Printable Promissory Note Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A promissory note is a written promise to pay a specified amount of money to a designated person at a specified time or on demand. |

| Governing Law | The New York Uniform Commercial Code (UCC) governs promissory notes in New York. |

| Essential Elements | For a valid promissory note, it must include the amount, the payee, the payer, and the date of issuance. |

| Types of Notes | Promissory notes can be secured or unsecured, depending on whether collateral backs the loan. |

| Interest Rates | Interest rates on promissory notes can be fixed or variable and must comply with New York usury laws. |

| Transferability | Promissory notes are generally transferable, allowing the holder to sell or assign the note to another party. |

| Enforcement | If a borrower defaults, the lender can enforce the note through legal action to recover the owed amount. |

Key takeaways

Understand the purpose of a promissory note. This document serves as a written promise to pay a specific amount of money to another party.

Clearly identify the parties involved. Include the names and addresses of both the borrower and the lender to avoid confusion.

Specify the loan amount. Clearly state the exact dollar amount being borrowed to ensure both parties are on the same page.

Outline the interest rate. If applicable, include the interest rate, whether it is fixed or variable, and how it will be calculated.

Set a repayment schedule. Indicate when payments are due and the method of payment to ensure timely repayment.

Include any late fees or penalties. Clearly state the consequences of late payments to encourage adherence to the schedule.

Sign and date the document. Both parties should sign the promissory note and date it to confirm their agreement.

Dos and Don'ts

When filling out the New York Promissory Note form, it is crucial to follow specific guidelines to ensure accuracy and legality. Below are important dos and don'ts to consider:

- Do provide accurate information regarding the borrower and lender's names and addresses.

- Do clearly state the loan amount and the interest rate, if applicable.

- Do specify the repayment terms, including due dates and payment frequency.

- Do include any collateral details if the loan is secured.

- Do ensure both parties sign and date the document to validate it.

- Don't leave any blank spaces on the form; every section should be completed.

- Don't use vague language; be clear and specific in all terms.

- Don't forget to keep a copy of the signed note for your records.

- Don't overlook the importance of consulting a legal professional if unsure about any terms.

More Promissory Note State Templates

Nc Promissory Note - This form can be customized to include specific terms that meet the needs of both parties.

Promissory Note Washington State - Terms should be discussed and agreed upon by both parties before signing the note.

Creating a reliable Last Will and Testament is crucial for ensuring that your wishes are honored after your passing. This important document outlines how your properties and assets should be distributed, providing peace of mind for you and your loved ones.

Create Promissory Note - It’s important to keep a copy of the promissory note for record-keeping purposes.

How to Do a Promissory Note - For tax purposes, the interest payable on a promissory note may have implications that both parties should be aware of.

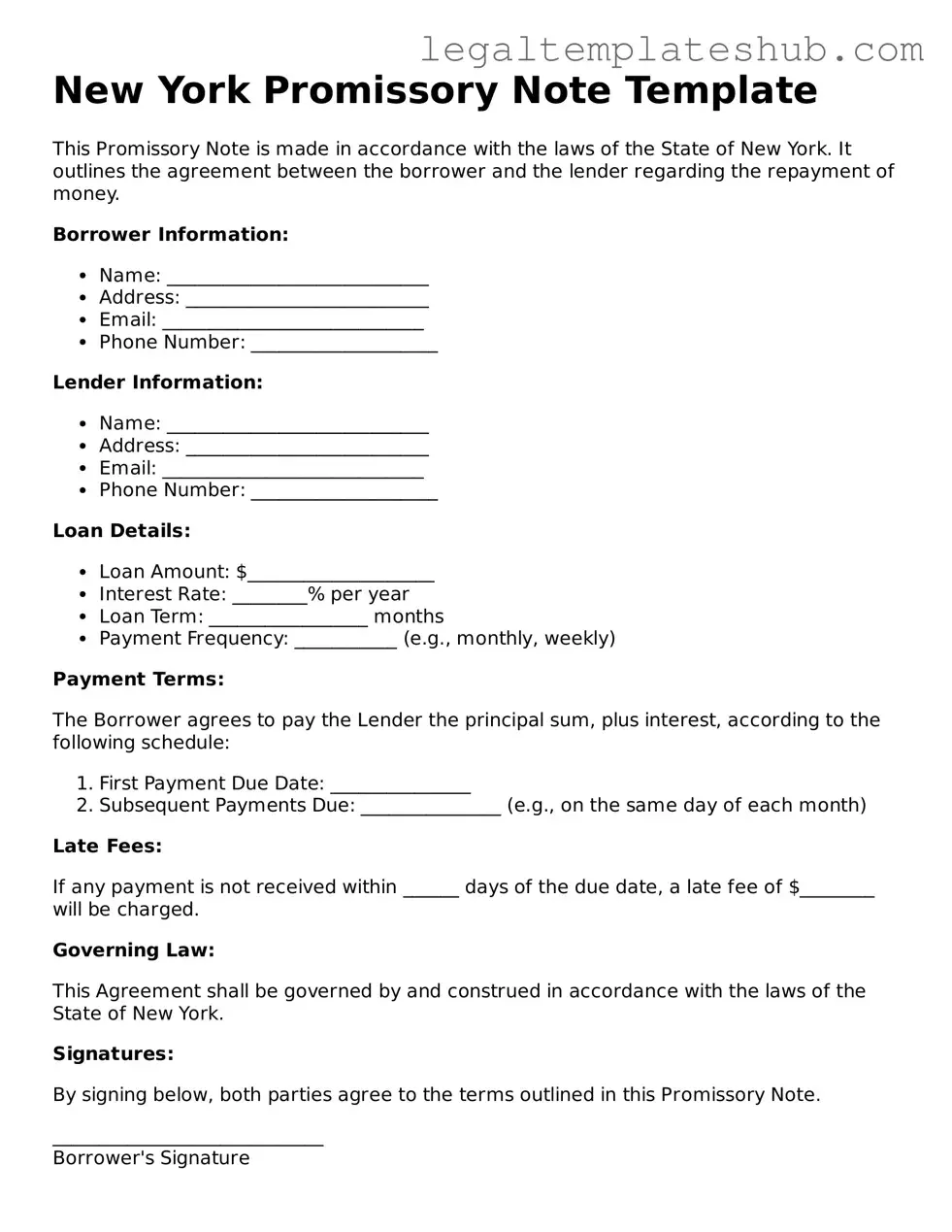

Instructions on Filling in New York Promissory Note

Once you have the New York Promissory Note form in hand, you will need to complete it accurately to ensure that all parties understand the terms of the agreement. Follow these steps carefully to fill out the form correctly.

- Begin by entering the date at the top of the form. This is the date when the note is being executed.

- Next, fill in the name and address of the borrower. This identifies the individual or entity that will be responsible for repaying the loan.

- Provide the name and address of the lender. This is the person or organization providing the loan.

- Specify the principal amount being borrowed. This is the total sum that the borrower agrees to repay.

- Indicate the interest rate. Clearly state the percentage that will be charged on the unpaid principal balance.

- Outline the repayment terms. Include details such as the frequency of payments (e.g., monthly, quarterly) and the due date for each payment.

- If applicable, include any late fees or penalties for missed payments. Clearly state how much these fees will be.

- Sign and date the form at the bottom. The borrower must sign to acknowledge the agreement, and the lender should also sign if required.

After completing the form, ensure that both parties retain a copy for their records. This will help avoid any misunderstandings in the future. If you have any questions or need further assistance, consider seeking professional guidance.

Misconceptions

When dealing with financial agreements, particularly promissory notes, misunderstandings can lead to significant issues. Here are nine common misconceptions about the New York Promissory Note form.

- All promissory notes are the same. Many people believe that all promissory notes follow a one-size-fits-all template. In reality, the terms can vary widely based on the specifics of the agreement.

- A promissory note must be notarized. While notarization can add an extra layer of validity, it is not a legal requirement for a promissory note to be enforceable in New York.

- Only banks can issue promissory notes. Individuals and businesses can create promissory notes as well. They are not limited to financial institutions.

- Verbal agreements are sufficient. Some believe that a verbal promise is enough to constitute a promissory note. However, written documentation is crucial for clarity and enforceability.

- Interest rates are always required. Many assume that a promissory note must include an interest rate. However, it is possible to create a note that is interest-free.

- Promissory notes are only for loans. While they are commonly used for loans, promissory notes can also be used in other financial agreements where one party promises to pay another.

- They are only valid if signed in person. In today's digital age, electronic signatures are often accepted, making it easier to execute a promissory note remotely.

- Once signed, a promissory note cannot be changed. Modifications can be made to a promissory note, but both parties must agree to the changes and document them properly.

- All promissory notes are automatically enforceable in court. While a promissory note can be a strong piece of evidence, its enforceability may depend on the clarity of its terms and the circumstances surrounding the agreement.

Understanding these misconceptions can help individuals and businesses navigate their financial agreements more effectively. Clarity in documentation is key to avoiding disputes and ensuring that all parties are on the same page.