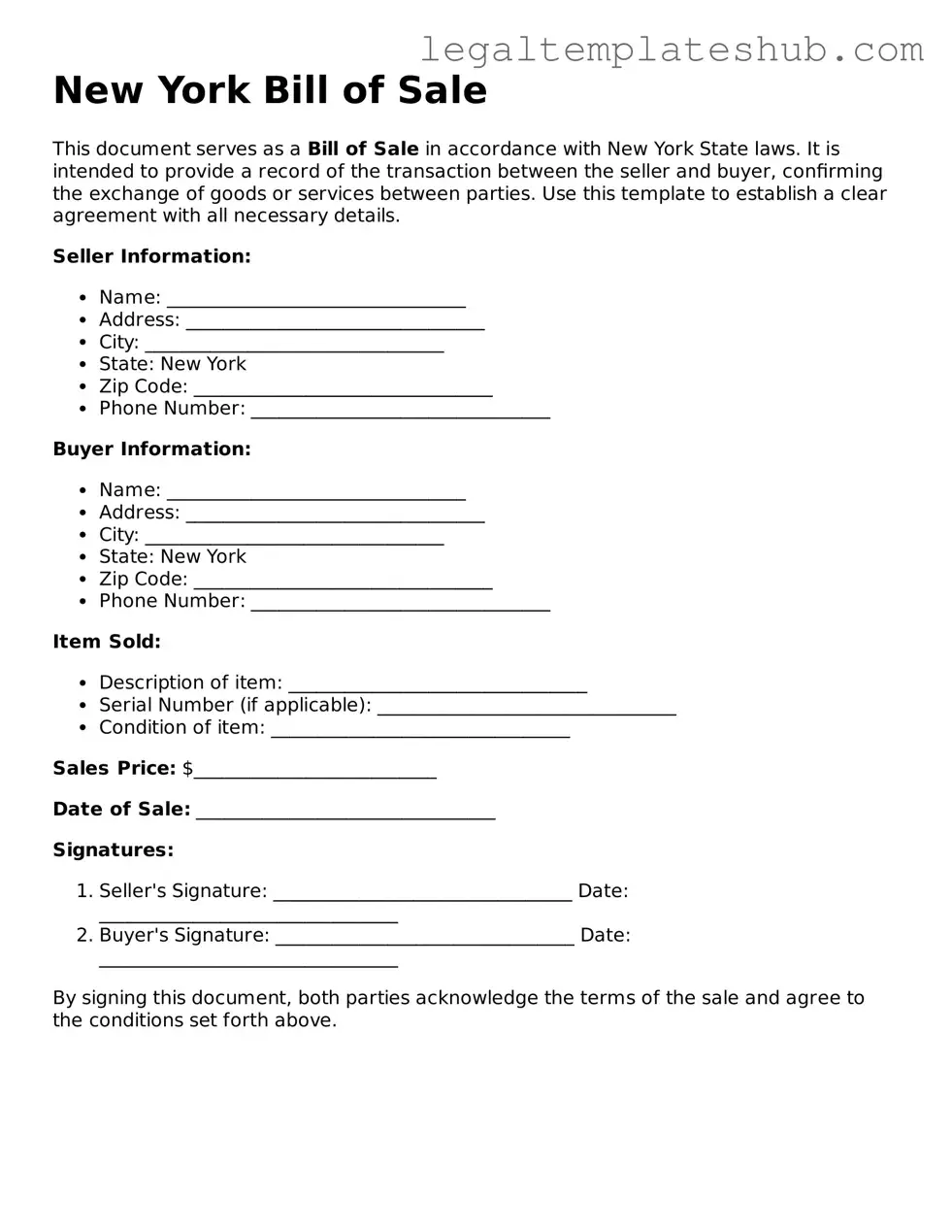

Printable Bill of Sale Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Purpose | A Bill of Sale serves as a legal document that transfers ownership of personal property from one party to another. |

| Governing Law | The New York Bill of Sale is governed by the New York General Obligations Law. |

| Types of Property | This form can be used for various types of personal property, including vehicles, equipment, and other tangible items. |

| Notarization | While notarization is not mandatory in New York, it is recommended for added legal protection. |

| Information Required | The form typically requires details such as the names of the buyer and seller, a description of the item, and the sale price. |

| As-Is Clause | Buyers should be aware that many Bills of Sale include an "as-is" clause, indicating that the seller is not responsible for defects after the sale. |

| Record Keeping | Both parties should retain a copy of the Bill of Sale for their records, as it serves as proof of the transaction. |

| Transfer of Title | For certain items, such as vehicles, the Bill of Sale may also facilitate the transfer of title, which is necessary for registration purposes. |

Key takeaways

When filling out and using the New York Bill of Sale form, several important considerations come into play. Here are key takeaways to keep in mind:

- Accurate Information: Ensure that all details, including the names of the buyer and seller, the date of sale, and a description of the item being sold, are accurate and complete.

- Consideration: The Bill of Sale should clearly state the purchase price or other consideration exchanged for the item. This establishes the value of the transaction.

- Signatures: Both the buyer and seller must sign the document. This provides proof of the agreement and can help avoid disputes later on.

- Record Keeping: Keep a copy of the Bill of Sale for personal records. This document may be necessary for future reference, especially for tax purposes or if any legal issues arise.

Dos and Don'ts

When filling out the New York Bill of Sale form, it’s essential to approach the task with care. Here are some important dos and don’ts to keep in mind:

- Do ensure that all information is accurate and complete. Double-check names, addresses, and item descriptions.

- Do include the date of the transaction. This helps establish a timeline for both parties.

- Do provide a clear description of the item being sold, including any serial numbers or identifying features.

- Do sign the document. Both the buyer and seller should sign to validate the transaction.

- Don’t leave any fields blank. If something doesn’t apply, indicate that clearly.

- Don’t use vague language. Be specific about the condition of the item and any warranties or guarantees.

- Don’t forget to keep a copy of the completed Bill of Sale for your records.

- Don’t rush through the process. Take your time to ensure everything is filled out correctly.

More Bill of Sale State Templates

Wa Bill of Sale - The Bill of Sale is not only important for legal reasons but also for personal record-keeping.

An Arizona Bill of Sale is a legal document used to transfer ownership of an item from one person to another. This form provides essential details about the transaction, including the parties involved and a description of the item being sold. For a smooth and secure transfer, consider filling out the form by clicking the button below, or you can refer to the Property Sale Agreement for further guidance.

Bill of Sale for Car Virginia - Many people find it useful to have a Bill of Sale when buying or selling high-value items.

Instructions on Filling in New York Bill of Sale

After obtaining the New York Bill of Sale form, it’s essential to fill it out accurately. This document serves as proof of a transaction between a buyer and a seller. Ensure all information is complete and correct to avoid any future disputes.

- Download the Form: Access the New York Bill of Sale form from a reliable source or your local government website.

- Identify the Parties: Fill in the full names and addresses of both the seller and the buyer. Make sure to provide accurate information for both parties.

- Describe the Item: Clearly describe the item being sold. Include details such as make, model, year, and any identifying numbers (like VIN for vehicles).

- Specify the Sale Price: Write down the agreed-upon sale price. Ensure this amount is clearly stated and easy to read.

- Include the Date: Enter the date of the transaction. This is crucial for record-keeping purposes.

- Signatures: Both the buyer and the seller must sign the document. This confirms that both parties agree to the terms outlined in the Bill of Sale.

- Notarization (if required): Depending on the type of item sold, you may need to have the document notarized. Check local requirements to ensure compliance.

Once completed, keep copies for your records. The buyer should receive the original Bill of Sale as proof of ownership. This document may be necessary for registration or insurance purposes, so handle it with care.

Misconceptions

When it comes to the New York Bill of Sale form, there are several misconceptions that can lead to confusion. Understanding these misconceptions can help ensure a smoother transaction process. Below is a list of common misunderstandings:

- It is only for vehicle sales. Many people believe the Bill of Sale is solely for transferring ownership of vehicles. In reality, it can be used for various types of personal property, including boats, furniture, and equipment.

- A Bill of Sale is not legally required. While it is not always mandatory, having a Bill of Sale provides proof of the transaction and can be essential for record-keeping and legal purposes, especially in disputes.

- All Bills of Sale are the same. Not all Bills of Sale are created equal. Different types of transactions may require specific information to be included, and variations exist depending on the nature of the sale.

- Only the seller needs to sign. Some believe that only the seller's signature is necessary. In fact, both the buyer and seller should sign the Bill of Sale to validate the agreement.

- It doesn't need to be notarized. While notarization is not always required, having the document notarized can add an extra layer of authenticity and protection for both parties.

- It is not necessary for private sales. Even in private sales, a Bill of Sale is beneficial. It serves as a formal record of the transaction and can help avoid misunderstandings in the future.

- Once signed, it cannot be changed. While a Bill of Sale is a binding agreement, amendments can be made if both parties agree to the changes. It is important to document any alterations properly.

Understanding these misconceptions can help individuals navigate the process of buying or selling personal property in New York more effectively. Always consider consulting with a knowledgeable professional if there are any uncertainties.