standard power of attorney. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. |

Durable Power of Attorney - Adapted for State

Key takeaways

Filling out a Durable Power of Attorney (DPOA) form is an important step in ensuring your financial and healthcare decisions are managed according to your wishes. Here are some key takeaways to keep in mind:

- Choose the right agent: Select someone you trust to act on your behalf. This person will have significant authority over your financial and medical decisions, so it’s crucial to choose wisely.

- Understand the scope of authority: Clearly define what powers you are granting. You can specify whether the agent has broad powers or limited ones, depending on your needs.

- Consider the timing: A Durable Power of Attorney remains effective even if you become incapacitated. This means it’s essential to think ahead and establish this document before a crisis occurs.

- Review and update regularly: Life circumstances change. Regularly review your DPOA to ensure it still reflects your wishes and that your chosen agent is still the right fit.

Dos and Don'ts

When filling out a Durable Power of Attorney form, it is essential to approach the task with care. Here are nine important dos and don'ts to consider:

- Do ensure you understand the responsibilities you are granting to your agent.

- Do clearly identify the agent you are appointing.

- Do specify the powers you are granting in the document.

- Do sign the document in the presence of a notary public, if required.

- Do keep a copy of the signed document for your records.

- Don't leave any blanks in the form; fill in all required fields.

- Don't use vague language that could lead to misunderstandings.

- Don't forget to discuss your wishes with your agent before finalizing the document.

- Don't assume that a general Power of Attorney is the same as a Durable Power of Attorney; they serve different purposes.

Common Types of Durable Power of Attorney Forms:

What Does a Power of Attorney Form Look Like - The form empowers a designated person to sign documents related to your real estate.

For those looking to navigate the vehicle transfer process in California, utilizing resources such as the PDF Documents Hub can significantly simplify the task of filling out the Motor Vehicle Bill of Sale form accurately and efficiently.

Temporary Power of Attorney for Child - Consider consulting with a legal professional if you have complex needs regarding the document.

Revocation of Power of Attorney Form - A proactive step in your financial and healthcare planning.

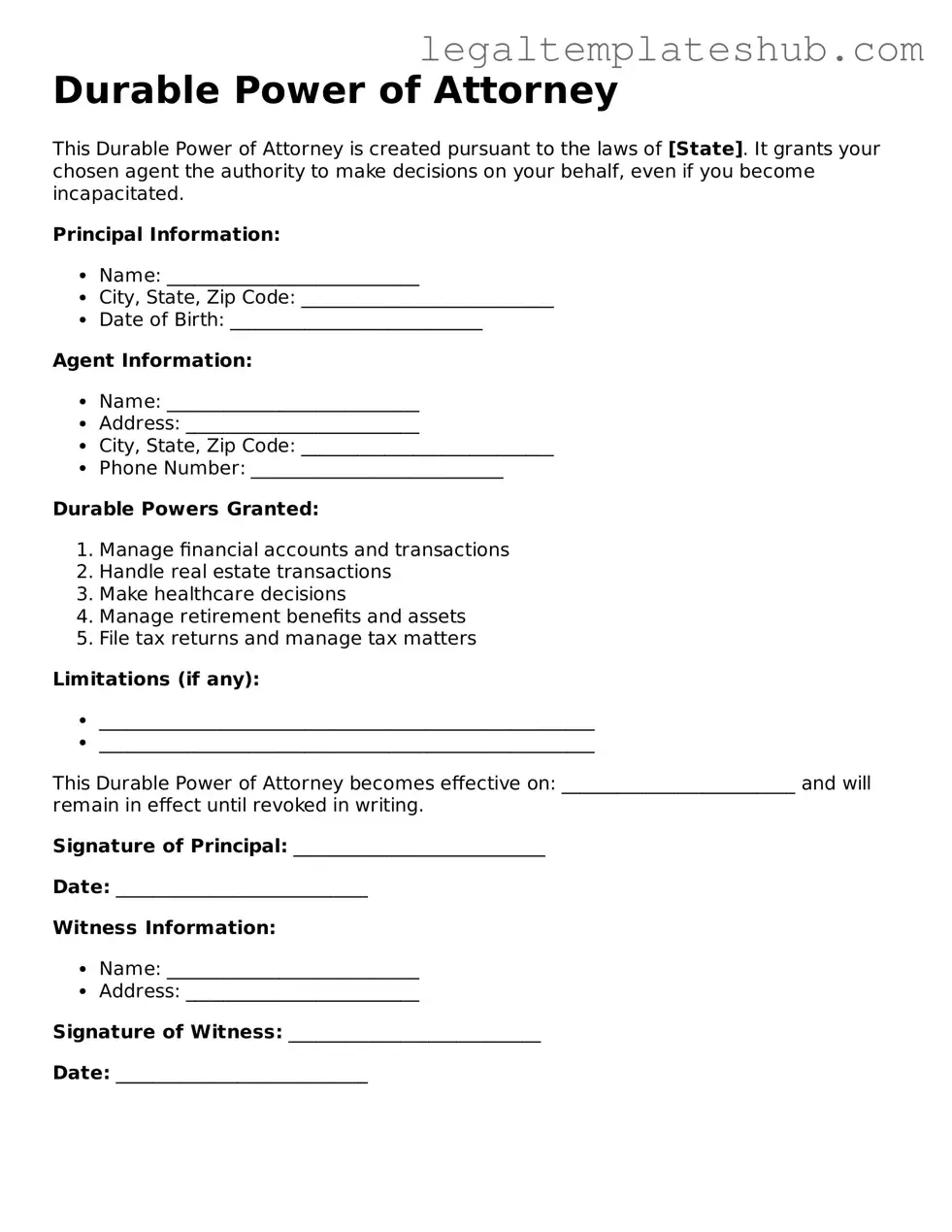

Instructions on Filling in Durable Power of Attorney

Filling out a Durable Power of Attorney form is a crucial step in ensuring that your financial and legal matters are handled according to your wishes if you become unable to manage them yourself. Completing this form carefully will help designate someone you trust to act on your behalf. Follow these steps to ensure the form is filled out correctly.

- Obtain the Durable Power of Attorney form. You can find it online or through your local legal office.

- Begin by entering your full name and address at the top of the form. This identifies you as the principal.

- Next, provide the name and address of the person you are appointing as your agent. This person will have the authority to act on your behalf.

- Specify the powers you wish to grant your agent. This may include handling financial matters, making healthcare decisions, or managing property.

- Indicate when the powers will begin. You can choose for them to start immediately or only if you become incapacitated.

- Sign and date the form in the designated area. This step is vital for the document to be legally binding.

- Have the form notarized or witnessed, depending on your state’s requirements. This adds an extra layer of validity to your document.

- Distribute copies of the completed form to your agent, any relevant financial institutions, and your healthcare providers.

After completing these steps, your Durable Power of Attorney form will be ready for use. Ensure you keep the original document in a safe place and inform your agent of its location. Regularly review the form to ensure it still reflects your wishes, especially if your circumstances change.

Misconceptions

Understanding the Durable Power of Attorney (DPOA) is essential for effective estate planning. However, several misconceptions often cloud its purpose and function. Here are five common misconceptions:

- A Durable Power of Attorney is only for the elderly. Many people believe that DPOAs are only necessary for seniors. In reality, anyone can benefit from this document, especially if they anticipate a time when they may be unable to make decisions due to illness or injury.

- A DPOA gives unlimited power to the agent. This is not true. The DPOA grants specific powers as outlined in the document. The principal can limit the authority or specify particular actions the agent can take on their behalf.

- A Durable Power of Attorney is the same as a regular Power of Attorney. While both documents allow someone to act on another's behalf, a DPOA remains effective even if the principal becomes incapacitated. In contrast, a regular Power of Attorney may become void under such circumstances.

- You cannot revoke a Durable Power of Attorney. This is a misconception. A principal can revoke a DPOA at any time, as long as they are mentally competent. It is essential to notify the agent and any relevant institutions of the revocation.

- Once a DPOA is signed, it cannot be changed. In fact, a DPOA can be modified or updated as needed. It’s advisable to review the document regularly to ensure it still meets your needs and reflects your wishes.

Being informed about these misconceptions can help individuals make better decisions regarding their legal and financial matters.