Blank IRS 1120 PDF Form

File Breakdown

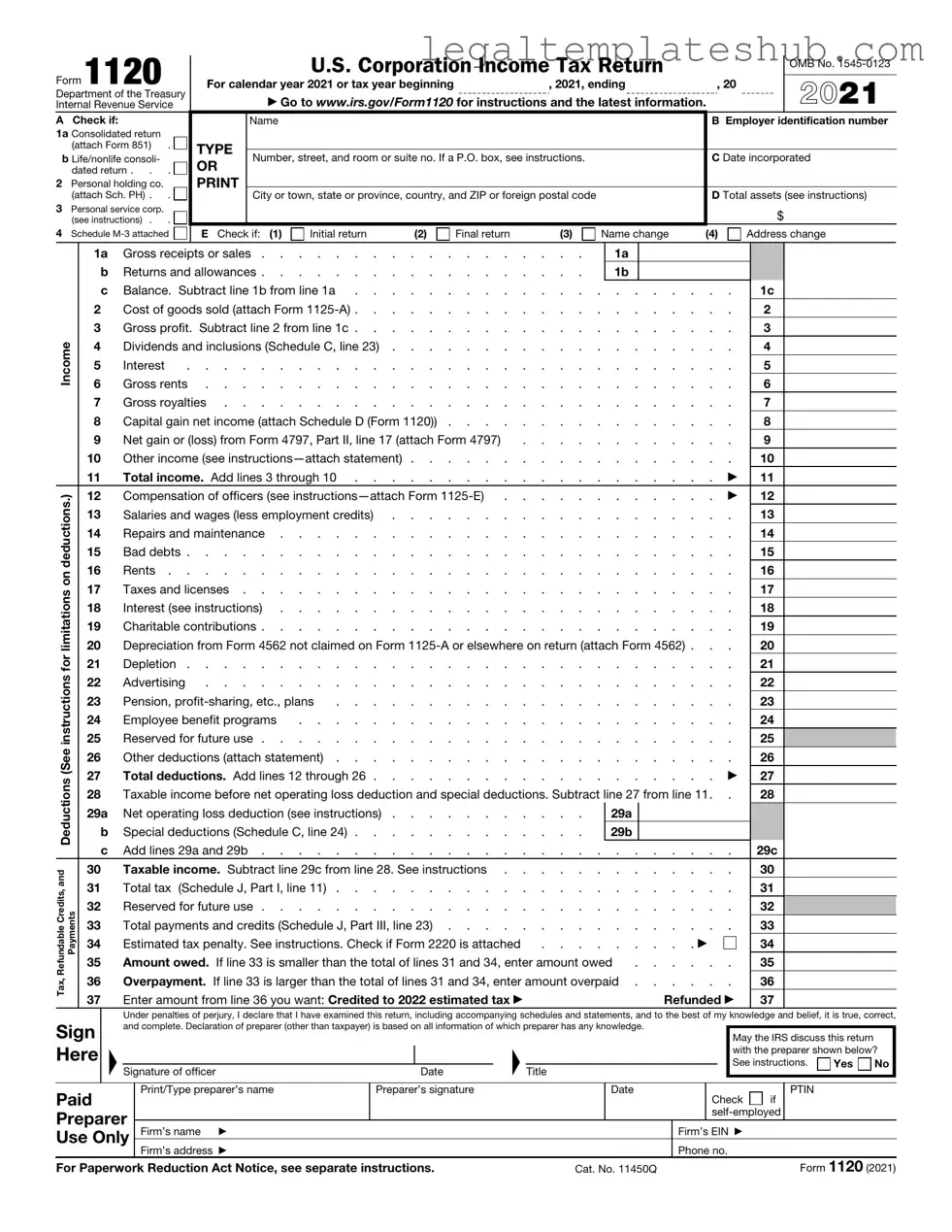

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 1120 is used by corporations to report income, gains, losses, deductions, and credits, as well as to calculate their federal income tax liability. |

| Filing Deadline | Corporations must file Form 1120 by the 15th day of the fourth month after the end of their tax year. For calendar year corporations, this typically falls on April 15. |

| Estimated Payments | Corporations may be required to make estimated tax payments throughout the year. These payments are based on the corporation's expected tax liability. |

| State-Specific Forms | Many states have their own corporate tax forms. For example, California requires Form 100, governed by the California Revenue and Taxation Code. |

| Electronic Filing | Corporations can file Form 1120 electronically. This method can expedite processing and reduce errors compared to paper filing. |

Key takeaways

Filling out the IRS 1120 form can seem daunting, but understanding its key aspects can simplify the process. Here are nine important takeaways to consider when dealing with this corporate tax return form.

- Understand the Purpose: The IRS 1120 form is used by corporations to report their income, gains, losses, deductions, and credits. This information is crucial for calculating the corporation's tax liability.

- Eligibility: Only C corporations, which are separate legal entities from their owners, are required to file this form. S corporations and other business structures have different filing requirements.

- Gather Necessary Information: Before starting, collect all relevant financial documents, including income statements, balance sheets, and records of expenses. This preparation will streamline the filling process.

- Filing Deadline: The form is typically due on the 15th day of the fourth month after the end of the corporation's tax year. Mark your calendar to avoid late penalties.

- Use Accurate Figures: Ensure that all numbers reported on the form are accurate and reflect the corporation's financial activities. Mistakes can lead to audits or penalties.

- Consider Deductions: Corporations can deduct certain expenses, such as salaries, rent, and utilities. Familiarize yourself with allowable deductions to minimize tax liability.

- Review Tax Credits: Look into available tax credits that your corporation may qualify for. These can significantly reduce the overall tax burden.

- Seek Professional Help: If the process feels overwhelming, consider consulting with a tax professional. Their expertise can help ensure compliance and optimize your tax situation.

- Keep Records: After filing, maintain copies of the submitted form and all supporting documents. This practice is essential for future reference and potential audits.

By keeping these key points in mind, corporations can navigate the IRS 1120 form with greater confidence and accuracy.

Dos and Don'ts

When filling out the IRS 1120 form, attention to detail is crucial. Here are some essential do's and don'ts to keep in mind:

- Do ensure all information is accurate and up-to-date. Double-check figures and descriptions.

- Do use the correct tax year when reporting income and expenses. This helps avoid discrepancies.

- Don't leave any required fields blank. Incomplete forms can lead to delays or rejections.

- Don't forget to sign and date the form before submission. An unsigned form may not be considered valid.

Common PDF Templates

Signing Over Parental Rights in Sc - Each section of the form is designed to elicit specific and necessary information.

The California Trailer Bill of Sale form is a legal document that facilitates the transfer of ownership of a trailer from the seller to the buyer. It serves as evidence that the transaction has occurred, detailing the terms and conditions agreed upon by both parties. This form is essential for the proper documentation of the sale and is a crucial step in the process of registering the trailer under the new owner's name. For more information on how to obtain or complete this form, you can visit https://californiapdf.com/editable-trailer-bill-of-sale/.

Where to Submit I 864 Affidavit of Support - It is important to keep copies of the I-864 and supporting documents.

Instructions on Filling in IRS 1120

Filling out the IRS 1120 form is an important step for corporations to report their income, gains, losses, deductions, and credits. Completing this form accurately ensures compliance with tax regulations and helps avoid potential penalties. Follow these steps carefully to ensure your submission is correct.

- Gather all necessary financial documents, including income statements, balance sheets, and records of expenses.

- Begin by entering the corporation's name, address, and Employer Identification Number (EIN) at the top of the form.

- Fill in the date of incorporation and the total assets at the end of the tax year in the designated sections.

- Report the corporation's income by completing the income section. Include gross receipts and any other sources of income.

- Deduct allowable expenses in the appropriate section. Ensure you have documentation for each expense claimed.

- Calculate the taxable income by subtracting total deductions from total income.

- Complete the tax computation section to determine the amount of tax owed.

- Review any applicable credits that may reduce the tax liability and fill in the relevant information.

- Sign and date the form. Ensure that the person signing has the authority to do so.

- Make a copy of the completed form for your records before submitting it to the IRS.

Once you have filled out the form, double-check all entries for accuracy. Submit the form by the deadline to avoid penalties. If you have questions or need assistance, consider consulting a tax professional.

Misconceptions

The IRS Form 1120 is an important document for corporations in the United States, but several misconceptions surround it. Understanding these misunderstandings can help business owners navigate their tax obligations more effectively. Below are four common misconceptions about Form 1120:

- Only large corporations need to file Form 1120. This is not true. Any corporation, regardless of size, must file Form 1120 if it is a C corporation. Even small businesses incorporated as C corporations are required to submit this form annually.

- Filing Form 1120 is optional for corporations. This is a misconception. Filing Form 1120 is mandatory for all C corporations. Failure to file can result in penalties and interest on unpaid taxes, so it is essential to comply with this requirement.

- Form 1120 is only for reporting income. While Form 1120 does report income, it also serves multiple purposes. It includes deductions, credits, and other necessary information to determine the corporation's tax liability. Understanding all aspects of the form is crucial for accurate reporting.

- Corporations can file Form 1120 at any time during the year. This is incorrect. Corporations must adhere to specific deadlines for filing Form 1120, typically on the 15th day of the fourth month after the end of their tax year. Missing this deadline can lead to complications and penalties.

By addressing these misconceptions, corporations can better prepare for their tax responsibilities and avoid potential pitfalls.