Blank Mortgage Statement PDF Form

File Breakdown

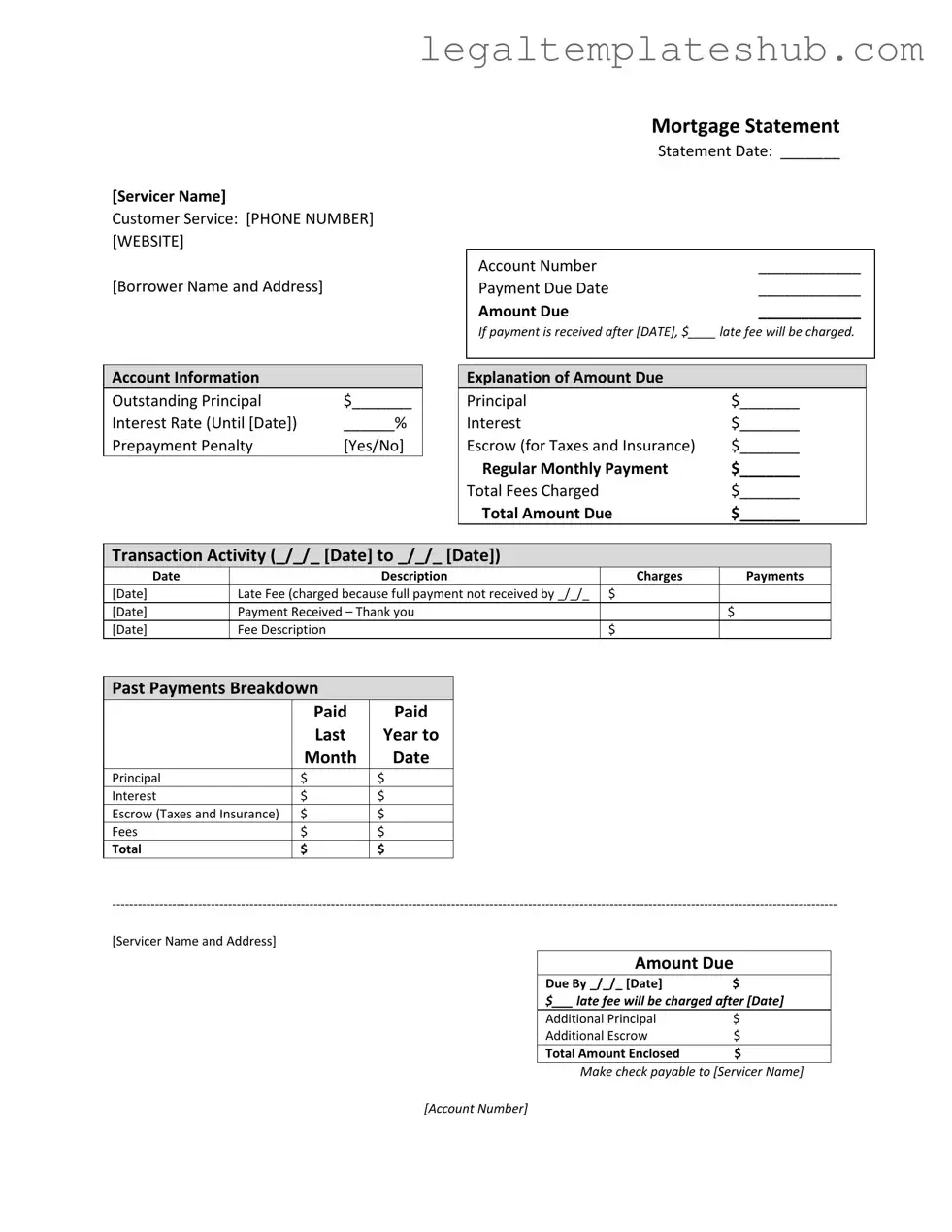

| Fact Name | Description |

|---|---|

| Servicer Information | The mortgage statement includes the servicer's name, customer service phone number, and website for easy access to support. |

| Borrower Details | It lists the borrower's name and address, ensuring clear identification of the account holder. |

| Account Information | The statement provides essential account details, such as the outstanding principal, interest rate, and any prepayment penalties. |

| Payment Due Date | It specifies the payment due date and the amount due, making it clear when payments must be made to avoid late fees. |

| Late Fee Notification | The statement informs borrowers of the late fee that will be charged if payment is not received by the specified date. |

| Transaction Activity | It includes a section for transaction activity, detailing charges and payments made during a specified period. |

| Delinquency Notice | A warning about potential foreclosure is provided if payments are not made, highlighting the seriousness of the situation. |

| Financial Assistance | Information about mortgage counseling or assistance is available for borrowers experiencing financial difficulties. |

Key takeaways

Understanding your Mortgage Statement is crucial for managing your home loan effectively. Here are some key takeaways to keep in mind:

- Review Your Account Information: Check the outstanding principal, interest rate, and any prepayment penalties. This information is essential for understanding your financial obligations.

- Payment Due Dates: Be aware of your payment due date and the amount due. Missing this date can result in late fees, which can add up quickly.

- Transaction Activity: Keep an eye on the transaction activity section. This provides a detailed history of your payments and any fees charged, helping you track your payment history.

- Partial Payments: Remember that partial payments are not applied to your mortgage. They are held in a suspense account until the full amount is paid, which can delay the crediting of your payments.

- Delinquency Notices: If you receive a delinquency notice, take it seriously. It indicates that you are behind on payments, and failure to address this can lead to foreclosure.

- Seek Help if Needed: If you are experiencing financial difficulties, do not hesitate to seek mortgage counseling or assistance. There are resources available to help you navigate tough times.

By paying attention to these details, you can manage your mortgage more effectively and avoid potential pitfalls.

Dos and Don'ts

When filling out the Mortgage Statement form, it’s crucial to follow specific guidelines to ensure accuracy and avoid delays. Here are ten essential dos and don'ts:

- Do double-check your personal information, including your name and address, for accuracy.

- Don't leave any sections blank; incomplete forms can lead to processing delays.

- Do clearly write the account number to avoid confusion with your servicer.

- Don't forget to note the payment due date; missing this can result in late fees.

- Do review the outstanding principal and interest rate to ensure they match your records.

- Don't ignore the prepayment penalty section; it’s essential to understand any fees associated with early payments.

- Do include the total amount due accurately to avoid additional fees.

- Don't submit partial payments unless you are aware they will not be applied to your mortgage.

- Do keep a copy of the completed form for your records.

- Don't hesitate to contact customer service if you have questions or need clarification on any part of the form.

Adhering to these guidelines will help ensure a smooth process when managing your mortgage statement. Take your time and review each section carefully.

Common PDF Templates

How to Estimate the Cost of a New Roof - Receive an impartial assessment of your roof's condition.

Before entering into a rental agreement, it is important to familiarize yourself with the Colorado Lease Agreement guidelines. This document is essential for outlining tenant and landlord rights, ensuring clarity on terms such as payment schedules and obligations. For further details, you can visit the important Colorado Lease Agreement considerations.

Family Law Financial Affidavit Short Form Florida - It serves as a foundation for negotiations between parties.

Instructions on Filling in Mortgage Statement

Completing the Mortgage Statement form accurately is essential for managing your mortgage payments effectively. This form will guide you through the necessary information related to your mortgage account, including payment details and outstanding balances. Here are the steps to fill out the form:

- Contact Information: Begin by entering the name of the servicer, their customer service phone number, and website at the top of the form.

- Borrower Information: Fill in your name and address as the borrower.

- Statement Details: Write the statement date, account number, payment due date, and the amount due in the designated fields.

- Late Fee Information: Indicate the late fee amount that will be charged if payment is received after the specified date.

- Account Information: Provide the outstanding principal amount, interest rate, and whether there is a prepayment penalty (Yes or No).

- Explanation of Amount Due: Break down the amount due by entering the principal, interest, escrow for taxes and insurance, regular monthly payment, total fees charged, and total amount due.

- Transaction Activity: Record the transaction activity by entering the dates, descriptions, charges, and payments for the specified period.

- Past Payments Breakdown: Fill in the total amounts paid last year for principal, interest, escrow, and fees.

- Amount Due: Confirm the amount due and the due date, along with the late fee that will be charged after the specified date.

- Payment Instructions: Indicate the total amount enclosed and make the check payable to the servicer name, including your account number.

- Important Messages: Review the important messages section, especially regarding partial payments and delinquency notices.

Once you have completed the form, double-check all entries for accuracy before submitting it. This will help ensure that your mortgage account is managed properly and that you avoid any unnecessary fees or complications.

Misconceptions

Understanding your mortgage statement can be challenging, and several misconceptions can lead to confusion. Here are five common misunderstandings:

- Mortgage statements are only for homeowners in default. Many people believe that mortgage statements are only sent to those who are behind on their payments. In reality, these statements are issued to all borrowers, regardless of their payment status, to provide a clear overview of their mortgage account.

- The amount due is always the same each month. Some assume that the amount due will remain constant throughout the life of the loan. However, factors like changes in escrow for taxes and insurance can cause fluctuations in the total amount due.

- Late fees are automatically applied. There is a misconception that late fees are charged immediately after a payment is missed. In fact, a grace period is usually provided, and late fees only apply if the payment is not received by a specified date.

- Partial payments are applied to the mortgage balance. Many believe that making a partial payment will reduce their mortgage balance. This is not the case. Partial payments are typically held in a separate suspense account until the full payment is made.

- Mortgage statements are only for tax purposes. Some think that mortgage statements serve solely to provide information for tax filings. While they do contain important information for taxes, they also serve to keep borrowers informed about their loan status and payment history.

Being aware of these misconceptions can help homeowners better understand their mortgage statements and manage their loans effectively.