Printable Gift Deed Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Gift Deed is a legal document that transfers ownership of property from one person to another without any exchange of money. |

| Voluntary Nature | The transfer of property through a Gift Deed must be voluntary; the donor cannot be coerced or pressured into making the gift. |

| Consideration | Unlike sales transactions, a Gift Deed does not require consideration (payment) in exchange for the property. |

| Governing Law | In the United States, the laws governing Gift Deeds can vary by state. For example, in California, the relevant law is found in the California Civil Code. |

| Requirements | Most states require that a Gift Deed be in writing, signed by the donor, and may need to be notarized. |

| Revocation | A Gift Deed can generally be revoked by the donor before it is delivered to the recipient, but once delivered, it is usually irrevocable. |

| Tax Implications | Gift Deeds may have tax implications, such as gift tax, depending on the value of the property and the relationship between the donor and recipient. |

| Record Keeping | It is important to record the Gift Deed with the appropriate county office to provide public notice of the property transfer. |

| Legal Capacity | The donor must have the legal capacity to make a gift, meaning they must be of sound mind and at least 18 years old in most states. |

| Joint Gifts | In some cases, multiple donors can execute a Gift Deed together, allowing for joint gifts to a single recipient. |

Key takeaways

When filling out and using a Gift Deed form, there are several important points to consider. Below are key takeaways that can help ensure the process goes smoothly.

- Understand the Purpose: A Gift Deed is used to transfer ownership of property or assets from one person to another without any payment involved.

- Complete Information: Make sure to include all required details, such as the names of the giver and receiver, the description of the property, and the date of the transfer.

- Signatures Required: The Gift Deed must be signed by the giver. In some cases, the receiver's signature may also be necessary.

- Notarization: Having the document notarized can add an extra layer of validity, although it may not be required in all states.

- Record the Deed: After completion, consider recording the Gift Deed with the appropriate local government office to ensure public record of the transfer.

Dos and Don'ts

When filling out a Gift Deed form, it's important to pay attention to detail. Here are some guidelines to help you.

- Do clearly state the full names of both the donor and the recipient.

- Do include a detailed description of the gift being given.

- Do ensure that the form is signed by both parties.

- Do have the document notarized to add legitimacy.

- Do keep a copy of the completed form for your records.

- Don't leave any sections of the form blank.

- Don't use vague language when describing the gift.

- Don't forget to check local laws regarding gift deeds.

- Don't rush through the process; take your time to review everything.

- Don't assume that verbal agreements are sufficient; always document in writing.

Common Types of Gift Deed Forms:

Title Companies and Transfer on Death Deeds - This option can also serve to provide a clear understanding of the owner's final wishes regarding property.

The importance of having a proper Mobile Home Bill of Sale cannot be overstated, as it not only facilitates a smooth transfer process but also protects the interests of both the seller and the buyer. For those looking to ensure that they are following the correct procedures, templates are readily available. One such resource for obtaining these essential documents is through PDF Templates, which provides a convenient option to create a legally binding bill of sale tailored for New York regulations.

Ladybird Deed Michigan Form - Ending your property struggles could be as simple as filing the appropriate Lady Bird Deed.

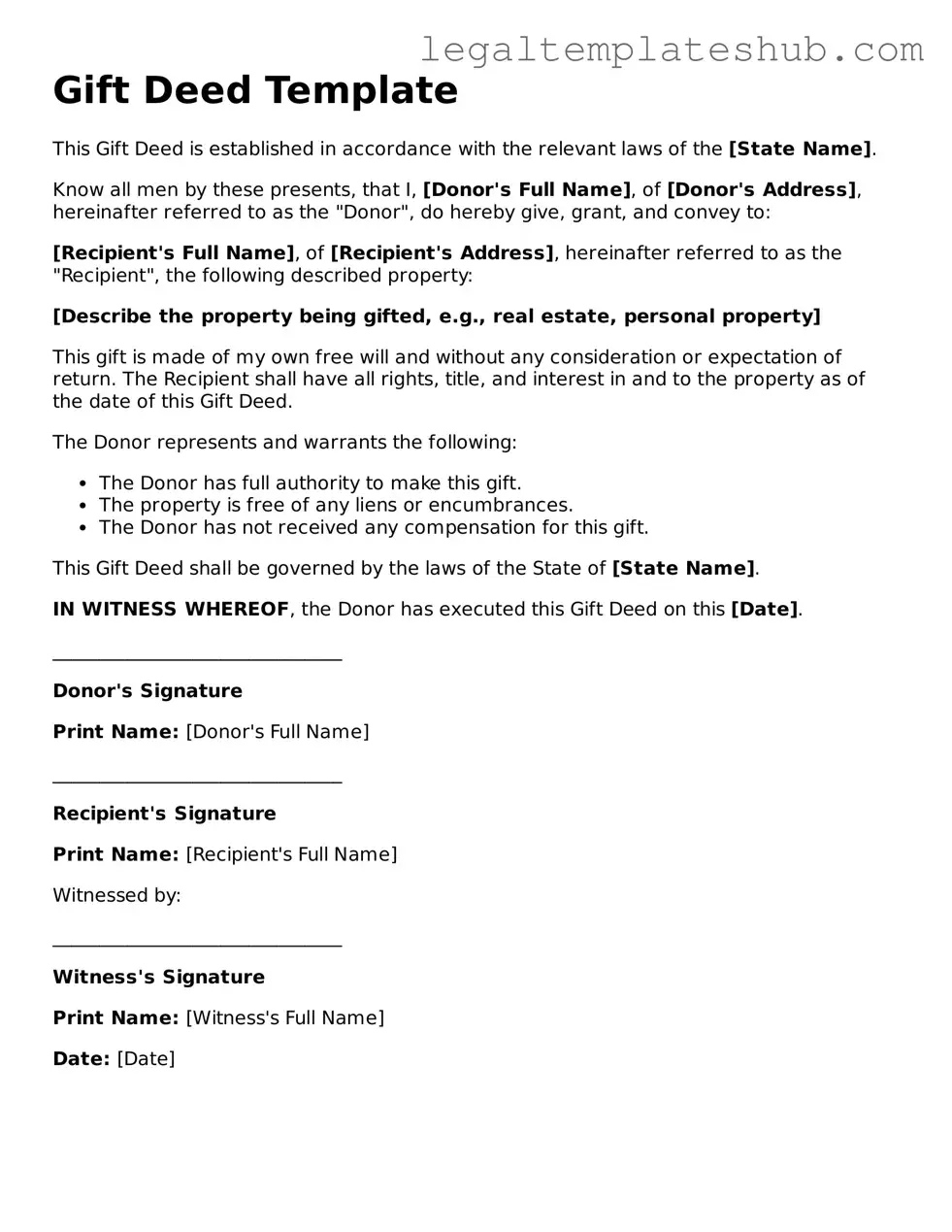

Instructions on Filling in Gift Deed

Completing a Gift Deed form requires careful attention to detail. After filling out the form, it will be necessary to have it signed and notarized to ensure its legal validity. Below are the steps to guide you through the process of filling out the form.

- Begin by entering the date at the top of the form.

- Identify the donor, the person giving the gift. Provide their full name and address.

- Next, specify the recipient, known as the donee. Include their full name and address as well.

- Clearly describe the gift being given. Include details such as type, value, and any relevant identification numbers.

- State the purpose of the gift, if applicable. This can include whether it is a gift for a specific occasion or simply a gesture of goodwill.

- Provide any conditions or restrictions related to the gift, if necessary.

- Have both the donor and donee sign the form in the designated areas.

- Finally, arrange for a notary public to witness the signatures and notarize the document.

Misconceptions

-

Misconception 1: A Gift Deed is only valid if it is notarized.

While notarization can add an extra layer of authenticity, a Gift Deed can still be legally binding without it. The key requirement is the intention of the giver to make a gift.

-

Misconception 2: A Gift Deed can only be used for real estate transactions.

This is not true. A Gift Deed can be used for various types of property, including personal items, cash, and stocks, as long as the giver intends to transfer ownership without expecting anything in return.

-

Misconception 3: The recipient must pay taxes on a gift received through a Gift Deed.

Generally, the giver is responsible for any gift tax, not the recipient. However, it is important to understand the tax implications and limits for gifts, as they can vary by state and the amount given.

-

Misconception 4: A Gift Deed cannot be revoked once signed.

This is misleading. While a Gift Deed is intended to be a permanent transfer, the giver may revoke the gift under certain conditions, such as if the deed was executed under duress or if fraud was involved.

-

Misconception 5: A Gift Deed does not require any formalities.

Although a Gift Deed is simpler than other legal documents, certain formalities must still be observed. For instance, it should be in writing and clearly state the intention to gift the property.

-

Misconception 6: All gifts require a Gift Deed.

Not every gift necessitates a formal Gift Deed. Small gifts or those below a certain value may not require documentation, but larger gifts typically benefit from a written record to avoid disputes.