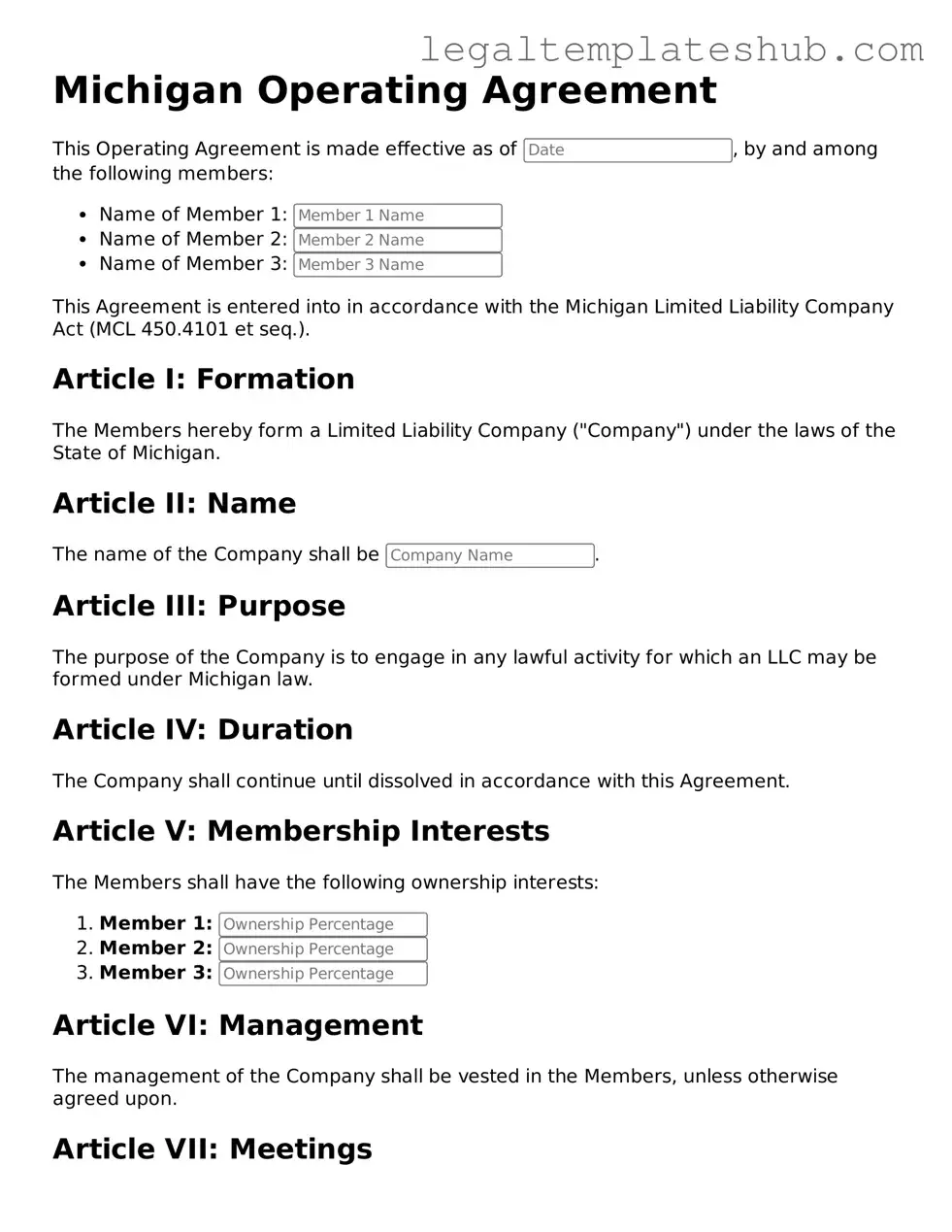

Printable Operating Agreement Document for Michigan

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The Michigan Operating Agreement form outlines the management structure and operating procedures of a limited liability company (LLC) in Michigan. |

| Governing Law | This form is governed by the Michigan Limited Liability Company Act, specifically MCL 450.4101 et seq. |

| Members' Rights | The agreement specifies the rights and responsibilities of the members, including profit distribution and decision-making processes. |

| Flexibility | Members can customize the agreement to suit their specific needs, allowing for variations in management styles and profit sharing. |

| Filing Requirement | While the operating agreement is not required to be filed with the state, it is essential for internal governance and legal protection. |

Key takeaways

When filling out and using the Michigan Operating Agreement form, keep these key takeaways in mind:

- Understand the purpose: The Operating Agreement outlines the management structure and operating procedures of your LLC.

- Gather necessary information: Before starting, collect details about members, ownership percentages, and management roles.

- Be clear and concise: Use straightforward language to avoid confusion among members regarding their rights and responsibilities.

- Include all members: Ensure that every member of the LLC is included in the agreement to establish clear ownership and voting rights.

- Address profit distribution: Specify how profits and losses will be allocated among members to prevent future disputes.

- Outline decision-making processes: Clearly define how decisions will be made, including voting procedures and quorum requirements.

- Consider future changes: Include provisions for adding new members or transferring ownership to ensure flexibility as the business grows.

- Review and update regularly: Periodically revisit the agreement to reflect any changes in the business structure or membership.

- Consult a professional if needed: If there are uncertainties, seek advice from a legal or business professional to ensure compliance and clarity.

Dos and Don'ts

When filling out the Michigan Operating Agreement form, it's important to follow certain guidelines to ensure accuracy and compliance. Here are eight things you should and shouldn't do:

- Do read the instructions carefully before starting to fill out the form.

- Do provide accurate and complete information about the members of the LLC.

- Do ensure that all signatures are obtained where required.

- Do keep a copy of the completed agreement for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any required fields blank; this can delay processing.

- Don't use outdated forms; always use the most current version available.

- Don't forget to review the agreement with all members before submission.

More Operating Agreement State Templates

How Much Does It Cost to Start an Llc in Texas - An Operating Agreement can establish voting rights and decision-making processes.

When entering into a business venture, it is crucial to have a clear understanding of the leasing terms, which is where the Florida Commercial Lease Agreement comes into play. This legally binding document ensures that both the landlord and the tenant are on the same page regarding their duties and rights during the lease period. For those interested in obtaining this form, you can find it at floridaformspdf.com/printable-commercial-lease-agreement-form.

Creating an Operating Agreement - This document helps to formalize agreements reached orally among members.

Instructions on Filling in Michigan Operating Agreement

After you gather the necessary information, you can begin filling out the Michigan Operating Agreement form. This document is essential for outlining the management structure and operating procedures of your business. Follow these steps to ensure you complete the form accurately.

- Start by entering the name of your LLC at the top of the form. Ensure it matches the name registered with the state.

- Provide the principal office address of your LLC. This should be a physical address, not a P.O. box.

- List the names and addresses of all members involved in the LLC. Include their ownership percentages if applicable.

- Detail the management structure. Indicate whether the LLC will be managed by members or appointed managers.

- Outline the purpose of the LLC. Describe the business activities it will engage in.

- Include provisions for voting rights. Specify how decisions will be made and what percentage is required for approval.

- Address the distribution of profits and losses among members. Clearly state how these will be allocated.

- Include any additional provisions that may be relevant to your LLC. This could cover matters like meetings, amendments, or dissolution procedures.

- Review the completed form for accuracy. Ensure all information is correct and complete.

- Finally, have all members sign and date the document. This signifies their agreement to the terms outlined in the Operating Agreement.

Misconceptions

When it comes to the Michigan Operating Agreement form, there are several misconceptions that people often have. Understanding these can help you navigate the process more effectively. Here’s a list of nine common misunderstandings:

- It's only necessary for large businesses. Many believe that only big companies need an operating agreement. In reality, even small businesses and single-member LLCs benefit from having one. It clarifies roles and responsibilities, which is crucial for any business size.

- It's a one-time document. Some think that once the operating agreement is created, it never needs to be updated. However, as your business evolves, so should your agreement. Regular reviews and updates are essential.

- It’s not legally binding. Many assume that an operating agreement is just a formality and holds no legal weight. In fact, it is a binding document that can be enforced in court, making it an important part of your business structure.

- All states have the same requirements. There's a misconception that operating agreements are uniform across all states. Each state, including Michigan, has its own specific requirements and laws that govern these agreements.

- It only covers financial matters. Some believe that the operating agreement is solely about finances. While it does address financial aspects, it also covers management structure, decision-making processes, and member responsibilities.

- It's unnecessary if you have a partnership agreement. Many think that if they have a partnership agreement, they don’t need an operating agreement. However, an operating agreement provides additional detail about the business operations that a partnership agreement may not cover.

- It can be verbal. Some individuals think that a verbal agreement is sufficient. In Michigan, an operating agreement should be written down to ensure clarity and legal enforceability.

- Only lawyers can draft it. While having a lawyer can be helpful, it’s not mandatory. Business owners can create their own operating agreements as long as they follow Michigan’s guidelines.

- It’s only for LLCs. Many believe that operating agreements are exclusive to LLCs. However, any business structure can benefit from a similar document outlining roles and responsibilities, even if it’s not formally called an operating agreement.

By addressing these misconceptions, you can better understand the importance of the Michigan Operating Agreement form and how it can benefit your business.