Printable Lady Bird Deed Document for Michigan

PDF Form Data

| Fact Name | Description |

|---|---|

| What is a Lady Bird Deed? | A Lady Bird Deed is a type of property deed that allows a property owner to transfer their property to beneficiaries while retaining the right to use and control the property during their lifetime. |

| Governing Law | The Lady Bird Deed is governed by Michigan law, specifically under the Michigan Compiled Laws (MCL) Section 565.451. |

| Retained Control | With a Lady Bird Deed, the property owner retains full control over the property, including the right to sell, mortgage, or change the beneficiaries at any time. |

| Beneficiary Rights | Beneficiaries do not have any rights to the property until the death of the original owner, making it a flexible estate planning tool. |

| Avoiding Probate | One of the main advantages of a Lady Bird Deed is that it allows the property to pass directly to the beneficiaries without going through probate, simplifying the transfer process. |

| Medicaid Planning | Lady Bird Deeds can be beneficial in Medicaid planning, as they may help protect the property from being counted as an asset for Medicaid eligibility. |

| Tax Implications | Generally, the property transferred via a Lady Bird Deed receives a step-up in basis for tax purposes, which can minimize capital gains taxes for beneficiaries. |

| Revocability | The deed can be revoked or amended at any time by the original owner, providing flexibility and peace of mind. |

| Execution Requirements | To be valid, a Lady Bird Deed must be executed, notarized, and recorded with the appropriate county register of deeds in Michigan. |

| Limitations | While beneficial, Lady Bird Deeds may not be suitable for all property types or situations, and consulting with an estate planning professional is advisable. |

Key takeaways

Filling out and using the Michigan Lady Bird Deed form can be a straightforward process if you understand its key components. Here are some essential takeaways to keep in mind:

- Understand the Purpose: A Lady Bird Deed allows property owners to transfer their real estate to beneficiaries while retaining control during their lifetime.

- Retain Control: The property owner retains the right to sell, mortgage, or change the beneficiaries at any time.

- Automatic Transfer: Upon the owner’s death, the property automatically transfers to the designated beneficiaries without going through probate.

- Simple Language: The form is designed to be user-friendly. Use clear and concise language to avoid confusion.

- Property Description: Ensure that the property description is accurate and includes the correct legal description.

- Beneficiary Designation: Clearly list the names of the beneficiaries. This is crucial for a successful transfer.

- Witnesses and Notarization: The deed must be signed in the presence of two witnesses and notarized to be valid.

- Record the Deed: After completing the form, file it with the local county register of deeds to ensure it is legally recognized.

- Consult Professionals: Consider seeking advice from an attorney or financial advisor to ensure the deed aligns with your estate planning goals.

- Review Regularly: Periodically review the deed and beneficiaries to ensure they reflect your current wishes.

By keeping these points in mind, you can navigate the process of filling out and using the Michigan Lady Bird Deed form with confidence and clarity.

Dos and Don'ts

When filling out the Michigan Lady Bird Deed form, it is essential to approach the task with care. Here are some important dos and don'ts to consider:

- Do ensure that you have all necessary information about the property and the parties involved.

- Do clearly identify the grantor and grantee on the form.

- Do review the form for accuracy before submission.

- Do consult with a professional if you have questions about the process.

- Don't leave any sections of the form blank; all fields should be completed.

- Don't use vague language; be specific about the property and the intentions.

- Don't forget to sign and date the form where required.

- Don't submit the form without making a copy for your records.

More Lady Bird Deed State Templates

Texas Transfer on Death Deed Form - It can simplify the transfer process and reduce the likelihood of family disputes after the owner's passing.

For those navigating the homeschooling process, understanding the significance of the Homeschool Letter of Intent is crucial. This important document must be submitted to local education authorities to formalize the intent to educate a child at home. For further details, refer to the key aspects of the Homeschool Letter of Intent requirements.

What States Allow Lady Bird Deeds - It is helpful for individuals seeking to leave their property to a loved one without adverse tax implications.

Instructions on Filling in Michigan Lady Bird Deed

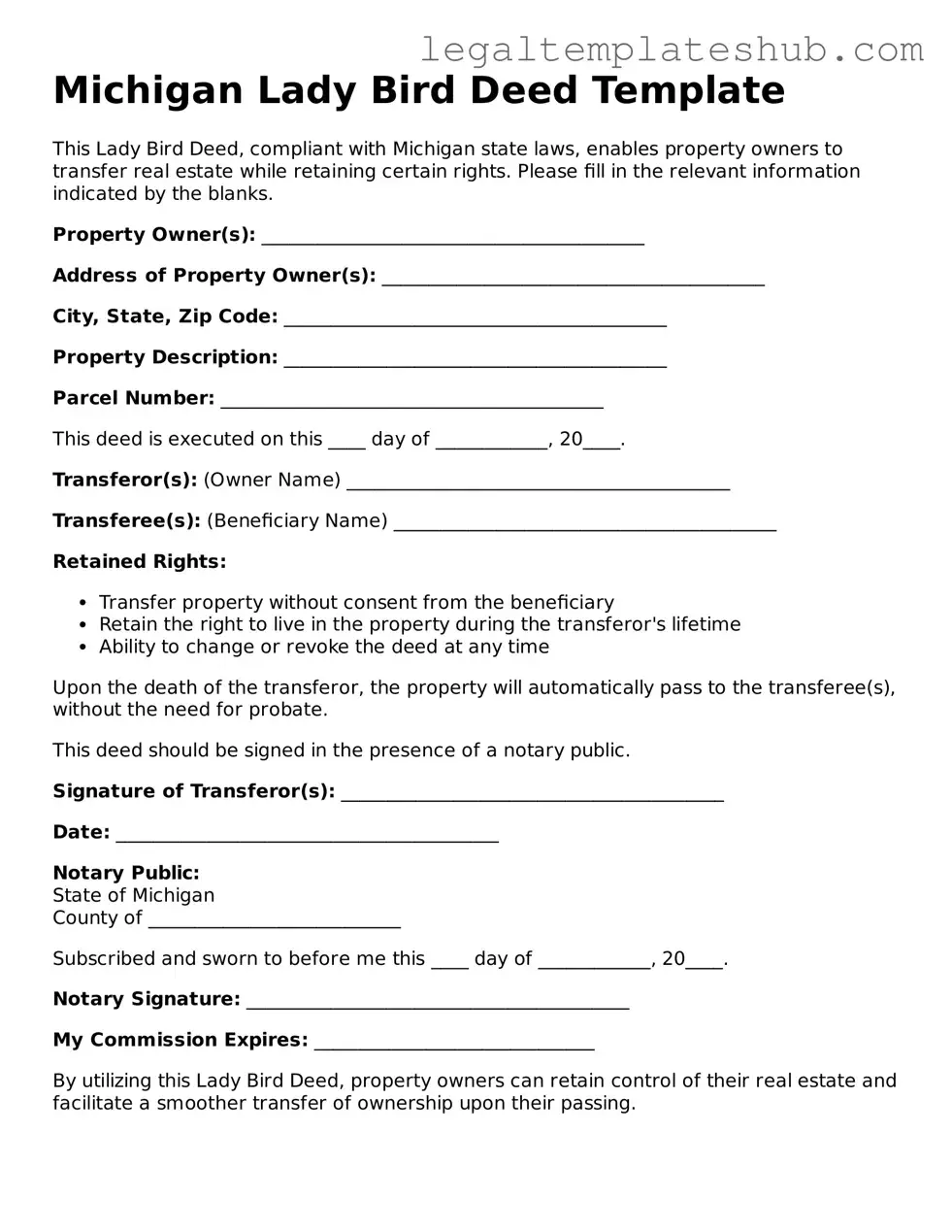

Once you have gathered the necessary information, you can begin filling out the Michigan Lady Bird Deed form. This process involves providing specific details about the property and the individuals involved. Follow these steps carefully to ensure accuracy.

- Obtain the Michigan Lady Bird Deed form from a reliable source or legal website.

- Begin with the title of the document at the top of the form. Write "Lady Bird Deed" clearly.

- Fill in the name of the property owner(s) in the designated area. Include full legal names as they appear on the property title.

- Provide the address of the property. Ensure that it is complete, including street number, street name, city, and zip code.

- Identify the beneficiaries who will inherit the property. List their full names and relationship to the property owner(s).

- Specify any conditions or limitations regarding the transfer of the property, if applicable. This might include instructions for the beneficiaries.

- Include the date of execution. This is the date when the deed is signed.

- Sign the form in the designated area. The property owner(s) must sign in front of a notary public.

- Have the deed notarized. This step is crucial for the document's validity.

- File the completed and notarized deed with the appropriate county register of deeds office. Check for any filing fees.

After completing these steps, the Lady Bird Deed will be officially recorded. Make sure to keep a copy for your records. This will help ensure that the property is transferred as intended in the future.

Misconceptions

The Michigan Lady Bird Deed form is a useful tool for property owners, but there are several misconceptions surrounding its use. Here are four common misunderstandings:

-

It is only for elderly property owners.

This is not true. While many elderly individuals use Lady Bird Deeds to avoid probate and maintain control over their property, anyone can utilize this form to manage their property effectively.

-

It eliminates all estate taxes.

A Lady Bird Deed does not eliminate estate taxes. It can help avoid probate, but property transferred through this deed may still be subject to taxes based on its value.

-

It requires the consent of all beneficiaries.

This misconception is incorrect. The property owner can create a Lady Bird Deed without needing the consent of beneficiaries. The owner retains full control until death.

-

It is the same as a traditional quitclaim deed.

While both deeds transfer property, a Lady Bird Deed includes specific features that allow the owner to retain certain rights during their lifetime, which a quitclaim deed does not provide.