Blank IRS Schedule C 1040 PDF Form

File Breakdown

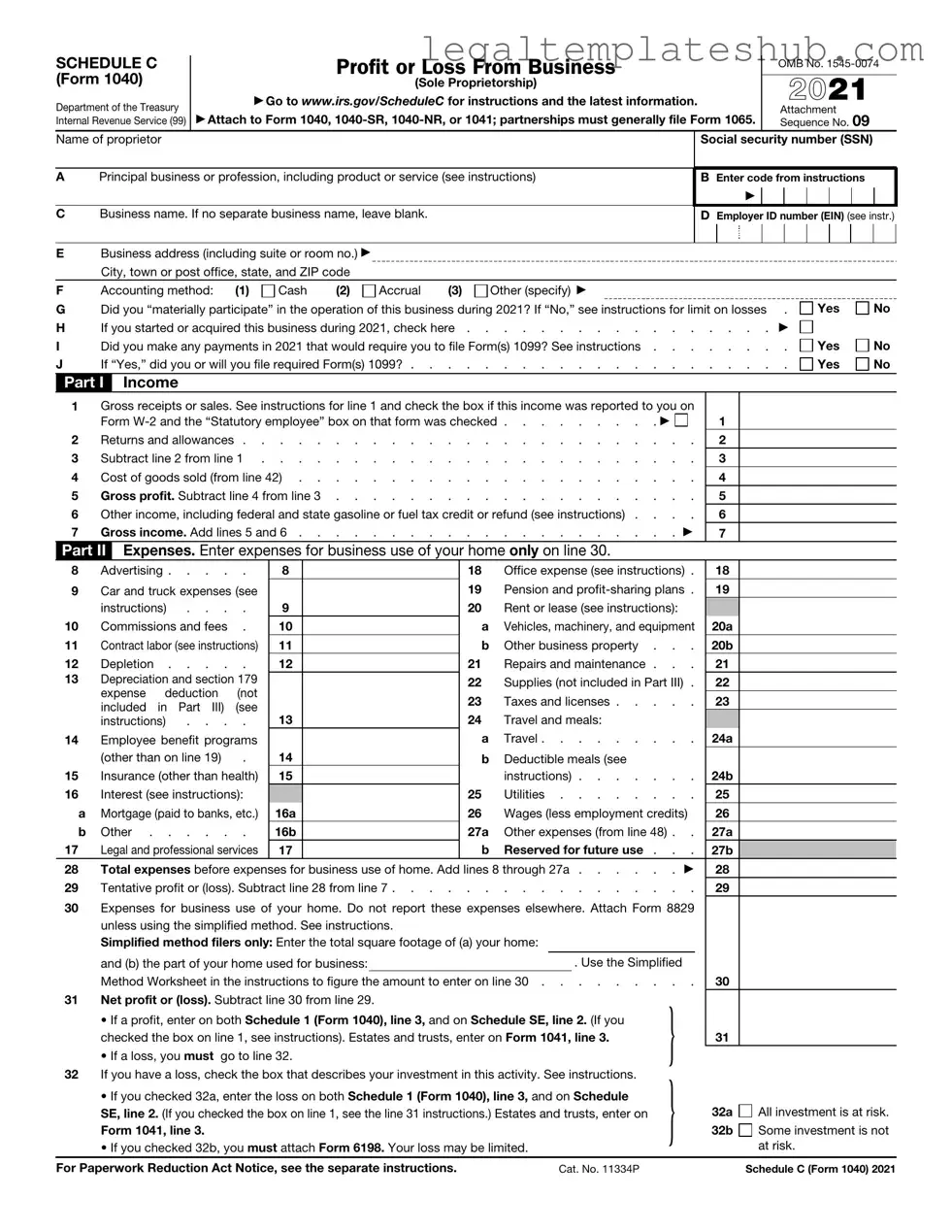

| Fact Name | Description |

|---|---|

| Purpose | The IRS Schedule C (Form 1040) is used by sole proprietors to report income and expenses from their business activities. |

| Eligibility | Any individual who operates a business as a sole proprietorship can file Schedule C, regardless of the business's size or revenue. |

| Filing Deadline | Schedule C must be filed by the tax return deadline, typically April 15, unless an extension is granted. |

| Income Reporting | All income generated from the business must be reported, including cash, checks, and electronic payments. |

| Deductible Expenses | Common deductible expenses include costs for supplies, utilities, and business-related travel. Keeping detailed records is crucial. |

| Net Profit or Loss | The form calculates the net profit or loss from the business, which is then transferred to the main Form 1040. |

| Self-Employment Tax | Profits reported on Schedule C are subject to self-employment tax, which funds Social Security and Medicare. |

| State-Specific Requirements | Some states may have additional forms or requirements for reporting business income, governed by state tax laws. |

| Record Keeping | Maintaining thorough records of all income and expenses is essential for accurate reporting and to support deductions claimed. |

Key takeaways

Filling out the IRS Schedule C (Form 1040) can be an important step for self-employed individuals. Here are some key takeaways to keep in mind:

- Purpose: Schedule C is used to report income and expenses from a business you operated or a profession you practiced as a sole proprietor.

- Record Keeping: Maintain accurate records of all income and expenses throughout the year. This will make completing the form easier and more accurate.

- Income Reporting: Report all income earned from your business activities. This includes cash, checks, and electronic payments.

- Deductible Expenses: Familiarize yourself with what expenses can be deducted. Common deductions include supplies, utilities, and business-related travel.

- Net Profit or Loss: The form calculates your net profit or loss, which is then transferred to your Form 1040. This figure affects your overall tax liability.

- Self-Employment Tax: If you earn a profit, you may also be responsible for self-employment tax, which covers Social Security and Medicare taxes.

- Filing Deadline: Schedule C must be submitted along with your Form 1040 by the tax filing deadline, usually April 15th.

- Consult a Professional: If you have questions or your situation is complex, consider consulting a tax professional for guidance.

Dos and Don'ts

When filling out the IRS Schedule C (Form 1040), it's essential to be careful and accurate. Here are some important dos and don’ts to keep in mind:

- Do ensure that all income from your business is reported accurately.

- Do keep thorough records of all business expenses to support your deductions.

- Do double-check your calculations to avoid any mistakes that could lead to issues with the IRS.

- Do file your Schedule C on time to avoid late fees and penalties.

- Don’t forget to include your business name and address as required.

- Don’t mix personal and business expenses; keep them separate for clarity.

- Don’t leave any sections blank; if something doesn’t apply, write “N/A” instead.

- Don’t ignore the importance of consulting a tax professional if you have questions.

Common PDF Templates

Broward County Animal Care - Enables quick access to vaccination details in emergencies.

To ensure a smooth transaction when buying or selling a trailer, both parties should utilize the California Trailer Bill of Sale form, which can be found at californiapdf.com/editable-trailer-bill-of-sale/. This document not only provides the necessary proof of ownership transfer but also outlines the specific terms of the sale, thereby protecting the interests of both the seller and the buyer throughout the registration process.

Ucc-1-308 - This form communicates one's explicit reservation of all legal rights to the public.

Instructions on Filling in IRS Schedule C 1040

Filling out the IRS Schedule C (Form 1040) is an important step for self-employed individuals to report income and expenses from their business. Completing this form accurately ensures that you provide the IRS with the necessary information about your business activities. Here’s how to fill it out step by step.

- Obtain the Form: Download Schedule C from the IRS website or get a physical copy from a tax professional.

- Enter Your Information: Fill in your name, Social Security number, and the name of your business at the top of the form.

- Choose Your Business Type: Indicate your business structure (sole proprietorship, LLC, etc.) and the principal business activity.

- Report Income: In Part I, list your gross receipts or sales. If you had returns and allowances, subtract them to find your net income.

- List Expenses: In Part II, detail your business expenses. Common categories include advertising, car and truck expenses, and supplies. Be thorough and accurate.

- Calculate Net Profit or Loss: Subtract total expenses from total income. This figure will be carried over to your Form 1040.

- Sign and Date: Don’t forget to sign and date the form before submitting it. This confirms that the information is true and complete.

Once you’ve filled out Schedule C, you’ll attach it to your Form 1040 when you file your taxes. Make sure to keep a copy for your records, as it may be needed for future reference or audits.

Misconceptions

The IRS Schedule C (Form 1040) is a crucial document for self-employed individuals and sole proprietors. However, several misconceptions exist regarding its purpose and requirements. Below are five common misunderstandings about this form.

-

Only Businesses with High Revenue Need to File Schedule C.

Many people believe that only businesses generating significant income must file Schedule C. In reality, anyone who earns income from self-employment, regardless of the amount, is required to report that income using this form.

-

All Expenses Can Be Deducted.

Some individuals think that all business-related expenses are fully deductible. However, only ordinary and necessary expenses that are directly related to the business can be deducted. Personal expenses or those not directly tied to business operations are not eligible.

-

Filing Schedule C Guarantees a Tax Refund.

There is a common belief that filing Schedule C will automatically result in a tax refund. While it may allow for deductions that lower taxable income, it does not guarantee a refund. The final tax outcome depends on various factors, including total income and tax liabilities.

-

Self-Employed Individuals Do Not Need to Pay Estimated Taxes.

Some self-employed individuals assume that they do not need to make estimated tax payments. In fact, if you expect to owe $1,000 or more in taxes for the year, you are generally required to make quarterly estimated tax payments to avoid penalties.

-

Schedule C Is Only for Full-Time Self-Employed Individuals.

Another misconception is that only full-time self-employed individuals need to file Schedule C. Part-time self-employed individuals must also report their income and expenses on this form, regardless of the number of hours worked.