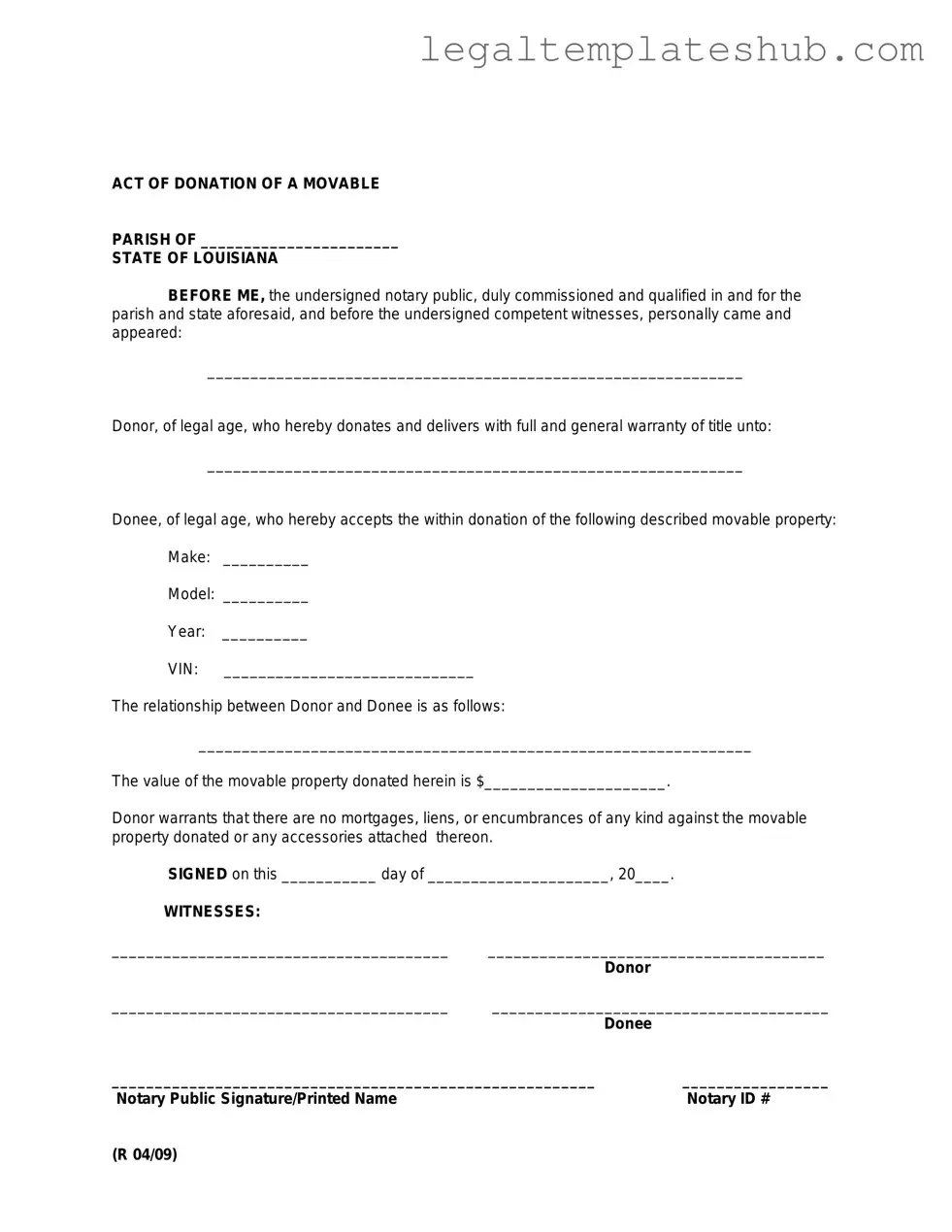

Blank Louisiana act of donation PDF Form

File Breakdown

| Fact Name | Description |

|---|---|

| Definition | The Louisiana Act of Donation is a legal document used to transfer ownership of property from one person to another without compensation. |

| Governing Law | This form is governed by the Louisiana Civil Code, specifically Articles 1468 to 1475. |

| Types of Donations | Donations can be inter vivos (between living persons) or mortis causa (through a will). |

| Requirements | The act must be in writing and signed by both the donor and the donee. |

| Witnesses | In some cases, the presence of witnesses may be required to validate the donation. |

| Revocation | A donor may revoke the donation if certain conditions are met, such as ingratitude by the donee. |

| Tax Implications | Donations may have tax implications for both the donor and the donee, including potential gift tax liabilities. |

| Record Keeping | It is advisable to record the act of donation with the appropriate parish clerk to ensure legal recognition. |

Key takeaways

Filling out and using the Louisiana Act of Donation form involves several important considerations. Here are key takeaways to keep in mind:

- The Act of Donation is a legal document used to transfer ownership of property without compensation.

- It is essential to clearly identify the property being donated, including a detailed description.

- Both the donor and the donee must be competent individuals, meaning they are of legal age and mentally capable.

- The form must be signed in the presence of a notary public to ensure its validity.

- Consideration of tax implications is important, as gifts may have tax consequences for both parties.

- Ensure that the form complies with Louisiana state laws to avoid any legal issues in the future.

- Donors may wish to include any specific conditions or restrictions related to the property in the form.

- Keep a copy of the completed form for personal records and future reference.

- Consulting with a legal professional can provide guidance and ensure all necessary details are included.

By following these takeaways, individuals can navigate the process of completing the Louisiana Act of Donation form more effectively.

Dos and Don'ts

When filling out the Louisiana act of donation form, it’s important to follow specific guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn’t do:

- Do: Read the instructions carefully before starting the form.

- Do: Provide complete and accurate information for all required fields.

- Do: Sign and date the form where indicated.

- Do: Keep a copy of the completed form for your records.

- Do: Consult with a legal expert if you have questions about the process.

- Don't: Leave any required fields blank; this may delay processing.

- Don't: Use correction fluid or tape to alter the form.

- Don't: Submit the form without verifying all information is correct.

- Don't: Forget to check for any additional documents that may be required.

Common PDF Templates

Legal Lease Agreement - Engaging in short-term rentals is expressly prohibited, protecting the landlord’s interests.

To ensure a smooth renting process, it is crucial for both landlords and tenants to have a clear understanding of the lease terms. Knowledge of what should be included in the agreement can significantly reduce potential disputes. For easy access to a structured format, you can find a convenient resource through PDF Templates, which can help guide you in completing the necessary documentation to protect both parties involved.

Injury Report Template - Use concrete details to provide a full picture of the incident.

Da31 Form - Completing this form accurately supports the Army's commitment to personnel welfare.

Instructions on Filling in Louisiana act of donation

Filling out the Louisiana act of donation form is an important process that requires attention to detail. After completing the form, you will need to submit it according to the specified guidelines. This ensures that the donation is legally recognized and properly recorded.

- Obtain the Louisiana act of donation form from a reliable source, such as a legal office or online resource.

- Read the instructions carefully to understand the information required.

- Begin by filling in your personal information, including your name, address, and contact details.

- Provide the recipient's information, ensuring that their name and address are accurate.

- Describe the property or assets being donated in clear terms.

- Specify any conditions or restrictions related to the donation, if applicable.

- Sign and date the form in the designated area.

- Have the form notarized, if required, to validate the donation.

- Make copies of the completed form for your records and for the recipient.

- Submit the form to the appropriate authority or organization as instructed.

Misconceptions

The Louisiana Act of Donation form is an important legal document, but several misconceptions often surround it. Understanding these can help ensure that individuals make informed decisions regarding their property and assets.

- It is only for wealthy individuals. Many people believe that only those with significant assets need to use the Act of Donation form. In reality, anyone wishing to donate property, regardless of its value, can benefit from this document.

- It requires a lawyer to complete. While legal advice can be beneficial, it is not mandatory to have a lawyer fill out the Act of Donation form. Individuals can complete it themselves as long as they understand the requirements.

- It must be notarized. Some think that notarization is a requirement for the Act of Donation to be valid. However, while notarization can provide additional assurance, it is not strictly necessary for the document to be legally binding.

- It can only be used for real estate. Many people assume that the Act of Donation is limited to real estate transactions. In fact, it can also apply to personal property, such as vehicles, jewelry, and other valuable items.

- It is irrevocable. There is a belief that once a donation is made using this form, it cannot be undone. While donations are generally intended to be permanent, certain circumstances may allow for revocation.

- It is only valid in Louisiana. Although the Act of Donation form is specific to Louisiana law, the principles of donation can apply in other states. However, individuals should check local laws if they are outside Louisiana.

- It is the same as a will. Some people confuse the Act of Donation with a will. While both documents deal with the transfer of property, a will takes effect after death, whereas the Act of Donation is effective immediately.

Understanding these misconceptions can empower individuals to navigate the donation process more effectively and make informed decisions about their assets.