Printable Tractor Bill of Sale Document for New Jersey

PDF Form Data

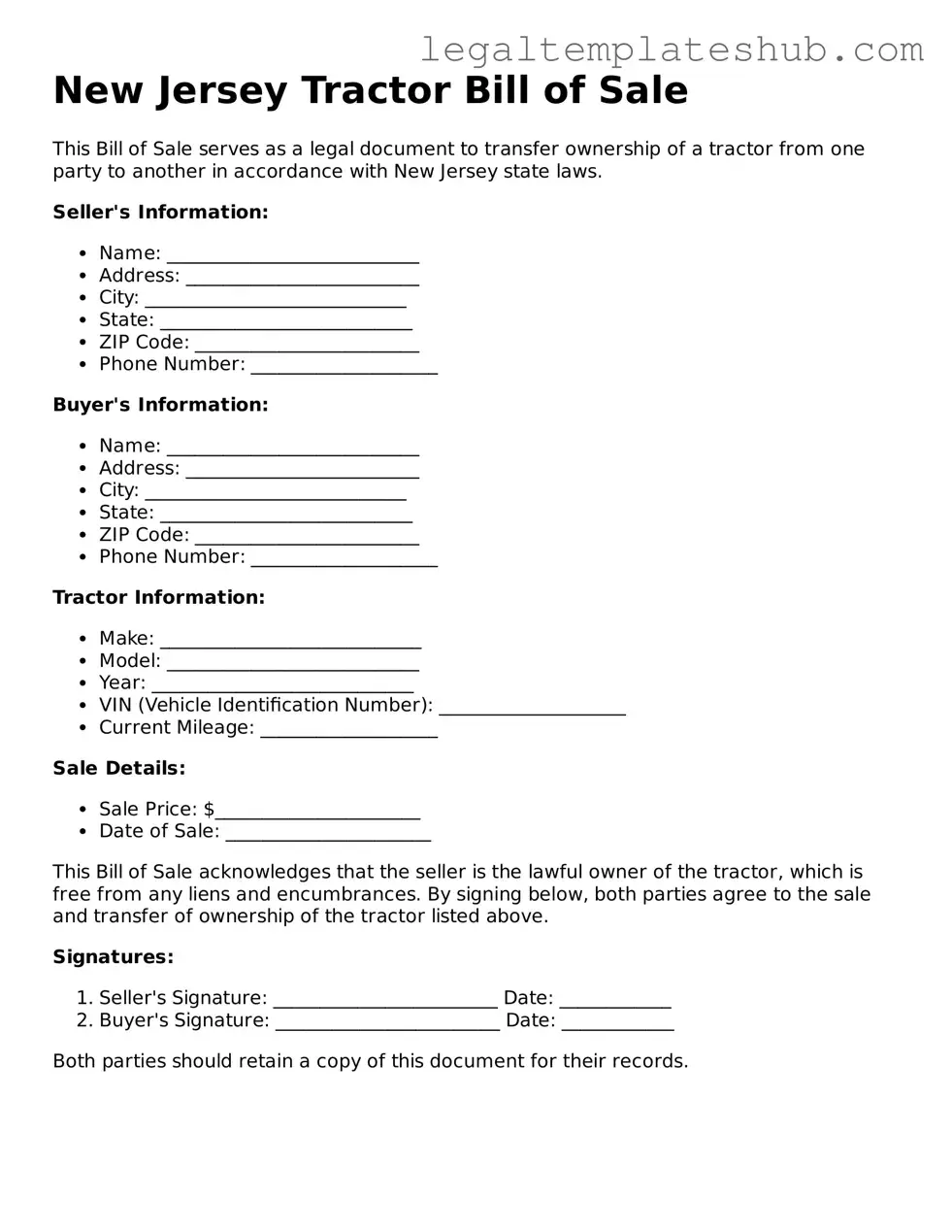

| Fact Name | Description |

|---|---|

| Purpose | The New Jersey Tractor Bill of Sale form is used to document the sale of a tractor between a buyer and a seller. |

| Governing Law | This form is governed by New Jersey state law, specifically N.J.S.A. 12A:2-101 et seq. |

| Identification | The form requires identification details for both the buyer and the seller, including names and addresses. |

| Tractor Details | Details about the tractor, such as make, model, year, and Vehicle Identification Number (VIN), must be included. |

| Sales Price | The form must specify the sales price of the tractor to ensure clarity in the transaction. |

| Signatures | Both parties must sign the form to validate the sale and confirm agreement to the terms. |

| Date of Sale | The date of the transaction must be recorded on the form to establish when the sale occurred. |

| Consideration | The form may include a statement of consideration, which is the value exchanged for the tractor. |

| Notarization | While notarization is not always required, it can add an extra layer of authenticity to the document. |

| Record Keeping | Both the buyer and seller should keep a copy of the completed form for their records and future reference. |

Key takeaways

When dealing with the New Jersey Tractor Bill of Sale form, understanding its key components can simplify the process. Here are some essential takeaways to keep in mind:

- Accurate Information: Ensure that all details about the tractor, including make, model, year, and Vehicle Identification Number (VIN), are filled out accurately. This information is crucial for proper identification.

- Seller and Buyer Details: Both the seller and buyer must provide their full names, addresses, and signatures. This creates a clear record of the transaction and protects both parties.

- Consideration Amount: Clearly state the sale price of the tractor. This amount is important for tax purposes and establishes the value of the transaction.

- Keep Copies: After completing the form, both the buyer and seller should keep a copy for their records. This can be useful for future reference or in case any disputes arise.

Dos and Don'ts

When filling out the New Jersey Tractor Bill of Sale form, there are several important considerations to keep in mind. Here’s a list of what you should and shouldn’t do to ensure a smooth transaction.

- Do include the full names and addresses of both the buyer and the seller.

- Don’t leave any sections blank; fill in all required fields to avoid delays.

- Do provide a detailed description of the tractor, including the make, model, year, and VIN.

- Don’t forget to include the sale price; this is essential for both parties and for tax purposes.

- Do sign and date the form in the appropriate sections.

- Don’t use abbreviations or shorthand; clarity is key for legal documents.

- Do keep a copy of the completed form for your records.

- Don’t ignore local regulations; check if there are any additional requirements in your county.

- Do consider having a witness sign the document for added protection.

By following these guidelines, you can ensure that your Tractor Bill of Sale is completed correctly and serves its purpose effectively.

More Tractor Bill of Sale State Templates

In Consideration of Bill of Sale Example - This form can assist in the resale of the tractor in the future by providing proof of prior ownership.

Completing the New York Residential Lease Agreement is crucial for both landlords and tenants to ensure a clear understanding of the rental arrangement; for your convenience, you can find a suitable format to assist you by visiting PDF Templates, which offers a variety of templates designed specifically for this purpose.

Bill of Sale Tractor - Helps avoid misunderstandings regarding the sale terms.

Bill of Sale Truck - Documents the sale price of the tractor.

Bill of Sale Tractor - Aids in protecting the rights of both the seller and buyer.

Instructions on Filling in New Jersey Tractor Bill of Sale

After completing the New Jersey Tractor Bill of Sale form, you will have a document that serves as proof of the transaction between the buyer and the seller. This form will need to be kept for your records and may be required for registration or titling purposes.

- Begin by entering the date of the sale at the top of the form.

- Provide the full name and address of the seller in the designated section.

- Next, fill in the buyer's full name and address.

- Describe the tractor being sold. Include details such as make, model, year, and Vehicle Identification Number (VIN).

- Indicate the sale price of the tractor clearly.

- Both the seller and buyer should sign and date the form at the bottom.

- Make copies of the completed form for both parties to retain.

Misconceptions

Understanding the New Jersey Tractor Bill of Sale form is important for both buyers and sellers. However, there are several misconceptions that can lead to confusion. Here are eight common misconceptions:

- It’s not necessary for private sales. Many believe that a bill of sale is only required for dealership transactions. In reality, it's important for private sales too, as it provides proof of ownership.

- All states have the same requirements. Some think that the requirements for a bill of sale are uniform across all states. New Jersey has specific rules that must be followed, which may differ from other states.

- A bill of sale is the same as a title. Some individuals assume that a bill of sale serves as a title. While it documents the sale, it does not replace the need for a proper title transfer.

- Only the seller needs to sign. There is a belief that only the seller's signature is necessary. However, both the buyer and seller should sign the document to validate the sale.

- It doesn’t need to be notarized. Many people think notarization is optional. In New Jersey, notarization is not always required, but having it can add an extra layer of security.

- The form is complicated to fill out. Some may feel intimidated by the form. In truth, it is straightforward and can be completed easily with basic information.

- It’s only for new tractors. A misconception exists that this form is only applicable for new tractors. However, it is equally important for used tractors to document the sale.

- It doesn’t affect taxes. Some buyers and sellers think that a bill of sale has no tax implications. In reality, it can be important for determining sales tax during registration.

By addressing these misconceptions, individuals can better navigate the process of buying or selling a tractor in New Jersey.