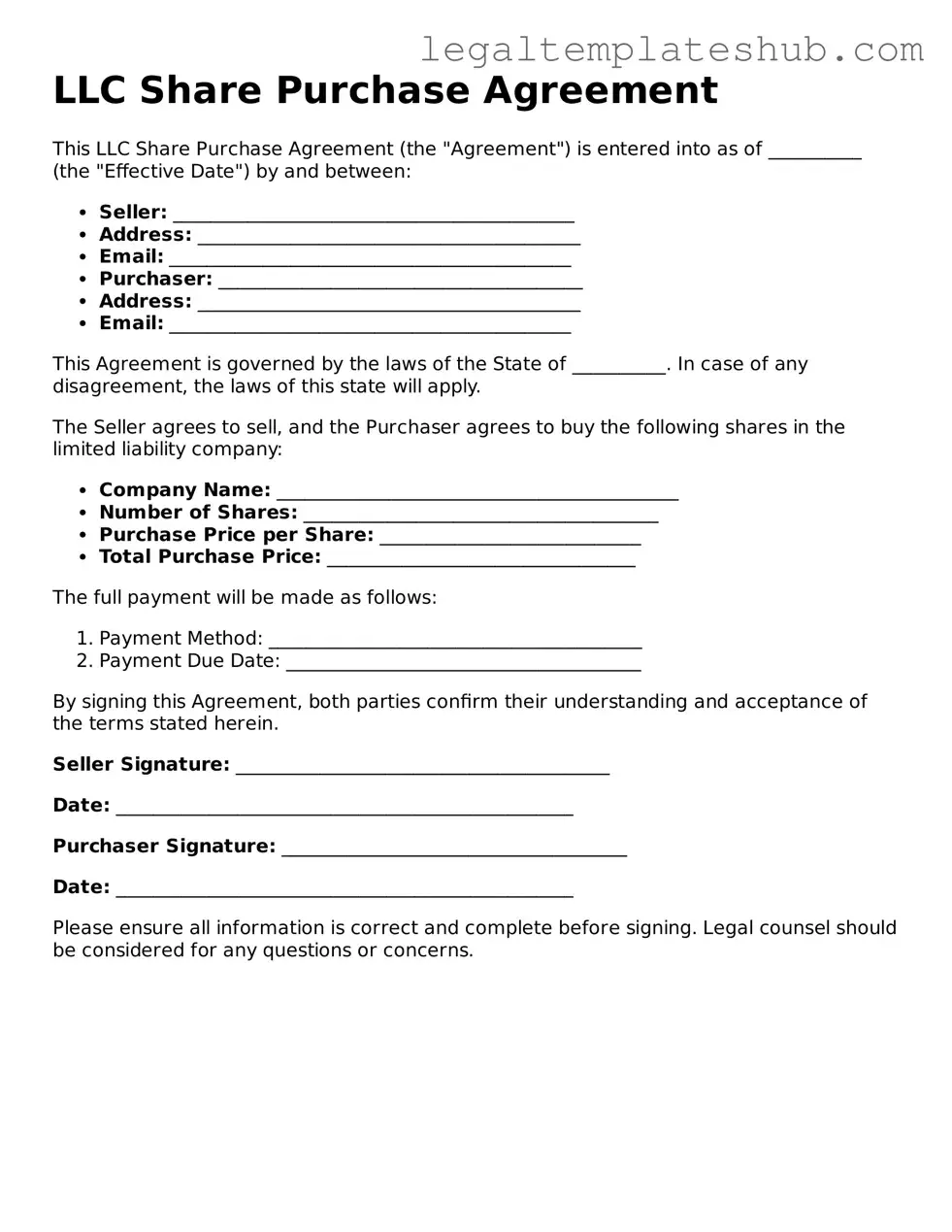

Printable LLC Share Purchase Agreement Template

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | An LLC Share Purchase Agreement outlines the terms under which shares of a Limited Liability Company are bought and sold. |

| Parties Involved | The agreement typically involves the seller (current owner of the shares) and the buyer (new owner of the shares). |

| Purchase Price | The document specifies the price that the buyer will pay for the shares, which can be a fixed amount or determined by a formula. |

| Governing Law | The agreement is subject to the laws of the state where the LLC is formed, such as Delaware or California. |

| Representations and Warranties | Both parties may make certain promises about the shares, including their ownership and any liabilities associated with them. |

| Closing Conditions | The agreement outlines what must happen before the sale is finalized, such as approvals or the completion of due diligence. |

| Confidentiality | Many agreements include clauses that protect sensitive information shared during the transaction process. |

Key takeaways

When filling out and using the LLC Share Purchase Agreement form, there are several important points to keep in mind. Here are key takeaways to ensure a smooth process:

- Clear Identification of Parties: Always start by clearly identifying the buyer and seller. Include full names and addresses to avoid any confusion later.

- Accurate Description of Shares: Provide a detailed description of the shares being purchased. This includes the number of shares, class of shares, and any specific rights associated with them.

- Payment Terms: Outline the payment terms clearly. Specify the total purchase price, payment method, and any installment arrangements if applicable.

- Signatures and Dates: Ensure that both parties sign and date the agreement. This step is crucial for the document to be legally binding.

By focusing on these key aspects, you can help ensure that the LLC Share Purchase Agreement serves its intended purpose effectively.

Dos and Don'ts

When filling out the LLC Share Purchase Agreement form, it is essential to follow certain guidelines to ensure accuracy and compliance. Here are eight things to do and avoid:

- Do: Carefully read the entire agreement before filling it out.

- Do: Provide accurate information about the buyer and seller.

- Do: Clearly specify the number of shares being purchased.

- Do: Include the purchase price and payment terms.

- Don't: Rush through the form; take your time to ensure completeness.

- Don't: Leave any sections blank; fill out all required fields.

- Don't: Use vague language; be specific in your descriptions.

- Don't: Forget to sign and date the agreement before submission.

Common Templates:

How to Write a Bill of Sale for a Boat - Helps buyers assess the boat's market value during negotiation.

Letter of Intent Buying a Business - A framework that includes necessary disclosures from the seller to the buyer.

To create an effective rental arrangement, landlords and business tenants must use a Florida Commercial Lease Agreement, which is a legally binding document that specifies the terms and conditions of the lease. This agreement not only protects the rights of both parties but also provides clear guidelines for the rental period and payment obligations. For those looking to draft such an agreement, you can find a useful template at https://floridaformspdf.com/printable-commercial-lease-agreement-form/.

What Is Letter of Intent for Job - A Letter of Intent to Hire might include further steps in the hiring process.

Instructions on Filling in LLC Share Purchase Agreement

Completing the LLC Share Purchase Agreement form is a critical step in finalizing the purchase of shares in a limited liability company. This document outlines the terms of the sale and protects the interests of both the buyer and the seller. Follow these steps carefully to ensure accuracy and compliance.

- Read the entire form to understand the requirements and sections that need to be filled out.

- Enter the date at the top of the form. This is the date when the agreement is executed.

- Provide the names of the buyer and the seller. Include full legal names as they appear on official documents.

- List the LLC name and its principal place of business. This identifies the company involved in the transaction.

- Specify the number of shares being purchased. Clearly indicate the quantity to avoid any confusion.

- State the purchase price for the shares. This should reflect the agreed-upon amount between the parties.

- Outline payment terms, including how and when the payment will be made.

- Include any conditions or contingencies that must be met before the sale is finalized.

- Sign and date the agreement. Both parties should sign to acknowledge their consent to the terms.

- Make copies of the completed agreement for both the buyer and the seller for their records.

Misconceptions

Understanding the LLC Share Purchase Agreement is crucial for anyone involved in the purchase or sale of shares in a limited liability company. However, several misconceptions can lead to confusion. Here are ten common misconceptions about this important document:

- LLC Share Purchase Agreements are only for large companies. Many believe that only large corporations need these agreements. In reality, any LLC, regardless of size, can benefit from a well-drafted purchase agreement.

- These agreements are not legally binding. Some think that LLC Share Purchase Agreements are informal and lack legal weight. In fact, when properly executed, they are enforceable contracts that protect both parties involved.

- All LLCs require a Share Purchase Agreement. While it’s advisable for many transactions, not all LLCs need this document. The necessity depends on the specific circumstances of the sale.

- Verbal agreements are sufficient. Many assume that a verbal agreement suffices in lieu of a written document. However, having a written agreement is essential for clarity and legal protection.

- Only the seller needs to review the agreement. Some believe that only the seller should focus on the details of the agreement. Both parties must review the terms to ensure mutual understanding and protection.

- Price is the only important term. While the purchase price is crucial, other terms such as payment methods, warranties, and representations are equally important and should not be overlooked.

- Once signed, the agreement cannot be changed. Many think that a signed agreement is final and unchangeable. In reality, amendments can be made if both parties agree to the changes in writing.

- LLC Share Purchase Agreements are the same as stock purchase agreements. While similar, these agreements cater to different types of entities. An LLC Share Purchase Agreement specifically addresses the unique aspects of limited liability companies.

- These agreements are only for initial purchases. Some believe that these agreements are only necessary for the initial purchase of shares. However, they are also important for subsequent transfers of ownership.

- Legal assistance is not necessary. Many think they can draft these agreements on their own without professional help. Engaging a legal expert ensures that the agreement meets all legal requirements and adequately protects both parties.

Being aware of these misconceptions can help individuals navigate the complexities of LLC Share Purchase Agreements more effectively. Understanding the true nature and importance of this document can lead to more successful transactions.