Blank Gift Letter PDF Form

File Breakdown

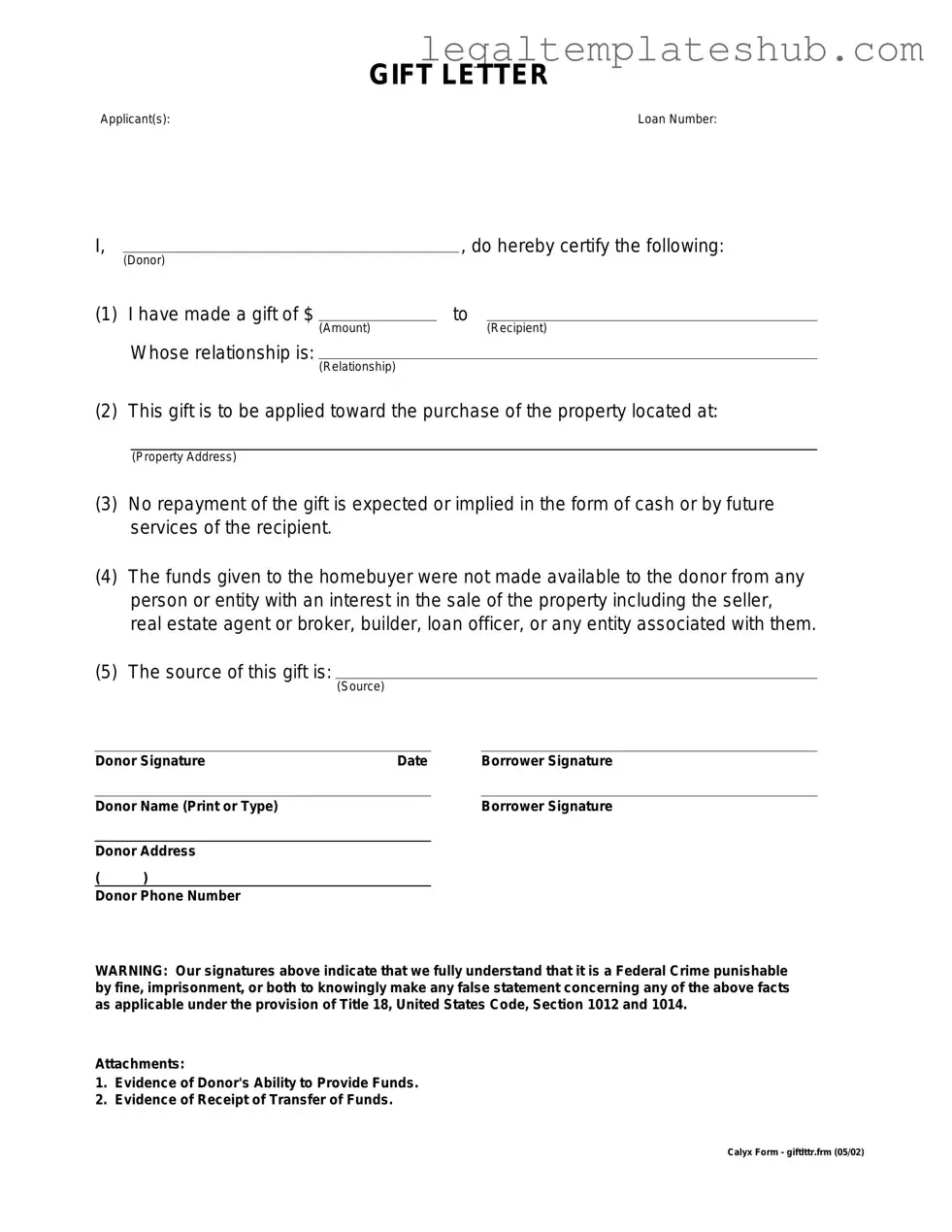

| Fact Name | Description |

|---|---|

| Purpose | A gift letter form is used to document monetary gifts, often for home purchases or other significant expenses. |

| Donor and Recipient | The form typically includes the names and contact information of both the donor (giver) and the recipient (receiver). |

| Amount | It specifies the exact amount of the gift being provided, which is crucial for financial records. |

| No Repayment | The letter should clearly state that the gift does not need to be repaid, distinguishing it from a loan. |

| State Variations | Some states may have specific requirements or variations of the gift letter form, so it's important to check local laws. |

| Signature Requirement | The donor must sign the letter to validate the gift, confirming their intent and understanding. |

| Tax Implications | Gifts above a certain threshold may have tax implications for the donor, which should be considered when completing the form. |

| Mortgage Lender Requirement | Many mortgage lenders require a gift letter to verify that the funds are a gift and not a loan. |

| Format Flexibility | The gift letter can be formatted in various ways, but it must include essential details to be effective. |

| Record Keeping | Both the donor and recipient should keep a copy of the gift letter for their records, ensuring transparency in financial dealings. |

Key takeaways

When filling out and using a Gift Letter form, there are several important points to consider. Here are six key takeaways to keep in mind:

- Purpose of the Gift Letter: A Gift Letter serves to document the transfer of funds from one person to another, typically for a down payment on a home. It clarifies that the money is a gift and not a loan.

- Clear Identification: Both the donor and recipient should be clearly identified in the letter. Include full names, addresses, and relationships to avoid any confusion.

- State the Amount: Clearly state the amount of the gift. This information is crucial for lenders who need to verify that the funds are indeed a gift.

- Signature Requirement: The donor must sign the Gift Letter. This signature confirms their intent and willingness to provide the funds as a gift.

- Tax Implications: Be aware of potential tax implications for the donor. Depending on the amount, the donor may need to file a gift tax return.

- Provide Additional Documentation: Sometimes, lenders may require additional documentation to verify the source of the funds. Be prepared to provide bank statements or other financial records if requested.

By keeping these key points in mind, you can ensure that the Gift Letter is completed accurately and serves its intended purpose effectively.

Dos and Don'ts

When filling out a Gift Letter form, it’s important to follow certain guidelines to ensure the process goes smoothly. Here are four things you should and shouldn't do:

- Do: Clearly state the amount of the gift. Transparency is key in financial transactions.

- Do: Include your name and contact information. This helps the recipient or any relevant parties reach you if there are questions.

- Don't: Forget to date the letter. A date provides context and can be crucial for record-keeping.

- Don't: Use vague language. Be specific about the nature of the gift to avoid misunderstandings.

Common PDF Templates

Business New Customer Credit Application Form - This form supports your need for business-related credit.

For those looking to finalize the sale, utilizing resources like the PDF Templates can streamline the process of completing your Pennsylvania Motor Vehicle Bill of Sale form efficiently and accurately.

How to Make a Column Graph on Excel - Ideal for academic projects that require organized content analysis.

Faa Form 8050-2 - Filing an AC 8050-2 is crucial for establishing your legal rights to the aircraft.

Instructions on Filling in Gift Letter

Filling out the Gift Letter form is an important step in documenting a financial gift. This process ensures clarity and transparency for all parties involved. Once completed, the form should be submitted to the appropriate parties as part of your financial documentation.

- Begin by entering the date at the top of the form.

- Fill in the name of the donor, the person giving the gift.

- Provide the donor's address, including city, state, and zip code.

- Enter the recipient's name, the person receiving the gift.

- Include the recipient's address, ensuring it matches their official documents.

- Clearly state the amount of the gift in dollars.

- Sign and date the form at the bottom to validate the gift.

- If required, have a witness or notary sign the form to add credibility.

Misconceptions

When it comes to the Gift Letter form, many people have misunderstandings. Here are five common misconceptions:

-

Gift Letters are only for large sums of money.

This is not true. Gift Letters can be used for any amount of money. Even small gifts can require documentation, especially when it comes to financial transactions like home purchases.

-

Only family members can provide a gift.

While family members often give gifts, friends and other individuals can also provide financial assistance. The key is to document the gift properly.

-

A Gift Letter is not legally binding.

Although it may not carry the same weight as a contract, a Gift Letter does serve as a formal declaration of the gift. It provides clarity and can help prevent misunderstandings.

-

You don’t need a Gift Letter if you’re not applying for a mortgage.

This is a misconception. Even if a mortgage is not involved, having a Gift Letter can be beneficial for tax purposes and to clarify the nature of the funds.

-

Gift Letters are only necessary for cash gifts.

This is incorrect. Gift Letters are also important for non-cash gifts, such as property or vehicles. Proper documentation helps ensure everything is clear.

Understanding these points can help you navigate the process of giving or receiving a gift more smoothly.