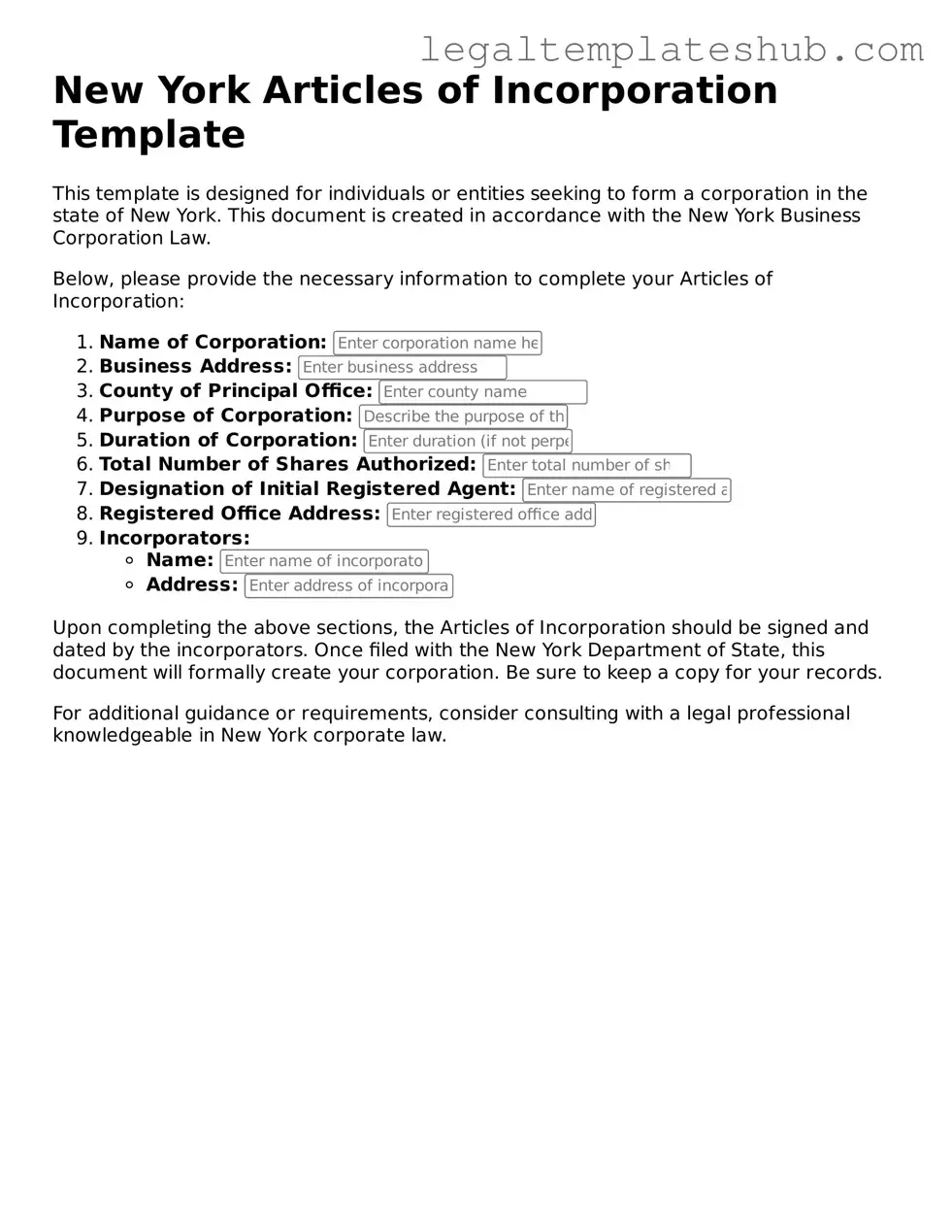

Printable Articles of Incorporation Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | The New York Articles of Incorporation form is used to legally establish a corporation in the state of New York. |

| Governing Law | This form is governed by the New York Business Corporation Law (BCL). |

| Filing Requirement | To complete the incorporation process, the form must be filed with the New York Department of State. |

| Information Required | Key information includes the corporation's name, purpose, office address, and details of the registered agent. |

| Fees | A filing fee is required when submitting the Articles of Incorporation, which varies based on the type of corporation. |

Key takeaways

When considering the process of filling out and using the New York Articles of Incorporation form, several important points should be kept in mind. Here are five key takeaways:

- Understand the Purpose: The Articles of Incorporation serve as the foundational document for establishing a corporation in New York. This document outlines the basic structure and purpose of your business.

- Provide Accurate Information: It is crucial to include accurate and complete information about your corporation. This includes the name of the corporation, the purpose of the business, and the registered agent's details.

- Filing Fees: Be aware that there is a filing fee associated with submitting the Articles of Incorporation. The fee amount may vary, so it is important to check the latest information on the New York Department of State's website.

- Review Requirements: Before submission, ensure that your Articles of Incorporation meet all state requirements. This includes compliance with naming conventions and other legal stipulations.

- Post-Filing Responsibilities: After filing, there are ongoing responsibilities to maintain your corporation's good standing. This includes filing annual reports and paying any necessary taxes.

By keeping these key takeaways in mind, individuals can navigate the process of incorporating a business in New York more effectively.

Dos and Don'ts

When filling out the New York Articles of Incorporation form, it's important to follow certain guidelines to ensure the process goes smoothly. Here’s a list of things you should and shouldn't do:

- Do provide accurate information about your business name.

- Do include the correct address of your principal office.

- Do specify the purpose of your corporation clearly.

- Do list the names and addresses of the initial directors.

- Don't use a name that is too similar to an existing corporation.

- Don't forget to sign and date the form before submission.

- Don't leave any required fields blank; incomplete forms can cause delays.

By following these guidelines, you can help ensure that your Articles of Incorporation are processed efficiently and correctly.

More Articles of Incorporation State Templates

North Carolina Corporation - Names the incorporators responsible for creating the corporation.

Wa Secretary of State Business Entity Search - Establishes guidelines for maintaining corporate goodwill.

Texas Articles of Incorporation - It outlines the basic structure of a business entity.

In addition to the crucial details required for the transaction, you can easily access the necessary documents through PDF Documents Hub, ensuring a smooth and efficient process when completing the California Motorcycle Bill of Sale form.

Llc Articles of Organization Nj - Including a statement about the corporation's initial registered office is common.

Instructions on Filling in New York Articles of Incorporation

Filling out the New York Articles of Incorporation form is an important step in establishing your business. Once completed, you will need to submit it to the New York Department of State along with the required filing fee. This document will officially create your corporation in New York.

- Obtain the form: Download the Articles of Incorporation form from the New York Department of State website or visit their office to pick up a physical copy.

- Choose a name: Decide on a unique name for your corporation that complies with New York naming rules. Ensure it is not already in use by another entity.

- Provide the purpose: Clearly state the purpose of your corporation. This can be a general statement or a specific business activity.

- Designate a registered agent: Identify a registered agent who will receive legal documents on behalf of the corporation. This can be an individual or a business entity authorized to conduct business in New York.

- List the incorporators: Include the names and addresses of the incorporators who are responsible for filing the Articles of Incorporation.

- State the duration: Indicate whether the corporation will exist perpetually or for a specific period.

- Sign the form: Ensure that all incorporators sign the form where required. Their signatures confirm the accuracy of the information provided.

- Prepare for submission: Review the completed form for any errors or omissions. Gather any additional documents required for submission.

- Submit the form: Send the completed Articles of Incorporation form along with the filing fee to the New York Department of State by mail or in person.

Misconceptions

Understanding the New York Articles of Incorporation form is essential for anyone looking to start a business in the state. However, several misconceptions can lead to confusion. Here are six common misunderstandings:

- Misconception 1: You need to have a physical office in New York.

- Misconception 2: The Articles of Incorporation is the only document needed to start a business.

- Misconception 3: Incorporating in New York is a quick and easy process.

- Misconception 4: You can change your business name after incorporation without any issues.

- Misconception 5: All businesses must incorporate in New York.

- Misconception 6: You cannot dissolve an incorporated business once it’s established.

Many believe that incorporating in New York requires a physical office presence. In reality, you can incorporate in New York even if your business operates elsewhere, as long as you have a registered agent in the state.

Some people think that filing the Articles of Incorporation is all that’s necessary. However, additional documents, like bylaws and tax registrations, may also be required to fully establish your business.

While the process can be straightforward, it often involves various steps that can take time. Depending on the complexity of your business and the accuracy of your paperwork, delays can occur.

Some think changing the business name post-incorporation is simple. However, it requires filing an amendment to your Articles of Incorporation and may involve additional fees.

Not every business needs to incorporate. Sole proprietorships and partnerships, for example, can operate without formal incorporation, though there are benefits to doing so.

Many believe that once a business is incorporated, it’s permanent. In fact, businesses can be dissolved if they are no longer operational or if the owners choose to close them.