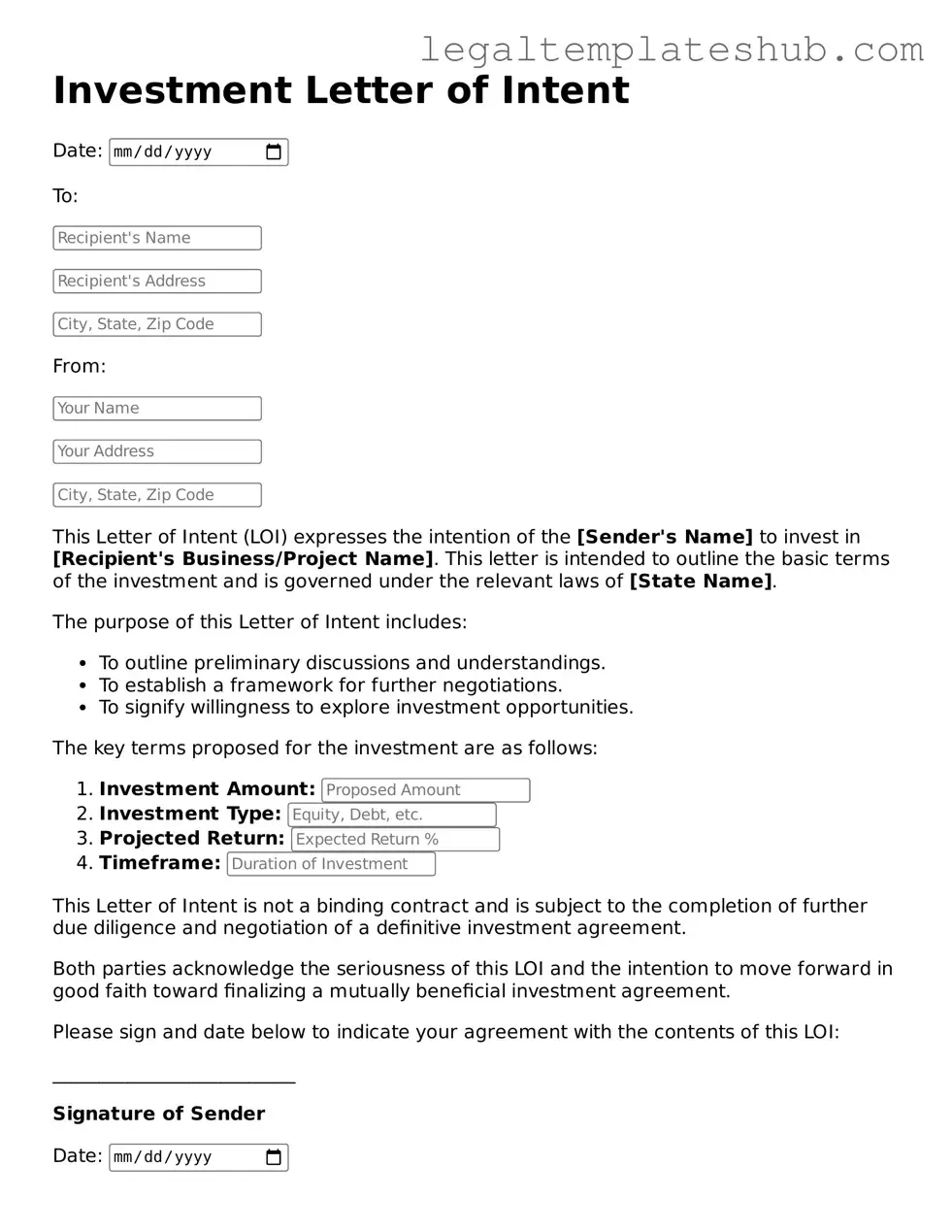

Printable Investment Letter of Intent Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Investment Letter of Intent (LOI) serves as a preliminary agreement outlining the terms and conditions for a potential investment. |

| Non-Binding Nature | Typically, an LOI is non-binding, meaning that it expresses intent rather than creating enforceable obligations for either party. |

| Key Components | Common elements include the investment amount, valuation, timeline, and any contingencies that must be met before finalizing the investment. |

| State-Specific Forms | Some states may have specific requirements or forms for LOIs, governed by local laws such as the Uniform Commercial Code (UCC) or state securities laws. |

| Importance of Legal Review | Before signing an LOI, it is crucial to have it reviewed by a legal expert to ensure that it aligns with your interests and complies with relevant laws. |

Key takeaways

Filling out and using the Investment Letter of Intent form can be a crucial step in the investment process. Here are some key takeaways to keep in mind:

- Understand the Purpose: The Investment Letter of Intent serves as a preliminary agreement between parties, outlining the basic terms of the investment.

- Clear Communication: Ensure that all parties involved have a mutual understanding of the investment terms to avoid confusion later on.

- Be Specific: Clearly detail the amount of investment, the type of investment, and any conditions that may apply.

- Review Carefully: Take the time to review the form thoroughly before submission to ensure all information is accurate and complete.

- Signature Requirement: Remember that all parties must sign the letter for it to be considered valid and enforceable.

- Confidentiality Clause: Consider including a confidentiality clause to protect sensitive information shared during negotiations.

- Legal Review: It may be beneficial to have a legal professional review the letter to ensure that it meets all necessary legal standards.

- Timeline Consideration: Specify any timelines for the investment process to keep all parties accountable and on track.

- Follow-Up: After submitting the letter, maintain open lines of communication with all involved parties to discuss any questions or concerns.

- Use as a Foundation: Treat the Investment Letter of Intent as a foundation for drafting a more detailed investment agreement in the future.

Dos and Don'ts

When filling out the Investment Letter of Intent form, attention to detail is crucial. Here are some important dos and don'ts to keep in mind:

- Do read the entire form carefully before starting to fill it out.

- Do provide accurate and complete information to avoid delays.

- Do double-check all financial figures and calculations.

- Do sign and date the form where required.

- Don't leave any required fields blank; fill in all necessary information.

- Don't use abbreviations or jargon that might confuse the reader.

- Don't submit the form without reviewing it for errors.

Following these guidelines can help ensure that your Investment Letter of Intent is processed smoothly and efficiently.

Common Types of Investment Letter of Intent Forms:

Letter of Intent Buying a Business - A document that may include proposed timelines for completing the sale.

Instructions on Filling in Investment Letter of Intent

After obtaining the Investment Letter of Intent form, you will need to fill it out carefully. Completing this form accurately is crucial for moving forward with your investment plans. Follow these steps to ensure you provide all necessary information correctly.

- Start by entering your full name in the designated field.

- Provide your current address, including city, state, and ZIP code.

- Fill in your email address and phone number for contact purposes.

- Indicate the amount of investment you are considering.

- Specify the type of investment you are interested in, such as equity or debt.

- Include any relevant details about the investment opportunity in the comments section.

- Review all the information you have entered for accuracy.

- Sign and date the form at the bottom to confirm your intent.

Once you have completed the form, you will be ready to submit it according to the provided instructions. This step is essential for ensuring your investment process can begin smoothly.

Misconceptions

Many people have misunderstandings about the Investment Letter of Intent (LOI) form. Here are five common misconceptions:

- 1. An LOI is a legally binding contract. Many believe that once they sign an LOI, they are legally obligated to go through with the investment. In reality, an LOI is usually a preliminary document that outlines intentions, but it is not a binding contract unless explicitly stated.

- 2. All terms are negotiable in an LOI. While many aspects of an LOI can be negotiated, some terms may be standard or non-negotiable, especially if they are dictated by the investment firm's policies. It’s important to clarify which terms can be adjusted.

- 3. An LOI guarantees funding. Some individuals think that signing an LOI guarantees they will receive funding. However, the LOI merely indicates interest and outlines the proposed terms; actual funding is contingent on further due diligence and agreement.

- 4. The LOI is the final step in the investment process. Many assume that once an LOI is signed, the investment process is complete. In truth, the LOI is just one step in a series of negotiations and evaluations that lead to a final agreement.

- 5. An LOI is only necessary for large investments. Some people think that LOIs are only for significant financial commitments. However, they can be useful for any investment, regardless of size, as they help clarify intentions and expectations.

Understanding these misconceptions can help investors navigate the process more effectively and make informed decisions.