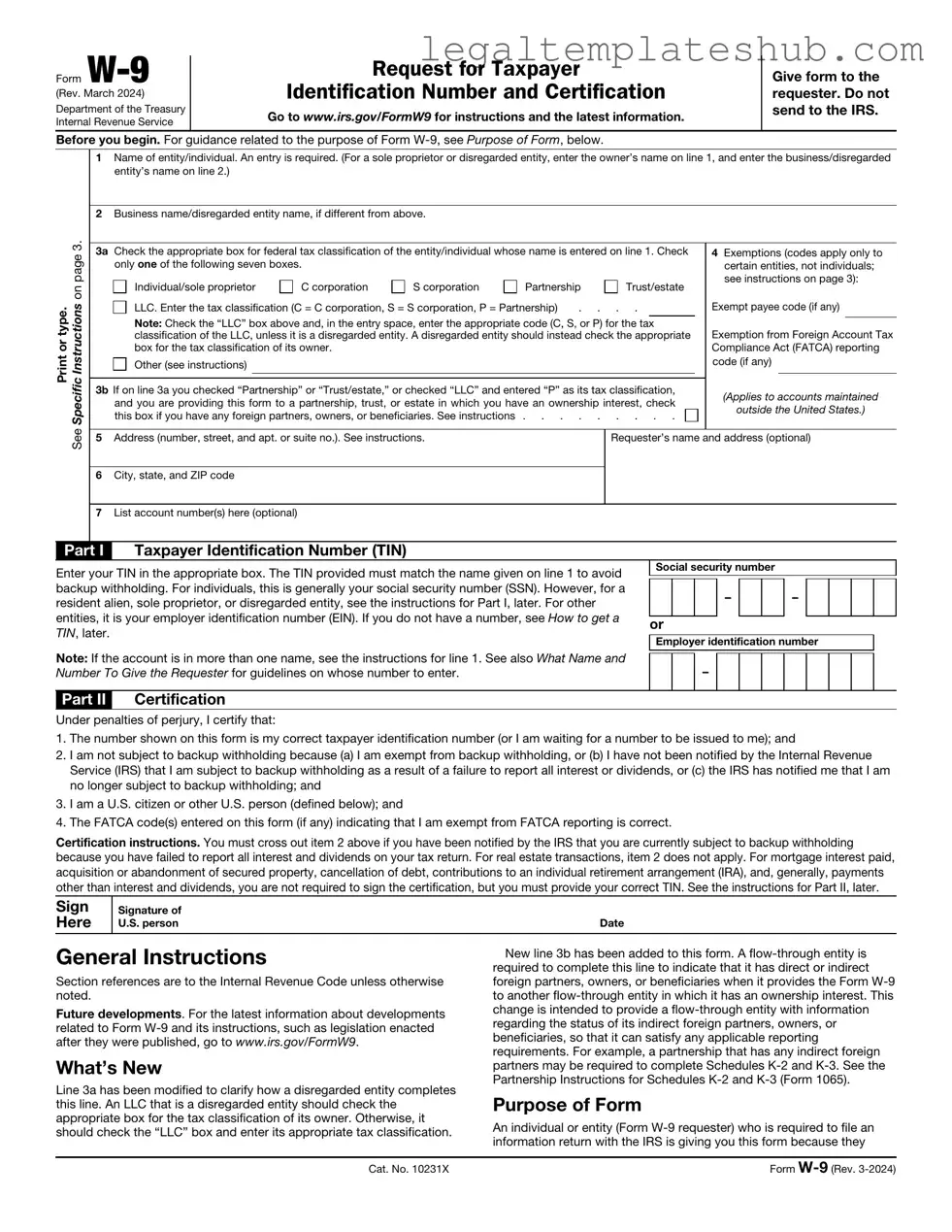

Blank IRS W-9 PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Purpose | The W-9 form is used to provide taxpayer information to the IRS, primarily for income reporting purposes. |

| Who Uses It | Individuals and businesses that are required to report income paid to contractors or freelancers use the W-9. |

| Taxpayer Identification | The form requires the individual or entity to provide their Taxpayer Identification Number (TIN), which can be a Social Security Number (SSN) or Employer Identification Number (EIN). |

| Filing Requirement | Businesses must collect a W-9 from any contractor or freelancer they pay $600 or more in a calendar year. |

| State-Specific Forms | Some states may have their own versions of the W-9 or additional forms for reporting income. Check local laws for specifics. |

| Privacy Concerns | Since the W-9 contains sensitive information, it should be stored securely to protect against identity theft. |

| Signature Requirement | The form must be signed by the individual or authorized representative to certify that the information provided is accurate. |

| Validity Period | Once submitted, the W-9 does not expire, but businesses may request a new one if there are changes in the taxpayer's information. |

| IRS Use | The IRS uses the information from the W-9 to match reported income with the taxpayer's records during audits. |

| Penalties for Inaccuracy | Providing false information on a W-9 can lead to penalties from the IRS, including fines and back taxes. |

Key takeaways

The IRS W-9 form is an important document for individuals and businesses. Here are key takeaways to keep in mind when filling it out and using it:

- The W-9 form is used to provide your taxpayer identification number (TIN) to others, typically for tax reporting purposes.

- Ensure that the name on the W-9 matches the name associated with your TIN to avoid any discrepancies.

- You must fill out the form accurately to prevent delays in processing payments or tax documents.

- Only provide the W-9 to those who request it for legitimate business purposes.

- Keep a copy of the completed W-9 for your records; this can be useful for future reference.

- Submit the W-9 form to the requester, not to the IRS.

- Be aware that failing to provide a W-9 when requested can result in backup withholding on your payments.

- Update your W-9 if there are any changes to your name, business structure, or TIN.

- Understand that the W-9 does not need to be filed with your tax return; it is only for the requester’s records.

Dos and Don'ts

When filling out the IRS W-9 form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are some things you should and shouldn't do:

- Do provide your full legal name as it appears on your tax return.

- Do check the appropriate box for your tax classification.

- Do include your correct taxpayer identification number (TIN).

- Do sign and date the form to certify the information is accurate.

- Don't use nicknames or abbreviations for your name.

- Don't leave any required fields blank.

- Don't submit the form without reviewing it for errors.

- Don't forget to update the form if your information changes.

Common PDF Templates

Asurion Phone - Your experience with Asurion begins with the completion of the F-017-08 MEN form.

To facilitate the ownership transfer process, it is crucial to utilize the appropriate documentation, and the Bill of Sale for Motorcycles is an essential tool for anyone looking to buy or sell a motorcycle in Arizona.

Dd Form 2870 Release of Information - The DD 2870 helps keep track of medical evaluations within military records.

Instructions on Filling in IRS W-9

Once you have the IRS W-9 form in hand, it's time to complete it accurately. This form is essential for providing your taxpayer information to the requester, often for purposes such as income reporting. Follow these steps to fill it out correctly.

- Begin by downloading the W-9 form from the IRS website or obtaining a physical copy.

- In the first section, enter your name as it appears on your tax return.

- If applicable, provide your business name in the next line.

- Select the appropriate box for your federal tax classification: individual/sole proprietor, corporation, partnership, etc.

- Fill in your address, including street, city, state, and ZIP code.

- Enter your taxpayer identification number (TIN). This can be your Social Security number (SSN) or Employer Identification Number (EIN).

- If you are exempt from backup withholding, indicate this in the appropriate section.

- Sign and date the form at the bottom. Ensure your signature matches the name provided at the top.

After completing the form, it should be submitted to the requester, not the IRS. Keep a copy for your records, as it may be needed for future reference.

Misconceptions

-

Misconception 1: The W-9 form is only for independent contractors.

Many people believe that the W-9 form is exclusively for independent contractors. In reality, it can be used by various individuals and entities, including freelancers, vendors, and corporations, to provide their taxpayer identification information to others for tax reporting purposes.

-

Misconception 2: Submitting a W-9 form means you will automatically be audited.

Some individuals fear that submitting a W-9 will trigger an audit by the IRS. This is not true. The W-9 is simply a tool for providing necessary information for tax reporting and does not, in itself, cause an audit.

-

Misconception 3: The W-9 form is only needed for payments over a certain amount.

It is a common belief that a W-9 form is only required for large payments. However, any payment that requires tax reporting may necessitate a W-9, regardless of the amount. This includes payments for services, rent, and other business transactions.

-

Misconception 4: Once you submit a W-9, you cannot change your information.

Some individuals think that submitting a W-9 form locks in their information permanently. This is incorrect. If a person's taxpayer identification information changes, they can submit a new W-9 to update their records with the requester.