Printable Deed Document for New York

PDF Form Data

| Fact Name | Details |

|---|---|

| Purpose | The New York Deed form is used to transfer ownership of real property in New York State. |

| Types of Deeds | Common types include Warranty Deeds, Quitclaim Deeds, and Bargain and Sale Deeds. |

| Governing Law | The transfer of property is governed by New York Real Property Law. |

| Signature Requirement | The deed must be signed by the grantor in the presence of a notary public. |

| Recording | To protect the buyer's interest, the deed should be recorded in the county where the property is located. |

| Consideration | The deed must state the consideration, or payment, for the property transfer. |

Key takeaways

When filling out and using the New York Deed form, there are several important points to keep in mind. Understanding these can help ensure that the process goes smoothly and that the deed is legally valid.

- Correct Form Selection: Choose the appropriate type of deed based on your needs, such as a warranty deed or a quitclaim deed.

- Accurate Information: Ensure all parties' names, addresses, and property details are correctly entered to avoid future disputes.

- Legal Description: Include a precise legal description of the property. This is crucial for identifying the property being transferred.

- Signatures Required: The deed must be signed by the grantor (the person transferring the property) and, in some cases, the grantee (the person receiving the property).

- Witnesses and Notary: Depending on the type of deed, you may need one or more witnesses and a notary public to validate the signatures.

- Recording the Deed: After completion, the deed should be recorded with the county clerk’s office to make the transfer public and protect your ownership rights.

- Transfer Taxes: Be aware of any transfer taxes that may apply when transferring property in New York.

- Consultation Recommended: It is advisable to consult with a real estate attorney to ensure compliance with local laws and regulations.

- Keep Copies: Retain copies of the completed deed for your records and future reference.

Dos and Don'ts

When filling out the New York Deed form, it's important to follow certain guidelines to ensure accuracy and compliance. Here’s a list of things you should and shouldn't do:

- Do double-check the names of all parties involved. Make sure they are spelled correctly.

- Don't leave any sections blank. If a section doesn't apply, write "N/A" or "Not Applicable."

- Do use clear and legible handwriting or type the information if possible.

- Don't forget to include the legal description of the property. This is crucial for identification.

- Do ensure the form is signed by all necessary parties. Signatures must be original.

- Don't use correction fluid or tape on the form. If you make a mistake, start over with a new form.

- Do include the date of the transaction. This helps establish the timeline of ownership.

- Don't overlook the need for notarization. Most deeds require a notary public's signature.

- Do keep a copy of the completed deed for your records. This is important for future reference.

- Don't forget to file the deed with the appropriate county office after completion. This is essential for it to be legally recognized.

More Deed State Templates

Texas Deed Transfer Form - Deeds can vary in complexity based on the property's nature.

When engaging in a vehicle transaction, it's essential to have a clear understanding of the necessary documentation, particularly the California Vehicle Purchase Agreement form, which you can find more about at https://californiapdf.com/editable-vehicle-purchase-agreement/. This form not only establishes the terms of the sale but also protects both the buyer and seller by outlining their rights and obligations.

Discharge of Mortgage Form Nj - A properly executed deed legally binds the parties involved in the property transaction.

Nc Deed Transfer Form - A Deed is an important step in real estate transactions.

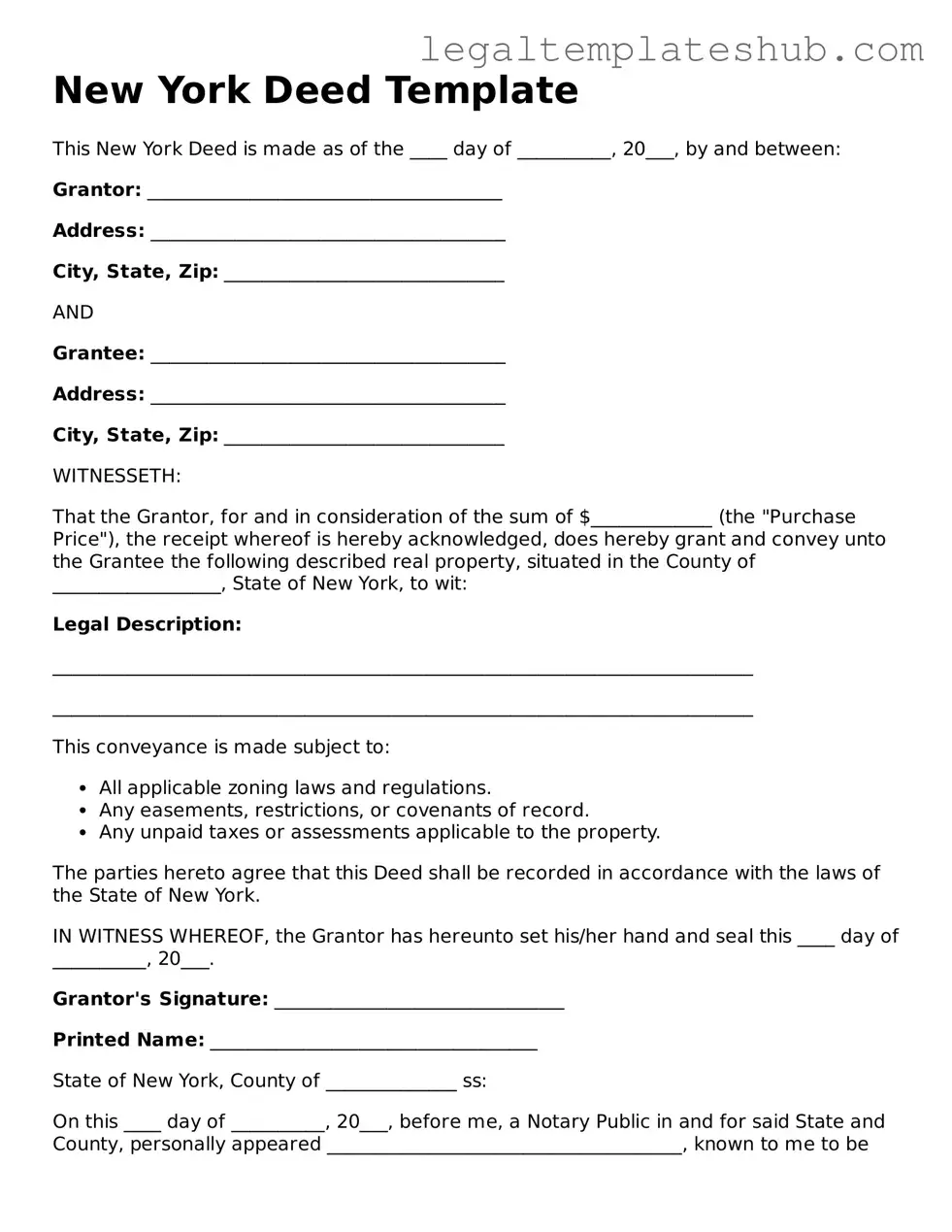

Instructions on Filling in New York Deed

After gathering the necessary information, you are ready to fill out the New York Deed form. Completing this form accurately is crucial for ensuring that the property transfer is legally recognized. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form. Use the format MM/DD/YYYY.

- Next, provide the name of the grantor (the person transferring the property). Include the full legal name as it appears on official documents.

- Then, enter the address of the grantor. Make sure to include the city, state, and ZIP code.

- Identify the grantee (the person receiving the property) by writing their full legal name in the designated section.

- Fill in the grantee's address, including city, state, and ZIP code.

- Next, describe the property being transferred. Include the street address and any relevant details that identify the property clearly.

- Indicate the type of property transfer by checking the appropriate box (e.g., sale, gift, inheritance).

- Provide the consideration amount, which is the value exchanged for the property. This is often the sale price or the value of the gift.

- Sign the form where indicated. The grantor must sign in the presence of a notary public.

- Finally, have the notary public complete their section, including their signature, seal, and the date of notarization.

Once the form is completed and notarized, it can be filed with the appropriate county clerk's office. This step is essential for making the property transfer official and ensuring that the deed is recorded in public records.

Misconceptions

When it comes to New York Deed forms, there are several misconceptions that can lead to confusion. Here are nine common myths, along with explanations to clarify the truth.

- All Deeds Are the Same: Many people think that all deeds serve the same purpose. In reality, there are different types of deeds, such as warranty deeds and quitclaim deeds, each with its own legal implications and protections.

- A Deed Is Just a Piece of Paper: While a deed is indeed a document, it carries significant legal weight. It formally transfers ownership of property and must be executed correctly to be valid.

- You Don’t Need a Lawyer: Some believe that they can handle a deed transfer without legal assistance. Although it’s possible, having a lawyer can help ensure that all legal requirements are met and that your rights are protected.

- Only the Seller Signs the Deed: It’s a common misconception that only the seller needs to sign the deed. In fact, both the seller and the buyer typically need to sign the document to complete the transfer of ownership.

- Verbal Agreements Are Sufficient: Some think that a verbal agreement is enough to transfer property. However, a deed must be in writing to be legally enforceable in New York.

- Once a Deed Is Signed, It Cannot Be Changed: While changing a deed can be complicated, it is possible to amend or create a new deed if necessary. However, this process must be done according to legal guidelines.

- Deeds Don’t Need to Be Recorded: Many people assume that recording a deed is optional. In New York, recording is crucial as it provides public notice of ownership and protects against future claims.

- All Deeds Are Automatically Valid: Just because a deed is signed doesn’t mean it’s automatically valid. It must meet specific legal requirements, including proper execution and notarization.

- Once You Have a Deed, You Own the Property Forever: Ownership can be challenged, especially if there are liens or other claims against the property. It’s important to ensure that the title is clear and free of encumbrances.

Understanding these misconceptions can help you navigate the process of property transfer more effectively. Always consider seeking professional guidance to ensure a smooth transaction.