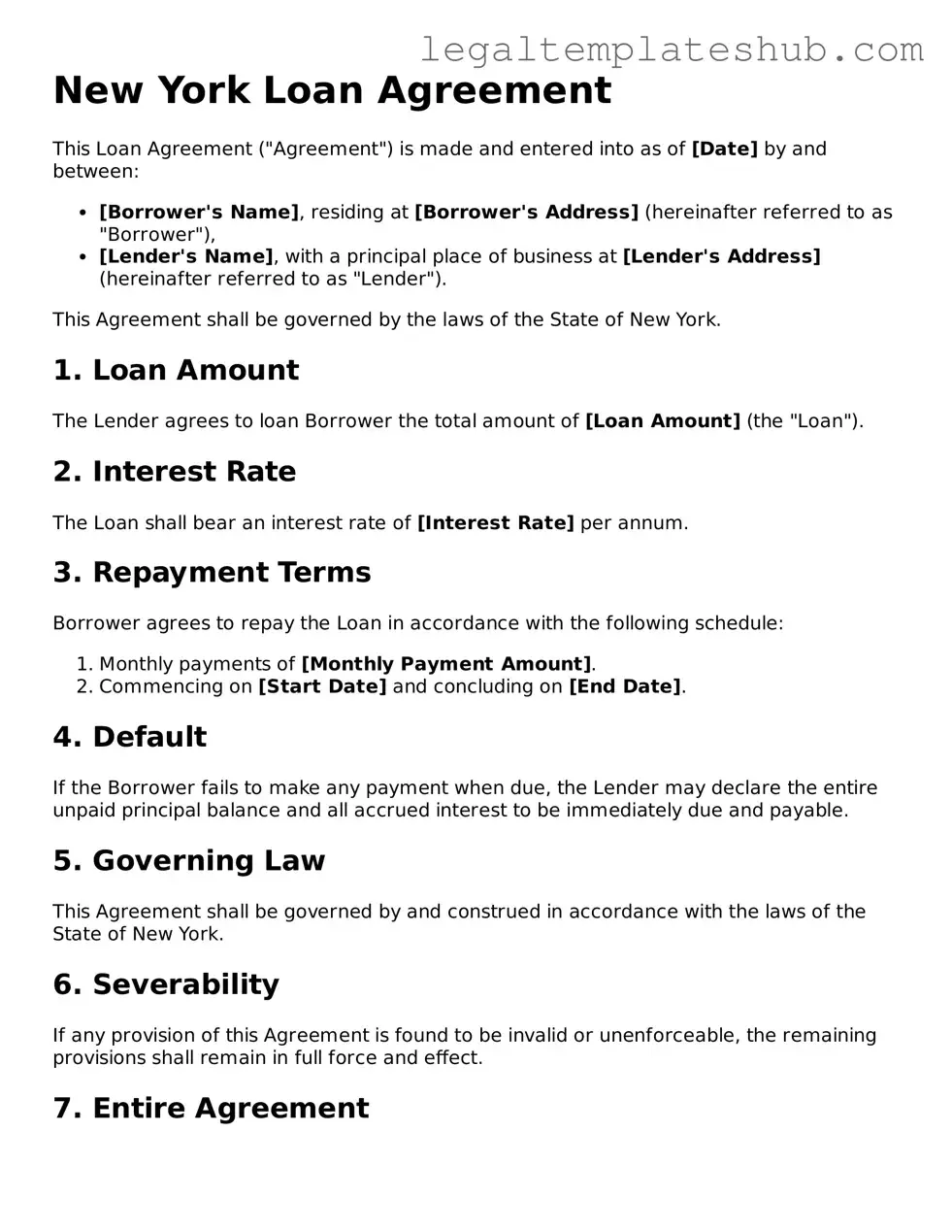

Printable Loan Agreement Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The New York Loan Agreement is governed by the laws of the State of New York. |

| Purpose | This form is used to outline the terms and conditions of a loan between a lender and a borrower. |

| Key Components | It typically includes details such as loan amount, interest rate, repayment schedule, and default terms. |

| Signatures Required | Both the lender and borrower must sign the agreement for it to be legally binding. |

| Amendments | Any changes to the agreement must be documented in writing and signed by both parties. |

Key takeaways

Filling out a New York Loan Agreement form requires careful attention to detail. Here are some key takeaways to keep in mind:

- Ensure that all parties involved are clearly identified. Include full names and addresses.

- Specify the loan amount. Clearly state the principal sum being borrowed.

- Outline the interest rate. Indicate whether it is fixed or variable and provide the percentage.

- Define the repayment terms. Include the schedule for payments and the duration of the loan.

- Include any late fees or penalties. Clearly state the consequences for late payments.

- Detail any collateral involved. If applicable, specify what assets secure the loan.

- Include a clause for default. Explain the actions that can be taken if the borrower fails to repay.

- Make sure to sign and date the agreement. Both parties should sign to make it legally binding.

- Consider having the agreement notarized. This adds an extra layer of security and authenticity.

- Keep a copy for your records. Both parties should retain signed copies of the agreement.

Understanding these points will help ensure that the Loan Agreement is filled out correctly and used effectively.

Dos and Don'ts

When filling out the New York Loan Agreement form, it is essential to approach the task with care and attention to detail. Below are some important dos and don’ts to keep in mind:

- Do read the entire form thoroughly before starting.

- Do ensure all personal information is accurate and up-to-date.

- Do provide clear and legible handwriting if filling out the form by hand.

- Do double-check all numbers and calculations for accuracy.

- Do sign and date the form where required.

- Don't leave any required fields blank.

- Don't use correction fluid or tape to fix mistakes; instead, cross out the error and initial it.

- Don't rush through the form; take your time to ensure everything is correct.

- Don't forget to keep a copy of the completed form for your records.

By following these guidelines, you can help ensure that your Loan Agreement form is completed correctly and efficiently.

More Loan Agreement State Templates

Texas Promissory Note - It may spell out collateral if the loan is secured against an asset.

For those looking to streamline the process of completing their motorcycle ownership transfer, utilizing resources like PDF Templates can be highly beneficial, ensuring that all necessary information is captured correctly and efficiently.

Instructions on Filling in New York Loan Agreement

Filling out the New York Loan Agreement form requires careful attention to detail. Each section must be completed accurately to ensure that all parties understand their rights and obligations. After completing the form, it will be necessary to review it for any errors before signing.

- Obtain a copy of the New York Loan Agreement form from a reliable source.

- Begin by entering the date at the top of the form.

- Fill in the names and addresses of all parties involved in the loan agreement.

- Clearly specify the loan amount in the designated space.

- Indicate the interest rate and any applicable fees associated with the loan.

- Outline the repayment schedule, including the due dates and payment amounts.

- Provide details about any collateral, if applicable.

- Include any additional terms or conditions that both parties have agreed upon.

- Review the completed form for accuracy and completeness.

- Have all parties sign and date the form in the designated areas.

Misconceptions

When it comes to the New York Loan Agreement form, many misunderstandings can lead to confusion. Here are nine common misconceptions, clarified for better understanding.

-

All loan agreements are the same.

Many believe that loan agreements follow a one-size-fits-all model. In reality, each agreement can vary significantly based on the terms negotiated between the lender and borrower.

-

Verbal agreements are sufficient.

Some think that a verbal agreement suffices. However, having a written loan agreement provides legal protection and clarity for both parties.

-

Only banks can issue loan agreements.

It's a common belief that only financial institutions can provide loan agreements. In fact, private lenders and individuals can also create legally binding loan agreements.

-

Loan agreements are only for large sums of money.

Many assume that loan agreements are only necessary for substantial loans. However, even small personal loans can benefit from a formal agreement.

-

Once signed, a loan agreement cannot be changed.

Some people think that a signed agreement is set in stone. Modifications can be made if both parties agree, but they should be documented in writing.

-

Loan agreements are only for personal loans.

There's a misconception that loan agreements apply solely to personal loans. They are also used in business transactions, real estate, and other financial arrangements.

-

Loan agreements are too complicated to understand.

Many feel overwhelmed by the legal language in loan agreements. However, they can be straightforward, and it's important to read and understand all terms before signing.

-

All loan agreements require a lawyer.

Some believe that a lawyer is necessary for every loan agreement. While legal advice can be beneficial, many individuals can create simple agreements on their own.

-

Defaulting on a loan has no consequences.

Finally, some think that if they default on a loan, there are no repercussions. In reality, defaulting can lead to serious financial and legal consequences, including damage to credit scores.

Understanding these misconceptions can help you navigate loan agreements more effectively. Always take the time to read and understand your rights and obligations before entering into any financial agreement.