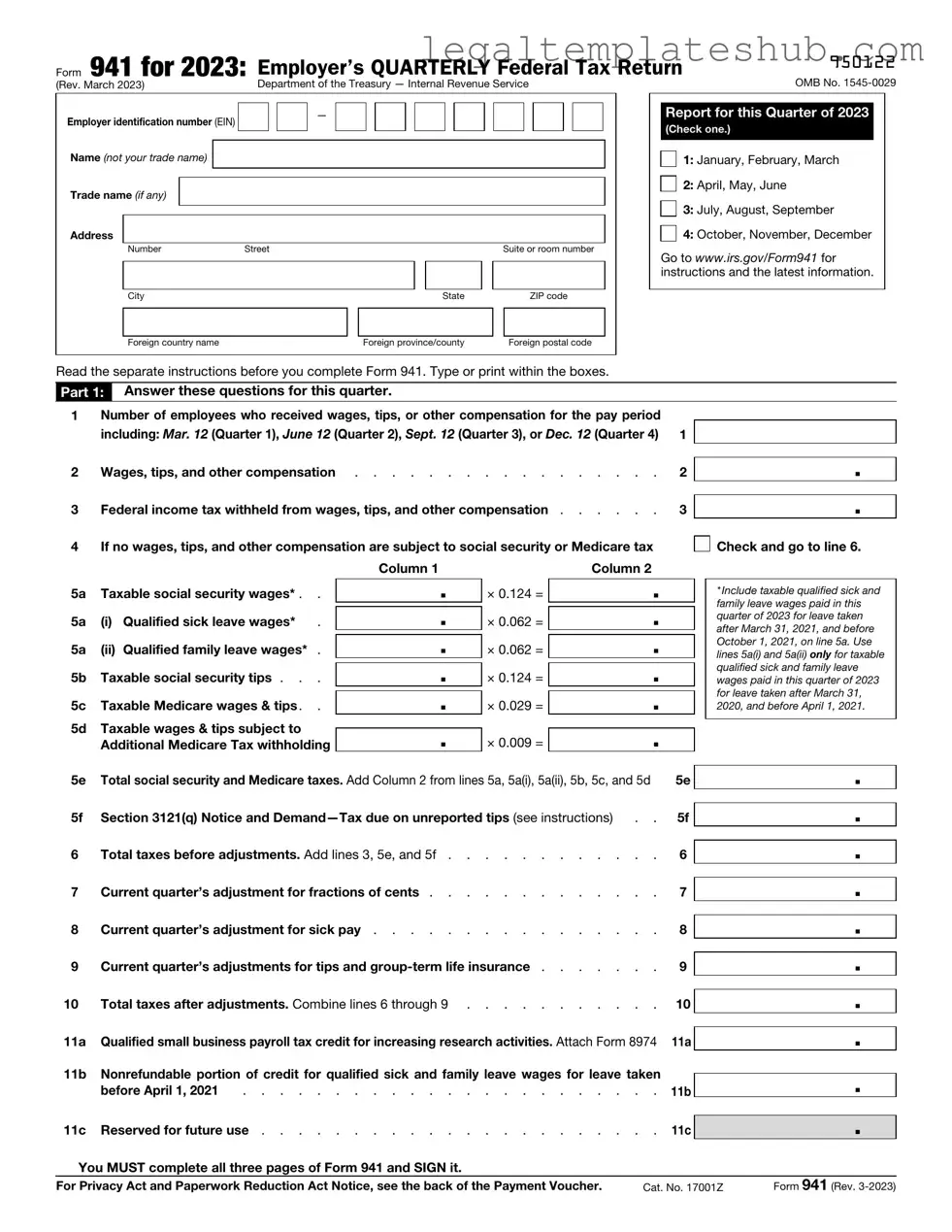

Blank IRS 941 PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The IRS Form 941 is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. |

| Filing Frequency | Employers must file Form 941 quarterly, with specific deadlines for each quarter. |

| Due Dates | Form 941 is due on the last day of the month following the end of each quarter: April 30, July 31, October 31, and January 31. |

| Penalties | Failure to file Form 941 on time may result in penalties and interest on unpaid taxes. |

| State-Specific Forms | Some states have their own forms for reporting state income tax withheld. For example, California requires Form DE 9. |

| Electronic Filing | Employers can file Form 941 electronically through the IRS e-file system, which may expedite processing. |

| Recordkeeping | Employers must keep records of employment taxes for at least four years after the date the tax becomes due. |

| Amended Returns | If errors are found after filing, employers can amend their returns using Form 941-X. |

| Signature Requirement | Form 941 must be signed by an authorized person, such as the business owner or a designated employee. |

| Tax Credits | Employers may claim certain tax credits, such as the Employee Retention Credit, directly on Form 941. |

Key takeaways

Filling out and using the IRS Form 941 is essential for employers to report payroll taxes. Here are some key takeaways to consider:

- Purpose: Form 941 is used to report income taxes, Social Security tax, and Medicare tax withheld from employee wages.

- Filing Frequency: Employers must file this form quarterly, which means it is due four times a year.

- Accurate Information: Ensure that all employee wages and taxes withheld are reported accurately to avoid penalties.

- Electronic Filing: The IRS encourages electronic filing, which can simplify the process and speed up processing times.

- Record Keeping: Maintain detailed records of all payroll information, as the IRS may request documentation to support the figures reported on Form 941.

- Amendments: If errors are found after submission, employers can file Form 941-X to correct any mistakes made on the original form.

Understanding these key points will help ensure compliance and make the process smoother for employers.

Dos and Don'ts

When filling out the IRS 941 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do double-check your employer identification number (EIN) for accuracy.

- Don't leave any fields blank; fill in all required information.

- Do report all wages, tips, and other compensation accurately.

- Don't forget to include any adjustments for overreported or underreported amounts.

- Do sign and date the form before submission.

- Don't ignore the deadlines; submit your form on time to avoid penalties.

- Do keep a copy of the completed form for your records.

- Don't assume that electronic filing is not an option; consider e-filing for convenience.

- Do consult the IRS instructions for any specific questions or concerns.

- Don't hesitate to seek professional help if you're unsure about any aspect of the form.

Common PDF Templates

How to Make Pay Stubs If Self Employed - This form can highlight discrepancies in payment amounts if any.

To ensure a smooth rental experience in New York, utilizing a comprehensive Lease Agreement form is crucial. By clearly laying out the expectations and obligations between the landlord and tenant, this document fosters transparency and accountability. For those looking for an efficient way to prepare this legal contract, the PDF Templates provide excellent resources that simplify the process and help prevent future misunderstandings.

Dd Form 2656 March 2022 Pdf - Completing this form accurately is crucial to avoid payment delays.

Instructions on Filling in IRS 941

Completing the IRS Form 941 is an important task for employers who need to report payroll taxes. After filling out the form, it is essential to ensure that all information is accurate and submitted on time to avoid penalties. The following steps will guide you through the process of filling out the form correctly.

- Obtain the IRS Form 941 from the official IRS website or your tax professional.

- Enter your business name, address, and Employer Identification Number (EIN) at the top of the form.

- Fill in the reporting period, which includes the month and year for which you are filing.

- Complete Part 1, where you will report the number of employees, wages paid, and the total taxes withheld.

- Calculate the total tax liability for the quarter and enter it in the appropriate section of Part 1.

- Move to Part 2 and indicate whether you are a seasonal employer, if applicable.

- In Part 3, sign and date the form. Ensure that the name of the person signing is printed clearly.

- Review the entire form for accuracy and completeness before submitting.

- Submit the completed Form 941 to the IRS by mail or electronically, depending on your preference.

Misconceptions

Understanding the IRS Form 941 can be tricky. Here are six common misconceptions that often arise:

-

Form 941 is only for large businesses.

This is not true. Form 941 is required for all employers who withhold income taxes and pay Social Security and Medicare taxes, regardless of the size of the business.

-

Form 941 is filed annually.

Many believe that Form 941 is an annual requirement. In reality, it must be filed quarterly. Employers need to submit it four times a year to report wages and taxes.

-

Only full-time employees are reported on Form 941.

Part-time employees also count. All employees, regardless of hours worked, must be included in the form's reporting.

-

Form 941 is the same as Form 944.

These forms serve different purposes. Form 944 is designed for smaller employers who can file annually, while Form 941 is for those who file quarterly.

-

Filing Form 941 guarantees a refund.

While some employers may receive a refund, it is not guaranteed. The form is primarily a reporting tool, and any overpayment will be addressed separately by the IRS.

-

Once filed, Form 941 cannot be amended.

This is a misconception. If errors are found, employers can file Form 941-X to correct any mistakes made on the original form.

Being informed about these misconceptions can help ensure accurate and timely filing of Form 941.