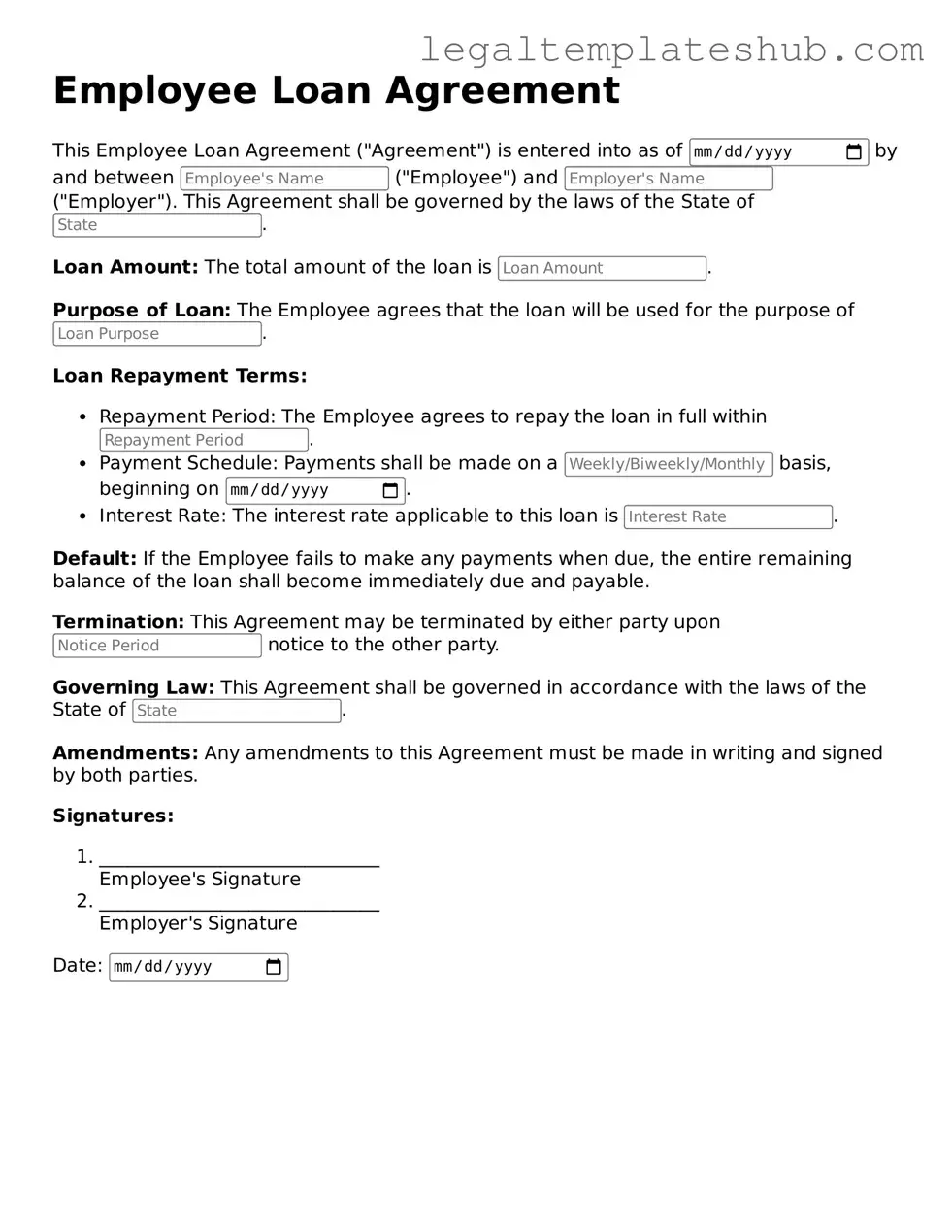

Printable Employee Loan Agreement Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | An Employee Loan Agreement is a formal document outlining the terms under which an employer lends money to an employee. |

| Purpose | This agreement serves to protect both the employer and the employee by clearly stating the repayment terms and conditions. |

| Repayment Terms | Typically, the agreement includes details such as the loan amount, interest rate, repayment schedule, and consequences for default. |

| Governing Law | The agreement is subject to the laws of the state where the employee works. For example, in California, it falls under California Labor Code. |

| Confidentiality | Both parties may agree to keep the terms of the loan confidential to protect personal financial information. |

| Signatures Required | Both the employer and the employee must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties to ensure clarity and enforceability. |

Key takeaways

When filling out and using the Employee Loan Agreement form, keep these key takeaways in mind:

- Understand the terms: Before signing, ensure you clearly understand the loan terms, including interest rates, repayment schedules, and any penalties for late payments.

- Document everything: Keep a copy of the signed agreement for your records. This will help you track your obligations and protect your rights.

- Communicate with your employer: If you encounter difficulties in repayment, inform your employer as soon as possible. Open communication can lead to flexible solutions.

- Review state laws: Familiarize yourself with any relevant state laws regarding employee loans. These laws can affect the terms and enforceability of the agreement.

Dos and Don'ts

When filling out the Employee Loan Agreement form, it is important to follow certain guidelines to ensure the process goes smoothly. Here are eight things to keep in mind:

- Do read the entire agreement carefully before signing.

- Do provide accurate personal information, including your full name and contact details.

- Do specify the loan amount clearly to avoid any misunderstandings.

- Do understand the repayment terms, including the interest rate and due dates.

- Don't leave any required fields blank; this can delay the approval process.

- Don't provide false information; this can lead to serious consequences.

- Don't rush through the form; take your time to ensure accuracy.

- Don't forget to keep a copy of the signed agreement for your records.

Instructions on Filling in Employee Loan Agreement

Filling out the Employee Loan Agreement form is a straightforward process that requires attention to detail. Completing this form accurately ensures clarity and understanding between the employee and the employer regarding the terms of the loan. Follow the steps below to ensure that you fill out the form correctly.

- Read the Instructions: Before you start, take a moment to read any instructions provided with the form. This will give you a clear understanding of what information is required.

- Employee Information: Enter the employee’s full name, address, and contact information in the designated sections. Make sure all details are accurate.

- Loan Amount: Clearly state the amount of the loan being requested. Double-check the figure for accuracy.

- Purpose of the Loan: Provide a brief explanation of why the loan is needed. This helps in understanding the context of the request.

- Repayment Terms: Specify the repayment terms, including the interest rate, payment schedule, and any other relevant details. Be as precise as possible.

- Signature: Both the employee and an authorized representative from the employer should sign the form. Ensure that the signatures are dated appropriately.

- Review: Before submitting the form, review all entries for completeness and accuracy. This step is crucial to avoid any delays.

Misconceptions

When it comes to the Employee Loan Agreement form, there are several misconceptions that can lead to confusion. Understanding the truth behind these misconceptions is essential for both employers and employees. Here’s a breakdown of nine common misunderstandings:

-

Misconception 1: The Employee Loan Agreement is the same as a paycheck advance.

This is not true. A paycheck advance is typically a short-term borrowing against future earnings, while an Employee Loan Agreement is a formal arrangement that outlines the terms of a loan, including repayment schedules and interest rates.

-

Misconception 2: Employees can borrow any amount they want.

Most companies set limits on how much an employee can borrow based on their salary, tenure, and company policy.

-

Misconception 3: There are no consequences for defaulting on the loan.

In reality, failing to repay the loan can lead to disciplinary actions, including deductions from future paychecks or even termination in severe cases.

-

Misconception 4: The Employee Loan Agreement is a casual document.

This is incorrect. It is a legally binding contract that requires careful consideration and understanding from both parties.

-

Misconception 5: Interest rates are always low or nonexistent.

While some companies may offer low-interest loans, others may charge rates similar to those of traditional lenders. Always check the terms.

-

Misconception 6: The agreement does not need to be signed.

Signing the agreement is crucial. It ensures that both the employer and employee are aware of the terms and conditions and are committed to them.

-

Misconception 7: Employees can take as long as they want to repay the loan.

This is a misunderstanding. Most agreements will specify a repayment period, and it’s important to adhere to that timeline.

-

Misconception 8: The loan can be used for any purpose.

Some companies may restrict the use of the loan to specific expenses, such as medical bills or education costs, rather than allowing it for personal use.

-

Misconception 9: Once the loan is repaid, the agreement is no longer relevant.

Even after repayment, it’s wise to keep a copy of the agreement for your records. It can serve as proof of the transaction and the terms agreed upon.

By clarifying these misconceptions, both employees and employers can navigate the Employee Loan Agreement process with confidence and understanding.