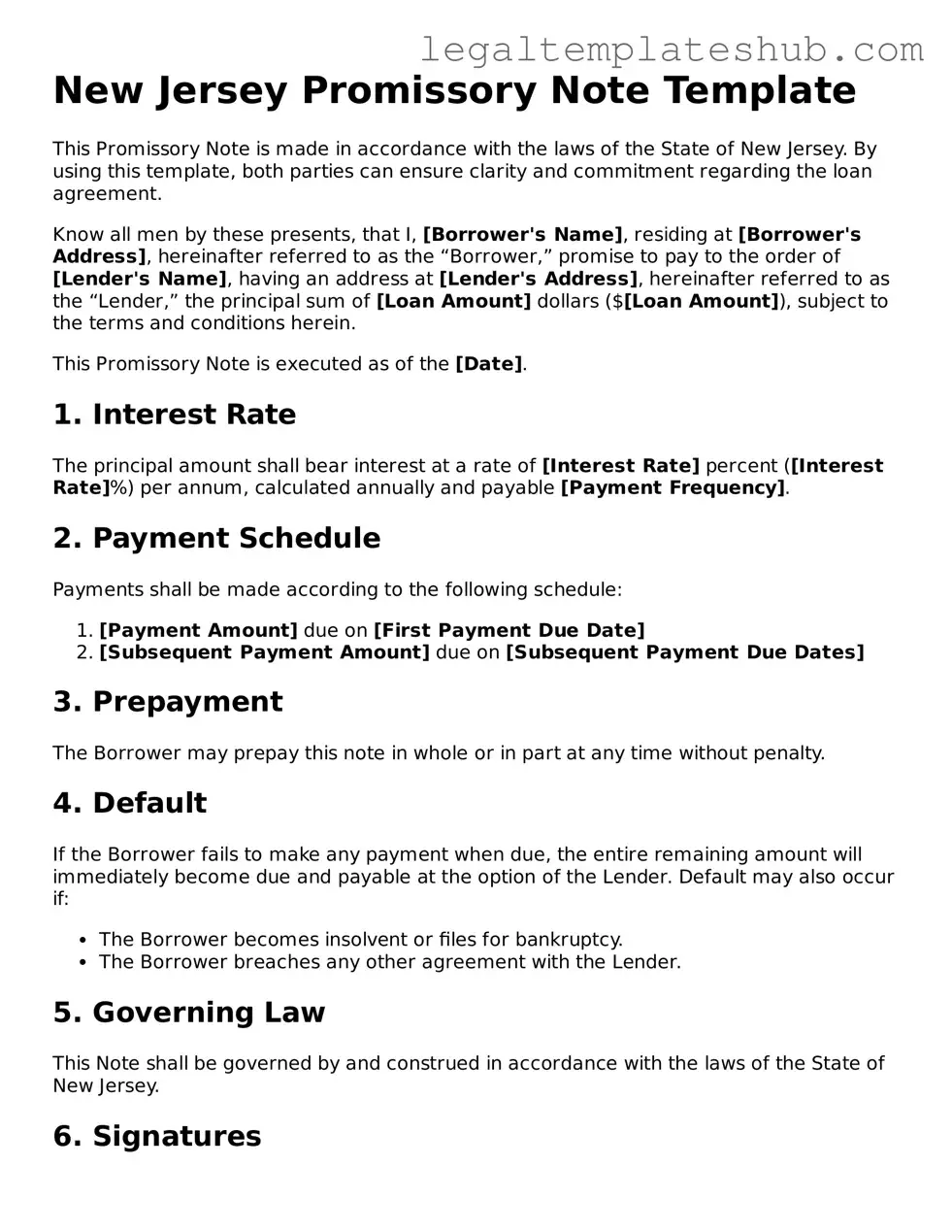

Printable Promissory Note Document for New Jersey

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specific amount of money at a specified time. |

| Governing Law | In New Jersey, promissory notes are governed by the Uniform Commercial Code (UCC), specifically N.J.S.A. 12A:3-104. |

| Parties Involved | The note involves two parties: the maker (who promises to pay) and the payee (who receives the payment). |

| Payment Terms | The note must clearly state the amount to be paid and the due date. |

| Interest Rate | If applicable, the interest rate should be specified in the note. This can be fixed or variable. |

| Signatures | The note must be signed by the maker to be legally binding. |

| Transferability | Promissory notes can be transferred to another party, making them negotiable instruments under the UCC. |

| Default Consequences | If the maker fails to pay, the payee can take legal action to recover the owed amount. |

Key takeaways

When dealing with a New Jersey Promissory Note, it's important to understand how to properly fill it out and use it. Here are some key takeaways to keep in mind:

- Understand the Basics: A promissory note is a written promise to pay a specified amount of money at a certain time. Familiarize yourself with its essential components.

- Identify the Parties: Clearly state the names and addresses of both the borrower and the lender. This ensures that both parties are easily identifiable.

- Specify the Loan Amount: Clearly indicate the total amount being borrowed. This figure should be accurate to avoid any future disputes.

- Outline the Terms of Repayment: Include details about the repayment schedule, including due dates and the frequency of payments. This helps set clear expectations.

- Include Interest Rates: If applicable, specify the interest rate and whether it is fixed or variable. This affects the total amount to be repaid.

- Signatures are Crucial: Both parties must sign the document. Without signatures, the note may not be enforceable.

- Keep Copies: After signing, make sure to keep copies of the promissory note for both parties. This is important for record-keeping and future reference.

By following these takeaways, you can ensure that your New Jersey Promissory Note is properly filled out and legally sound.

Dos and Don'ts

When filling out the New Jersey Promissory Note form, it's important to follow certain guidelines to ensure the document is valid and clear. Here are some dos and don'ts to consider:

- Do clearly state the amount being borrowed.

- Do include the names and addresses of both the borrower and the lender.

- Do specify the interest rate, if applicable.

- Do outline the repayment terms, including due dates.

- Don't leave any blank spaces that could be misinterpreted later.

- Don't use vague language; be specific about the terms.

- Don't forget to sign and date the document.

- Don't overlook the need for witnesses or notarization, if required.

More Promissory Note State Templates

Create Promissory Note - This document can be altered if both parties agree to the new terms in writing.

Promissory Note for Personal Loan - Promissory notes are often used in real estate transactions.

Using the Pennsylvania Motor Vehicle Bill of Sale form not only clarifies the transaction but also ensures compliance with local regulations; for those needing a convenient option, you can find a template at PDF Templates.

Pennsylvania Promissory Note - Useful tool for managing personal finances and loan agreements.

Instructions on Filling in New Jersey Promissory Note

Once you have the New Jersey Promissory Note form in front of you, it's time to fill it out accurately to ensure that it meets legal standards. Completing this form correctly will help protect the interests of both the lender and the borrower. Follow these steps to guide you through the process.

- Begin by entering the date at the top of the form. This should be the date on which the note is created.

- Next, fill in the name and address of the borrower. Make sure to provide accurate contact information.

- Then, enter the name and address of the lender. Again, accuracy is key here.

- Specify the principal amount being borrowed. This is the total amount that the borrower agrees to repay.

- Indicate the interest rate, if applicable. Clearly state whether the interest is fixed or variable.

- Outline the repayment schedule. This includes how often payments will be made (e.g., monthly, quarterly) and the due date for each payment.

- Include any terms regarding late payments or default. This section should clarify the consequences if the borrower fails to make payments on time.

- Finally, both the borrower and lender should sign and date the document. Ensure that all signatures are clear and legible.

With the form completed, it’s advisable to keep copies for both parties. This ensures that everyone has a record of the agreement. If needed, consider having the document notarized for added legal protection.

Misconceptions

Here are five common misconceptions about the New Jersey Promissory Note form:

- It's only for large loans. Many people believe that promissory notes are only necessary for significant amounts of money. In reality, they can be used for any loan amount, regardless of size.

- Verbal agreements are sufficient. Some think that a verbal agreement is enough to document a loan. However, having a written promissory note provides legal protection and clarity for both parties.

- All promissory notes are the same. There is a misconception that all promissory notes follow a standard format. In truth, the terms and conditions can vary significantly based on the agreement between the lender and borrower.

- They do not need to be notarized. Many assume that notarization is unnecessary for a promissory note. While it is not always required, having it notarized can add an extra layer of legitimacy and enforceability.

- Once signed, they cannot be changed. Some believe that a signed promissory note is set in stone. In fact, parties can amend the terms if both agree and document the changes properly.