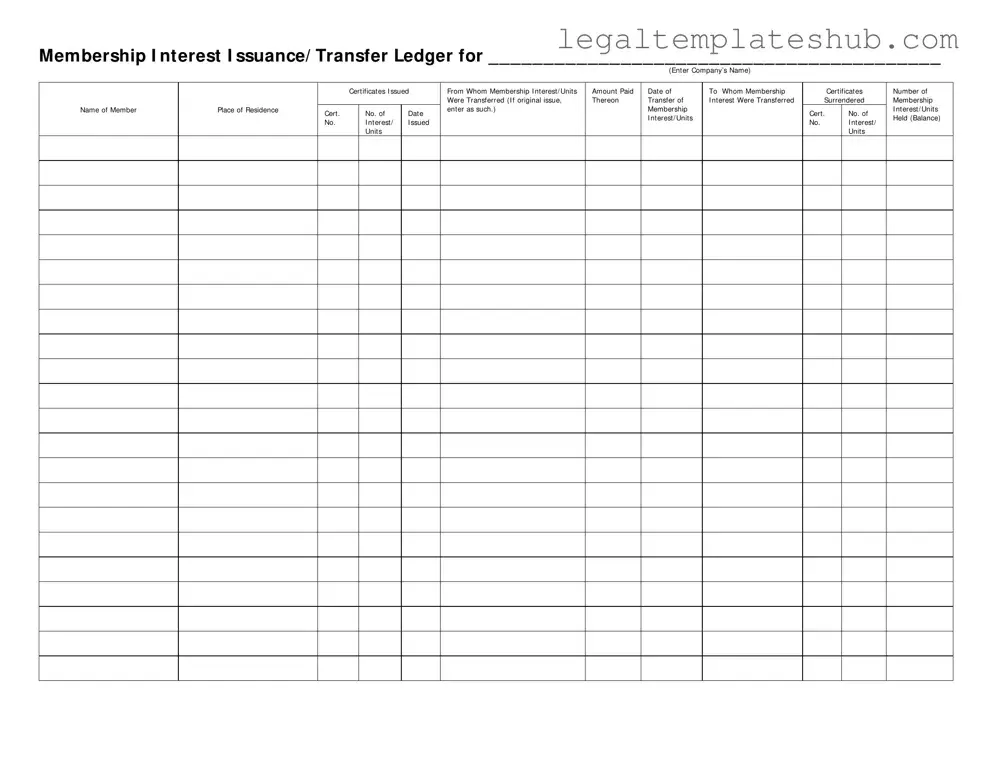

Blank Membership Ledger PDF Form

File Breakdown

| Fact Name | Details |

|---|---|

| Purpose | The Membership Ledger form is used to track the issuance and transfer of membership interests or units in a company. |

| Company Name | The form requires the company’s name to be entered at the top, ensuring clarity about which entity the ledger pertains to. |

| Certificate Tracking | It includes sections for recording certificate numbers related to membership interests, which helps in maintaining accurate records. |

| Transfer Documentation | The form captures details about the transfer of membership interests, including the names of both the transferor and transferee. |

| Payment Information | Details about the amount paid for the membership interests are documented, providing a clear financial record. |

| Date Tracking | It includes fields for recording the dates of issuance and transfer, which are essential for compliance and historical reference. |

| Balance Reporting | The form allows for tracking the balance of membership interests held by each member, ensuring accurate ownership records. |

| Governing Laws | The specific governing laws for the Membership Ledger may vary by state; it is important to consult state regulations for compliance. |

Key takeaways

When it comes to managing membership interests, the Membership Ledger form is an essential tool. Here are some key takeaways to consider when filling out and using this form:

- Accurate Information: Ensure that all entries, including the company’s name and the details of membership interests, are filled out accurately. This helps maintain clear records.

- Document Transfers: When membership interests are transferred, document the names of both the sender and receiver. This provides a clear trail of ownership.

- Record Dates: Always include the dates of transfers and issuances. This information is vital for tracking the history of membership interests over time.

- Certificate Numbers: Each membership interest should have a corresponding certificate number. Keep these organized to avoid confusion.

- Balance Tracking: Regularly update the ledger to reflect the current number of membership interests held. This helps in understanding the distribution of interests at any given time.

- Legal Compliance: Using the Membership Ledger form correctly can aid in compliance with legal requirements. Proper records can protect the organization and its members.

Dos and Don'ts

When filling out the Membership Ledger form, it's important to follow certain guidelines to ensure accuracy and clarity. Here are five things you should do and five things you should avoid.

- Do enter the company's name clearly at the top of the form.

- Do provide accurate details for each certificate issued, including the date and amount paid.

- Do list the names of members and their places of residence accurately.

- Do ensure that the certificate numbers are correct and match the issued certificates.

- Do keep a copy of the completed form for your records.

- Don't leave any sections blank; all fields must be filled out.

- Don't use abbreviations that may confuse the reader.

- Don't forget to double-check for typos or errors before submitting the form.

- Don't mix up the entries for transferred memberships and original issues.

- Don't submit the form without reviewing it for completeness.

Common PDF Templates

How to Apply for Asylum in Usa - Completing the I-589 requires detailed information about personal circumstances.

For parents considering homeschooling, the submission of a Homeschool Letter of Intent is an important step to officially notify the district of their educational plans. This form serves not only to comply with state regulations but also establishes the foundation for the homeschooling process.

Blank Fillable Invoice - Adjust prices and add notes directly in the form.

Instructions on Filling in Membership Ledger

Completing the Membership Ledger form requires careful attention to detail. This form helps track the issuance and transfer of membership interests within a company. Follow these steps to ensure accurate and complete information is recorded.

- Begin by entering the Company’s Name at the top of the form in the designated space.

- In the section labeled Certificates Issued From, indicate the name of the person or entity issuing the certificates.

- Next, fill in the Membership Interest/Units and Amount Paid for each certificate issued.

- Record the Date of Transfer for each membership interest or unit being transferred.

- In the To Whom Membership Were Transferred section, write the name of the individual or entity receiving the membership interest.

- For original issues, note the Name of Member and their Place of Residence.

- Enter the Cert. No. of the membership interest being transferred.

- Document the Date of the transfer in the appropriate space.

- If any certificates were surrendered, list the Cert. No. of those certificates.

- Finally, indicate the Number of Membership Interest/Units Held (Balance) to reflect the current holdings.

Misconceptions

-

Misconception 1: The Membership Ledger form is only for new memberships.

This is incorrect. The form is designed to track both the issuance of new membership interests and the transfer of existing interests. It serves as a comprehensive record for all transactions related to membership interests.

-

Misconception 2: Only the company’s management can fill out the Membership Ledger form.

In reality, any authorized individual can complete the form. This may include members themselves or other designated representatives. Proper authorization is key, but it does not limit completion to management alone.

-

Misconception 3: The form is not necessary if no transfers have occurred.

This is misleading. Maintaining an up-to-date Membership Ledger is essential for accurate record-keeping, even when there are no transfers. It helps in tracking the overall membership structure and can prevent future discrepancies.

-

Misconception 4: The form does not need to be updated regularly.

This is a common error. Regular updates are crucial to reflect any changes in membership interests. Failure to do so can lead to confusion and potential legal issues regarding ownership and rights.

-

Misconception 5: The Membership Ledger form is only relevant for large companies.

This assumption overlooks the fact that any organization with membership interests, regardless of size, benefits from using the form. Small businesses and non-profits also need to track their membership interests accurately.