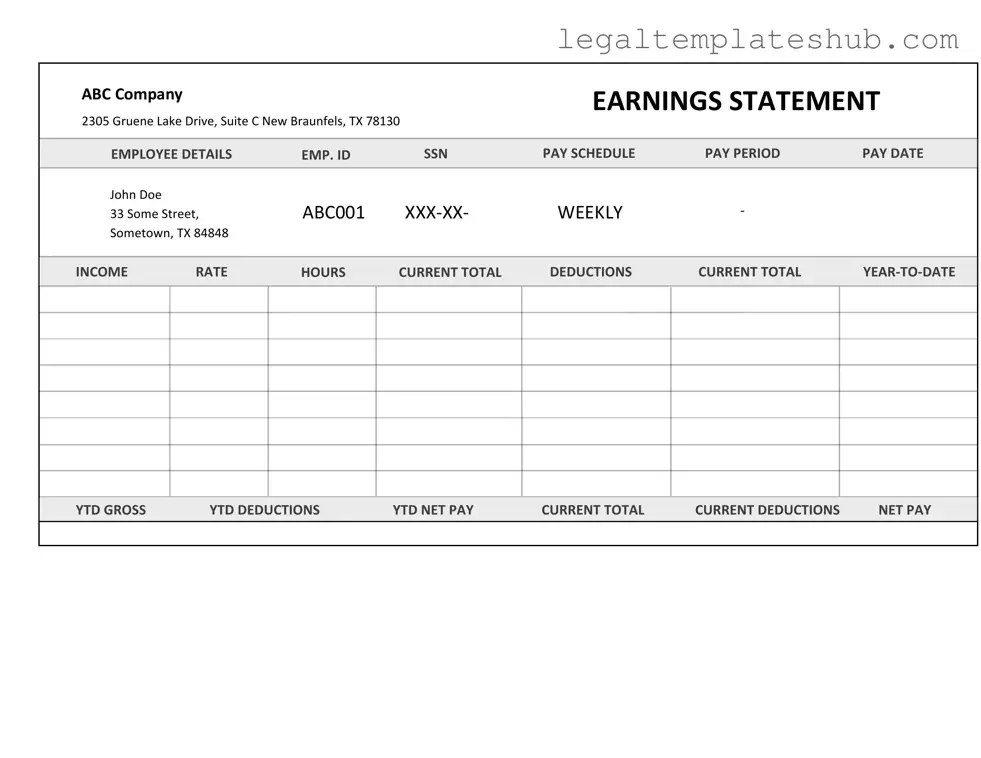

Blank Independent Contractor Pay Stub PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The Independent Contractor Pay Stub form is used to provide a detailed record of payments made to independent contractors for services rendered. |

| Components | This form typically includes information such as the contractor's name, payment amount, date of payment, and a breakdown of services provided. |

| State-Specific Requirements | Some states may have specific laws governing the information that must be included on pay stubs. For example, California law requires detailed itemization of deductions. |

| Record Keeping | Both contractors and businesses should keep copies of pay stubs for their records. This documentation can be essential for tax purposes and financial planning. |

Key takeaways

When filling out and using the Independent Contractor Pay Stub form, several key points should be considered to ensure accuracy and compliance.

- Ensure all personal information is accurate, including the contractor's name and address.

- Clearly state the period for which the payment is being made.

- List the services provided by the contractor during the pay period.

- Include the total amount earned before any deductions.

- Detail any deductions that apply, such as taxes or fees.

- Provide the net amount that the contractor will receive after deductions.

- Include the date of payment to establish a clear timeline.

- Use clear and legible formatting to enhance readability.

- Retain a copy of the pay stub for record-keeping purposes.

- Confirm that both parties (the contractor and the hiring entity) have access to the completed form.

Following these guidelines will help ensure that the Independent Contractor Pay Stub form is filled out correctly and serves its intended purpose.

Dos and Don'ts

When filling out the Independent Contractor Pay Stub form, it’s essential to be thorough and accurate. Here are four key dos and don’ts to keep in mind:

- Do provide accurate personal information, including your name and address.

- Do clearly state the services you provided and the corresponding payment amount.

- Don't leave any sections blank; incomplete forms can lead to delays in payment.

- Don't use vague descriptions for your work; specificity helps clarify your contributions.

Common PDF Templates

What Happens If Your Late on Puppy Shots - The form can also assist in emergency situations regarding pet care.

The Pennsylvania Bill of Sale form is an essential tool for anyone involved in buying or selling personal property, as it clearly documents the transfer of ownership and ensures that both parties have a mutual understanding of the transaction. It's an important step to maintain clarity and avoid future disputes, and for those seeking reliable templates to facilitate this process, you can find useful resources at PDF Templates.

Printable:5s6uydlipco= Living Will Template - Many legal and healthcare professionals recognize Five Wishes as a valid express of individual healthcare decisions.

Renewing a Passport - Renewal applications cannot be processed without the original passport.

Instructions on Filling in Independent Contractor Pay Stub

Filling out the Independent Contractor Pay Stub form is straightforward. This form helps you document payments made to independent contractors, ensuring clarity and transparency in financial transactions. Follow the steps below to complete the form accurately.

- Start by entering the date of payment at the top of the form.

- Fill in the contractor's name in the designated space.

- Next, write the contractor's address below their name.

- Provide the contractor's identification number or Social Security Number.

- In the next section, indicate the payment amount made to the contractor.

- Specify the payment method, such as check, bank transfer, or cash.

- Include the service description or work completed by the contractor.

- Finally, sign and date the form to validate the payment.

Misconceptions

Understanding the Independent Contractor Pay Stub form can be challenging. Many people hold misconceptions about its purpose and use. Here are five common misconceptions, along with clarifications to help set the record straight.

-

Misconception 1: The Independent Contractor Pay Stub is only for full-time contractors.

This is not true. The pay stub is applicable to all independent contractors, regardless of their hours or workload. Part-time contractors can also benefit from having a pay stub to document their earnings.

-

Misconception 2: The pay stub serves as a tax document.

While the pay stub provides a summary of earnings, it is not a tax document. Independent contractors are responsible for reporting their income on their tax returns. The pay stub can, however, help in tracking earnings for tax purposes.

-

Misconception 3: All states require independent contractors to issue pay stubs.

This varies by state. Some states may have regulations regarding pay stubs, while others do not require them for independent contractors. It is essential to check local laws to understand the requirements.

-

Misconception 4: Independent contractors cannot dispute information on their pay stubs.

Independent contractors have the right to dispute any discrepancies found on their pay stubs. If there are errors, they should communicate with the client or company that issued the pay stub to resolve the issue.

-

Misconception 5: The format of the pay stub is standardized across all industries.

This is false. The format of pay stubs can vary significantly depending on the industry and the company issuing them. Each pay stub may include different information based on the specific needs of the contractor and the services provided.