Blank Employee Advance PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Employee Advance form is used to request an advance on wages or expenses from an employer. |

| Eligibility | Typically, employees who have been with the company for a certain period can apply for an advance. |

| Repayment Terms | Repayment terms for the advance are usually outlined in the form, including the deduction schedule from future paychecks. |

| State-Specific Laws | In states like California, the governing law for advances is found in the California Labor Code, which outlines employee rights regarding wage advances. |

| Confidentiality | Information provided in the Employee Advance form is generally kept confidential to protect the employee's privacy. |

Key takeaways

Filling out and using the Employee Advance form requires attention to detail and understanding of the process. Here are six key takeaways to ensure a smooth experience:

- Ensure all required fields are completed accurately. Incomplete forms can delay processing.

- Provide a clear purpose for the advance. This helps in assessing the validity of the request.

- Attach any necessary documentation. Supporting materials can strengthen your case for the advance.

- Submit the form to the appropriate department promptly. Timeliness is crucial for receiving funds when needed.

- Keep a copy of the submitted form for your records. This can be useful for tracking and follow-up purposes.

- Understand the repayment terms before signing. Knowing your obligations is essential to avoid future issues.

Dos and Don'ts

When filling out the Employee Advance form, it’s important to be thorough and accurate. Here’s a list of things you should and shouldn’t do to ensure a smooth process.

- Do read the instructions carefully before starting.

- Do provide accurate information about your request.

- Do include all necessary documentation to support your request.

- Do double-check your calculations if you're requesting a specific amount.

- Do keep a copy of the completed form for your records.

- Don’t leave any required fields blank.

- Don’t submit the form without your supervisor’s approval.

- Don’t provide false information, even unintentionally.

- Don’t forget to sign and date the form before submission.

- Don’t wait until the last minute to fill out the form, as processing may take time.

By following these guidelines, you can help ensure that your Employee Advance request is processed efficiently and effectively.

Common PDF Templates

How to File Mechanics Lien - A recorded mechanics lien becomes part of the property record and disclosure.

In the context of vehicle transactions, having a clear understanding of the process is essential, and that's why the California Vehicle Purchase Agreement form is highly recommended. This document serves as a reliable reference for both buyers and sellers, providing clarity and security in their agreement. For those looking for a customizable version, you can refer to californiapdf.com/editable-vehicle-purchase-agreement/ to create an agreement that suits your specific needs.

Cg2010 Form - Applies only if the additional insured is named in the schedule.

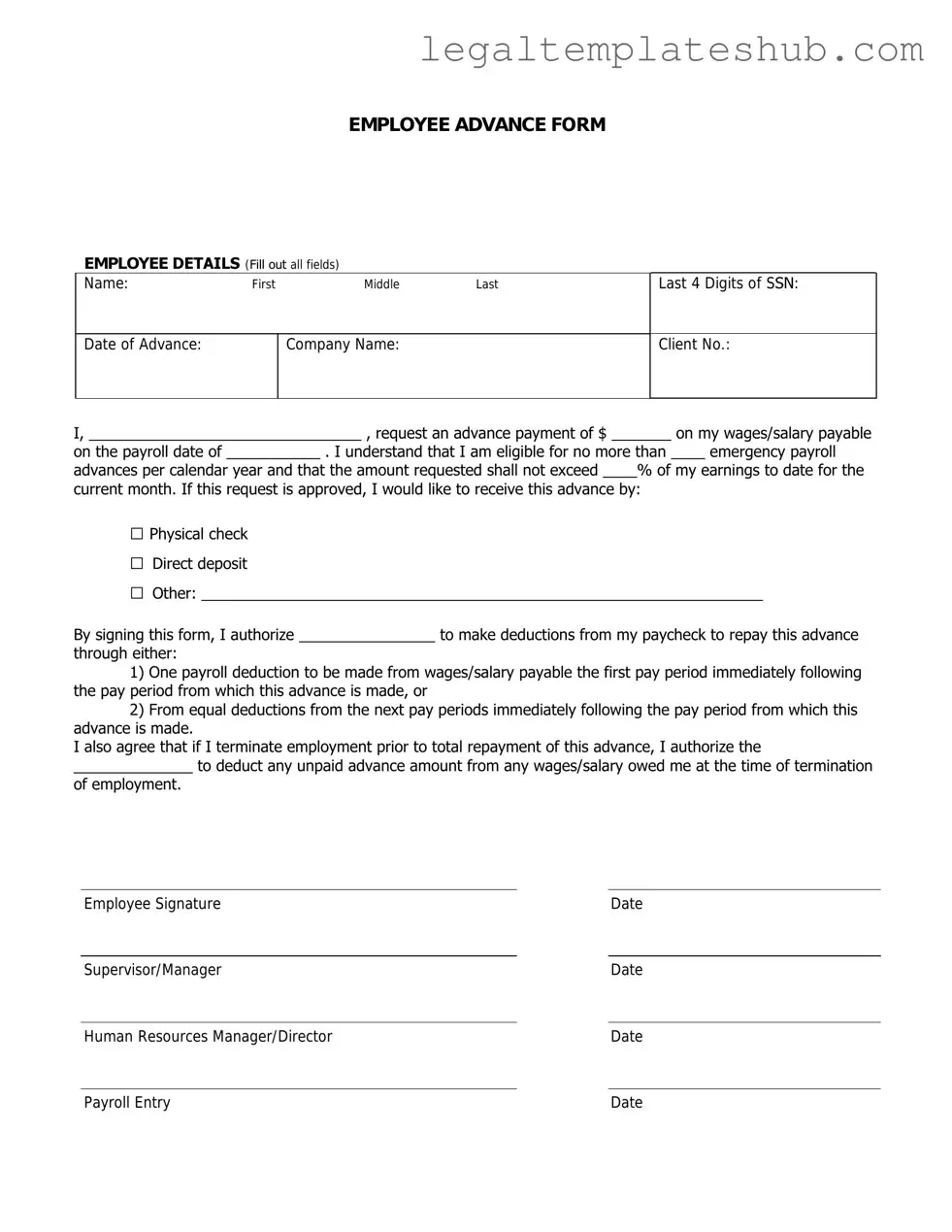

Instructions on Filling in Employee Advance

Completing the Employee Advance form is a straightforward process that requires careful attention to detail. Once you have filled out the form, it will be submitted for approval, allowing you to receive the necessary funds for your upcoming expenses.

- Begin by entering your full name in the designated field at the top of the form.

- Provide your employee ID number. This helps the finance department to identify your records quickly.

- Fill in the date of your request. Use the format MM/DD/YYYY to ensure clarity.

- In the next section, specify the amount you are requesting as an advance. Double-check this figure for accuracy.

- Describe the purpose of the advance. Be concise but clear about how you intend to use the funds.

- If applicable, indicate any supporting documents you are attaching. This may include receipts or estimates related to your request.

- Sign and date the form at the bottom. Your signature confirms that you understand the terms of the advance.

- Submit the completed form to your supervisor for approval. Ensure you keep a copy for your records.

Misconceptions

Understanding the Employee Advance form is crucial for both employees and employers. However, several misconceptions can lead to confusion. Here are five common misunderstandings about the Employee Advance form:

-

All employees are eligible for an advance.

This is not always the case. Eligibility often depends on company policy, tenure, and specific circumstances. Not every employee may qualify for an advance.

-

Advances are automatically granted.

Many believe that once the form is submitted, the advance will be approved without further review. In reality, approvals are subject to managerial discretion and company guidelines.

-

There are no consequences for not repaying the advance.

Some individuals think that failing to repay an advance will have no impact. However, non-repayment can affect future eligibility and may lead to deductions from future paychecks.

-

The advance is considered a bonus.

This is a misconception that can lead to misunderstandings about financial planning. An advance is a loan, not a bonus, and it must be repaid.

-

Submitting the form is the final step.

Many assume that filling out the form is the end of the process. In fact, further communication may be necessary, including discussions with a supervisor or HR.

By addressing these misconceptions, employees can navigate the Employee Advance process with greater clarity and confidence. Understanding the terms and conditions is key to making informed decisions.