Printable Promissory Note Document for Michigan

PDF Form Data

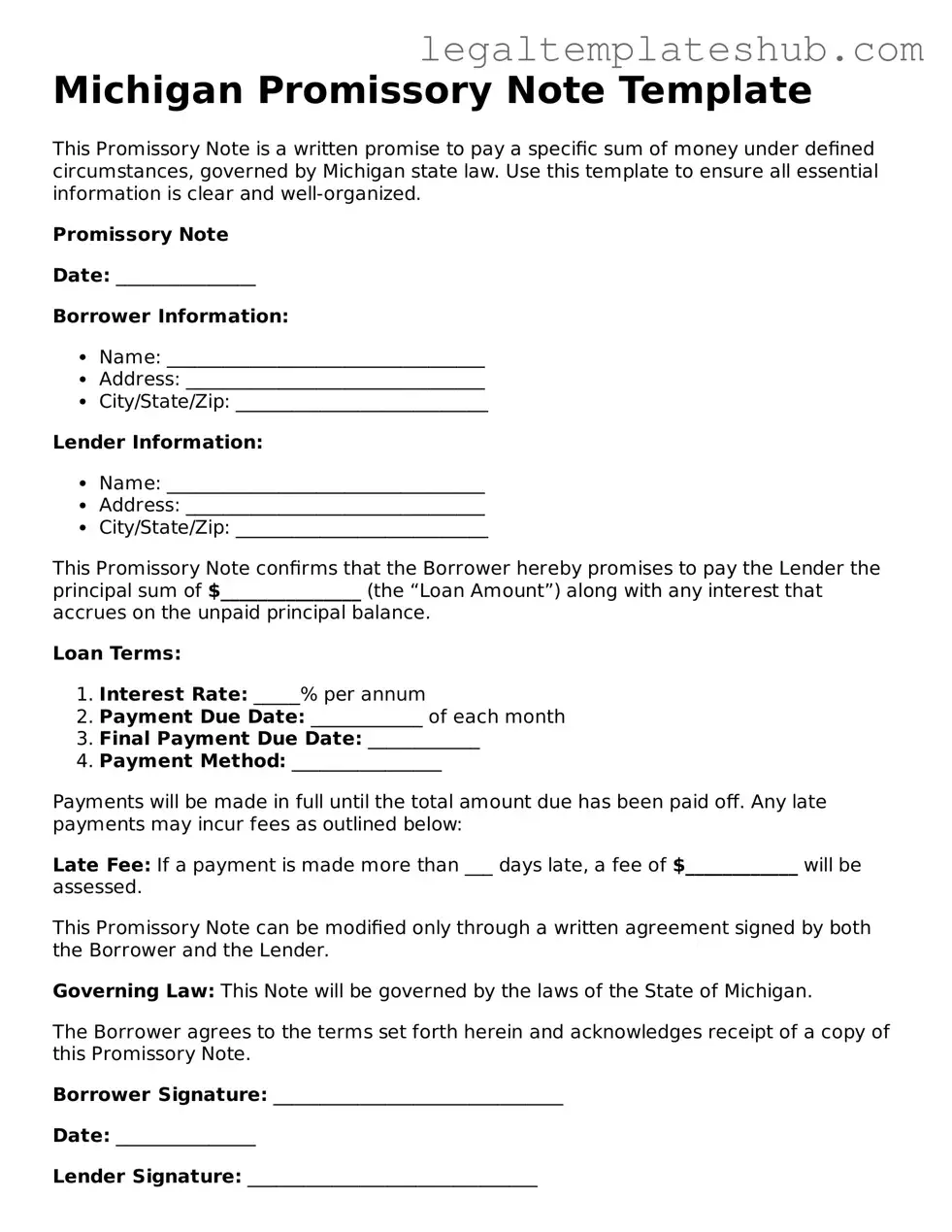

| Fact Name | Description |

|---|---|

| Definition | A Michigan Promissory Note is a written promise to pay a specified amount of money to a designated person or entity at a specified time or on demand. |

| Governing Law | The Michigan Promissory Note is governed by the Michigan Uniform Commercial Code (UCC), specifically Article 3, which deals with negotiable instruments. |

| Key Components | The note typically includes the principal amount, interest rate, payment schedule, and the signatures of the borrower and lender. |

| Legal Enforceability | When properly executed, a promissory note is legally enforceable in Michigan, meaning that the lender can take legal action if the borrower defaults. |

| Types of Notes | Michigan recognizes various types of promissory notes, including secured and unsecured notes, depending on whether collateral is involved. |

Key takeaways

When filling out and using the Michigan Promissory Note form, there are several important aspects to consider. Understanding these key takeaways can help ensure that the document serves its intended purpose effectively.

- Clear Terms: Ensure that the terms of the loan, including the amount borrowed, interest rate, and repayment schedule, are clearly stated. Ambiguity can lead to disputes later.

- Signatures Required: Both the borrower and lender must sign the document for it to be legally binding. This step is crucial to validate the agreement.

- Consider Legal Compliance: Verify that the promissory note complies with Michigan state laws. This includes adhering to regulations regarding interest rates and lending practices.

- Keep Copies: After the document is completed and signed, both parties should retain copies. This ensures that each party has access to the terms of the agreement for future reference.

Dos and Don'ts

When filling out the Michigan Promissory Note form, it’s important to be careful and thorough. Here are five things you should and shouldn't do:

- Do read the entire form carefully before starting.

- Don't leave any required fields blank; this can cause delays.

- Do clearly write or type your information to avoid misunderstandings.

- Don't use any abbreviations that may confuse the reader.

- Do keep a copy of the completed form for your records.

Following these guidelines will help ensure that your Promissory Note is filled out correctly and efficiently.

More Promissory Note State Templates

Promissory Note for Personal Loan - The maturity date specifies when the loan must be repaid.

Pennsylvania Promissory Note - Used to secure loans for personal, business, or real estate purposes.

For those looking to simplify the process of transferring vehicle ownership, utilizing resources like the PDF Templates can be incredibly helpful, ensuring that all required information is readily available and properly formatted.

Utah Promissory Note - The straightforward nature of a promissory note makes it an ideal choice for private lending arrangements.

Instructions on Filling in Michigan Promissory Note

Once you have the Michigan Promissory Note form in hand, you can begin the process of filling it out. This form requires specific information to ensure clarity and legality. Follow the steps below carefully to complete the form accurately.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, provide the name and address of the borrower. Ensure that this information is accurate and up to date.

- In the designated space, write the amount of money being borrowed. Use numerals and spell out the amount in words for clarity.

- Specify the interest rate, if applicable. Clearly state whether it is fixed or variable.

- Indicate the repayment terms. This includes the frequency of payments (e.g., monthly, quarterly) and the duration of the loan.

- Include any late fees or penalties for missed payments. Be specific about the conditions under which these fees apply.

- Provide the names and signatures of both the borrower and the lender at the bottom of the form. Make sure both parties sign and date the document.

- Finally, keep a copy of the completed form for your records. This is important for future reference.

After completing the form, both parties should review it for accuracy. Once satisfied, the borrower and lender can proceed with the next steps in their agreement.

Misconceptions

Understanding the Michigan Promissory Note form is crucial for anyone involved in lending or borrowing money. However, several misconceptions can lead to confusion. Here’s a list of common misunderstandings about this important document:

- It must be notarized to be valid. Many believe that a promissory note requires notarization. In Michigan, notarization is not necessary for the note to be legally binding.

- Only banks can issue promissory notes. This is not true. Individuals can create and sign promissory notes as well, making them a versatile option for personal loans.

- Promissory notes are only for large loans. People often think these documents are only for significant amounts. In reality, promissory notes can be used for any amount, big or small.

- They are the same as IOUs. While both serve as evidence of a debt, a promissory note is a more formal and legally enforceable document compared to an informal IOU.

- Once signed, the terms cannot be changed. Some assume that the terms of a promissory note are set in stone. However, parties can modify the terms if both agree and document the changes properly.

- Interest rates must be included. It's a common belief that all promissory notes must specify an interest rate. However, notes can be created with or without interest, depending on the agreement.

- They are only for personal loans. This is misleading. Promissory notes are also frequently used in business transactions and can be part of larger financial agreements.

- They are not enforceable in court. Some people think that promissory notes lack legal standing. In fact, a properly executed promissory note is enforceable in a court of law.

- All promissory notes are the same. Each promissory note can vary significantly in terms and conditions. It's essential to customize the document to fit the specific agreement between the parties.

Being aware of these misconceptions can help you navigate the process of creating or signing a promissory note in Michigan. Always consider consulting with a legal professional to ensure that your document meets all necessary requirements.