Blank Erc Broker Market Analysis PDF Form

File Breakdown

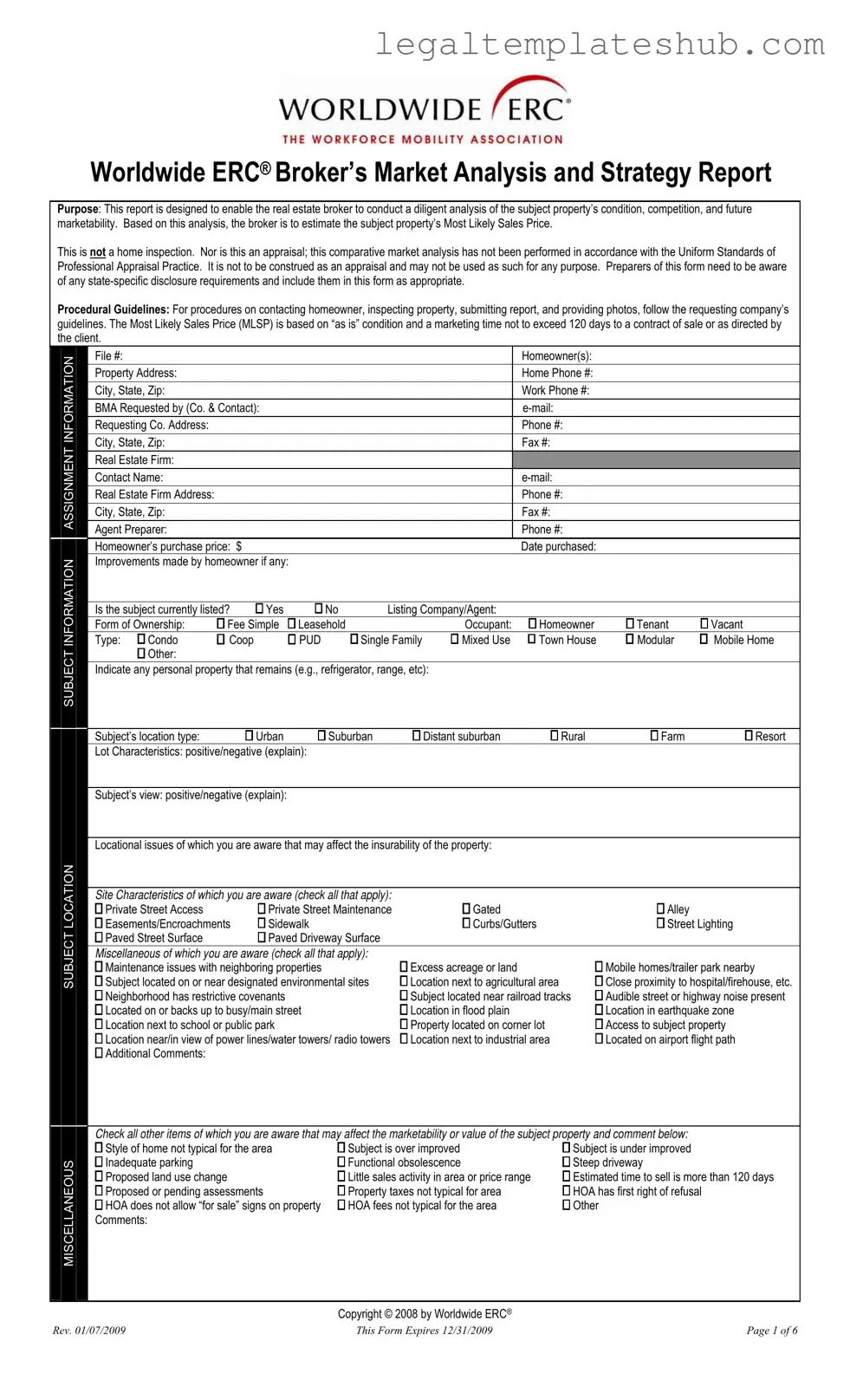

| Fact Name | Description |

|---|---|

| Purpose | This report helps real estate brokers analyze a property's condition, competition, and marketability to estimate its Most Likely Sales Price (MLSP). |

| Not an Appraisal | The Broker's Market Analysis is not an appraisal and does not follow the Uniform Standards of Professional Appraisal Practice. |

| State-Specific Requirements | Preparers must be aware of and include any state-specific disclosure requirements in the report. |

| Timeframe for Sales Price | The MLSP is based on the property's "as is" condition and assumes a marketing time of no more than 120 days unless directed otherwise by the client. |

Key takeaways

- Purpose of the Form: The ERC Broker Market Analysis form helps brokers assess a property's condition, competition, and marketability. This analysis aids in estimating the property's Most Likely Sales Price (MLSP).

- Not an Appraisal: This form is not a home inspection or an appraisal. It is a comparative market analysis and should not be used as such for any purpose.

- State-Specific Requirements: Brokers must be aware of and include any state-specific disclosure requirements in the form as needed.

- Follow Guidelines: When filling out the form, brokers should adhere to the requesting company's guidelines for contacting homeowners, inspecting properties, and submitting reports.

- Time Frame for Sale: The MLSP is based on the property's "as is" condition and assumes a marketing time not exceeding 120 days unless directed otherwise by the client.

- Detailed Information Required: The form requires comprehensive details about the property, including its condition, improvements, financing options, and neighborhood characteristics, to provide an accurate analysis.

Dos and Don'ts

When filling out the ERC Broker Market Analysis form, it’s essential to approach the task with care and attention. Here’s a list of things to do and avoid to ensure your submission is accurate and effective.

- Do read the entire form carefully before starting.

- Do gather all necessary information about the property and its condition.

- Do ensure you understand the specific guidelines provided by the requesting company.

- Do provide honest and accurate descriptions of the property.

- Do include any state-specific disclosure requirements as needed.

- Don't skip any sections of the form that are applicable to the property.

- Don't use vague language; be specific in your comments and observations.

- Don't make assumptions about the property’s condition; verify facts through observation.

- Don't forget to check for any required signatures or contact information.

- Don't submit the form without a thorough review for errors or omissions.

By following these guidelines, you can ensure that your analysis is comprehensive and meets the necessary requirements for effective market evaluation.

Common PDF Templates

How to Create a Coat of Arms - Stately buildings frequently display coats of arms.

The California Trailer Bill of Sale form is a legal document that facilitates the transfer of ownership of a trailer from the seller to the buyer. It serves as evidence that the transaction has occurred, detailing the terms and conditions agreed upon by both parties. To ensure all details are correctly handled, you can find an editable version of the form at californiapdf.com/editable-trailer-bill-of-sale. This form is essential for the proper documentation of the sale and is a crucial step in the process of registering the trailer under the new owner's name.

Ucc-1-308 - This form helps affirm one’s legal status and right to sovereignty.

Progressive Insurance Logo Png - Consider carrying a digital copy on your mobile device as backup.

Instructions on Filling in Erc Broker Market Analysis

Completing the ERC Broker Market Analysis form requires careful attention to detail and an understanding of the property being evaluated. The information collected will contribute to a comprehensive analysis that helps estimate the Most Likely Sales Price (MLSP) of the subject property. Follow the steps below to ensure that all necessary information is accurately recorded.

- Begin by entering the File #, Homeowner(s), and Property Address at the top of the form.

- Fill in the Home Phone #, Work Phone #, and e-mail of the homeowner.

- Provide the BMA Requested by details, including the company name and contact person.

- Complete the Requesting Co. Address and contact information.

- Under the ASSIGNMENT section, fill in the Real Estate Firm name, Contact Name, and their respective contact details.

- Document the Agent Preparer information, including their phone number.

- Record the Homeowner’s purchase price and the Date purchased.

- Indicate any Improvements made by homeowner if applicable.

- Specify if the subject property is currently listed by checking Yes or No and include the Listing Company/Agent if applicable.

- Choose the Form of Ownership from the options provided.

- Identify the Occupant type and the property Type.

- Note any personal property that remains with the subject property.

- Describe the Subject’s location type and provide details about Lot Characteristics and Subject’s view.

- List any Locational issues that may affect the insurability of the property.

- Check all applicable Site Characteristics and Miscellaneous

- Complete the Property Condition section by checking the appropriate boxes and providing descriptions as needed.

- For the Recommended Repairs and Improvements, list items along with their estimated costs and comments.

- Document the total estimated costs for both interior and exterior repairs.

- List any required, customary, and additionally recommended inspections.

- Identify the most probable means of financing and describe any necessary financing concessions.

- Address any anticipated issues affecting financing and provide details about the subject neighborhood.

- Calculate the months supply of inventory and describe marketing conditions.

- Fill in the COMPETING LISTINGS and COMPARABLE SALES sections with accurate data for properties similar to the subject.

After completing the form, review all entries for accuracy and completeness. Submit the form according to the requesting company’s guidelines, ensuring that all necessary documentation is included. This process will help in delivering a thorough analysis that supports the property's market evaluation.

Misconceptions

Understanding the Erc Broker Market Analysis form is essential for real estate professionals. However, several misconceptions can lead to confusion about its purpose and use. Here are five common misconceptions:

- This form is an appraisal. Many believe that the Erc Broker Market Analysis form serves as an official appraisal. In reality, it is a comparative market analysis, which means it estimates a property's value based on market conditions and comparable properties, not through formal appraisal standards.

- The Most Likely Sales Price is a guaranteed sale price. Some people think that the Most Likely Sales Price (MLSP) indicated in the report is a fixed price at which the property will sell. Instead, the MLSP is an educated estimate based on current market conditions and is subject to change based on various factors.

- This form includes a home inspection. A common misunderstanding is that the Erc Broker Market Analysis form includes a thorough inspection of the property. However, it does not replace a home inspection. Instead, it provides a general assessment of the property's condition and marketability.

- State-specific disclosure requirements are not important. Some may overlook the importance of including state-specific disclosure requirements in the analysis. It is crucial to be aware of and comply with these regulations, as they can significantly impact the transaction.

- The form can be used for any property type. Lastly, there is a misconception that this form is suitable for all types of properties. While it is versatile, it is essential to ensure that the form is appropriate for the specific type of property being analyzed, as certain nuances may apply.

By addressing these misconceptions, real estate professionals can better utilize the Erc Broker Market Analysis form to assist their clients effectively.