Blank Free And Invoice Pdf PDF Form

File Breakdown

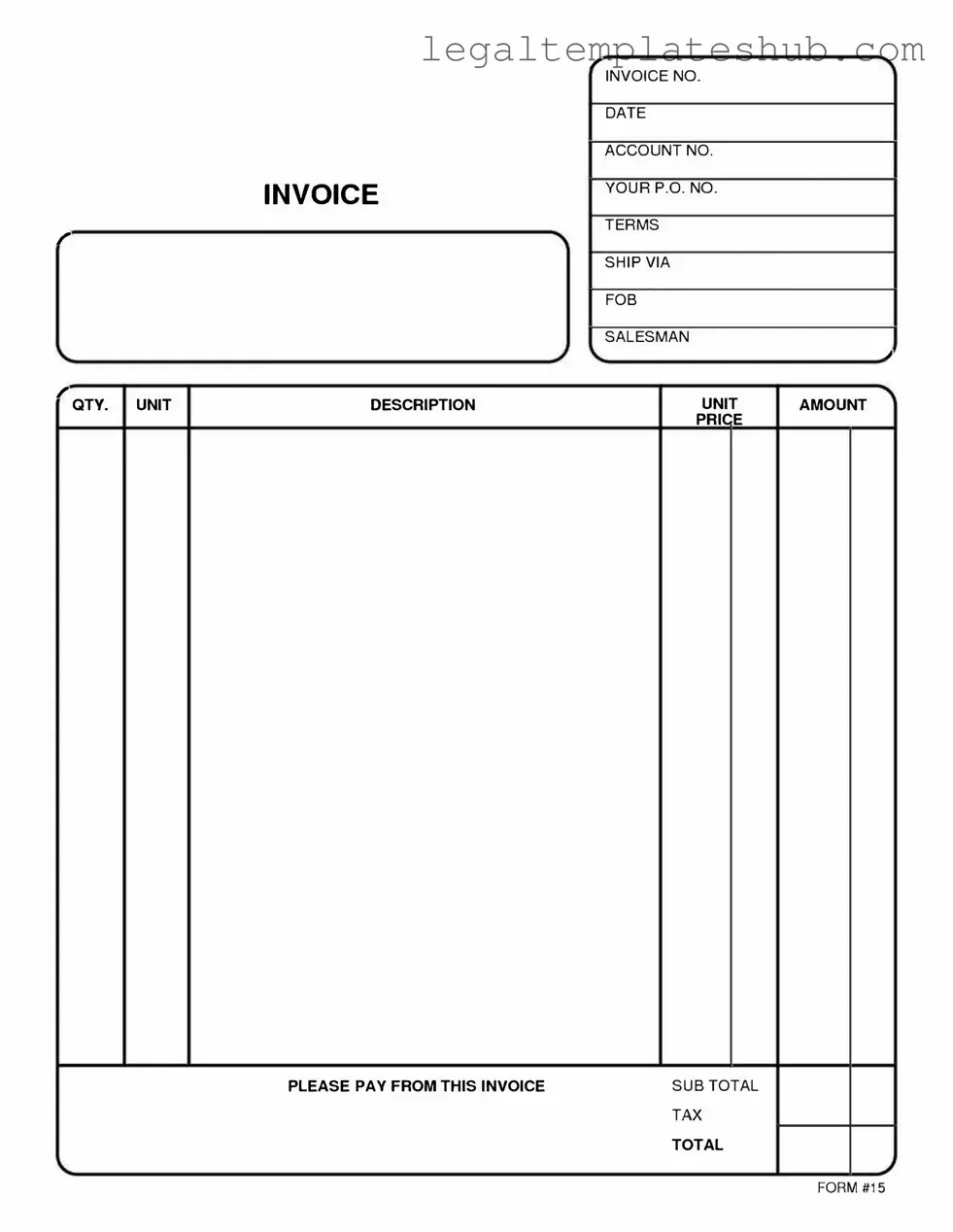

| Fact Name | Description |

|---|---|

| Purpose | The Free and Invoice PDF form is designed to help businesses create invoices easily and efficiently. |

| Format | This form is typically available in PDF format, making it easy to fill out and print. |

| Customization | Users can customize the form with their business name, logo, and other relevant details. |

| Legal Compliance | Using an invoice form helps ensure compliance with tax laws by providing a record of sales. |

| State-Specific Requirements | Different states may have specific invoicing requirements, so it's essential to check local laws. |

| Payment Terms | The form allows businesses to specify payment terms, such as due dates and late fees. |

| Tracking | Invoices generated from this form can help businesses track payments and manage cash flow. |

| Distribution | Invoices can be sent via email or printed and mailed, offering flexibility in communication. |

| Record Keeping | Keeping copies of invoices is crucial for accounting and tax purposes. |

| Accessibility | This form is often available for free online, making it accessible for small businesses and freelancers. |

Key takeaways

Filling out and using the Free And Invoice PDF form can streamline your invoicing process. Here are five key takeaways to consider:

- Accuracy is Essential: Ensure that all fields are filled out accurately. Mistakes can lead to payment delays or confusion.

- Include All Necessary Information: Provide detailed information such as your business name, contact details, and a clear description of the services or products provided.

- Utilize the PDF Format: The PDF format preserves the layout and ensures that your invoice appears professional when sent to clients.

- Keep a Copy: Always save a copy of the completed invoice for your records. This can help with tracking payments and managing finances.

- Follow Up: If payment is not received within the agreed timeframe, don’t hesitate to follow up with the client. Communication is key to maintaining good business relationships.

Dos and Don'ts

When filling out the Free And Invoice PDF form, it's essential to approach the task with care. Here’s a helpful list of things to do and avoid:

- Do read all instructions carefully before starting.

- Do double-check your information for accuracy.

- Do use clear and legible handwriting if filling it out by hand.

- Do ensure that all required fields are completed.

- Do keep a copy of the completed form for your records.

- Don't leave any mandatory fields blank.

- Don't use abbreviations unless specified.

- Don't submit the form without reviewing it first.

- Don't forget to sign and date the form if required.

- Don't provide false information, as it can lead to complications.

Common PDF Templates

Proof of Pregnancy Form Planned Parenthood California - Understood rights about consent and treatment will help you make informed choices.

Mortgage Interest Form for Taxes - Stay informed about your mortgage with this comprehensive statement at your fingertips.

For those looking to ensure a smooth and legal transfer of ownership, the California Motorcycle Bill of Sale form is essential. This document acts as a formal receipt that includes vital details about the transaction, like the motorcycle's make, model, and identification number. To get started, you can access the necessary template through PDF Documents Hub, ensuring both parties are protected and informed throughout the process.

How to File a Construction Lien in Florida - All parties are encouraged to reach an amicable resolution as soon as possible.

Instructions on Filling in Free And Invoice Pdf

Filling out the Free And Invoice PDF form is an important step in ensuring that your information is accurately recorded. Follow these steps carefully to complete the form correctly.

- Begin by downloading the Free And Invoice PDF form from the designated source.

- Open the PDF file using a PDF reader that allows for editing.

- Locate the section for your personal information. Enter your full name, address, and contact details as required.

- Move to the section for invoice details. Fill in the necessary information, including item descriptions, quantities, and prices.

- Review all entries for accuracy. Make sure there are no typos or missing information.

- Once satisfied with the information, save the completed form to your device.

- Print the form if a physical copy is needed, or prepare it for electronic submission as required.

Misconceptions

There are several misconceptions surrounding the Free And Invoice PDF form that can lead to confusion for users. Below is a list of ten common misunderstandings, along with clarifications to help set the record straight.

-

Misconception 1: The form is only for businesses.

This is not true. Individuals can also use the Free And Invoice PDF form for personal transactions, such as freelance work or side gigs.

-

Misconception 2: You must pay to access the form.

The form is free to download and use. There are no hidden fees associated with obtaining it.

-

Misconception 3: The form is complicated to fill out.

While it may seem daunting at first, the form is designed to be user-friendly. Clear instructions guide you through each section.

-

Misconception 4: You can only use it for specific types of services.

The form is versatile and can be adapted for various services and products. It is not limited to a particular industry.

-

Misconception 5: Once submitted, the form cannot be edited.

This is incorrect. You can save a copy of the form and make edits as needed before sending it to your client.

-

Misconception 6: The form does not comply with legal standards.

The Free And Invoice PDF form is designed to meet standard invoicing requirements, making it suitable for most transactions.

-

Misconception 7: You need special software to use the form.

Most users can fill out the form using standard PDF readers. No specialized software is required.

-

Misconception 8: The form is only available in English.

Depending on the source, some versions of the form may be available in multiple languages to accommodate diverse users.

-

Misconception 9: It’s unnecessary to keep a copy of the form.

It is always a good practice to keep a copy for your records. This helps in tracking payments and maintaining financial organization.

-

Misconception 10: The form is outdated and not relevant.

On the contrary, the Free And Invoice PDF form remains a widely used tool for invoicing, adapting to current business practices.