Printable Durable Power of Attorney Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A Durable Power of Attorney in New York allows an individual (the principal) to appoint someone else (the agent) to make financial and legal decisions on their behalf, even if they become incapacitated. |

| Governing Law | The Durable Power of Attorney in New York is governed by the New York General Obligations Law, specifically Section 5-1501 et seq. |

| Durability | This form remains effective even if the principal becomes incapacitated, which distinguishes it from a standard power of attorney that would terminate in such circumstances. |

| Agent's Authority | The agent can be granted broad or limited powers, depending on the principal's wishes. This can include managing finances, real estate transactions, and legal matters. |

| Execution Requirements | To be valid, the Durable Power of Attorney must be signed by the principal and acknowledged by a notary public. It is advisable to have witnesses as well. |

| Revocation | The principal can revoke the Durable Power of Attorney at any time, as long as they are mentally competent to do so. Revocation should be documented in writing. |

Key takeaways

Filling out and using the New York Durable Power of Attorney form is an important step in ensuring that your financial and legal matters are handled according to your wishes, especially if you become unable to manage them yourself. Here are some key takeaways to consider:

- Understand the Purpose: A Durable Power of Attorney allows you to designate someone to act on your behalf in financial matters, even if you become incapacitated.

- Choose Your Agent Wisely: Select a trusted individual who is responsible and capable of making decisions in your best interest.

- Specify Powers Clearly: Clearly outline the powers you are granting to your agent. This can include managing bank accounts, paying bills, and handling investments.

- Consider Limitations: You have the option to limit the powers of your agent. If there are specific areas you do not want them to handle, make sure to state those explicitly.

- Sign and Date the Form: The form must be signed and dated by you in the presence of a notary public. This adds a layer of legal validity to the document.

- Notify Your Agent: Once the form is completed, inform your agent that they have been designated. This ensures they are prepared to act when needed.

- Keep Copies: Maintain copies of the signed document in a safe place and provide copies to your agent and any relevant financial institutions.

- Review Regularly: Periodically review the document to ensure it still reflects your wishes, especially after major life events.

- Understand Revocation: You can revoke the Durable Power of Attorney at any time, as long as you are mentally competent. Ensure you follow the proper procedures for revocation.

Being informed about the Durable Power of Attorney form can provide peace of mind. It ensures that your affairs will be managed according to your preferences, safeguarding your interests during challenging times.

Dos and Don'ts

When filling out the New York Durable Power of Attorney form, it's important to follow specific guidelines to ensure that the document is valid and effective. Here are six things you should and shouldn't do:

- Do: Clearly identify the principal, the person granting the power, and the agent, the person receiving the power.

- Do: Specify the powers being granted to the agent. This helps avoid confusion later.

- Do: Sign the form in the presence of a notary public to ensure it is legally binding.

- Do: Keep a copy of the completed form for your records and provide copies to your agent.

- Don't: Leave any sections blank. Incomplete forms may be considered invalid.

- Don't: Use outdated forms. Always use the most current version to comply with legal requirements.

More Durable Power of Attorney State Templates

Pa Durable Power of Attorney - You can choose someone who knows your wishes best to act for you.

Free Michigan Power of Attorney Forms to Print - The Durable Power of Attorney can encompass a wide range of decision-making areas, including financial and healthcare matters.

When it comes to mitigating risks in potentially hazardous activities, utilizing a Release of Liability form is essential. This legal document, which can be easily obtained through sources like PDF Templates, ensures that individuals recognize the inherent risks and agree not to pursue legal action against other parties involved. Understanding the significance of this form not only provides a layer of protection but also fosters a sense of responsibility among participants.

How to Get Power of Attorney in Nc - It can be revoked or amended whenever you’re capable, ensuring your authority remains in your hands as long as you wish.

How to Get Power of Attorney in Nj - You can specify what powers your agent has in the document.

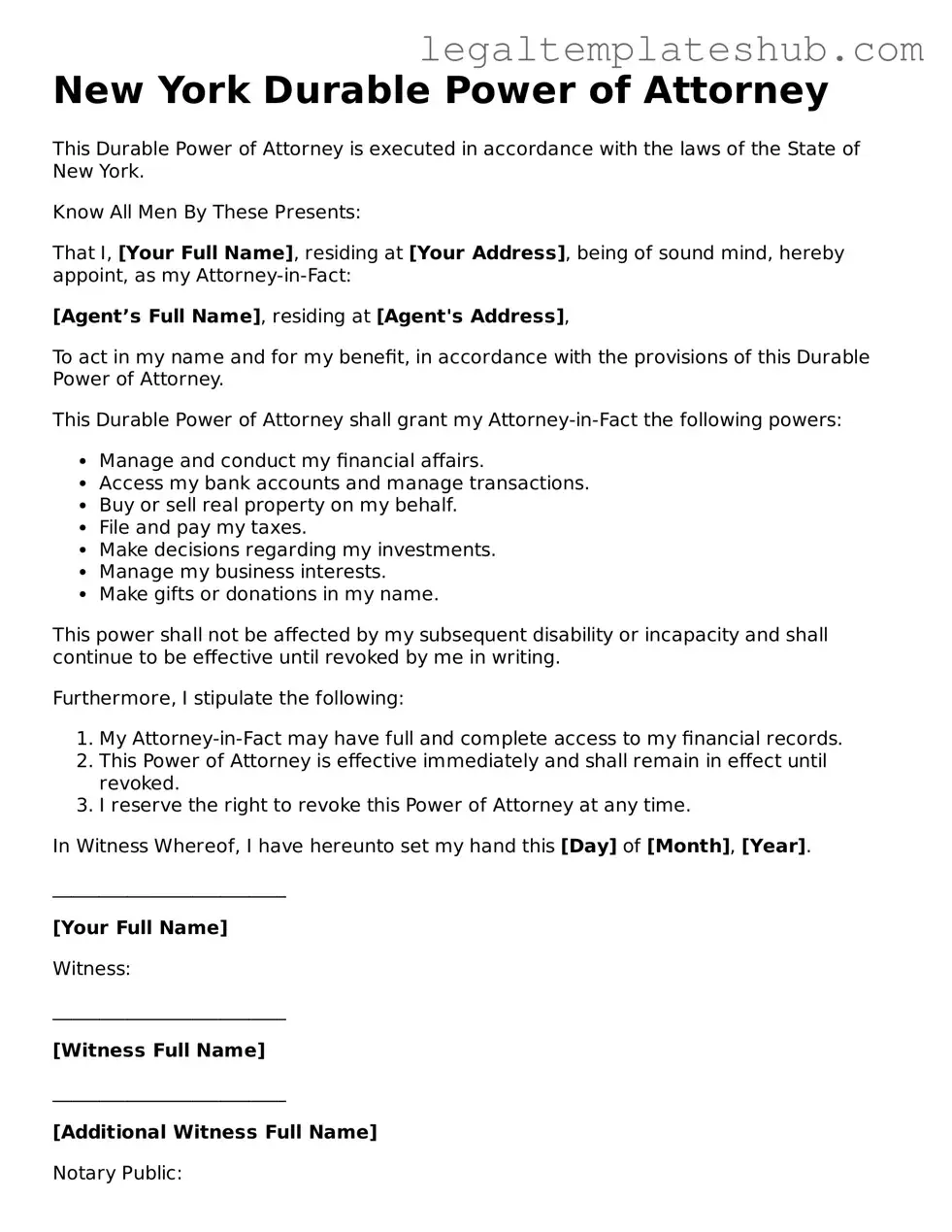

Instructions on Filling in New York Durable Power of Attorney

Filling out the New York Durable Power of Attorney form is a straightforward process that allows you to designate someone to make financial decisions on your behalf. Before starting, gather the necessary information and ensure you understand the responsibilities involved. Follow the steps below to complete the form accurately.

- Obtain the New York Durable Power of Attorney form. You can download it from the New York State government website or request a physical copy from a legal office.

- Begin by filling in your name and address in the designated sections at the top of the form. This identifies you as the principal.

- Next, clearly write the name and address of the person you are appointing as your agent. This individual will have the authority to act on your behalf.

- Decide if you want to grant your agent broad powers or limit their authority to specific tasks. Indicate your choice by checking the appropriate boxes on the form.

- In the section that outlines the powers granted, review the options carefully. You may choose to grant your agent powers related to real estate, banking, investments, and more. Mark the boxes that apply.

- If you wish to include any additional instructions or limitations, write them in the space provided on the form.

- Sign and date the form in the designated area. Your signature must be witnessed by at least one individual who is not your agent.

- Have your signature notarized. This step adds an additional layer of verification to the document.

- Provide copies of the completed form to your agent, any relevant financial institutions, and keep one for your records.

After completing the form, ensure that all parties involved understand their roles and responsibilities. Keeping open communication with your agent can help facilitate smooth decision-making in the future.

Misconceptions

Many people have misunderstandings about the New York Durable Power of Attorney form. Here are nine common misconceptions, along with clarifications to help you understand this important legal document.

- Misconception 1: A Durable Power of Attorney is only for elderly people.

- Misconception 2: The agent can do anything they want with my money.

- Misconception 3: A Durable Power of Attorney is the same as a regular Power of Attorney.

- Misconception 4: I can’t change my Durable Power of Attorney once it’s signed.

- Misconception 5: My agent has to be a lawyer.

- Misconception 6: The Durable Power of Attorney will automatically end when I die.

- Misconception 7: I need to file my Durable Power of Attorney with the court.

- Misconception 8: A Durable Power of Attorney is only for financial matters.

- Misconception 9: Once I give someone a Durable Power of Attorney, I lose control over my affairs.

This is not true. Anyone can create a Durable Power of Attorney, regardless of age. It is a useful tool for anyone who wants to ensure their financial matters are managed if they become unable to do so.

While the agent has significant authority, they must act in your best interest. They are bound by a fiduciary duty to manage your finances responsibly and ethically.

A Durable Power of Attorney remains effective even if you become incapacitated, while a regular Power of Attorney does not. This distinction is crucial for long-term planning.

You can revoke or change your Durable Power of Attorney at any time, as long as you are mentally competent. It’s important to keep your documents up to date.

This is false. You can choose anyone you trust to be your agent, including family members or friends. However, they should be responsible and capable of managing your affairs.

This is correct. Once you pass away, the Durable Power of Attorney becomes void. Your estate will then be managed according to your will or state laws.

You do not need to file this document with the court. It should be kept in a safe place, and copies should be given to your agent and any relevant financial institutions.

While it primarily deals with financial decisions, it can also grant authority over certain health care decisions if you include those provisions in the document.

This is a common fear, but you retain control. You can still manage your own affairs as long as you are capable. The agent steps in only when you cannot make decisions for yourself.