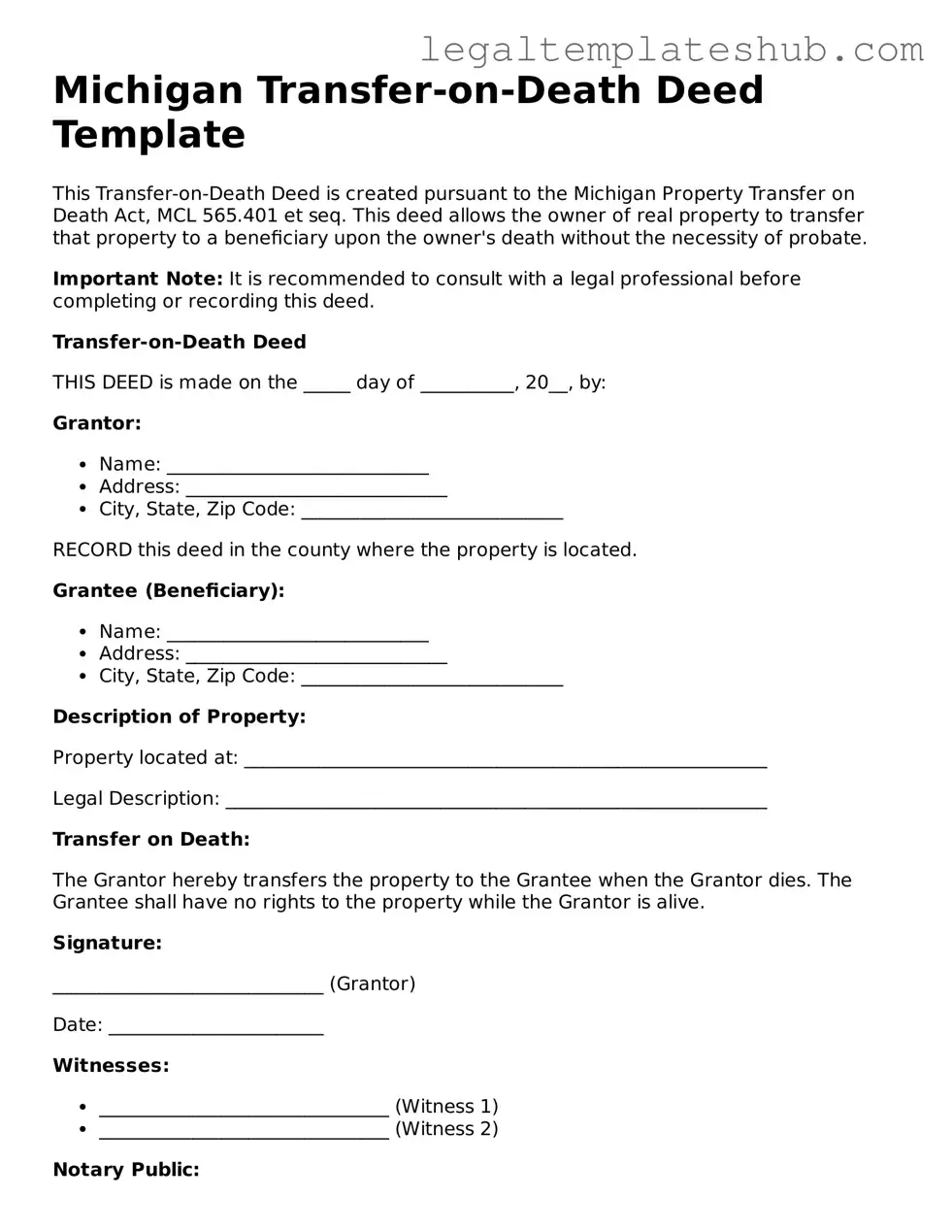

Printable Transfer-on-Death Deed Document for Michigan

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | The Michigan Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | This deed is governed by the Michigan Compiled Laws, specifically MCL 565.25. |

| Eligibility | Any individual who owns real estate in Michigan can create a Transfer-on-Death Deed. |

| Beneficiaries | Property owners can name one or more beneficiaries to receive the property after their death. |

| Revocation | The deed can be revoked at any time before the owner's death by executing a new deed or a revocation document. |

| Filing Requirement | The deed must be recorded with the county register of deeds in the county where the property is located. |

| Effectiveness | The Transfer-on-Death Deed becomes effective immediately upon recording, but the transfer occurs only at the owner's death. |

| Tax Implications | There are no immediate tax implications for the beneficiaries until they sell the property after the owner's death. |

| Limitations | This deed cannot be used to transfer property subject to a mortgage or other liens without addressing those obligations. |

Key takeaways

Filling out and using the Michigan Transfer-on-Death Deed form can be straightforward, but there are important details to consider. Here are six key takeaways to keep in mind:

- Understand the Purpose: The Transfer-on-Death Deed allows property owners to transfer their real estate to beneficiaries upon their death, avoiding probate.

- Eligibility Requirements: Only certain types of property can be transferred using this deed. Ensure the property qualifies before proceeding.

- Complete the Form Accurately: Fill out the form with precise information, including the names of the grantor and beneficiaries, as well as a clear legal description of the property.

- Sign and Notarize: The deed must be signed by the property owner in the presence of a notary public to be valid.

- Record the Deed: After signing, the deed should be recorded with the county register of deeds where the property is located to ensure it takes effect.

- Revocation is Possible: The property owner can revoke the deed at any time before their death, allowing for changes in beneficiaries or property ownership.

Dos and Don'ts

When filling out the Michigan Transfer-on-Death Deed form, it's important to follow certain guidelines to ensure the process goes smoothly. Here is a list of things you should and shouldn't do:

- Do ensure that you are the owner of the property you wish to transfer.

- Do provide accurate and complete information on the form.

- Do sign the deed in front of a notary public.

- Do record the deed with the county register of deeds.

- Don't leave any sections of the form blank.

- Don't forget to include the legal description of the property.

- Don't use the form for properties that are not eligible for transfer-on-death designation.

Following these guidelines will help ensure that the deed is filled out correctly and legally binding.

More Transfer-on-Death Deed State Templates

What Are the Disadvantages of a Transfer on Death Deed? - Valid only for real estate; does not apply to personal property.

Virginia Tod Deed - Ensure your property remains in the family without legal entanglements by using a Transfer-on-Death Deed.

When entering into a leasing arrangement, businesses must utilize a Florida Commercial Lease Agreement form to delineate their rights and responsibilities clearly; for detailed information, you can refer to this resource: https://floridaformspdf.com/printable-commercial-lease-agreement-form.

Transfer on Death Deed in Pa - Upon the owner's death, the property title automatically transfers to the specified beneficiary without delay.

Problems With Transfer on Death Deeds in Indiana - Using this deed can significantly reduce the time and cost associated with settling your estate.

Instructions on Filling in Michigan Transfer-on-Death Deed

After obtaining the Michigan Transfer-on-Death Deed form, you will need to fill it out accurately to ensure it reflects your intentions regarding the transfer of property. This process involves providing specific information about the property and the beneficiaries. Follow the steps below to complete the form correctly.

- Begin by entering your name as the current owner of the property. Include any middle initials if applicable.

- Next, provide your address. This should be the address where you currently reside.

- Identify the property you wish to transfer. Include the complete legal description of the property, which can typically be found on your property tax bill or deed.

- List the name(s) of the beneficiary or beneficiaries who will receive the property upon your passing. If there are multiple beneficiaries, make sure to clearly indicate how the property will be divided among them.

- Include the beneficiaries' addresses. This is important for identification purposes.

- Sign and date the form. Ensure that you are signing in front of a notary public to validate the document.

- Have the notary public sign and stamp the form to complete the notarization process.

- Finally, file the completed deed with the appropriate county register of deeds office where the property is located. This step is crucial for the deed to be legally effective.

Misconceptions

When it comes to the Michigan Transfer-on-Death Deed form, there are several misconceptions that can lead to confusion. Understanding these misconceptions can help individuals make informed decisions regarding their estate planning.

- Misconception 1: The Transfer-on-Death Deed automatically transfers property upon death.

- Misconception 2: A Transfer-on-Death Deed can be revoked at any time without formalities.

- Misconception 3: Using a Transfer-on-Death Deed avoids probate entirely.

- Misconception 4: Only certain types of property can be transferred using a Transfer-on-Death Deed.

This is not accurate. The deed allows for the transfer of property upon the owner's death, but it must be properly executed and recorded during the owner's lifetime. If not done correctly, the property may not transfer as intended.

While it is true that the deed can be revoked, it must be done in a specific manner. The revocation must be recorded with the county register of deeds to be effective. Simply deciding to revoke it verbally or in writing without recording it will not suffice.

This is misleading. While the property transferred through a Transfer-on-Death Deed does not go through probate, other assets owned by the deceased may still need to go through the probate process. It is important to have a comprehensive estate plan that addresses all assets.

In Michigan, a Transfer-on-Death Deed can be used for most real estate properties, but there are exceptions. For example, properties held in certain types of trusts or properties with liens may not be eligible for this type of transfer. Always consult with an expert to understand the specifics.