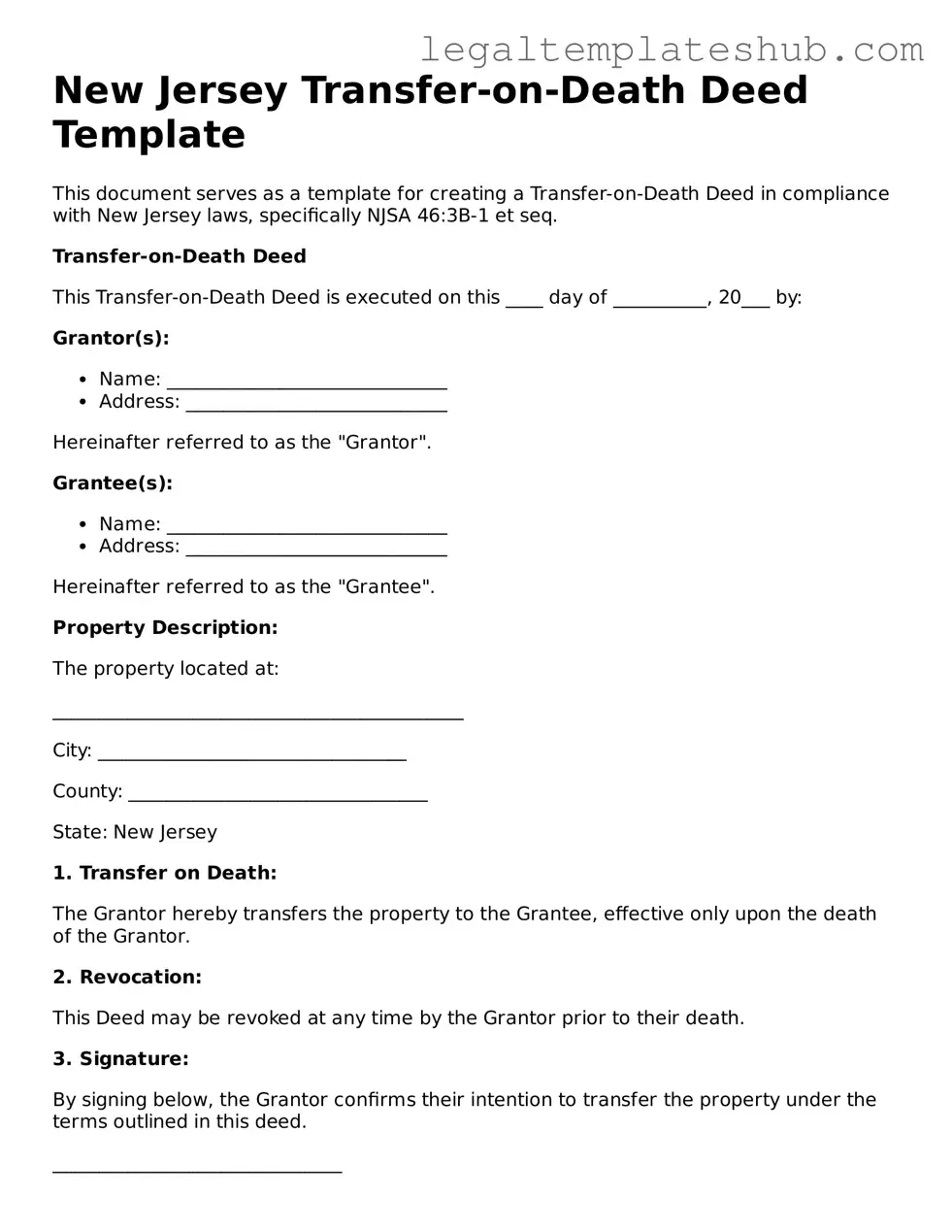

Printable Transfer-on-Death Deed Document for New Jersey

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Transfer-on-Death Deed allows property owners to transfer real estate to beneficiaries upon their death without going through probate. |

| Governing Law | The Transfer-on-Death Deed in New Jersey is governed by the New Jersey Statutes, specifically N.J.S.A. 46:3B-1 et seq. |

| Eligibility | Any individual who owns real estate in New Jersey can create a Transfer-on-Death Deed, provided they have the legal capacity to do so. |

| Beneficiaries | Property owners can name one or more beneficiaries in the deed, allowing for flexibility in how the property is distributed. |

| Revocation | A Transfer-on-Death Deed can be revoked at any time by the property owner, ensuring they maintain control over their property until death. |

| Filing Requirements | The deed must be signed by the property owner and recorded with the county clerk's office in the county where the property is located. |

| Tax Implications | Transfer-on-Death Deeds do not trigger gift taxes during the owner's lifetime, but beneficiaries may be subject to inheritance taxes. |

| Effectiveness | The deed becomes effective upon the death of the property owner, transferring ownership directly to the named beneficiaries. |

Key takeaways

Filling out and using the New Jersey Transfer-on-Death Deed form requires careful attention to detail. Here are some key takeaways to consider:

- Ensure that the form is completed accurately to avoid any delays in the transfer process.

- The deed must be signed by the property owner in the presence of a notary public.

- It is essential to record the deed with the county clerk's office where the property is located.

- The Transfer-on-Death Deed allows for the property to pass directly to the designated beneficiary upon the owner's death, bypassing probate.

- Revocation of the deed is possible if the owner changes their mind; this must also be recorded.

- Consulting with a legal professional can help clarify any uncertainties regarding the use of this deed.

Understanding these points can help ensure a smoother transfer of property in New Jersey.

Dos and Don'ts

When filling out the New Jersey Transfer-on-Death Deed form, it is important to follow certain guidelines to ensure that the document is completed correctly and effectively. Below are six recommendations, divided into things you should do and things you should avoid.

Things You Should Do:

- Ensure that you have the correct form for the Transfer-on-Death Deed specific to New Jersey.

- Provide accurate information about the property, including the legal description and address.

- Include the full names and addresses of all beneficiaries who will receive the property upon your passing.

Things You Shouldn't Do:

- Do not leave any sections of the form blank; incomplete forms may lead to complications.

- Avoid using ambiguous language that could lead to misunderstandings about your intentions.

- Do not forget to sign and date the form in the presence of a notary public, as required by New Jersey law.

By adhering to these guidelines, individuals can facilitate a smoother process for transferring property upon death, ensuring that their wishes are clearly communicated and legally recognized.

More Transfer-on-Death Deed State Templates

Affidavit for Transfer Without Probate Ohio - Personalizing your estate plan with this deed can provide peace of mind about property distribution.

Washington Transfer on Death Deed - This form can minimize family disputes over property, as it clearly states intended heirs.

An Operating Agreement is a vital document that outlines the management structure and operating procedures for a limited liability company (LLC). It serves as an internal guide for members, detailing financial arrangements, voting rights, and responsibilities. To ensure compliance and clarity, consider filling out the form by clicking the button below, or you can find useful resources like PDF Templates to assist you.

Problems With Transfer on Death Deeds in Indiana - Periodic review of your estate plan can ensure the Transfer-on-Death Deed remains in line with your wishes.

Instructions on Filling in New Jersey Transfer-on-Death Deed

After obtaining the New Jersey Transfer-on-Death Deed form, it is important to fill it out accurately to ensure that the property is transferred according to your wishes. Follow these steps to complete the form correctly.

- Begin by entering the name of the property owner in the designated section. This should be the person who currently holds the title to the property.

- Provide the address of the property. Include the street address, city, state, and zip code to ensure clarity.

- Identify the beneficiary. This is the person who will receive the property upon the owner's death. Write their full name and relationship to the owner.

- Include the legal description of the property. This may be found on the current deed or property tax records. Ensure that it is accurate and complete.

- Sign the form. The property owner must sign the deed in the presence of a notary public. This step is crucial for the deed to be valid.

- Have the deed notarized. A notary public will verify the identity of the property owner and witness the signing of the document.

- File the completed deed with the county clerk's office in the county where the property is located. This step is necessary for the deed to take effect.

Misconceptions

Many people have misunderstandings about the New Jersey Transfer-on-Death Deed form. Here are some common misconceptions:

- Misconception 1: The Transfer-on-Death Deed automatically transfers property upon the owner’s death.

- Misconception 2: A Transfer-on-Death Deed can only be used for residential property.

- Misconception 3: The Transfer-on-Death Deed avoids all taxes.

- Misconception 4: Once a Transfer-on-Death Deed is recorded, it cannot be changed.

This is not accurate. The deed only transfers the property after the owner passes away, but it must be properly recorded and executed while the owner is alive.

This is incorrect. The deed can be used for various types of real estate, not just residential properties. It can apply to commercial properties as well.

This is misleading. While the deed can help avoid probate, it does not exempt the property from estate taxes or other potential taxes that may arise upon the owner's death.

This is false. The owner can revoke or change the deed at any time before their death, as long as they follow the proper legal procedures.