Printable Deed in Lieu of Foreclosure Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A deed in lieu of foreclosure allows a borrower to transfer property ownership to the lender to avoid foreclosure. |

| Governing Law | This process is governed by New York Real Property Actions and Proceedings Law (RPAPL) and New York State General Obligations Law. |

| Eligibility | Homeowners facing financial difficulties may qualify, but they must typically be in default on their mortgage. |

| Benefits | It can help borrowers avoid the lengthy foreclosure process and reduce the impact on their credit score. |

| Process | The borrower must negotiate with the lender and provide necessary documentation before the deed is transferred. |

| Impact on Debt | In some cases, the lender may forgive the remaining mortgage debt, but this is not guaranteed and should be discussed upfront. |

Key takeaways

When dealing with the New York Deed in Lieu of Foreclosure form, it’s essential to understand its implications and the process involved. Here are five key takeaways to keep in mind:

- Understanding the Purpose: A Deed in Lieu of Foreclosure allows a homeowner to voluntarily transfer ownership of their property to the lender to avoid foreclosure. This can help mitigate the impact on your credit score.

- Eligibility Requirements: Not all homeowners qualify. Lenders typically require that the borrower is in default and that the property is free of other liens. Check with your lender for specific criteria.

- Legal Implications: Once the deed is signed, the homeowner relinquishes all rights to the property. It’s crucial to understand the long-term consequences before proceeding.

- Consulting a Professional: Before filling out the form, consider seeking advice from a legal expert or a real estate professional. They can provide guidance tailored to your situation.

- Document Preparation: Ensure all necessary documents are completed accurately. This includes the Deed in Lieu of Foreclosure form and any additional paperwork required by your lender.

Taking these steps can help navigate the process more smoothly and ensure that you are making informed decisions regarding your property.

Dos and Don'ts

When filling out the New York Deed in Lieu of Foreclosure form, it's important to follow specific guidelines. Here’s a list of what to do and what to avoid:

- Do read the entire form carefully before starting.

- Do ensure all information is accurate and complete.

- Do include all necessary signatures from all parties involved.

- Do consult with a legal professional if you have questions.

- Do keep copies of all documents for your records.

- Don't rush through the form; take your time to avoid mistakes.

- Don't leave any sections blank unless instructed to do so.

- Don't forget to notarize the document if required.

- Don't submit the form without double-checking for errors.

- Don't ignore deadlines for submission.

More Deed in Lieu of Foreclosure State Templates

Deed in Lieu Vs Foreclosure - Homeowners should be informed about potential tax implications of this deed.

In addition to outlining the management structure of your LLC, the New York Operating Agreement allows members to define their roles and responsibilities clearly, making it essential for smooth operations. To facilitate this process, resources like PDF Templates can be invaluable in ensuring that all necessary details are accurately captured and compliant with state requirements.

Foreclosure Vs Deed in Lieu - Each lender may have its own requirements and protocols for accepting a Deed in Lieu.

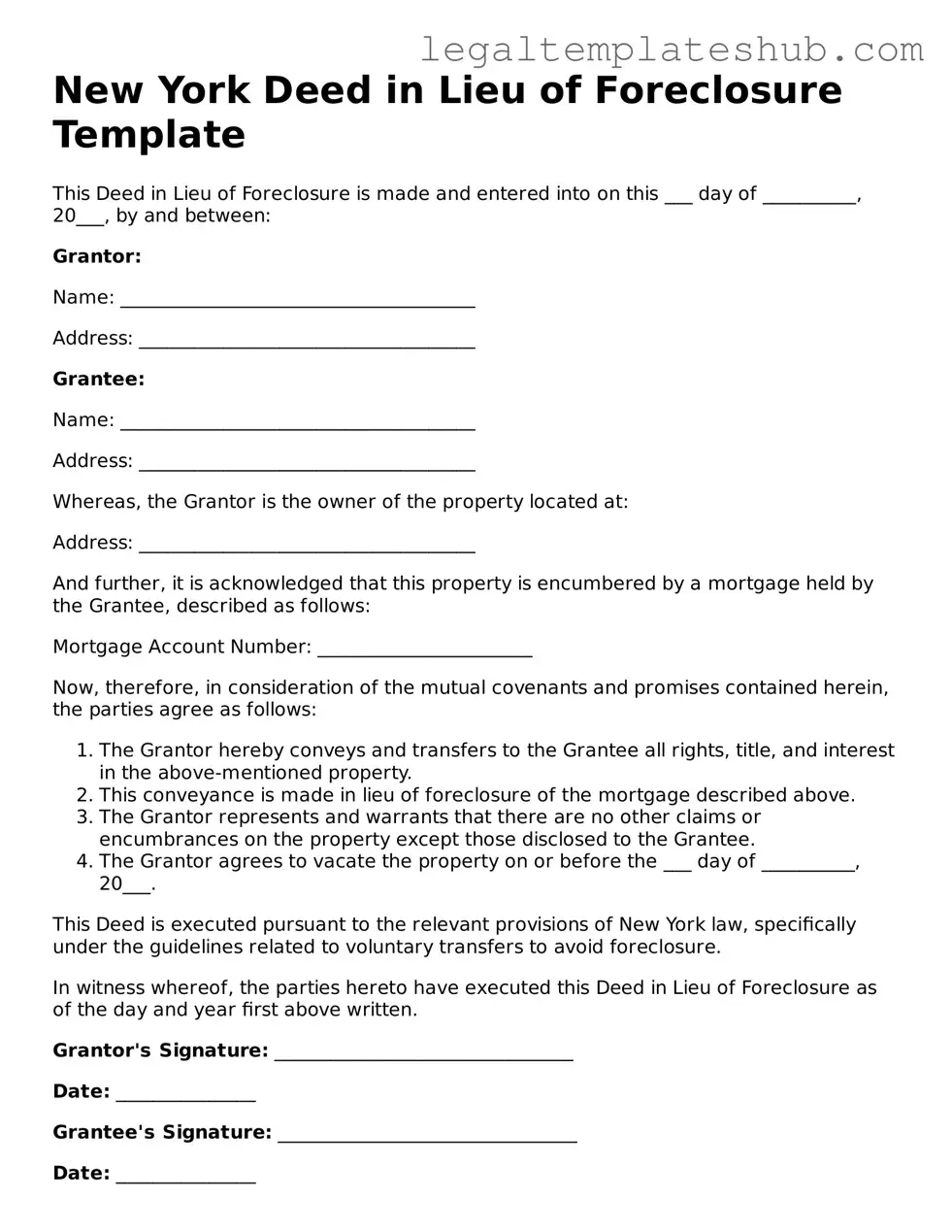

Instructions on Filling in New York Deed in Lieu of Foreclosure

After you have decided to proceed with the Deed in Lieu of Foreclosure, it’s important to complete the form accurately. This document will transfer ownership of the property back to the lender, so it’s essential to ensure that all information is filled out correctly. Here’s how to fill out the form step by step.

- Obtain the form: You can find the New York Deed in Lieu of Foreclosure form online or through your lender.

- Fill in the property details: Enter the full address of the property, including the city, state, and zip code.

- Provide your information: Include your name, address, and any other required personal details. Make sure this matches the information on your mortgage documents.

- Identify the lender: Write the name and address of the lender who will receive the deed.

- Include the legal description: This is a specific description of the property, often found in your mortgage documents. Ensure it is accurate to avoid any confusion.

- Sign the document: You will need to sign the form in the designated area. It’s often required to have a witness or notary public present during this process.

- Submit the form: Once completed, submit the form to your lender. Keep a copy for your records.

After submitting the form, the lender will review it and process the transfer of ownership. It’s a good idea to follow up to ensure everything is in order and to discuss any next steps with your lender.

Misconceptions

Understanding the New York Deed in Lieu of Foreclosure form can be challenging due to several misconceptions. Here are ten common misunderstandings:

- It eliminates all debt immediately. Many believe that signing a deed in lieu of foreclosure wipes out all mortgage debt. However, it only transfers ownership of the property to the lender and does not necessarily eliminate any remaining debt.

- It's the same as a foreclosure. While both processes involve the lender taking possession of the property, a deed in lieu is a voluntary agreement, whereas foreclosure is a legal action initiated by the lender.

- It affects credit score less than foreclosure. Some think a deed in lieu has a lesser impact on credit scores compared to foreclosure. In reality, both can significantly damage credit, often resulting in similar effects.

- It's an easy way out of financial trouble. Many assume that a deed in lieu is a quick fix. In truth, it requires negotiation and approval from the lender, which can be a lengthy process.

- All lenders accept deeds in lieu. Not every lender offers this option. Some institutions may prefer to proceed with foreclosure, making it essential to check with the lender first.

- It releases all liability for the property. Signing a deed in lieu may not absolve the homeowner from all liabilities, particularly if there are second mortgages or other liens on the property.

- It guarantees a smooth transition. While it can simplify the process of leaving a property, complications can still arise, such as disagreements over property condition or unresolved debts.

- It is only for homeowners in dire financial situations. Some believe that only those facing severe financial hardship can use a deed in lieu. However, it can also be an option for those who simply want to avoid the foreclosure process.

- It can be done without legal advice. Many think they can navigate the process alone. However, consulting with a legal professional can help ensure that all terms are understood and rights are protected.

- It has no tax implications. Some homeowners think that a deed in lieu is free of tax consequences. However, there may be tax liabilities related to debt forgiveness, which should be considered.