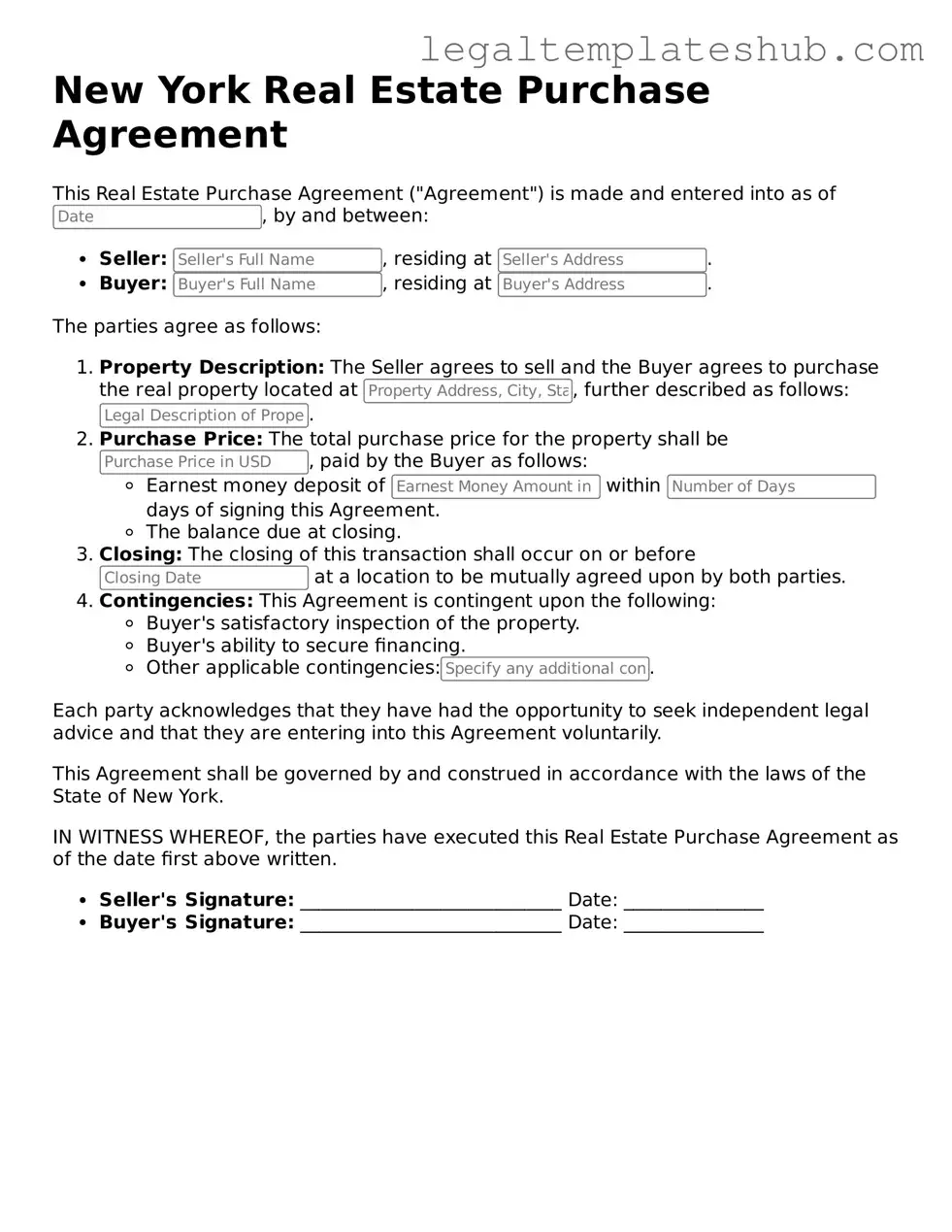

Printable Real Estate Purchase Agreement Document for New York

PDF Form Data

| Fact Name | Description |

|---|---|

| Governing Law | The New York Real Estate Purchase Agreement is governed by the laws of the State of New York. |

| Purpose | This form serves as a legally binding document outlining the terms of a real estate transaction between a buyer and a seller. |

| Essential Elements | The agreement typically includes details such as the purchase price, property description, and closing date. |

| Contingencies | Buyers may include contingencies in the agreement, such as financing or inspection requirements, to protect their interests. |

Key takeaways

When filling out and using the New York Real Estate Purchase Agreement form, it’s essential to keep several key points in mind. Here are ten takeaways to help guide you through the process:

- Understand the Basics: Familiarize yourself with the structure of the agreement. It typically includes sections on purchase price, property description, and closing details.

- Accurate Information: Ensure that all information, such as buyer and seller names, property address, and legal descriptions, is accurate and complete.

- Contingencies: Pay attention to contingencies, such as financing and inspection. These clauses protect buyers and should be clearly stated.

- Deposit Requirements: Be aware of any earnest money deposit required. This amount shows the seller that the buyer is serious.

- Closing Date: Specify a closing date in the agreement. This date is crucial for both parties to understand their timelines.

- Review Terms: Carefully review all terms related to repairs, fixtures, and inclusions. These details can significantly impact the transaction.

- Legal Review: Consider having a real estate attorney review the agreement. Their expertise can help avoid potential pitfalls.

- Amendments: If changes need to be made after the initial agreement is signed, document them properly. Amendments should be clear and agreed upon by both parties.

- Signatures: Ensure that all required signatures are obtained. An unsigned agreement is not legally binding.

- Keep Copies: After the agreement is signed, keep copies for your records. This can be useful for future reference or disputes.

By following these guidelines, you can navigate the New York Real Estate Purchase Agreement with confidence and clarity.

Dos and Don'ts

When filling out the New York Real Estate Purchase Agreement form, it’s important to be mindful of certain practices to ensure the process goes smoothly. Here are four things you should and shouldn’t do:

- Do read the entire agreement carefully. Understanding all terms and conditions is crucial before signing.

- Do provide accurate information. Ensure that all details about the property and parties involved are correct to avoid future disputes.

- Do consult a real estate attorney. Having professional guidance can help clarify complex terms and ensure compliance with local laws.

- Do keep copies of all documents. Retaining a copy of the signed agreement is essential for your records.

- Don’t rush the process. Take your time to fill out the form to prevent mistakes that could delay the transaction.

- Don’t leave any sections blank. Fill in all required fields, as incomplete forms may be rejected.

- Don’t ignore deadlines. Pay attention to any timelines mentioned in the agreement to avoid penalties or complications.

- Don’t hesitate to ask questions. If something is unclear, seek clarification rather than making assumptions.

More Real Estate Purchase Agreement State Templates

Trec Real Estate - It can provide a timeline for necessary disclosures to the buyer.

The Colorado Durable Power of Attorney form is a crucial document that empowers an individual to designate a trusted person to oversee their financial matters, should they become unable to do so themselves. For further insights, visit our guide on the importance of establishing a Durable Power of Attorney for your financial security.

Pa Standard Agreement of Sale - Defines the method of conveying ownership from seller to buyer.

Instructions on Filling in New York Real Estate Purchase Agreement

After gathering the necessary information, you are ready to fill out the New York Real Estate Purchase Agreement form. Completing this form accurately is essential for a smooth transaction. Follow these steps to ensure that all required details are provided correctly.

- Identify the Parties: Enter the full names and addresses of the buyer(s) and seller(s) at the top of the form.

- Property Description: Provide a detailed description of the property being sold, including the address, type of property, and any relevant tax identification numbers.

- Purchase Price: Clearly state the agreed-upon purchase price for the property.

- Deposit Information: Indicate the amount of the earnest money deposit and specify how it will be held (e.g., in escrow).

- Financing Terms: Outline the financing arrangements, including any contingencies related to mortgage approval.

- Closing Date: Specify the proposed closing date when the transaction will be finalized.

- Contingencies: List any contingencies that must be satisfied before the sale can proceed, such as inspections or appraisals.

- Signatures: Ensure that all parties sign and date the agreement to make it legally binding.

Once the form is completed, it is advisable to review it carefully for accuracy. After that, both parties should retain copies for their records. The next steps involve negotiating any necessary changes and preparing for the closing process.

Misconceptions

Many people have misconceptions about the New York Real Estate Purchase Agreement form. Understanding these misconceptions can help buyers and sellers navigate the process more effectively. Here are five common misunderstandings:

- Misconception 1: The agreement is just a formality.

- Misconception 2: All agreements are the same.

- Misconception 3: A verbal agreement is sufficient.

- Misconception 4: The seller can back out easily.

- Misconception 5: The agreement does not require legal review.

Some believe that signing the agreement is merely a formality and that it does not hold significant legal weight. In reality, this document outlines the terms of the sale and can be enforced in a court of law.

Many assume that all real estate purchase agreements are identical. However, each agreement can vary based on the specifics of the transaction, including property type, financing arrangements, and local laws.

Some individuals think that a verbal agreement is enough to secure a deal. In New York, real estate transactions must be in writing to be legally binding, making the written agreement essential.

There is a belief that sellers can back out of the agreement without consequences. Once signed, the seller is typically bound to the terms unless specific conditions allow for cancellation.

Many people think that they can complete the transaction without legal assistance. Engaging a lawyer to review the agreement is crucial to ensure that all terms are understood and protect one's interests.