Printable Loan Agreement Template

PDF Form Data

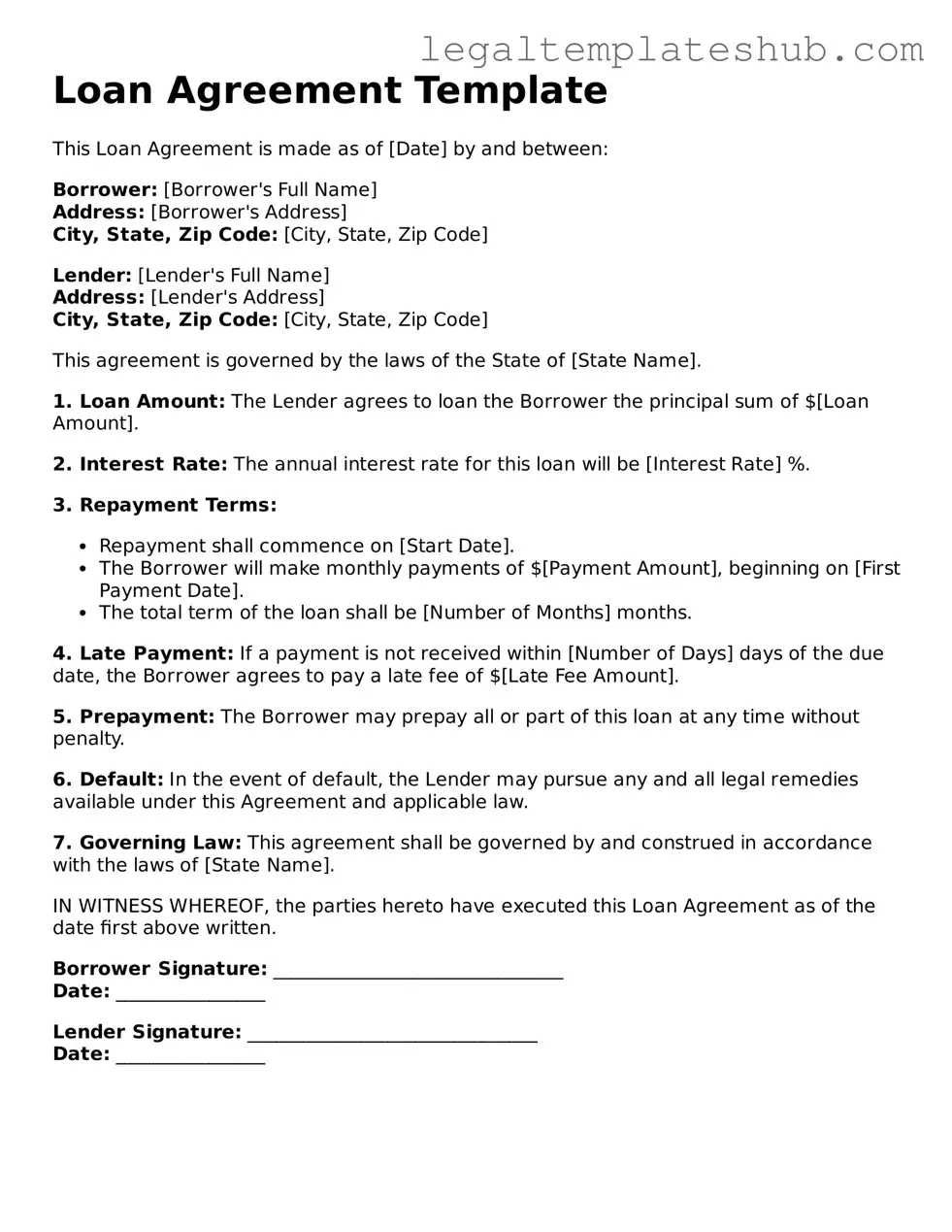

| Fact Name | Description |

|---|---|

| Purpose | A Loan Agreement form outlines the terms and conditions under which one party lends money to another party. |

| Parties Involved | The form typically includes the lender and borrower, clearly identifying each party's legal name and contact information. |

| Loan Amount | The specific amount of money being borrowed is stated, ensuring both parties understand the financial commitment involved. |

| Interest Rate | The agreement specifies the interest rate applicable to the loan, which can be fixed or variable. |

| Repayment Terms | Details regarding how and when the borrower will repay the loan are outlined, including payment frequency and due dates. |

| Governing Law | The form may specify the state law that governs the agreement, which varies by state. For example, California law may apply for loans made in California. |

| Default Conditions | Conditions under which the borrower would be considered in default are included, along with the lender's rights in such a situation. |

| Signatures | Both parties must sign the agreement to indicate their acceptance of the terms, making it legally binding. |

| Amendments | The agreement may contain provisions for how changes to the terms can be made, requiring mutual consent in writing. |

Loan Agreement Document Categories

Key takeaways

When filling out and using a Loan Agreement form, it is important to keep several key points in mind. Understanding these elements can help ensure clarity and protect the interests of all parties involved.

- Complete Information: Fill in all required fields accurately. This includes names, addresses, loan amounts, and interest rates. Incomplete information can lead to misunderstandings.

- Clear Terms: Clearly outline the terms of the loan. This includes repayment schedules, late fees, and any collateral involved. Both parties should understand their obligations.

- Signatures Required: Ensure that all parties sign the agreement. Without signatures, the document may not be legally binding.

- Keep Copies: Retain copies of the signed agreement for your records. This can be important for future reference or in case of disputes.

- Consult Professionals: If unsure about any terms or conditions, consider consulting a legal professional. They can provide guidance tailored to your situation.

Following these takeaways can help facilitate a smoother loan process and minimize potential issues in the future.

Dos and Don'ts

When filling out a Loan Agreement form, it’s important to be careful and thorough. Here are some key things to do and avoid:

- Do: Read the entire agreement carefully before signing.

- Do: Provide accurate and up-to-date information.

- Do: Ask questions if you don’t understand any part of the agreement.

- Do: Keep a copy of the signed agreement for your records.

- Don't: Rush through the form; take your time to ensure accuracy.

- Don't: Leave any fields blank unless instructed.

- Don't: Ignore terms and conditions that seem unclear.

- Don't: Sign the agreement without reading it thoroughly.

Common Templates:

Liability Waiver Form for Personal Trainers - Sets the framework for resolving potential disputes between parties.

Where to Submit I 864 Affidavit of Support - Changes in sponsorship must be communicated to USCIS in a timely manner.

To ensure you have a legally valid document in place, consider using a template from PDF Templates, which provides guidance on how to complete your Power of Attorney form effectively and securely, ensuring your decisions are honored when the time comes.

Dr Note to Return to Work - A practical step towards reducing the stigma around former offenders.

Instructions on Filling in Loan Agreement

Filling out the Loan Agreement form is a straightforward process that requires attention to detail. Ensure you have all necessary information at hand before starting. This will help facilitate a smooth completion of the form and avoid any potential delays.

- Begin by entering your full name in the designated field. Make sure to use the name as it appears on your identification.

- Provide your current address. Include the street address, city, state, and ZIP code.

- Next, input your contact information, including your phone number and email address. Double-check for accuracy.

- Indicate the loan amount you are requesting. This should be a clear numerical value.

- Specify the purpose of the loan. Be concise but clear about how you intend to use the funds.

- Fill in the repayment terms. This includes the duration of the loan and the frequency of payments.

- Review the interest rate being offered. Make sure to enter it as a percentage.

- Sign and date the form at the bottom. Your signature confirms your agreement to the terms outlined.

- Finally, make a copy of the completed form for your records before submitting it.

Misconceptions

Loan agreements are essential documents that outline the terms of borrowing money. However, several misconceptions surround these agreements. Here are five common misunderstandings:

-

All loan agreements are the same.

This is not true. Loan agreements can vary significantly based on the lender, the amount borrowed, and the specific terms negotiated. Each agreement should be carefully reviewed to understand its unique provisions.

-

You don’t need to read the agreement.

Many borrowers believe they can simply sign without reading. This is a risky approach. It is crucial to understand all terms and conditions, as they can have long-term financial implications.

-

A loan agreement is only important if you default.

While it’s true that the agreement becomes critical in case of default, it is equally important to understand the terms while making timely payments. Knowing your rights and obligations helps in managing the loan effectively.

-

Verbal agreements are sufficient.

Some borrowers think that a verbal agreement with the lender is enough. However, a written loan agreement provides legal protection and clarity, which verbal agreements lack.

-

You can change the terms anytime.

This is a misconception. Changes to the loan agreement typically require the consent of both parties. Modifications should be documented in writing to avoid misunderstandings.