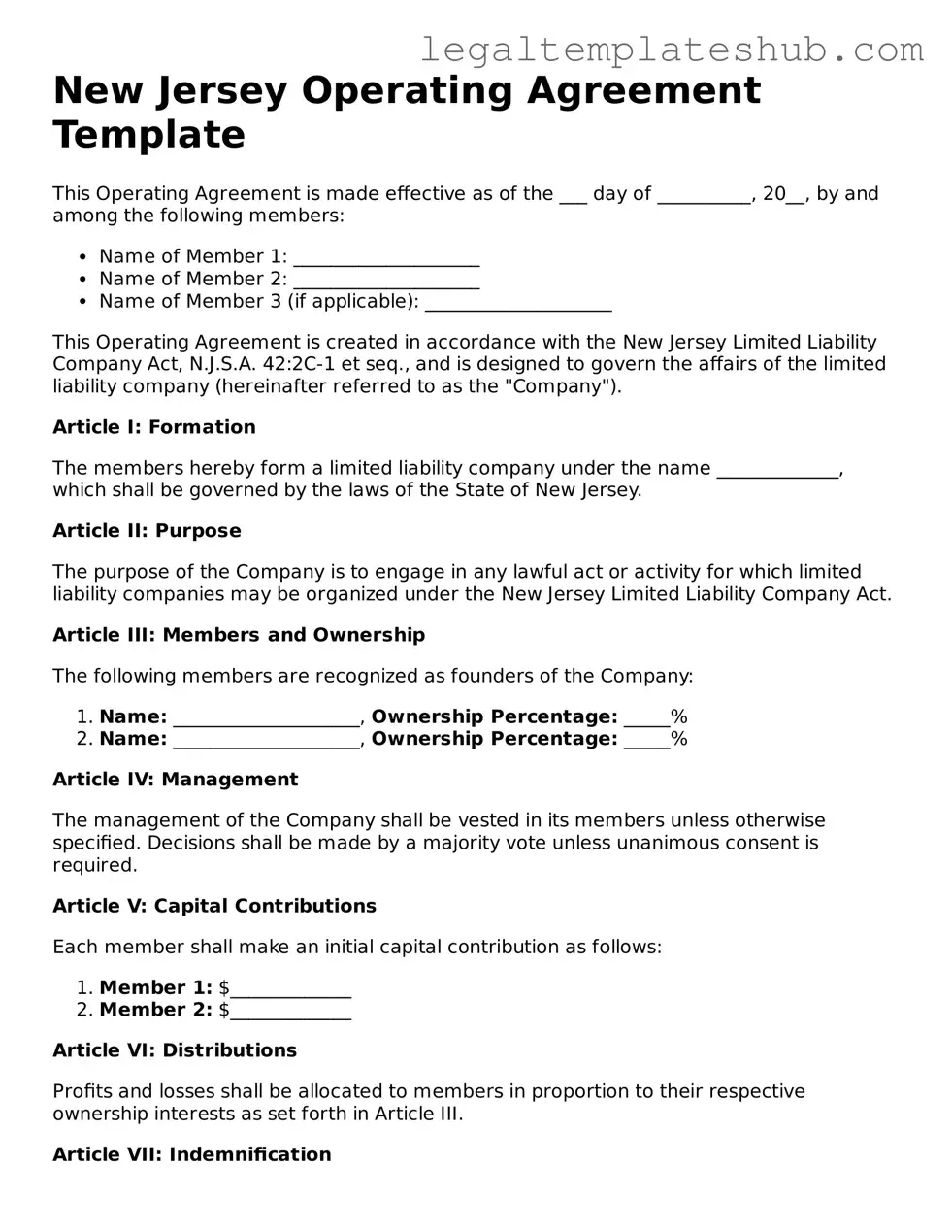

Printable Operating Agreement Document for New Jersey

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | The New Jersey Operating Agreement is a legal document that outlines the management structure and operating procedures of a limited liability company (LLC). |

| Governing Law | This agreement is governed by the New Jersey Limited Liability Company Act, specifically N.J.S.A. 42:2B-1 et seq. |

| Mandatory Requirement | While not required by law, it is highly recommended for all LLCs to have an operating agreement to clarify internal operations. |

| Member Rights | The agreement specifies the rights and responsibilities of each member, including profit distribution and decision-making processes. |

| Customization | Members can tailor the agreement to fit their specific needs, addressing issues like management structure and voting rights. |

| Dispute Resolution | It often includes provisions for resolving disputes among members, which can help avoid costly litigation. |

| Amendments | Provisions for amending the operating agreement can be included, allowing flexibility as the business evolves. |

| Confidentiality | The agreement can contain confidentiality clauses to protect sensitive business information from being disclosed. |

| Duration | The operating agreement can specify the duration of the LLC, whether it is perpetual or limited to a certain timeframe. |

| Legal Protection | Having a well-drafted operating agreement can provide legal protection for members by clearly defining roles and expectations. |

Key takeaways

When filling out and utilizing the New Jersey Operating Agreement form, there are several important points to keep in mind. Understanding these key takeaways can help ensure that your agreement is both effective and compliant with state regulations.

- Clarity is Crucial: Clearly outline the roles and responsibilities of each member. This helps prevent misunderstandings and conflicts down the road.

- Include Profit Distribution: Specify how profits and losses will be shared among members. This section should reflect the agreement of all parties involved.

- Amendment Procedures: Establish a process for making changes to the agreement. This ensures that the document can evolve as your business needs change.

- State Compliance: Ensure that the agreement complies with New Jersey state laws. This may require consulting with a legal professional to avoid potential issues.

By keeping these takeaways in mind, you can create a comprehensive Operating Agreement that serves the best interests of all members involved.

Dos and Don'ts

When filling out the New Jersey Operating Agreement form, it’s essential to follow certain guidelines to ensure accuracy and compliance. Here’s a helpful list of dos and don’ts to keep in mind.

- Do read the entire form carefully before starting.

- Do provide accurate information about the members and their contributions.

- Do clearly outline the management structure of the LLC.

- Do specify the voting rights of each member.

- Do include provisions for handling disputes among members.

- Don't leave any sections blank unless instructed.

- Don't use vague language; be as specific as possible.

- Don't forget to date and sign the document.

- Don't overlook the importance of having the agreement reviewed by a legal professional.

More Operating Agreement State Templates

Llc Operating Agreement Michigan - An Operating Agreement can clarify what happens during dispute resolution.

Creating an Operating Agreement - The Operating Agreement can clarify the process for profit reinvestment or distribution.

Ohio Llc Operating Agreement - This document may include rules on transferring ownership interests.

Once you have gathered all necessary information regarding the vehicle, utilizing the PDF Templates will help you create a properly formatted Pennsylvania Motor Vehicle Bill of Sale form, ensuring that all details are accurately captured for the transaction.

Llc New York - This document specifies the rights and responsibilities of each member.

Instructions on Filling in New Jersey Operating Agreement

Once you have the New Jersey Operating Agreement form ready, it's time to fill it out carefully. Ensure you have all necessary information on hand, as this will help you complete the form accurately and efficiently.

- Begin by entering the name of your LLC at the top of the form. Make sure it matches the name registered with the state.

- Next, provide the principal office address. This should be a physical location where your business is based.

- List the names and addresses of all members of the LLC. Include any managers if applicable.

- Specify the purpose of your LLC. Clearly state what type of business activities it will engage in.

- Outline the management structure. Indicate whether the LLC will be member-managed or manager-managed.

- Detail the ownership percentages of each member. This shows how profits and losses will be shared.

- Include the rules for meetings. Specify how often meetings will occur and the notice required.

- State the procedures for adding or removing members. This ensures everyone understands how changes will be handled.

- Sign and date the form. All members should sign to indicate their agreement to the terms outlined.

After completing the form, review it for accuracy. Once confirmed, you can proceed with filing it with the appropriate state office. This step is crucial for ensuring your LLC operates smoothly and in compliance with New Jersey laws.

Misconceptions

Many individuals and business owners have misunderstandings about the New Jersey Operating Agreement form. Clarifying these misconceptions can help ensure compliance and proper management of limited liability companies (LLCs). Below is a list of common misconceptions along with explanations.

- Operating Agreements are optional in New Jersey. While New Jersey does not require LLCs to have an Operating Agreement, it is highly advisable to create one. This document outlines the management structure and operating procedures, providing clarity and protection for members.

- All Operating Agreements must be filed with the state. This is not true. Operating Agreements are internal documents and do not need to be submitted to the state. However, they should be kept on file for reference and legal purposes.

- Operating Agreements are only for large businesses. Small businesses and single-member LLCs also benefit from having an Operating Agreement. It helps define roles, responsibilities, and procedures, regardless of the company size.

- Once created, an Operating Agreement cannot be changed. This is a misconception. Members can amend the Operating Agreement as needed, provided they follow the procedures outlined within the document for making changes.

- All members must agree on every detail of the Operating Agreement. While it is ideal for all members to reach a consensus, the Operating Agreement can be structured to allow for majority decisions, depending on the terms set forth.

- The state provides a standard Operating Agreement template. New Jersey does not offer a standardized template. Each LLC should create a tailored Operating Agreement that reflects its specific needs and agreements among members.

- Operating Agreements are only for multi-member LLCs. Single-member LLCs also benefit from having an Operating Agreement. It formalizes the business structure and can help protect personal assets.

- Verbal agreements are sufficient. Relying solely on verbal agreements can lead to misunderstandings and disputes. A written Operating Agreement provides clear documentation of the terms agreed upon by members.

- Operating Agreements are only necessary during the formation of the LLC. This is false. Operating Agreements should be reviewed and updated regularly to reflect any changes in membership, management, or business operations.

- Having an Operating Agreement guarantees legal protection. While an Operating Agreement is a crucial step in protecting members, it does not provide absolute immunity from legal issues. Compliance with state laws and regulations is still necessary.

Understanding these misconceptions can help ensure that LLC members in New Jersey create a solid foundation for their business operations. A well-drafted Operating Agreement can significantly enhance the management and stability of the company.