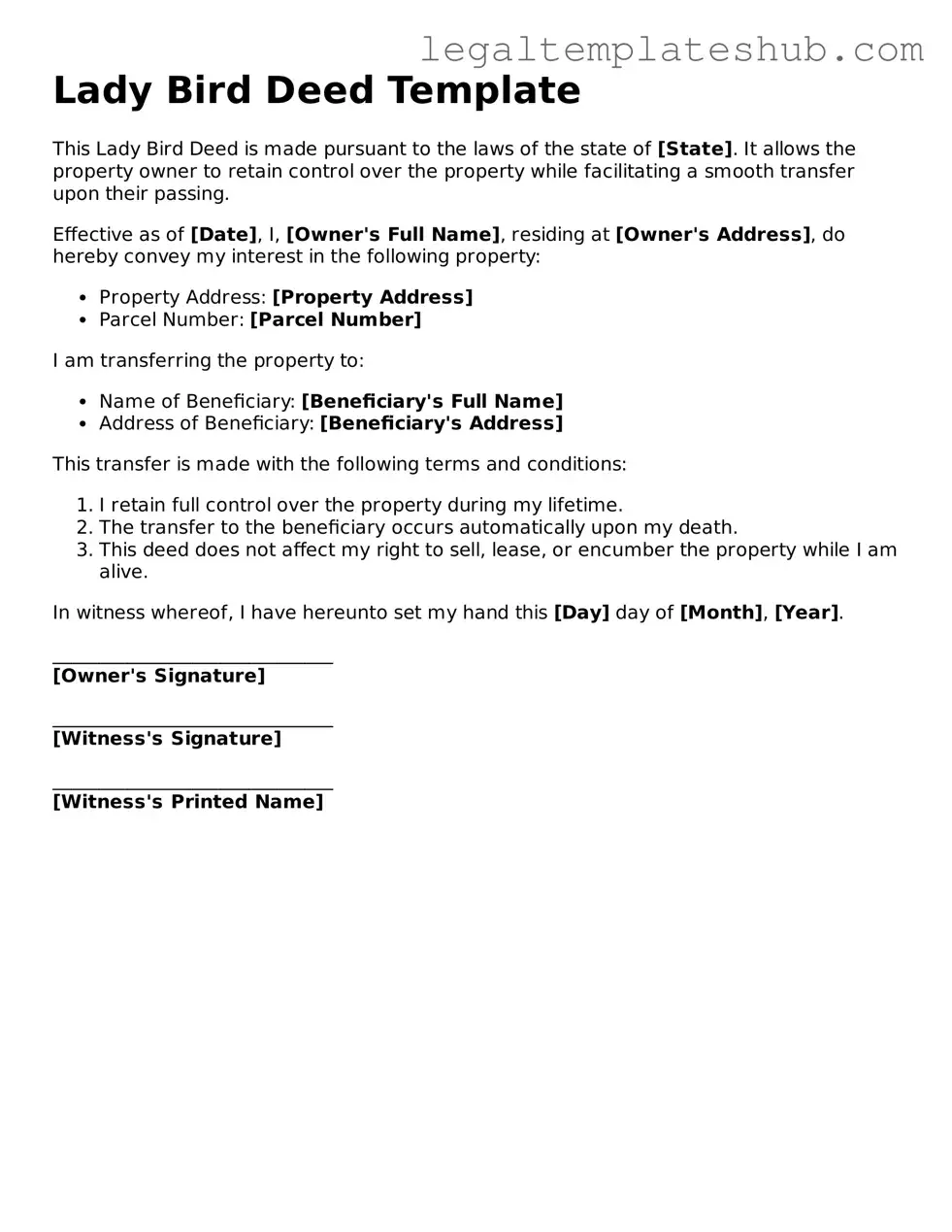

Printable Lady Bird Deed Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining the right to live in and control the property during their lifetime. |

| Benefits | This type of deed can help avoid probate, ensuring that the property passes directly to the beneficiaries upon the owner's death. |

| State-Specific Law | In states like Florida and Texas, Lady Bird Deeds are recognized and governed by state property laws, which outline their use and requirements. |

| Tax Implications | Using a Lady Bird Deed can potentially help in avoiding capital gains taxes for beneficiaries, as the property receives a step-up in basis upon the owner's death. |

| Revocability | Owners can revoke or change the terms of a Lady Bird Deed at any time during their lifetime, providing flexibility in estate planning. |

Lady Bird Deed - Adapted for State

Key takeaways

Here are some important points to consider when filling out and using the Lady Bird Deed form:

- Ownership Transfer: The Lady Bird Deed allows you to transfer property to your beneficiaries while retaining control over it during your lifetime.

- Tax Benefits: This type of deed can help avoid probate, which may save time and reduce costs for your heirs.

- Revocable Nature: You can change or revoke the deed at any time, giving you flexibility if your circumstances change.

- Medicaid Protection: In some cases, the Lady Bird Deed can protect your property from being counted as an asset for Medicaid eligibility.

Dos and Don'ts

When filling out the Lady Bird Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are five things you should and shouldn't do:

- Do double-check all names and property descriptions for accuracy.

- Do consult with a legal professional if you have any questions.

- Do ensure that all required signatures are obtained.

- Don't leave any sections of the form blank unless instructed.

- Don't use outdated forms; always use the most current version.

Common Types of Lady Bird Deed Forms:

Correction Deed Form California - Inaccuracies such as incorrect dates can be easily remedied through a Corrective Deed.

The process of ensuring document authenticity in Ohio is greatly facilitated by the use of a Notary Acknowledgement form, which confirms that signatures are given voluntarily and without coercion. This crucial step not only deters potential fraud but also reinforces the legal standing of important agreements, providing peace of mind to all parties involved.

Instructions on Filling in Lady Bird Deed

To complete the Lady Bird Deed form, gather the necessary information about the property and the individuals involved. This process involves accurately filling in details to ensure proper transfer of property rights. Follow these steps carefully to complete the form.

- Obtain the Lady Bird Deed form from a reliable source.

- Fill in the names of the current property owners in the designated section.

- Provide the legal description of the property. This can usually be found on the property deed.

- Enter the names of the beneficiaries who will receive the property upon the owner's death.

- Specify any conditions or limitations regarding the transfer of property.

- Sign the form in the presence of a notary public to ensure its validity.

- Make copies of the completed form for your records.

- File the original form with the appropriate county clerk or recorder's office.

Misconceptions

The Lady Bird Deed is a popular estate planning tool, but several misconceptions surround its use. Understanding these misconceptions can help individuals make informed decisions regarding property transfer and estate planning.

-

It is only available in certain states.

While the Lady Bird Deed is most commonly recognized in states like Florida and Texas, it is not universally available. Some states do not recognize this type of deed, so it’s important to check local laws.

-

It avoids probate entirely.

The Lady Bird Deed can simplify the transfer of property and may help avoid probate, but it does not eliminate the process in all cases. Other assets may still require probate.

-

It is only for married couples.

Individuals, single people, and unmarried couples can also utilize a Lady Bird Deed. It is not restricted to married couples, making it a flexible option for various situations.

-

It automatically transfers all property rights.

The Lady Bird Deed allows the property owner to retain certain rights during their lifetime, such as the right to sell or mortgage the property. Full rights are not transferred until the owner passes away.

-

Using a Lady Bird Deed is too complicated.

While legal documents can be complex, the Lady Bird Deed is relatively straightforward. Many people can complete it with the help of a qualified professional without extensive legal knowledge.

-

It does not affect Medicaid eligibility.

The Lady Bird Deed can impact Medicaid eligibility, as it may be considered a transfer of assets. Consulting with a Medicaid planning expert is advisable to understand the implications.

-

It eliminates the need for a will.

While a Lady Bird Deed can transfer property, it does not replace the need for a will. A comprehensive estate plan should include both a will and any necessary deeds to ensure all assets are managed appropriately.