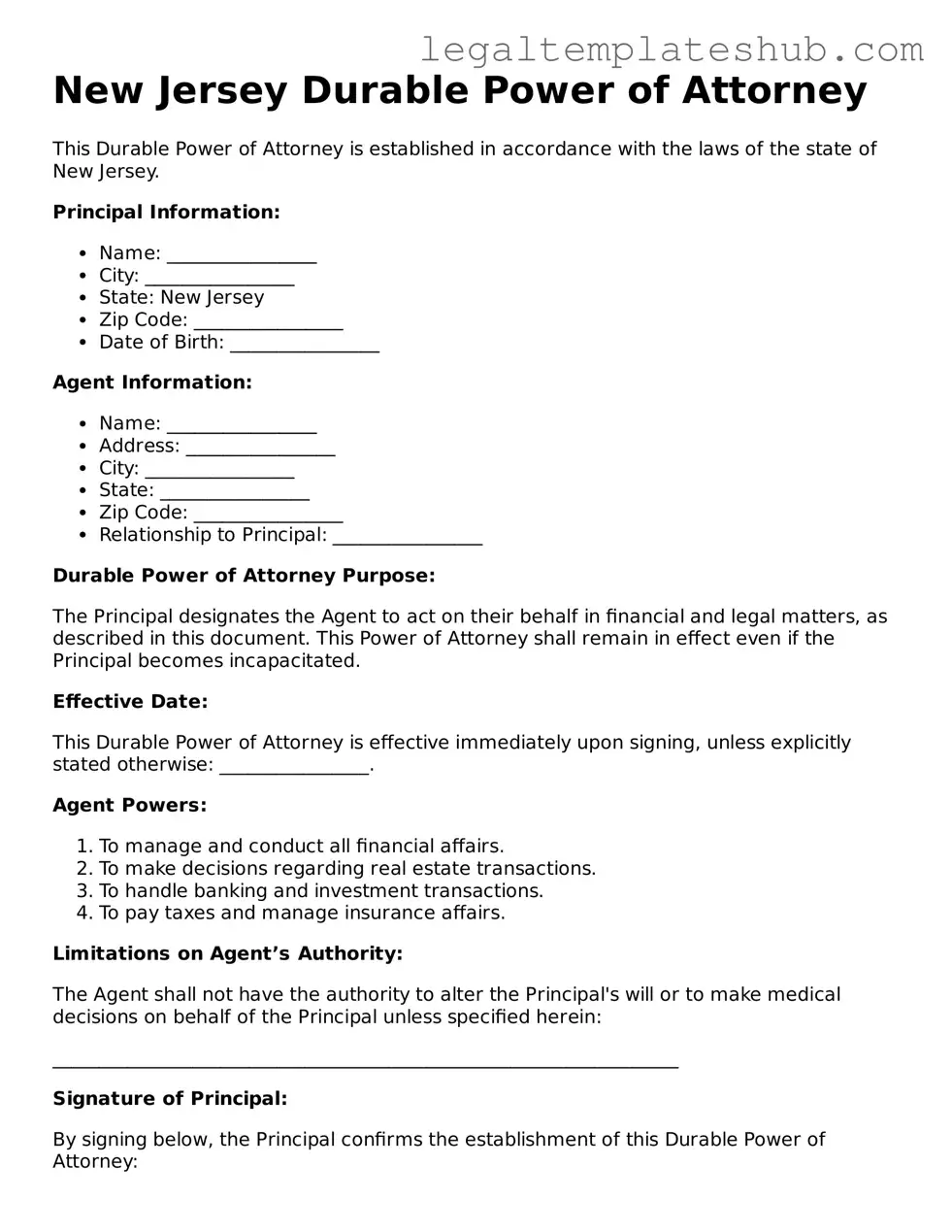

Printable Durable Power of Attorney Document for New Jersey

PDF Form Data

| Fact Name | Details |

|---|---|

| Definition | A Durable Power of Attorney allows an individual to designate another person to manage their financial and legal affairs. |

| Durability | This form remains effective even if the principal becomes incapacitated. |

| Governing Law | The Durable Power of Attorney in New Jersey is governed by the New Jersey Statutes, specifically N.J.S.A. 46:2B-8. |

| Principal | The individual who creates the Durable Power of Attorney is known as the principal. |

| Agent | The person designated to act on behalf of the principal is referred to as the agent or attorney-in-fact. |

| Execution Requirements | The form must be signed by the principal in the presence of a notary public or two witnesses. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, provided they are competent to do so. |

| Scope of Authority | The agent can be granted broad or limited powers, depending on the principal's wishes outlined in the document. |

| Legal Advice | It is advisable for individuals to seek legal counsel when creating a Durable Power of Attorney to ensure it meets their needs and complies with state law. |

Key takeaways

Here are key takeaways about filling out and using the New Jersey Durable Power of Attorney form:

- Understand the Purpose: This document allows you to appoint someone to make decisions on your behalf if you become incapacitated.

- Choose Your Agent Wisely: Select a trustworthy individual who understands your values and wishes.

- Specify Powers Clearly: Clearly outline the powers you are granting to your agent, such as financial or medical decisions.

- Consider Multiple Agents: You may appoint more than one agent, but ensure they can work together effectively.

- Include Successor Agents: Designate alternate agents in case your primary agent is unable or unwilling to act.

- Complete the Form Accurately: Fill out the form completely, ensuring all required sections are addressed.

- Sign and Date: Your signature and the date are essential. The document must be signed while you are still competent.

- Witness and Notarization: New Jersey requires at least one witness and notarization for the form to be valid.

- Keep Copies Accessible: Store copies of the completed form in a safe place and provide copies to your agent and relevant parties.

- Review Regularly: Periodically review and update the document to reflect any changes in your circumstances or preferences.

Dos and Don'ts

When filling out the New Jersey Durable Power of Attorney form, it’s important to ensure that the document is completed accurately to avoid any complications in the future. Here’s a list of things you should and shouldn’t do:

- Do read the entire form carefully before starting to fill it out.

- Do consult with an attorney if you have any questions about the form or its implications.

- Do ensure that the person you are appointing as your agent is trustworthy and understands your wishes.

- Do sign and date the form in the presence of a notary public to validate it.

- Don’t leave any sections of the form blank; incomplete forms may not be accepted.

- Don’t use outdated versions of the form; always use the most current version available.

- Don’t appoint more than one agent unless you specify how they should act together.

- Don’t forget to provide copies of the completed form to your agent and any relevant institutions.

More Durable Power of Attorney State Templates

Virginia Power of Attorney - Executing this form typically requires signatures from the principal and, in some cases, witnesses or notaries.

When considering an equine purchase, obtaining a reliable Horse Bill of Sale template is critical for a seamless transaction. This document not only outlines the terms but also safeguards both buyer and seller, ensuring mutual understanding. You can access a suitable template at this helpful Horse Bill of Sale guide.

Does a Power of Attorney Need to Be Notarized in Ohio - Ensures your wishes are followed when you cannot decide.

Instructions on Filling in New Jersey Durable Power of Attorney

Filling out the New Jersey Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are managed according to your wishes. This form allows you to designate someone you trust to make decisions on your behalf if you become unable to do so. Follow these steps carefully to complete the form accurately.

- Obtain the New Jersey Durable Power of Attorney form. You can find it online or request a copy from a legal professional.

- Begin by filling in your personal information at the top of the form. Include your full name, address, and contact information.

- Next, identify the person you are appointing as your agent. Write their full name, address, and relationship to you.

- Clearly outline the powers you wish to grant your agent. You can choose general powers or specify particular powers, such as managing real estate or handling bank accounts.

- If you want to limit your agent's authority, make sure to include any restrictions in the appropriate section of the form.

- Sign and date the form in the designated area. Your signature must be witnessed by at least one person or notarized, depending on your preference.

- Provide copies of the completed form to your agent and any relevant financial institutions or individuals who may need it.

After completing these steps, it's crucial to keep the original form in a safe place while ensuring that your agent knows where to find it. This will help avoid any delays or confusion in the future.

Misconceptions

When it comes to the New Jersey Durable Power of Attorney (DPOA) form, there are several common misconceptions that can lead to confusion. Here are eight of them, along with clarifications to help you understand the realities of this important legal document.

-

Misconception 1: A Durable Power of Attorney is only for the elderly.

This is not true. Anyone can benefit from a DPOA, regardless of age. It’s a proactive measure to ensure your wishes are honored if you become incapacitated.

-

Misconception 2: A DPOA gives unlimited power to the agent.

While a DPOA does grant significant authority, the powers can be limited to specific tasks or decisions as outlined in the document. The principal can define the scope of authority.

-

Misconception 3: A DPOA is only effective when the principal is incapacitated.

Actually, a Durable Power of Attorney becomes effective immediately upon signing, unless specified otherwise. This means the agent can act on your behalf right away.

-

Misconception 4: You cannot change or revoke a DPOA once it is created.

This is incorrect. A principal can revoke or change a DPOA at any time, as long as they are mentally competent. It’s important to communicate any changes to your agent and relevant institutions.

-

Misconception 5: A DPOA is the same as a living will.

A DPOA and a living will serve different purposes. A DPOA allows someone to make financial or legal decisions on your behalf, while a living will addresses medical decisions and end-of-life care.

-

Misconception 6: All DPOAs must be notarized to be valid.

In New Jersey, a DPOA must be signed by the principal and witnessed by two individuals or notarized. This means notarization is not the only way to validate the document.

-

Misconception 7: A DPOA automatically expires after a certain time.

A Durable Power of Attorney remains in effect until the principal revokes it, passes away, or becomes legally incompetent without a DPOA in place. It does not have an automatic expiration.

-

Misconception 8: You don’t need a DPOA if you have a will.

A will only takes effect after death, while a DPOA is essential for managing affairs during your lifetime, especially if you become unable to make decisions. Both documents serve different but important roles.

Understanding these misconceptions can help you make informed decisions about your legal needs and ensure that your wishes are respected.