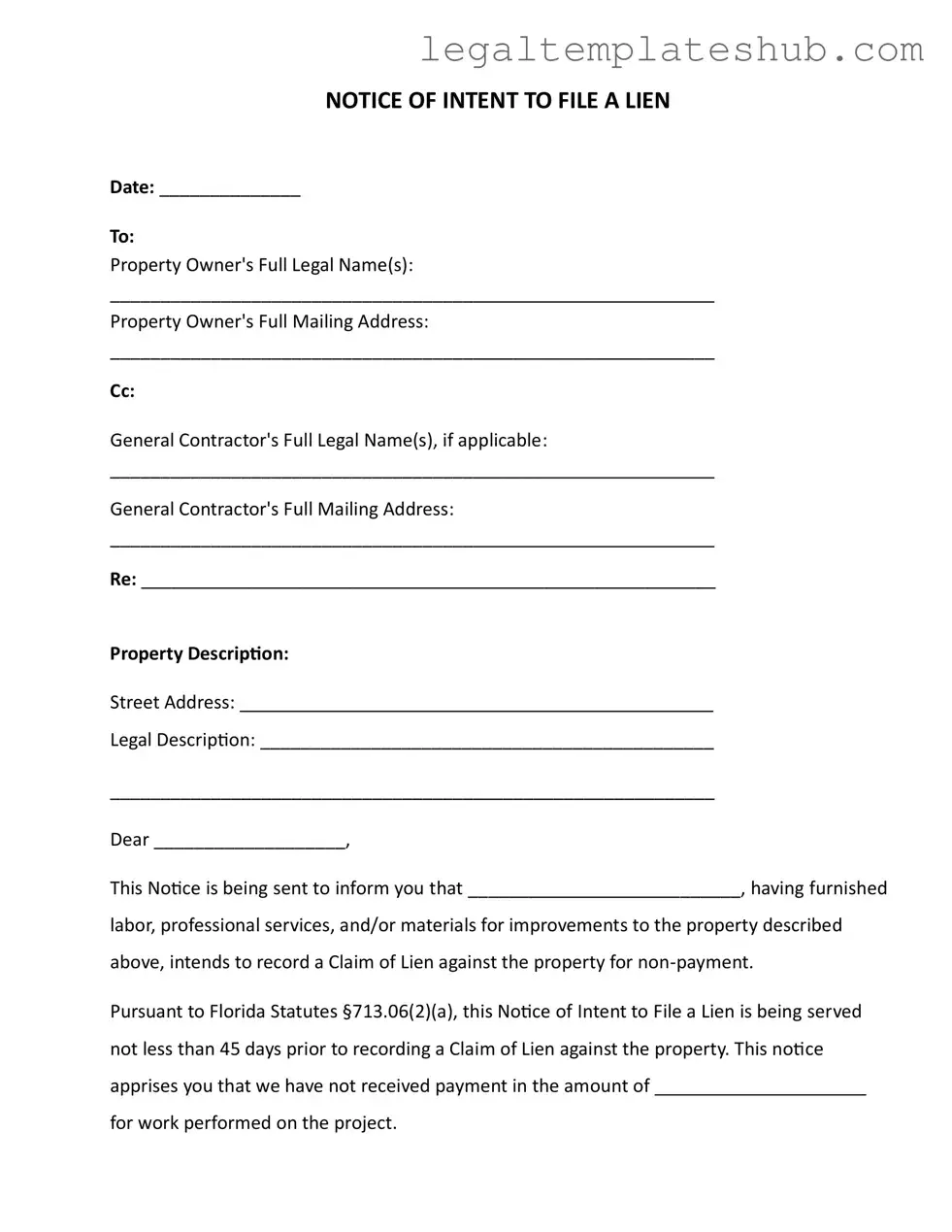

Blank Intent To Lien Florida PDF Form

File Breakdown

| Fact Name | Details |

|---|---|

| Date Requirement | The Notice of Intent to File a Lien must include the date it is issued, ensuring all parties are aware of the timeline. |

| Property Owner Information | It is essential to include the full legal name and mailing address of the property owner to ensure proper notification. |

| General Contractor Details | If applicable, the full legal name and mailing address of the general contractor should also be included to maintain transparency. |

| Florida Statutes Reference | This form is governed by Florida Statutes §713.06, which outlines the requirements for filing a lien. |

| Payment Notification | The notice informs the property owner of the amount owed for labor, services, or materials, emphasizing the need for prompt payment. |

| Response Timeframe | The property owner has 30 days to respond to the notice before a lien may be recorded, highlighting the urgency of addressing the matter. |

| Consequences of Non-Payment | Failure to respond or pay may lead to a lien being placed on the property, potentially resulting in foreclosure and additional costs. |

Key takeaways

Understanding the Intent to Lien form in Florida is crucial for anyone involved in construction or property improvement projects. Here are some key takeaways to keep in mind:

- The Intent to Lien serves as a formal notice to property owners about unpaid labor or materials.

- It must be sent at least 45 days before filing a Claim of Lien, according to Florida law.

- Property owners have 30 days to respond after receiving the notice to avoid further legal action.

- Failure to respond can lead to a lien being recorded, which may result in foreclosure proceedings.

- The form requires detailed information, including the property owner's name, address, and a description of the property.

- It is essential to specify the amount owed for work completed, as this amount can impact negotiations.

- Sending the notice via certified mail or other documented methods ensures there is proof of delivery.

- Consulting with a legal professional can help clarify any questions about the process and protect your rights.

By following these guidelines, you can navigate the complexities of the lien process more effectively. Always prioritize communication and documentation to safeguard your interests.

Dos and Don'ts

When filling out the Intent To Lien Florida form, it is essential to be thorough and accurate. Here are some important guidelines to follow:

- Do ensure all fields are filled out completely, including the property owner's full legal name and mailing address.

- Do provide a clear description of the property, including both the street address and the legal description.

- Do specify the amount owed for the work performed, as this is crucial for clarity.

- Do send the notice at least 45 days before you plan to record a Claim of Lien.

- Don't omit any required information, as incomplete forms may lead to delays or legal issues.

- Don't ignore the timeline; remember that the property owner has 30 days to respond to avoid further action.

- Don't forget to sign the document, as an unsigned notice may not be valid.

- Don't use vague language; be specific about the services or materials provided to avoid misunderstandings.

Following these guidelines will help ensure that your Intent To Lien form is completed correctly and that your rights are protected. It is a serious matter, but with careful attention to detail, you can navigate this process with confidence.

Common PDF Templates

Create Gift Certificate - Wrap up your admiration and love with the gift of a flexible gift certificate!

The Hold Harmless Agreement is a fundamental legal tool that contractors and businesses rely on to mitigate risks in various operations. For those seeking to understand this important aspect of risk management, a thorough exploration of the Hold Harmless Agreement details can be found at key insights into the Hold Harmless Agreement process.

Wage and Tax Statement - Employees who haven’t received their W-2 by mid-February should contact their employer.

Erc Forms - Neighborhood statistics guide brokers in justifying their pricing strategies.

Instructions on Filling in Intent To Lien Florida

After completing the Intent To Lien form, it is crucial to ensure that all information is accurate and that it is served to the appropriate parties. This step is vital to protect your rights and to initiate the process of securing a lien if necessary.

- Fill in the date at the top of the form.

- Enter the full legal name(s) of the property owner(s) in the designated space.

- Provide the full mailing address of the property owner(s).

- If applicable, include the full legal name(s) of the general contractor in the "Cc" section.

- Write the full mailing address of the general contractor, if included.

- Specify the subject of the lien in the "Re" section.

- Fill in the street address of the property in the property description section.

- Provide the legal description of the property.

- In the body of the notice, state the name of the individual or entity that furnished labor, services, or materials.

- Indicate the amount owed for the work performed on the project.

- Clearly sign and print your name at the bottom of the notice.

- Include your title, phone number, and email address below your signature.

- Complete the "Certificate of Service" section, including the date of service and the name of the recipient.

- Indicate the method of service by checking the appropriate box.

- Sign and print your name in the certificate section.

Misconceptions

Misconceptions about the Intent to Lien form in Florida can lead to confusion among property owners and contractors alike. Understanding these misconceptions is crucial for all parties involved in property improvement projects. Below are five common misconceptions:

- The Intent to Lien form is the same as a lien. Many believe that submitting the Intent to Lien form automatically places a lien on the property. In reality, this form serves as a notification that a lien may be filed if payment is not made. The lien itself is only recorded after the specified time period has passed.

- Only contractors need to file an Intent to Lien. This is not accurate. Subcontractors, suppliers, and other professionals who provide labor or materials can also file this notice. Anyone who contributes to the improvement of a property has the right to protect their interests through this form.

- Sending the Intent to Lien form guarantees payment. While this notice can prompt a property owner to settle outstanding debts, it does not guarantee that payment will be received. It is a formal reminder of the obligation to pay but does not compel immediate action from the property owner.

- The notice must be sent via certified mail only. Some people think that certified mail is the only acceptable method for delivering the Intent to Lien form. In fact, the law allows several methods of delivery, including hand delivery and delivery by a process server, which can be more effective in certain situations.

- The Intent to Lien form can be ignored. Ignoring this notice is a risky decision. If the recipient does not respond or make payment within the specified time frame, the filer can proceed to record a lien, which can lead to foreclosure and additional costs for the property owner.