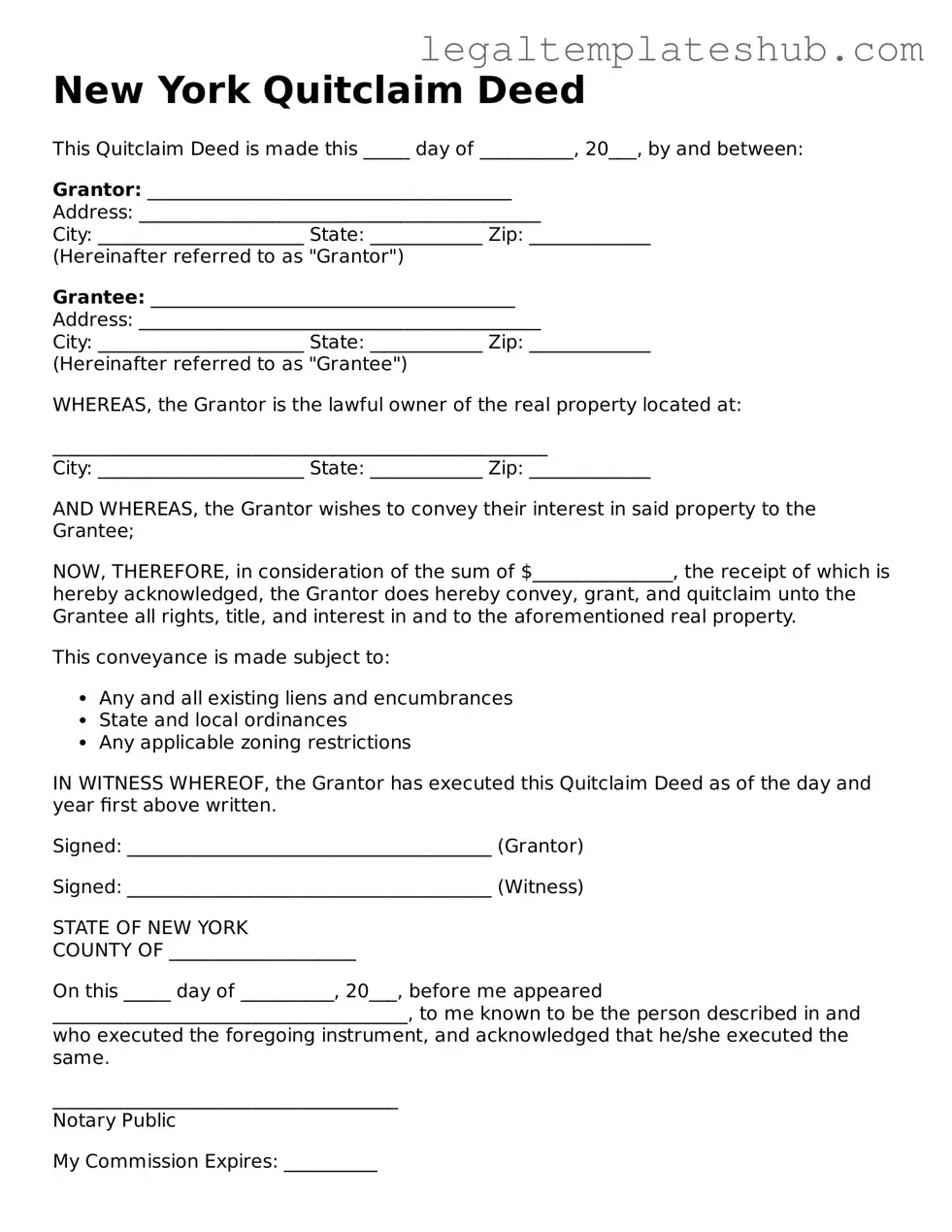

Printable Quitclaim Deed Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Definition | A quitclaim deed is a legal document that transfers ownership of real property from one party to another without any warranties or guarantees. |

| Governing Law | The New York Quitclaim Deed is governed by New York Real Property Law, specifically Article 9. |

| Parties Involved | The parties involved in a quitclaim deed are the grantor (the person transferring the property) and the grantee (the person receiving the property). |

| No Warranty | Unlike other types of deeds, a quitclaim deed does not provide any warranties regarding the title. The grantor simply relinquishes their interest in the property. |

| Use Cases | Quitclaim deeds are often used in situations such as divorce settlements, transferring property between family members, or clearing up title issues. |

| Execution Requirements | The deed must be signed by the grantor and notarized to be valid in New York. |

| Recording | To protect the interests of the grantee, the quitclaim deed should be recorded with the county clerk's office where the property is located. |

| Tax Implications | Property transfers using a quitclaim deed may have tax implications, including potential transfer taxes. It is advisable to consult a tax professional. |

Key takeaways

When dealing with the New York Quitclaim Deed form, understanding its components and proper usage is essential. Here are some key takeaways:

- Purpose of the Quitclaim Deed: This document transfers ownership of property from one party to another without guaranteeing that the title is clear. It is often used among family members or in situations where the parties know each other well.

- Parties Involved: The form requires the names of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Ensure that all names are spelled correctly.

- Property Description: A detailed description of the property is necessary. This includes the address and any identifying information, such as tax parcel numbers, to avoid confusion.

- Consideration: While a quitclaim deed can be executed without monetary exchange, it is common to include a nominal amount (like $1) as consideration to validate the transaction.

- Signature Requirements: The grantor must sign the deed in the presence of a notary public. This step is crucial for the deed to be legally binding.

- Filing the Deed: After completion, the quitclaim deed must be filed with the county clerk’s office in the county where the property is located. This step ensures public record of the transfer.

- Tax Implications: Be aware that transferring property may have tax consequences. Consulting with a tax professional can help clarify any potential liabilities.

- Use in Divorce or Estate Planning: Quitclaim deeds are often utilized in divorce settlements or estate planning to transfer property rights without the complexities of a traditional sale.

- Limitations: A quitclaim deed does not guarantee that the property is free from liens or other encumbrances. Buyers should conduct due diligence to understand any existing claims on the property.

By keeping these points in mind, individuals can effectively navigate the process of using a Quitclaim Deed in New York.

Dos and Don'ts

When filling out the New York Quitclaim Deed form, it is essential to follow specific guidelines to ensure accuracy and legality. Below is a list of things you should and shouldn't do.

- Do ensure that the names of the grantor and grantee are correct and clearly written.

- Do provide a complete legal description of the property being transferred.

- Do sign the form in the presence of a notary public.

- Do check for any local filing requirements that may apply.

- Don't leave any sections of the form blank; incomplete forms can lead to delays.

- Don't use outdated forms; ensure you are using the latest version of the Quitclaim Deed.

- Don't forget to include the date of the transaction.

- Don't overlook the need for recording the deed with the appropriate county clerk's office.

More Quitclaim Deed State Templates

Quit Deed Form Texas - This document can be a straightforward solution for real estate gifting.

Deed Transfer Nj - Often used to transfer rights when securing financing.

For anyone looking to navigate the complexities of horse transactions, a well-crafted Horse Bill of Sale document is crucial for ensuring a smooth process. You can find a reliable template at our printable Horse Bill of Sale, which serves as a valuable resource for both buyers and sellers in Colorado.

Quitclaim Deed Washington State - It is commonly used in situations involving shared ownership properties.

Instructions on Filling in New York Quitclaim Deed

After obtaining the New York Quitclaim Deed form, it is important to fill it out accurately to ensure a smooth transfer of property ownership. Each section of the form must be completed with care, as any errors could lead to delays or complications in the process.

- Gather Necessary Information: Collect the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property).

- Property Description: Write a clear and accurate description of the property being transferred. This should include the property’s address and any additional identifying information, such as the lot number or block number.

- Fill Out the Form: Start with the title section at the top of the form. Clearly state that it is a Quitclaim Deed. Then, enter the grantor’s name and address, followed by the grantee’s name and address.

- Consideration: Indicate the consideration, or payment, for the property transfer. If no payment is involved, you can state “for love and affection” or “nominal consideration.”

- Signatures: The grantor must sign the document in the presence of a notary public. Ensure that the signature matches the name as it appears on the form.

- Notarization: The notary public will complete the notarization section of the form, confirming the identity of the grantor and witnessing the signature.

- Record the Deed: After completing the form, take it to the local county clerk's office to have it recorded. This step is essential to make the transfer official.

By following these steps, the Quitclaim Deed will be properly filled out and ready for recording, facilitating the transfer of property ownership in New York.

Misconceptions

Many people have misunderstandings about the New York Quitclaim Deed form. Here are nine common misconceptions:

- A Quitclaim Deed transfers ownership completely. This is not always the case. A Quitclaim Deed transfers whatever interest the grantor has in the property, but it does not guarantee that the grantor has full ownership or clear title.

- A Quitclaim Deed is only for married couples. This form can be used by anyone transferring property, not just spouses. It is often used between family members or in situations where a property is being gifted.

- A Quitclaim Deed eliminates all liens on the property. This is incorrect. If there are existing liens or debts against the property, those will still remain even after the Quitclaim Deed is executed.

- You don’t need to file a Quitclaim Deed. While it may not be legally required to file one, it is highly recommended to record the deed with the county clerk. This helps protect the new owner's interests.

- A Quitclaim Deed is a quick way to sell property. A Quitclaim Deed does not involve a sale; it simply transfers interest. If a sale is intended, a different type of deed is typically used.

- A Quitclaim Deed provides buyer protection. This is misleading. Since it does not guarantee clear title, the buyer may not be fully protected against claims or disputes regarding ownership.

- You can use a Quitclaim Deed for any type of property. While it can be used for most properties, some transactions, like those involving mortgages, may require different forms.

- A Quitclaim Deed is the same as a Warranty Deed. These two are different. A Warranty Deed offers guarantees about the title, while a Quitclaim Deed does not.

- Once a Quitclaim Deed is signed, it cannot be changed. While it is true that the deed itself cannot be changed, the parties involved can create a new deed to amend the terms if needed.

Understanding these misconceptions can help individuals make informed decisions regarding property transfers in New York.